UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

Check the appropriate box:

|

¨

|

Preliminary Information Statement

|

|

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

x

|

Definitive Information Statement

|

|

COOL TECHNOLOGIES, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14c-5(g)

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule, or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

COOL TECHNOLOGIES, INC.

8875 Hidden River Parkway

Tampa, Florida 33637

Dear Stockholders:

The enclosed Information Statement is being furnished to the holders of record of the shares of the common stock (the “

Common Stock

”) of Cool Technologies, Inc., a Nevada corporation (the “

Company)

, as of the close of business on the record date, December 15, 2016 (the “

Record Date

”). The purpose of the Information Statement is to notify our stockholders that on October 7, 2016, the Company received a joint written consent in lieu of a meeting (the “

Joint Written Consent

”) from the members of the Board of Directors (the “

Board

”) and the holders of all of the issued and outstanding shares of Series B preferred stock representing 66 2/3% of the voting stock of the Company (the “

Consenting Stockholders”)

. The Joint Written Consent adopted resolutions which authorized the Company to act on a proposal to effect a reverse stock split on the issued and outstanding shares of Common Stock of the Company at a ratio of 1 new post reverse split Common Stock (the “

New Share

”) for each 15 outstanding pre reverse split Common Stock (the “

Old Shares

”) of the Company (the “

Reverse Split

”).

You are urged to read the Information Statement in its entirety for a description of the action taken by the Consenting Stockholders of the Company. The action will become effective on a date that is not earlier than twenty one (21) calendar days after this Information Statement is first mailed to our stockholders.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No action is required by you. The enclosed Information Statement is being furnished to you to inform you that the foregoing action has been approved by the Consenting Stockholders. Because the Consenting Stockholders have voted in favor of the foregoing actions, and have sufficient voting power to approve such actions through their ownership of Common Stock, no other stockholder consents will be solicited in connection with the transactions described in this Information Statement. The Board is not soliciting your proxy in connection with the adoption of the resolution, and proxies are not requested from stockholders.

This Information Statement is being mailed on or about November 22, 2016 to stockholders of record on the Record Date.

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

By:

|

/s/ Timothy Hassett

|

|

|

|

|

Timothy Hassett

|

|

|

|

|

Chairman and Chief Executive Officer

|

|

COOL TECHNOLOGIES, INC.

8875 Hidden River Parkway

Tampa, Florida 33637

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

_____________________________________

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being furnished to the holders of record of the shares of the common stock (the “Common Stock”) of Cool Technologies, Inc., a Nevada corporation (the “

Company”

), as of the close of business on the record date, December 15, 2016 (the “

Record Date

”). The purpose of the Information Statement is to notify our stockholders that on October 7, 2016, the Company received a joint written consent in lieu of a meeting (the “

Joint Written Consent

”) from the members of the Board of Directors (the “

Board

”) and the holders of all of the issued and outstanding shares of Series B preferred stock (the “

Series B Stock”)

of the Company representing 66 2/3% of the voting stock of the Company (the “

Consenting Stockholders”)

. The Joint Written Consent adopted resolutions which authorized the Company to act on a proposal to effect a reverse stock split on the issued and outstanding shares of Common Stock of the Company at a ratio of 1 new post reverse split Common Stock (the “

New Share

”) for each 15 outstanding pre reverse split Common Stock (the “

Old Shares

”) of the Company (the “

Reverse Split

”).

The action will become effective on a date that is not earlier than twenty one (21) calendar days after this Information Statement is first mailed to our stockholders.

Because the Consenting Stockholders have voted in favor of the foregoing action, and have sufficient voting power to approve such actions through their ownership of Common Stock, no other stockholder consents will be solicited in connection with the transactions described in this Information Statement. The Board is not soliciting proxies in connection with the adoption of these resolutions, and proxies are not requested from stockholders.

In accordance with our bylaws, our Board has fixed the close of business on December 15, 2016 as the record date for determining the stockholders entitled to notice of the above noted action. This Information Statement is being mailed on or about November 22, 2016 to stockholders of record on the Record Date.

Under Nevada law, stockholders have no appraisal or dissenters’ rights in connection with the Reverse Split.

DISTRIBUTION AND COSTS

We will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. In addition, we will only deliver one Information Statement to multiple security holders sharing an address, unless we have received contrary instructions from one or more of the security holders. Also, we will promptly deliver a separate copy of this Information Statement and future stockholder communication documents to any security holder at a shared address to which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and future stockholder communication documents to any security holder or holders sharing an address to which multiple copies are now delivered, upon written request to us at our address noted above.

Security holders may also address future requests regarding delivery of information statements by contacting us at the address noted above.

VOTE REQUIRED; MANNER OF APPROVAL

Approval to implement the Reverse Split requires the affirmative vote of the holders of a majority of the voting power of the Company. There are currently 112,240,843 shares of Common Stock outstanding, and each share of Common Stock is entitled to one vote. There are currently 116 shares of Series A preferred stock (“

Series A Stock

”) outstanding. Each share of Series A Stock has the voting right of 50,000 shares of Common Stock. There are currently 3,636,360 shares of Series B Stock outstanding. For so long as the Series B Stock is issued and outstanding, the holders of Series B Stock shall vote together as a single class with the holders of the Common Stock and the holders of any other class or series of shares entitled to vote with the Common Stock, with the holders of Series B Stock being entitled to 66 2/3% of the total votes on all such matters. Because all of holders of the Series B Stock having 66 2/3% of the voting rights of the Company have voted in favor of the foregoing action, and have sufficient voting power to approve such actions through their ownership of Series B Stock, no other stockholder consents will be solicited in connection with the transaction described in this Information Statement. The Board is not soliciting proxies in connection with the adoption of these proposals, and proxies are not requested from stockholders.

In addition, the Nevada Revised Statutes (the “

NRS

”) provide in substance that stockholders may take action without a meeting of the stockholders and without prior notice if a consent or consents in writing, setting forth the action so taken, is signed by the holders of the outstanding voting shares holding not less than the minimum number of votes that would be necessary to approve such action at a stockholders meeting. The action is effective when written consents from holders of record of a majority of the outstanding shares of voting stock are executed and delivered to the Company.

Written consent was received from the holders of all of the issued and outstanding holders of the Series B Stock having 66 2/3% voting power. Accordingly, the necessary majority of votes necessary to implement the Reverse Split was received. In accordance with our bylaws, the Board has fixed the close of business on December 15, 2016 as the record date for determining the stockholders entitled to vote or give written consent.

On October 7, 2016, the Board and the Consenting Stockholders executed and delivered to the Company the Joint Written Consent. Accordingly, in compliance with the NRS, at least a majority of the total voting stock of the Company have approved the Reverse Split. As a result, no vote or proxy is required by the stockholders to approve the adoption of the foregoing actions.

REASON FOR THE REVERSE STOCK SPLIT OF ALL OF THE ISSUED AND OUTSTANDING SHARES OF COMMON STOCK OF THE COMPANY AT A RATIO OF 1 NEW SHARE FOR EACH 15 OLD SHARES.

On the Effective Date (hereinafter defined), we will implement a one-for- fifteen (1:15) reverse split of our issued and outstanding shares of Common Stock. The Company currently has authorized capital stock of 140,000,000 shares of Common Stock, of which 112,240,843 shares are issued and outstanding. The effect of the Reverse Split is that prior to the Effective Date, the Old Shares will be automatically converted into the New Shares, reducing the number of issued and outstanding shares of Common Stock to approximately 7,482,722.87 shares, subject to rounding. The par value of the New Shares will remain unchanged at $0.001 per share. Any fractional shares resulting from the Reverse Split will be rounded up. The Reverse Split will become effective on a date that is not earlier than 21 calendar days after the mailing of this Information Statement (the “Effective Date”).

Our Common Stock will be quoted on the OTC Bulletin Board at the post-split price on the Effective Date. The New Shares will be fully paid and non-assessable. The New Shares will have the same voting rights, dividend rights, distribution rights and will be identical in all other respects to the Old Shares.

The Board believes that the Reverse Split will provide the Company with greater flexibility with respect to the Company’s capital structure for such purposes as additional equity financing and stock based acquisitions and strategic alliances and provide a more manageable number of Common Stock shares issued and outstanding, allowing the Company’s management to more efficiently manage stockholders’ interests. Also, currently, the Company’s authorized shares are insufficient if all of its outstanding preferred stock and warrants were exercised and/or converted. The effective increase in the number of our authorized but unissued shares generated by the Reverse Split will enable the Company to fulfill our obligations to issue shares on a fully-diluted basis.

An alternative to a Reverse Split is an increase in our authorized number of Common Stock. We chose not to increase our authorized amount of Common Stock because if we authorized additional shares, we felt that we would convey the wrong impression that too many cheap shares of our Common Stock could be issued, thereby decreasing potential stockholder value. For example, if we have fewer shares of our Common Stock issued as proposed in the Reverse Split, our stock price could be higher and attract a different type of investor looking for long-term growth and not a quick run-up in the value of low price stock. However, stockholders should note that the effect of the Reverse Split upon the market price for our Common Stock cannot be accurately predicted and that an increase in our share price is not a certainty. Furthermore, there can be no assurance that the market price of our Common Stock immediately after the Reverse Split will be maintained for any period of time. Moreover, because some investors may view the Reverse Split negatively, there can be no assurance that the Reverse Split will not adversely impact the market price of our Common Stock or, alternatively, that the market price following the Reverse Split will either exceed or remain in excess of the current market price.

In evaluating the Reverse Split, the Board took into consideration negative factors associated with reverse stock splits. These factors include the negative perception of reverse stock splits held by many investors, analysts and other stock market participants, as well as the fact that the stock price of some companies that have effected reverse stock splits has subsequently declined back to pre-reverse split levels. The Board, however, made a determination that these negative factors were outweighed by the potential benefits to the Company.

Potential Effects of the Reverse Split

The immediate effect of a Reverse Split will be to reduce the number of shares of Common Stock outstanding, and to increase the trading price of our Common Stock. However, the effect of any Reverse Split upon the market price of the Company's Common Stock cannot be predicted, and the history of Reverse Splits for companies in similar circumstances is varied. The Company cannot assure you that the trading price of the Company's Common Stock after the Reverse Split will rise in exact proportion to the reduction in the number of shares of the Company's Common Stock outstanding as a result of the Reverse Split, or in fact rise at all. Also, as stated above, the Company cannot assure you that a Reverse Split would lead to a sustained increase in the trading price of the Company's Common Stock. The trading price of the Company's Common Stock may change due to a variety of other factors, including the Company's operating results, other factors related to the Company's business, and general market conditions.

Effects on Ownership by Individual Stockholders

On the Effective Date, the number of shares of Common Stock held by each stockholder would be reduced by dividing the number of shares held immediately before the Reverse Split by fifteen (15) and then rounding up to the nearest whole share. The Reverse Split would affect the Company's Common Stock uniformly and would not affect any stockholder's percentage ownership interests in the Company or proportionate voting power, except to the extent that whole shares will be exchanged in lieu of fractional shares.

Effect on Options, Warrants and Other Securities

Any outstanding shares of options, warrants, notes, debentures and other securities entitling their holders to purchase shares of the Company's Common Stock would be adjusted as a result of the Reverse Split, as required by the terms of these particular securities. The conversion ratio for each instrument would be reduced, and the exercise price, if applicable, would be increased, in accordance with the terms of each instrument and based on the 1 for 15 ratio.

Other Effects on Outstanding Shares

On the Effective Date, the rights of the outstanding shares of Common Stock would remain the same after the Reverse Split.

The Reverse Split may result in stockholders owning "odd-lots" of less than 20 shares of Common Stock. Brokerage commissions and other costs of transactions in odd-lots are generally higher than the costs of transactions in "round-lots" of even multiples of 100 shares.

The Common Stock is currently registered under Section 12(g) of the Securities Exchange Act of 1934, as amended. As a result, the Company is subject to the periodic reporting and other requirements of the Securities Exchange Act. The proposed Reverse Split would not affect the registration of the Common Stock under the Securities Exchange Act.

On the Effective Date, each issued and outstanding share of Common Stock would automatically be changed into a fraction of a share of Common Stock in accordance with the ratio of 1 for 15. The par value of the Common Stock would remain unchanged at $0.001 per share. Any fractional shares resulting from the Reverse Split will be rounded up to the nearest whole number. The Reverse Split would become effective 21 days after the delivery of this Information Statement to stockholders, or on such subsequent date as is designated by the Board.

Anti-Takeover Effects

The Reverse Split, after being effectuated, will have the effect of decreasing the number of authorized and issued common stock while leaving unchanged the number of authorized shares of Common Stock. We will continue to have 140,000,000 shares of authorized Common Stock after the Reverse Split. However, while the total number of authorized shares will not change, after the Effective Date, the number of authorized but unissued shares of Common Stock effectively will be increased significantly by the reverse split because the 112,240,843 shares outstanding prior to the Reverse Split, approximately 80.2% of the 140,000,000 authorized shares, will be reduced to approximately 7,482,723 shares, or 5.34% of the 140,000,000 authorized shares.

In the future, if additional authorized common shares are issued, it may have the effect of diluting the earnings per share and book value per share, as well as the stock ownership and voting rights, of the currently outstanding shares of Common Stock.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Pre-Split

The following table lists, as of November 22, 2016, the number of pre-reverse split shares of Common Stock beneficially owned by (i) each person or entity known to the Company to be the beneficial owner of more than 5% of the outstanding Common Stock; (ii) each executive officer and director of our Company; and (iii) all officers and directors as a group. Information relating to beneficial ownership of Common Stock by our principal stockholders and management is based upon information furnished by each person using “beneficial ownership” concepts under the rules of the Securities and Exchange Commission (the

“SEC”

). Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within sixty (60) days. Under the SEC rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power. Unless otherwise indicated, the business address of each such person is c/o Cool Technologies, Inc., 8875 Hidden River Parkway, Suite 300, Tampa, Florida 33637.

The percentages below are calculated based on 112,240,843 pre Reverse Split issued and outstanding shares of Common Stock and 116 issued and outstanding shares of Series A Stock (each such share of Series A Stock has the voting right of 50,000 shares of Common Stock) as of November 22, 2016.

|

Name of Beneficial Owner

|

|

Number of Shares Beneficially

Owned

|

|

|

Percentage

|

|

|

|

|

|

|

|

|

|

|

|

|

5% or Greater Stockholders

Spirit Bear Limited (1)

1470 First Avenue, No. 4a

New York, NY 10075

|

|

|

11,374,854

|

(2)

|

|

|

9.67

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Gemini Master Fund, Ltd. (3)

% Gemini Strategies Inc.

619 Vulcan Avenue, Suite 203

Encinitas, California 92024

|

|

|

13,116,229

|

|

|

|

11.69

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Mark Hodowanec

|

|

|

7,100,000

|

(4)

|

|

|

6.27

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Eric Paul Brown

1877 S. Wiesbrook Road

Wheaton, Illinois 60189

|

|

|

1,969,998

|

(5)

|

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

|

Christopher J. Jones

1314 E. Forest Avenue

Wheaton, Illinois 60189

|

|

|

2,425,452

|

(7)

|

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

|

Inverom Corporation (8)

16W235 83

rd

Street, Suite A

Burr Ridge, Illinois 60527

|

|

|

1,818,180

|

(9)

|

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

|

KHIC, LLC (10)

120 West 45

th

Street

New York, New York 10036

|

|

|

15,144,914

|

(11)

|

|

|

11.90

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Directors and executive officers

|

|

|

|

|

|

|

|

|

|

Timothy Hassett

|

|

|

8,001,500

|

(12)

|

|

|

7.07

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Quentin Ponder

|

|

|

2,800,000

|

(13)

|

|

|

2.49

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Judson Bibb

|

|

|

3,862,000

|

(14)

|

|

|

3.36

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Christopher McKee

|

|

|

744,444

|

(15)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard J. "Dick" Schul

|

|

|

500,000

|

(16)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

Donald Bowman

|

|

|

250,000

|

(17)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

Daniel C. Ustian

|

|

|

4,562,624

|

(18)

|

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

|

All executive officers and directors as a group (8 persons)(19)

|

|

|

27,820,568

|

|

|

|

22.71

|

%

|

_______

* less than 1%

|

(1)

|

Jay Palmer, President of Spirit Bear Limited (“Spirit Bear”), has sole voting and disposition power over shares held by Spirit Bear.

|

|

(2)

|

Represents (i) 5,650,000 shares of Common Stock underlying 113 shares of Series A Stock (having voting rights to 50,000 shares of Common Stock for each share of Series A Stock), (ii) currently exercisable warrants to purchase an aggregate of 5,400,000 shares of Common Stock and (iii) 324,854 shares of Common Stock.

|

|

(3)

|

Steven Winters, President of Gemini Strategies Inc., investment manager of Gemini Master Fund, Ltd. has sole voting and dispositive power over shares held by Gemini Master Fund, Ltd.

|

|

(4)

|

Includes options to purchase 1,000,000 shares of Common Stock at $2.00 per share. Excludes 80,000 shares held by Mr. Hodowanec’s minor children and 110,000 shares held by his spouse.

|

|

(5)

|

Includes (i) 909,090 shares of Series B Stock which are convertible by the Series B stockholder into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Common Stock trades in excess of $2.25 for any consecutive 20-day period, (ii) a warrant to purchase 909,090 shares of Common Stock at $0.07 per share and (iii) a warrant to purchase 60,909 shares of Common Stock at $0.75 per share.

|

|

(6)

|

The Series B Stock votes together as a single class with the holders of the Common Stock, with the holders of Series B Stock being entitled to 66 2/3% of the total votes.

|

|

(7)

|

Includes (i) 909,090 shares of Series B Stock which are convertible by the Series B stockholder into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Common Stock trades in excess of $2.25 for any consecutive 20-day period, (ii) a warrant to purchase 909,090 shares of Common Stock at $0.07 per share and (iii) a warrant to purchase 243,636 shares of Common Stock at $0.75 per share

|

|

(8)

|

Roman Kuropas, President of Inverom Corporation, has sole voting and dispositive power over the shares held by Inverom Corporation.

|

|

(9)

|

Includes (i) 909,090 shares of Series B Stock which are convertible into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Common Stock trades in excess of $2.25 for any consecutive 20-day period and (ii) a warrant to purchase 909,090 shares of Common Stock at $0.07 per share. Excludes warrants to purchase 200,000 shares of Common Stock at $0.80 per share held by Roman Kuropas, President of Inverom.

|

|

(10)

|

Eric Hess, member and Secretary of KHIC, LLC, has sole voting and dispositive power over the shares held by KHIC, LLC.

|

|

(11)

|

Represents (i) 150,000 shares of common stock underlying 3 shares of Series A Preferred Stock (having voting rights to 50,000 shares of common stock for each share of Series A Stock), and (iii)14,994,914 shares of Common Stock issuable upon the conversion of a convertible promissory note at a conversion price of $0.025 per share.

|

|

(12)

|

Includes (i) an option to purchase 1,000,000 shares of Common Stock at $2.00 per share and (ii) a currently exercisable warrant to purchase 625,000 shares of Common Stock at $0.22 per share. Does not include an aggregate of 90,000 shares held by Mr. Hassett's minor children.

|

|

(13)

|

Includes a currently exercisable warrant to purchase 400,000 shares of Common Stock at $0.22 per share

|

|

(14)

|

Includes (i) options to purchase 2,000,000 shares of Common Stock at $2.00 per share, and (ii) a currently exercisable warrant to purchase 750,000 shares of Common Stock at $0.22 per share.

|

|

(15)

|

Includes (i) a currently exercisable warrant to purchase 222,222 shares of Common Stock at $0.45 per share, (ii) a currently exercisable warrant to purchase 200,000 shares of Common Stock at $0.80, and (iii) currently exercisable warrant to purchase 100,000 shares of Common Stock at $0.27 per share.

|

|

(16)

|

Includes a currently exercisable warrant to purchase 200,000 shares of common stock at $0.50 per share, (ii) a currently exercisable warrant to purchase 100,000 shares of common stock at $0.27 per share, and (iii) a currently exercisable warrant to purchase 100,000 shares of common stock at $0.22.

|

|

(17)

|

Represents a currently exercisable warrant to purchase 250,000 shares of Common Stock at $0.60 per share.

|

|

(18)

|

Includes (i)909,090 shares of Series B Stock which are convertible by Mr. Ustian into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Company’s common stock trades in excess of $2.25 for any consecutive 20-day period, (ii) a currently exercisable warrant to purchase 909,090 shares of Common Stock at $0.07 per share, (iii) a currently exercisable warrant to purchase 222,222 shares of Common Stock at $0.45 per share; (iv) a currently exercisable warrant to purchase 200,000 shares of Common Stock at $0.80 per share, (v) a currently exercisable warrant to purchase 100,000 shares of Common Stock at $0.27, and (vi) a currently exercisable warrant to purchase 1,000,000 shares of Common Stock at $0.22 per share.

|

|

(19)

|

Includes Mark Hodowanec, Chief Technology Officer.

|

Post-Split

The following table lists the number of post-reverse split shares of Common Stock beneficially owned by (i) each person or entity known to the Company to be the beneficial owner of more than 5% of the outstanding Common Stock; (ii) each officer and director of our Company; and (iii) all officers and directors as a group. Information relating to beneficial ownership of Common Stock by our principal stockholders and management is based upon information furnished by each person using “beneficial ownership” concepts under the rules of the SEC. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within sixty (60) days. Under the SEC rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power. Except as noted below, each person has sole voting and investment power. Unless otherwise indicated, the business address of each such person is c/o Cool Technologies, Inc., 8875 Hidden River Parkway, Suite 300, Tampa, Florida 33637.

The percentages below are calculated based on 7,482,723 post Reverse Split issued and outstanding shares of Common Stock and 116 issued and outstanding shares of Series A Stock (each such share of Series A Stock has the voting right of 3,334 shares of Common Stock).

|

Name of Beneficial Owner

|

|

Number of Shares Beneficially

Owned

|

|

|

Percentage

|

|

|

|

|

|

|

|

|

|

|

5% or Greater Stockholders

Spirit Bear Limited (1)

1470 First Avenue, No. 4a

New York, NY 10075

|

|

|

758,324

|

(2)

|

|

9.67

|

%

|

|

|

|

|

|

|

|

|

|

|

Gemini Master Fund, Ltd. (3)

% Gemini Strategies Inc.

619 Vulcan Avenue, Suite 203

Encinitas, California 92024

|

|

|

874,416

|

|

|

11.69

|

%

|

|

|

|

|

|

|

|

|

|

|

Mark Hodowanec

|

|

|

473,334

|

(4)

|

|

6.27

|

%

|

|

|

|

|

|

|

|

|

|

|

Eric Paul Brown

1877 S. Wiesbrook Road

Wheaton, Illinois 60189

|

|

|

131,334

|

(5)

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

Christopher J. Jones

1314 E. Forest Avenue

Wheaton, Illinois 60189

|

|

|

161,697

|

(7)

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

Inverom Corporation (8)

16W235 83

rd

Street, Suite A

Burr Ridge, Illinois 60527

|

|

|

121,212

|

(9)

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

KHIC, LLC (10)

120 West 45

th

Street

New York, New York 10036

|

|

|

1,009,661

|

(11)

|

|

11.90

|

%

|

|

|

|

|

|

|

|

|

|

|

Directors and executive officers

|

|

|

|

|

|

|

|

|

Timothy Hassett

|

|

|

533,434

|

(12)

|

|

7.07

|

%

|

|

|

|

|

|

|

|

|

|

|

Quentin Ponder

|

|

|

186,667

|

(13)

|

|

2.49

|

%

|

|

|

|

|

|

|

|

|

|

|

Judson Bibb

|

|

|

257,467

|

(14)

|

|

3.36

|

%

|

|

|

|

|

|

|

|

|

|

|

Christopher McKee

|

|

|

49,630

|

(15)

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

Richard J. "Dick" Schul

|

|

|

33,334

|

(16)

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

Donald Bowman

|

|

|

16,667

|

(17)

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

Daniel C. Ustian

|

|

|

304,175

|

(18)

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

All executive officers and directors as a group (8 persons)(19)

|

|

|

1,854,705

|

|

|

22.71

|

%

|

________________

* less than 1%

|

(1)

|

Jay Palmer, President of Spirit Bear Limited (“Spirit Bear”), has sole voting and disposition power over shares held by Spirit Bear.

|

|

(2)

|

Represents (i) 376,667 shares of Common Stock underlying 119 shares of Series A Stock (having voting rights to 3,334 shares of Common Stock for each share of Series A Stock), (ii) currently exercisable warrants to purchase an aggregate of 360,000 shares of Common Stock and (iii) 21,657 shares of Common Stock.

|

|

(3)

|

Steven Winters, President of Gemini Strategies Inc., investment manager of Gemini Master Fund, Ltd. has sole voting and dispositive power over shares held by Gemini Master Fund, Ltd.

|

|

(4)

|

Includes options to purchase 66,667 shares of Common Stock at $2.00 per share. Excludes 5,334 shares held by Mr. Hodowanec’s minor children and 7,334 shares held by his spouse.

|

|

(5)

|

Includes (i) 60,606 shares of Series B Stock which are convertible by the Series B stockholder into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Common Stock trades in excess of $2.25 for any consecutive 20-day period, (ii) a warrant to purchase 60,606 shares of Common Stock at $0.07 per share and (iii) a warrant to purchase 4,061 shares of Common Stock at $0.75 per share.

|

|

(6)

|

The Series B Stock votes together as a single class with the holders of the Common Stock, with the holders of Series B Stock being entitled to 66 2/3% of the total votes.

|

|

(7)

|

Includes (i) 60,606 shares of Series B Stock which are convertible by the Series B stockholder into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Common Stock trades in excess of $2.25 for any consecutive 20-day period, (ii) a warrant to purchase 60,606 shares of Common Stock at $0.07 per share and (iii) a warrant to purchase 16,243 shares of Common Stock at $0.75 per share

|

|

(8)

|

Roman Kuropas, President of Inverom Corporation, has sole voting and dispositive power over the shares held by Inverom Corporation.

|

|

(9)

|

Includes (i) 60,606 shares of Series B Stock which are convertible into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Common Stock trades in excess of $2.25 for any consecutive 20-day period and (ii) a warrant to purchase 60,606 shares of Common Stock at $0.07 per share. Excludes warrants to purchase 13,334 shares of Common Stock at $0.80 per share held by Roman Kuropas, President of Inverom.

|

|

(10)

|

Eric Hess, member and Secretary of KHIC, LLC, has sole voting and dispositive power over the shares held by KHIC, LLC.

|

|

(11)

|

Represents (i) 10,000 shares of common stock underlying 3 shares of Series A Preferred Stock (having voting rights to 3,334 shares of common stock for each share of Series A Stock), and (iii)999,661 shares of Common Stock issuable upon the conversion of a convertible promissory note at a conversion price of $0.025 per share.

|

|

(12)

|

Includes (i) an option to purchase 66,667 shares of Common Stock at $2.00 per share and (ii) a currently exercisable warrant to purchase 41,667 shares of Common Stock at $0.22 per share. Does not include an aggregate of 6,000 shares held by Mr. Hassett's minor children.

|

|

(13)

|

Includes a currently exercisable warrant to purchase 26,667 shares of Common Stock at $0.22 per share

|

|

(14)

|

Includes (i) options to purchase 133,334 shares of Common Stock at $2.00 per share, and (ii) a currently exercisable warrant to purchase 50,000 shares of Common Stock at $0.22 per share.

|

|

(15)

|

Includes (i) a currently exercisable warrant to purchase 14,815 shares of Common Stock at $0.45 per share, (ii) a currently exercisable warrant to purchase 13,334 shares of Common Stock at $0.80, and (iii) currently exercisable warrant to purchase 6,667 shares of Common Stock at $0.27 per share.

|

|

(16)

|

Includes a currently exercisable warrant to purchase 13,334 shares of common stock at $0.50 per share, (ii) a currently exercisable warrant to purchase 6,667 shares of common stock at $0.27 per share, and (iii) a currently exercisable warrant to purchase 6,667 shares of common stock at $0.22.

|

|

(17)

|

Represents a currently exercisable warrant to purchase 16,667 shares of Common Stock at $0.60 per share.

|

|

(18)

|

Includes (i) 60,606 shares of Series B Stock which are convertible by Mr. Ustian into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Company’s common stock trades in excess of $2.25 for any consecutive 20-day period, (ii) a currently exercisable warrant to purchase 60,606 shares of Common Stock at $0.07 per share, (iii) a currently exercisable warrant to purchase 14,815 shares of Common Stock at $0.45 per share; (iv) a currently exercisable warrant to purchase 13,334 shares of Common Stock at $0.80 per share, (v) a currently exercisable warrant to purchase 6,667 shares of Common Stock at $0.27, and (vi) a currently exercisable warrant to purchase 66,667 shares of Common Stock at $0.22 per share.

|

|

(19)

|

Includes Mark Hodowanec, Chief Technology Officer.

|

INTEREST OF CERTAIN PERSONS IN OR IN

OPPOSITION TO MATTERS TO BE ACTED UPON

Except that Daniel Ustian, a director of the Company, is also a holder of 909,090 shares of Series B Stock and a Consenting Stockholder, and Roman Kuropas, a member of the Company’s Advisory Board, is the President of Inverom Corporation, a holder of 909,090 shares of Series B Stock and a Consenting Stockholder, no director, executive officer, associate of any officer or director or executive officer, or any other person has any interest, direct or indirect, by security holdings or otherwise, in the Reverse Split which is not shared by all other stockholders.

OTHER INFORMATION

The Reverse Split will be effected by NASDAQ and will be reported to our stock transfer agent. NASDAQ will increase the quote of our common stock by a factor of 15 on or after December 15, 2016, the Effective Date of the Reverse Split.

Following the Effective Date, the share certificates representing the Old Shares will continue to be valid. In the future, new share certificates will be issued reflecting the effect of the Reverse Split, but this in no way will affect the validity of your current share certificates. The Reverse Split will occur on the Effective Date without any further action on the part of our stockholders. After the Effective Date, each share certificate representing Old Shares will be deemed to represent 1/15th share of Common Stock. Certificates representing New Shares will be issued in due course as old share certificates are tendered for exchange or transfer to our transfer agent, Manhattan Transfer Registrar Company-. We request that stockholders do not send in any of their stock certificates at this time.

As applicable, new share certificates evidencing New Shares that are issued in exchange for Old Shares representing restricted shares will contain the same restrictive legend as on the old certificates if the restriction period has not expired. Also, for purposes of determining the term of the restrictive period applicable to the New Shares, the time period during which a stockholder has held their existing pre-split shares will be included in the total holding period.

ADDITIONAL INFORMATION

For more detailed information about the Company, including financial statements, you may refer to our:

Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on March 30, 2016, which contains our audited financial statements;

Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2016 filed with the SEC on May 19, 2016;

Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2016 filed with the SEC on August 22, 2016; and

Quarterly Report on Form 10-Q/A for the quarterly period ended June 30, 2016 filed with the SEC on August 30, 2016.

The reports we file with the SEC and the accompanying exhibits may be inspected without charge at the Public Reference Section of the Commission at 100 F Street, N.E., Washington, DC 20549. Copies of such materials may also be obtained from the SEC at prescribed rates. The SEC also maintains a Web site that contains reports, proxy and information statements and other information regarding public companies that file reports with the SEC. Copies of the Reports may be obtained from the SEC’s EDGAR archives at http://www.sec.gov. We will also mail copies of our prior reports to any stockholder upon written request.

Upon written request, we will furnish without charge to record and beneficial holders of our common stock a copy of any and all of the documents referred to in this Information Statement. These documents will be provided by first class mail. Please make your request to the address or telephone number below.

OTHER MATTERS

The Board knows of no other matters other than those described in this Information Statement which have been approved or considered by the holders of a majority of the shares of the Company’s voting stock.

IF YOU HAVE ANY QUESTIONS REGARDING THIS INFORMATION STATEMENT, PLEASE CONTACT:

Cool Technologies, Inc.

8875 Hidden River Parkway

Tampa, Florida 33637

(813) 975-7467

|

|

By Order of the Board,

|

|

|

|

|

|

|

|

|

By

|

/s/ Timothy Hassett

|

|

|

|

|

Timothy Hassett

|

|

|

|

|

Chairman and Chief Executive Officer

|

|

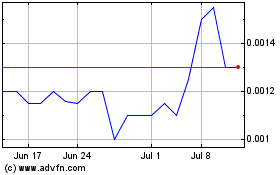

Cool Technologies (PK) (USOTC:WARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cool Technologies (PK) (USOTC:WARM)

Historical Stock Chart

From Apr 2023 to Apr 2024