The Four Companies That Sent the Dow to 19000

November 23 2016 - 8:02AM

Dow Jones News

Shares of banks, industrials and health-care companies propelled

the Dow Jones Industrial Average to 19000 on Tuesday. The bets on

those sectors largely reflect investors' expectations of looser

regulation, and higher growth and interest rates under a Trump

administration. Here is a look at four companies that have

benefited from those assumptions, contributing the most points to

the blue-chip index's 1,135.59-point gain since the Dow last closed

below 18000 on Nov. 4.

Goldman Sachs Group Inc. (contributed 240.99 points to the Dow

industrials since Nov. 4) and J.P. Morgan Chase & Co. (73.76

points)

The two banks have been big factors in the blue-chip index's

rally this month, largely because of the improved outlook for bank

earnings and the rebound in long-term bond yields, which can make

lending activity more profitable.

That has particularly helped J.P. Morgan, the largest bank in

the nation by both assets and market value. Since the presidential

election, bond yields have risen and the gap between long- and

short-dated debt has widened. That should help banks' income

because it increases the difference between what lenders charge on

loans and pay out on deposits.

President-elect Donald Trump has also made comments about

infrastructure projects to boost the economy. Banks and Wall Street

firms such as Goldman Sachs are likely to be in the middle of these

plans, either as advisers or lenders. Goldman, which derives more

of its revenue from advising companies and trading their

securities, also stands to benefit from increased volatility in

recent weeks and widespread debate about the future of the global

economy. Both factors increase investors' appetite to trade, which

helps the firms' massive bond and stock-trading desks. Investors

are also betting on reduced regulatory and tax costs under a Trump

administration, which should help banks. Many of the prospective

appointees for key economic posts in a Trump administration either

have worked on Wall Street or have expressed sympathy with the idea

that banks have been too heavily regulated.

Analysts at Credit Suisse expect earnings per share in 2017

could beat their pre-election base case forecast by 24% at Goldman

and 30% at J.P. Morgan. However, it is an improvement from low

expectations and conditions are still far from ideal for the big

U.S. banks. For example, while there have been recent signs of

health -- notably increased trading volumes -- long-term interest

rates are still lower than they were a year ago and the so-called

yield curve is slightly flatter -- which means interest income will

likely remain under pressure.

--John Carney

UnitedHealth Group Inc. (99.64 points)

The largest U.S. health insurer has struggled to eke out

profitability from its Affordable Care Act plans. UnitedHealth

Group has said it intends to withdraw from nearly all of the

health-law marketplaces next year amid anticipated annual losses of

about $850 million on ACA plans. Other insurers have also pulled

back from their coverage areas under the law, leaving many counties

with only one participating insurer and increased premiums.

President-elect Donald Trump has pledged to "repeal and replace"

the Affordable Care Act. Still, the law has also resulted in a

Medicaid expansion, bringing new customers to the insurer. In its

latest quarter, the company added 9% more Medicaid members.

UnitedHealth also said medical spending was in line with its

expectations, reassuring investors. The company has increasingly

relied on its health-services unit, Optum, to drive growth. Optum

is rapidly expanding its primary-care business and the unit, which

also has analytics and pharmacy services divisions, is a

differentiator for UnitedHealth compared with other insurers. In

its latest quarter, revenue grew 12% to $46.29 billion.

--Austen Hufford

Caterpillar Inc. (77.45 points)

The manufacturing giant has faced a tougher second half of the

year than executives were expecting amid persistent weak demand for

its construction, mining and oil equipment around the world.

Revenue fell 16% in its latest quarter, and the company in October

predicted another tough year in 2017 as the company deals with the

fallout from the global commodities bust and prepares for a

transition in top leadership. Caterpillar, whose sales hit an

all-time high in 2012 under Chairman and Chief Executive Doug

Oberhelman, has struggled since his move to drive the company

deeper into mining equipment by pouring billions of dollars into

factories. The move backfired when miners began shelving

equipment-buying plans as commodity prices fell. Mr. Oberhelman

will retire next year, earlier than expected, leaving company

veteran Jim Umpleby to battle a historic sales slump after

ill-timed bets on China and mining equipment.

--Joshua Jamerson

(END) Dow Jones Newswires

November 23, 2016 07:47 ET (12:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

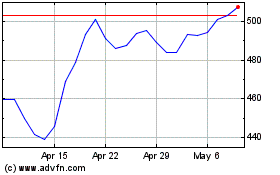

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024