UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

|

All for One Media Corp.

|

|

(Exact name of Registrant as specified in its charter)

|

|

Utah

|

|

5592357-1042

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

Attn: Brian Lukow

236 Sarles Street

Mt. Kisco, New York 10549

(914) 574-6174

|

|

(Address and Telephone Number of Registrant’s Principal Executive Offices and Principal Place of Business)

|

Securities to be registered pursuant to Section 12(b) of the Act:

|

Title of each class to be so registered

|

|

Name of each exchange on which each class is to be registered

|

|

None

|

|

None

|

Securities to be registered pursuant to Section 12(g) of the Act:

|

Common Stock, par value $0.001

|

|

(Title of class)

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

|

|

Table of Contents

Item 1. Business.

All for One Media Corp. (referred to herein as the “Company,” “All for One” or “AFOM”) was incorporated under the laws of the State of Utah on March 2, 2004, as “Early Equine, Inc.” The Company is principally engaged in content development of media targeted at the “tween” demographic consisting of children between the ages of seven and fourteen. We specialize in creating, launching, and marketing original pop music performed by “boy bands” and “girl groups,” though we also produce motion pictures, pre-recorded music, television, live concert performances, and licensed merchandise. On October 26, 2015, the Company entered into an asset exchange agreement with Crazy for the Boys, LLC, a Delaware limited liability company (“CFTB”), wherein the Company acquired movie screenplays, master recordings, trademarks, URLs, and other assets from CFTB in exchange for 5,201,500 shares of the Company’s common stock. As of the date of this registration statement, CFTB beneficially owns approximately 31.54% of the Company’s outstanding common stock. The Company also carries out its business through its subsidiary, Tween Entertainment Brands Inc., a corporation organized under the laws of the state of Florida. On November 4, 2015 the Company changed its name to All for One Media Corp.

From inception to date, we have generated no revenues, we have an accumulated deficit of $2,399,072 as of June 30, 2016, and we anticipate generating losses for the next twelve months. As of June 30, 2016, we had cash and cash equivalents of $30,694, and we will need to raise capital to implement our planned operations. If we are unable to do so, an entire investment in our stock could be lost. To address this concern, we have had discussions with prospective investors interested in financing the Company directly, as well as joint venture partners who have expressed interest in funding or co-funding certain of our projects. Our independent public accounting firm has issued an audit opinion, which includes a statement that the results of our operations and our financial condition raise substantial doubt about our ability to continue as a going concern.

The address of our principal executive office is:

All for One Media Corp.

236 Sarles Street

Mt. Kisco, New York 10549

Our telephone number is (914) 574-6174. Our e-mail address is brian@entbrands.com. Our website can be viewed at www.allforone.media. Information included in our website is not a part of this registration statement.

Competition

The Company competes with all forms of entertainment. A large number of companies, many with significantly more resources than All for One Media, Inc., produce and distribute film and music recordings, exploit products in the home entertainment market, and produce music for live theater and performance. Our competitive position primarily depends on the amount and quality of the content produced, its distribution and marketing success, and public response. We also compete to obtain creative and performing talents, story properties, and many other rights that are essential to the success of our business. Operating results for these offerings are influenced by seasonal consumer purchasing behavior, consumer preferences, levels of marketing and promotion, and by the timing and performance of releases, which may be directly or indirectly influenced by competitors.

Trademarks & Copyrights

We own the website URLs www.crazyfortheboys.com, www.allforone.media, and www.thescab.org.

Regulatory Matters

Children’s Privacy

Various laws and regulations intended to protect the interests of children are applicable to our business, including measures designed to protect the privacy of minors online. As we are currently focused on marketing content to this demographic, we will be subject to these regulations. The U.S. Children’s Online Privacy Protection Act (“COPPA”) limits the collection of personal information online from children under the age of 13 by operators of websites or online services. Effective July 1, 2013, the Federal Trade Commission adopted revisions to regulations under COPPA to further expand the scope of the regulations. Such regulations also limit the types of advertising we are able to sell on our websites and applications and impose strict liability for certain actions of advertisers, which could affect advertising demand and pricing. State and federal policymakers are also considering regulatory and legislative methods to protect consumer privacy on the Internet, and these efforts have focused particular attention on children and teens.

Legal Proceedings

We know of no existing or pending legal proceedings against us, nor are we involved as a plaintiff in any proceeding or pending litigation. There are no proceedings in which any of our directors, officers or any of their respective affiliates, or any beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

Employees

The Company currently has one full-time employee and no part-time employees.

Through in-house and third-party production service companies, we will engage the services of writers, directors, performers, musicians, and various crew members who are subject to certain industry-wide and/or specially negotiated collective bargaining agreements or one-off letter agreements. The Alliance of Motion Picture and Television Producers is a multi-employer trade association, which, along with and on behalf of hundreds of member companies, negotiates the industry-wide collective bargaining agreements with these parties. Any labor dispute with the labor organizations that represent any of these parties could disrupt our operations and reduce our revenues.

Item 1A. Risk Factors.

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

RISKS RELATED TO OUR COMPANY

We may not achieve profitability or positive cash flow.

Our ability to achieve and maintain profitability and positive cash flow will be dependent upon such factors as our ability to organize and promote concerts. Based upon current plans, we expect to incur operating losses in future periods because we expect to incur expenses that will exceed revenues for an unknown period of time. We cannot guarantee that we will be successful in generating sufficient revenues to support operations in the future.

We have a limited operating history which may not be an indicator of our future results.

We are a development stage company with a limited capital base. We have been engaged in organization and start-up activities related to financing the launch of a girl group band. We have no operating history investors may use to evaluate our future performance. As a result of our limited operating history, our plan for rapid growth, and the increasingly competitive nature of the markets in which we operate, the historical financial data is of limited value in evaluating our future revenue and operating expenses. Our planned expense levels will be based in part on expectations concerning future revenue, which is difficult to forecast accurately based on current plans of expansion and growth. We may be unable to adjust spending in a timely manner to compensate for any unexpected shortfall in revenue. Further, general and administrative expenses may increase significantly as we expand operations. To the extent that these expenses precede, or are not rapidly followed by, a corresponding increase in revenue, our business, operating results, and financial condition will suffer.

We have never produced, distributed or marketed a movie.

We intend to rely on a number of production, distribution, and marketing methods. Our primary focus will be the production, distribution, and marketing of Crazy For The Boys. Our management team has never produced, distributed or marketed a movie. Production, distribution, and marketing of movies is highly competitive and there can be no assurance that we will be able to market our product.

We are dependent on a limited number of proprietary copyrights.

We will initially derive all revenue from two properties, the Crazy For The Boys film and the Crazy For The Boys soundtrack, which, even if successful, will likely generate revenues for only a limited period of time. Because our licensing revenue is highly subject to the changing trends in the entertainment business, our licensing revenue may be subject to dramatic increases and decreases. Nevertheless, we feel that by promoting these two properties to launch our brand, we can successfully leverage the maturity of social media to connect tweens with content that is relevant and with which they can identify.

Competition in the entertainment industry may make it difficult to succeed long-term.

The recorded music, motion picture, and music publishing industries are highly competitive. Our competition includes major media and entertainment studios, independent film and music production companies, and television networks, both generally and concurrently at the time of release of our respective content. We compete with larger production studios that are better capitalized, who can fund projects based on the returns of prior productions. We will compete with these companies for artists, talent, airtime, and space in retail outlets. We are not at present, and do not expect in the foreseeable future to be, a significant participant in this marketplace. The market for music and movie production, distribution, and marketing is very competitive, and our lack of experience, compared to that of these competitors, may impair our ability to successfully produce content that creates a positive return on investment. Furthermore, we face indirect competition from alternative forms of leisure, such as travel, sporting events, outdoor recreation, and other cultural activities.

The entertainment industry is highly competitive, rapidly evolving, and subject to constant change. Other entertainment companies currently offer one or more of each of the types of products and services we plan to offer. In addition, our music and motion picture productions will compete for audience acceptance and exhibition outlets with music and motion pictures produced and distributed by other larger, more established companies. As a result, the success of any of our recorded music products or motion pictures is dependent not only on the quality and acceptance of a particular production, but also on numerous independent companies with whom we may partner. Some of our competitors in the music business will include Motown, Time Warner Inc., Universal Music Group, Sony BMG, and EMI, and numerous independent companies. We expect that our film business will compete with well-established companies, including MGM, DreamWorks, Time Warner Inc., Sony, Paramount, and Universal, as well as numerous small independent companies, all of which produce, develop or market films, DVDs, television, and cable programming.

The Company must respond successfully to ongoing changes in the U.S. video entertainment industry and consumer viewing patterns to remain competitive.

The Company expects that a substantial portion of its revenues and profits will be derived from the production and licensing of video entertainment offerings. The U.S. video entertainment industry is evolving, with developments in technology leading to new video services that are experiencing rapid growth, resulting in higher overall video content consumption as well as a shift in consumer viewing patterns as consumers seek more control over when, where, and how they view video content. These changes pose risks to the traditional U.S. television industry and some of the Company’s business models, including the disruption of the traditional television content delivery model by video streaming services, some of which are growing rapidly. The Company’s strategy to address these risks, including continuing to produce high-quality original content, and investing in technology and working with partners to enhance our content offerings, may not be successful. The Company may incur significant costs to implement its strategy and respond to and mitigate the risks from these changes, and, if not successful, could experience a significant adverse impact on the Company’s competitive position, businesses and results of operations.

The popularity of content is difficult to predict and can change rapidly, and low public acceptance of the Company’s content will adversely affect its results of operations.

The revenues expected from the sale, distribution, and licensing of television programming, feature films, music, and other content will depend primarily on widespread public acceptance of that content, which is difficult to predict and can change rapidly. The Company must invest substantial amounts in the production and marketing of its content before it learns whether such content will reach anticipated levels of popularity with consumers. The popularity of the Company’s content depends on many factors, only some of which are within the Company’s control. Examples include the popularity of competing content (including locally-produced content internationally), the availability of alternative forms of leisure and entertainment activities, the Company’s ability to maintain or develop strong brand awareness and target key audiences, and the Company’s ability to successfully anticipate (and timely adapt its content to) changes in consumer tastes in the countries and territories in which the Company operates. Low public acceptance of the Company’s content will adversely affect its results of operations.

Generally, feature films that perform well upon initial release also have commercial success in subsequent distribution channels. Therefore, the underperformance of a feature film, especially an “event” film, upon its public release can result in lower than expected revenues for the Company from the license of the film to broadcast and cable networks. If a new “event” film fails to achieve commercial success upon release, it may limit the Company’s ability to create new content. The failure to develop successful new content could have an adverse effect on the Company’s results of operations.

Consumer purchasing habits are not consistent throughout the year.

Sales of music and licensed goods concepts are seasonal, with a high percentage of retail sales occurring during the third and fourth quarters of the calendar year. As a result of the seasonal nature of our industry, we would be significantly and adversely affected by unforeseen events that negatively impact the retail environment or consumer buying patterns, particularly if such events were to impact the key-selling season.

Some initiatives to respond to and address the changes to the U.S. entertainment industry and consumer viewing and listening patterns may be outside the Company’s control.

While the Company supports the development of better consumer interfaces, the development and implementation of these interfaces are often outside the Company’s control. In addition, the Company may not be able to introduce new business models and products to enhance the value of its content without the cooperation of affiliates or other partners.

Advances in technology may have a material adverse effect on our revenues.

Advances in technology may affect the manner in which entertainment content is distributed to consumers. These changes, which might affect the entertainment industry as a whole, include the proliferation of digital music players, cloud-based services that allow consumers to download and store single songs, and pay-per-view movie services. These developments have created new outlets for consumers to purchase entertainment content. These new outlets may affect the quantity of entertainment products available for purchase and may reduce the amount that consumers are willing to pay for particular products. As a result, there could be a negative impact on our ability to sell DVDs and CDs. Any failure to adapt our business model to these changes could have a material adverse effect on our revenues.

Our success will depend on external factors in the music and film industries.

Operating in the music and film industries involves a substantial degree of risk. Each planned girl group and boy band music project or film production is an individual artistic work, and unpredictable audience reactions determine commercial success. The commercial success of a music or film project also depends on:

|

|

·

|

the quality and acceptance of other competing records or films released into the marketplace at or near the same time;

|

|

|

·

|

critical reviews;

|

|

|

·

|

the availability of alternative forms of entertainment and leisure activities;

|

|

|

·

|

general economic conditions; and

|

|

|

·

|

various other tangible and intangible factors.

|

Each of these factors is subject to change and cannot be predicted with certainty. There can be no assurance that our planned music and film projects will receive favorable ratings or reviews or that consumers will purchase our entertainment products and services.

The Company’s results of operations may be adversely affected if the Company’s efforts to increase sales of its video content and make digital ownership of content more compelling to consumers are not successful.

Several factors have contributed to an industry-wide decline in sales of home entertainment products in physical formats in recent years, including consumers shifting to on demand video subscriptions and electronic purchases and rentals; consumers electing to rent films using discount rental kiosks; changing retailer strategies and initiatives (

e.g.

, reduction in floor space devoted to home entertainment products in physical formats); retail store closures; weak economic conditions; increasing competition for consumer discretionary time and spending; and piracy. The Company’s efforts to offset the decline in sales of home entertainment products in physical formats and to make digital ownership of content more attractive to consumers may not be successful or may take several more years to become successful.

The Company may be adversely affected if distributors fail to adequately promote our creative projects.

Decisions regarding the timing of release and promotional support of our girl group and boy band music, music video, motion picture, television, and related licensing products are important in determining the success of the Company. As with most production companies, we do not control the manner in which our distributing partners distribute our content to final consumers. Although our distributors will have a financial interest in the success of our girl group and boy band projects, and decision by our distributors to not promote our products, or to promote a competitor’s products, could have a material adverse affect on our business and financial condition.

If the Company fails to compete successfully against alternative sources of entertainment, there may be an adverse effect on the Company’s results of operations.

The Company competes with all other sources of entertainment, including television, premium pay television services, on demand video subscriptions, feature films, the Internet, home entertainment products, videogames, social networking, print media, pirated content, live sports and other events, for consumers’ leisure and entertainment time and discretionary spending. The increased number of media and entertainment choices available to consumers has made it much more difficult to attract and obtain their attention and time. There can be no assurance that the Company will be able to compete successfully in the future against existing or new competitors.

The Company must protect its intellectual property.

We will rely on copyright, trademark, and other proprietary rights law to protect the intellectual property of our girl group and boy band projects. Our business is subject to the risk of third parties infringing on these intellectual property rights. We may need to pursue litigation to protect our intellectual property and that of our authorized licensors, which could result in substantial costs and divert resources.

Threats of piracy of the Company’s content, products, and other intellectual property may further decrease the revenues received from the legitimate sale, licensing, and distribution of its content and adversely affect its business and profitability.

Though the Company has never been victim of copyright piracy, it may be negatively affected this practice, and any piracy of the Company’s content, products and other intellectual property could reduce the revenues the Company earns from the legitimate sale, licensing and distribution of its content, products and other intellectual property. The risks relating to piracy have increased in recent years due to technological developments that have made it easier to create, distribute and store high-quality unauthorized copies of content, such as the proliferation of cloud-based storage and streaming services, increased broadband Internet speeds and penetration rates, and increased availability and speed of mobile data transmission. Piracy is particularly prevalent in countries that lack effective copyright and technical legal protections or enforcement measures, and illegitimate operators based in those parts of the world can attract viewers from anywhere in the world. Once our projects are produced for mass distribution, the Company will devote the necessary resources to protect its content, products and intellectual property, but these efforts to enforce rights and combat piracy may not be successful.

The Company may be subject to claims that it infringed intellectual property rights of others, which could require the Company to change its business practices.

Successful claims that the Company infringes on the intellectual property rights of others could require the Company to enter into royalty or licensing agreements on unfavorable terms, incur substantial monetary liability, be prohibited preliminarily or permanently from further use of the intellectual property in question or require the Company to change its business practices to stop the infringing use, which could limit its ability to compete effectively. Even if the Company believes a claim of intellectual property infringement is without merit, defending against the claim can be time-consuming and costly and divert management’s attention and resources away from its businesses.

We may be negatively affected by adverse general economic conditions.

Current conditions in domestic and global economies are extremely uncertain. Adverse changes may occur as a result of softening global economies, wavering consumer confidence caused by the threat of terrorism and war, and other factors capable of affecting economic conditions. Such changes could have a material adverse effect on our business, financial condition, and results of operations.

The Company’s businesses are subject to labor interruption.

The Company and some of its suppliers and business partners retain the services of writers, directors, actors, technicians, trade employees and others involved in the development and production of its television, feature film, and music content, who are covered by collective bargaining agreements. If negotiations to renew expiring collective bargaining agreements are not successful or become unproductive, the affected unions could take actions such as strikes, work slowdowns or work stoppages. Such actions or the possibility of such actions could result in delays in the production of the Company’s television programming and feature films. The Company could also incur higher costs from such actions, new collective bargaining agreements or the renewal of collective bargaining agreements on less favorable terms. Many of the collective bargaining agreements that cover individuals providing services to the Company are industry-wide agreements, and the Company may lack practical control over the negotiations and terms of these agreements. Depending on their duration, such union or labor disputes could have an adverse effect on the Company’s results of operations.

Our success depends largely on our management.

We are dependent on the continued employment of Brian Lukow, our President and CEO. Although we believe that we would be able to locate a suitable replacement, if we lose the services of Mr. Lukow, we cannot assure you that we would be able to do so. Additionally, our future operating results will substantially depend on our ability to attract and retain highly qualified management, financial, technical, creative, and administrative personnel. Competition for such people is intense and can lead to increased compensation expenses. We cannot assure you that we will be able to attract and retain the personnel necessary for the development of our business.

We need to obtain additional financing in order to continue our operations.

On a prospective basis, we will require both short-term financing for operations and long-term capital to fund our expected growth. We have no existing bank lines of credit and have not established any definitive sources for additional financing programs. The entertainment industry is rapidly evolving and our inability to take advantage of opportunities because of capital constraints may have a material adverse effect on our current business and future prospects.

RISKS RELATED TO OUR SECURITIES

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on the OTC Pink and other similarly-tiered quotation boards have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

|

|

·

|

variations in our operating results;

|

|

|

·

|

changes in expectations of our future financial performance, including financial estimates by securities analysts and investors;

|

|

|

·

|

changes in operating and stock price performance of other companies in our industry;

|

|

|

·

|

additions or departures of key personnel; and

|

|

|

·

|

future sales of our common stock.

|

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Our common shares may become thinly traded and you may be unable to sell at or near ask prices, or at all.

We cannot predict the extent to which an active public market for trading our common stock will be sustained. This situation is attributable to a number of factors, including the fact that we are a small company that is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

Because the SEC imposes additional sales practice requirements on brokers who deal in shares of penny stocks, some brokers may be unwilling to trade our securities. This means that you may have difficulty reselling your shares, which may cause the value of your investment to decline.

Our shares are classified as penny stocks and are covered by Section 15(g) of the Exchange Act, which imposes additional sales practice requirements on brokers-dealers who sell our securities. For sales of our securities, broker-dealers must make a special suitability determination and receive a written agreement prior from you to making a sale on your behalf. Because of the imposition of the foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our common stock. This could prevent you from reselling your shares and may cause the value of your investment to decline.

Financial Industry Regulatory Authority (FINRA) sales practice requirements may limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

Volatility in our common share price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management's attention and resources.

Our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

Sales of our currently issued and outstanding stock may become freely tradable pursuant to Rule 144 and may dilute the market for your shares and have a depressive effect on the price of the shares of our common stock.

A majority of the outstanding shares of our common stock are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”) (“Rule 144”). As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Securities Act and as required under applicable state securities laws. Rule 144 provides in essence that one year following a company filing Form 10 information with the SEC to that effect, a non-affiliate who has held restricted securities for a period of at least six months may sell their shares of common stock. Under Rule 144, affiliates who have held restricted securities for a period of at least six months may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1% of a company’s outstanding shares of common stock or the average weekly trading volume during the four calendar weeks prior to the sale.

We may seek to raise additional funds, finance acquisitions or develop strategic relationships by issuing capital stock.

We may finance our operations and develop strategic relationships by issuing equity or debt securities, which could significantly reduce the percentage ownership of our existing stockholders. Furthermore, any newly issued securities could have rights, preferences and privileges senior to those of our existing stock. Moreover, any issuances by us of equity securities may be at or below the prevailing market price of our stock and in any event may have a dilutive impact on your ownership interest, which could cause the market price of our stock to decline.

Our preferred stock could be issued to inhibit potential investors or delay or prevent a change of control that may favor you.

Some of the provisions of our certificate of incorporation, our bylaws and Utah law could, together or separately, discourage potential acquisition proposals or delay or prevent a change in control. In particular, our board of directors is authorized to issue up to 5,000,000 shares of preferred stock (less any outstanding shares of preferred stock) with rights and privileges that might be senior to our common stock, without the consent of the holders of the common stock.

Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

|

·

|

that a broker or dealer approve a person’s account for transactions in penny stocks; and

|

|

|

·

|

the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

|

|

·

|

obtain financial information and investment experience objectives of the person; and

|

|

|

·

|

make a reasonable determination that the transaction in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

|

|

·

|

sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

|

·

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Item 2. Financial Information.

The following discussion should be read in conjunction with the financial statements and related notes that appear elsewhere in this prospectus. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements.

All forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made.

Management’s Discussion and Analysis or Plan of Operations

Certain statements in this Report constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause such a difference include, among others, uncertainties relating to general economic and business conditions; industry trends; changes in demand for our products and services; uncertainties relating to customer plans and commitments and the timing of orders received from customers; announcements or changes in our pricing policies or that of our competitors; unanticipated delays in the development, market acceptance or installation of our products and services; changes in government regulations; availability of management and other key personnel; availability, terms and deployment of capital; relationships with third-party equipment suppliers; and worldwide political stability and economic growth. The words "believe", "expect", "anticipate", "intend" and "plan" and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made.

Liquidity and Capital Resources

Liquidity is the ability of a company to generate funds to support its current and future operations, satisfy its obligations, and otherwise operate on an ongoing basis. We have not generated revenues to fund our operating expenses. At September 30, 2015, we had a cash balance of $102 and working capital deficit of $102,337. At June 30, 2016, we had a cash balance of $30,694 and working capital deficit of $66,493. The Company’s principal liquidity for the year ended September 30, 2015 debt financing of approximately $22,000. The Company’s principal liquidity for the nine months ended June 30, 2016 came from the sale of equity interests of approximately $203,000 and debt financing of approximately $30,000.

As discussed above, the Company anticipates incurring significant expenditures during the coming year and to pursue its planned business operations including development of content and entertainment media. The Company’s ability to execute on these plans is dependent on its ability to generate additional investment proceeds. In the event that the Company is unable to raise the necessary funds, it would have to modify its current business plans and may not be able to attract the customers necessary to generate positive income from operations in such case; the business plan would have to be modified to address the funding issues.

As noted, the past operating expenses and cash needs are not indicative of our current operations which require substantially more cash to operate. At this time, the Company is dependent on outside funding to support its operations and anticipates it will need outside funding for at least the next twelve to twenty four months to support its business model. If the Company is unable to obtain continued outside funding, its operations would be severely impacted and it may not be possible to remain in business. Given current operations, traditional debt financing is not likely and the Company will have to continue to rely on equity or debt investments for outside non-banking sources.

Plan of Operations

All For One Media Corp. is in the business of exploiting the lucrative tween demographic across a multitude of entertainment platforms. The Company's primary business objective is to embark on creating, launching and marketing original pop music groups, commonly referred to as "boy bands" and "girl groups," by utilizing both traditional and social media models. All For One Media created and owns over thirty completed master recordings as well as a full length motion picture called "Crazy For The Boys," which is a musical comedy that also serves as the back story to the Company's plan to launch a new girl group.

The Company expects to generate revenues from sales, downloads and streaming of original recorded music, videos, motion pictures, music publishing, live performances, licensed merchandise and corporate sponsorships.

The Company is currently developing a new girl group (hereinafter the “Girl Group,” though the exact name has yet to be determined) brand based on an original pop group consisting of five teenage girls. Each group member portrays a different fictional character

.

Each character represents a distinct cross section of popular teen personas. They are: the “hip hop girl,” the “punk rocker,” the “biker babe,” the “hippie chick,” and “preppie cheerleader.” Each character will be highly stylized to represent a distinct fashion statement. An overriding theme to the group is the celebration of individuality. The underlying social message is anti–clique. The girl group will be marketed to children primarily between the ages of seven and fourteen. This target demo is often referred to as the “tween market.” Management is committed to recruiting girls of the highest triple threat caliber. “Triple threat” refers to a performer’s ability to excel at singing, dancing, and acting.

The production process starts with a series of auditions held in New York City, New York and Los Angeles, California to find the key acting and singing performers, which began in October 2016. We enlisted reputable personnel to assist in this process, including highly regarded youth casting directors, choreographers, a vocal coach, an audition pianist, and a representative from our social media agency. The cost for this step in the process is approximately $100,000.

Currently, our casting directors are negotiating offers with leading candidates and their agents for the five Girl Group roles, which is expected to continue through December 2016. We anticipate incurring expenses of approximately $10,000 during this phase.

Preliminary recordings and rehearsal is expected to begin January 2017, which is expected to last six weeks. Full-scale filming and production for Crazy for the Boys will begin when the Company finalizes all necessary financing, ideally in March 2017. We currently plan for the shooting schedule to require 23 days, followed by ten weeks of post-production editing and reviewing.

Each cast member will be signed to exclusive production and management contracts with the Company. The cast members of the Girl Group will be paid a guaranteed salary. Girl Group members will be contractually obligated to make the group their full time professional commitment.

The Company plans to retain control of all future original master recordings by the Girl Group. The Company believes that ownership of the masters will allow for both the maximum financial return and greatest leverage.

The Company is likewise developing a cast and projects for a boy band (hereinafter the “Boy Band,” though the exact name has yet to be determined) that will be comprised of five teenage boys. The cast members of the Boy Band will be paid a guaranteed salary. The Boy Band members will be contractually obligated to make the Boy Band their full time professional commitment. Management believes the boys cast for the group will be of the highest triple threat caliber. When the Company is ready to produce Boy Band projects, it expects the costs and scheduling of such to be similar to those incurred for the production of the Girl Group and Crazy for the Boys.

Target Market

The Girl Group and the Boy Band will be focused on exploiting what is now commonly referred to as the “tween” market, consisting of children between the ages of seven to fourteen years old. This demographic represents a significant opportunity for companies who are successful in penetrating it. Currently there are an estimated thirty-five million tweens in the United States alone. Over the last decade, the tween population has grown at twice the rate of the overall U.S. population. It is estimated that aggregate spending by U.S. tweens was over $41 billion in 2015. Additionally, tweens influence a staggering $270 billion of their parents’ spending. The biggest segments of tween spending are clothes, music, toys and hobbies, video games, and entertainment.

The financing required to execute these steps will be approximately $1,000,000 over the next twelve months of operation.

Results of Operations

The Company principally engaged in content development of media targeted at the “tween” demographic consisting of children between the ages of seven and fourteen. During the year ended September 30, 2015 and for the nine months ended June 30, 2016, we did not generate any revenue.

Total operating expenses for the year ended September 30, 2015 as compared to the year ended September 30, 2014, were approximately $54,000 and $23,000, respectively. The $31,000 increase in operating expenses was primarily due to increased legal and consulting fees.

Total operating expenses for the nine months ended June 30, 2016 as compared to the nine months ended June 30, 2015, were approximately $2,067,000 and $40,000, respectively. The $2,027,000 increase in operating expenses for the nine months ended June 30, 2016 is comprised largely of a $675,000 increase in compensation to our CEO and the recognition of stock based compensation to our CEO, an increase of $1,329,000 in professional and consulting primarily due to the recognition of stock based consulting fees to consultants and two of our directors and an increase of $23,000 in general and administrative expenses due to an increase in rent and office expenses.

Off Balance Sheet Arrangements

The Company has not had any off balance sheet arrangements.

Item 3. Properties.

The Company currently maintains a corporate office at 236 Sarles Street, Mt. Kisco, New York 10549. The Company leases this property from its President, Brian Lukow, for $1,000 a month, which includes telephone, Internet, and electricity utilities. The Company’s subsidiary also leases this space from the Company’s President, under the same terms. The Company feels this space is sufficient until the Company commences full operations.

Item 4. Security Ownership of Certain Beneficial Owners and Management.

The following table lists, as of October 11, 2016, the number of shares of common stock of our Company that are beneficially owned by (i) each person or entity known to our Company to be the beneficial owner of more than 5% of the outstanding common stock; (ii) each officer and director of our Company; and (iii) all officers and directors as a group. Information relating to beneficial ownership of common stock by our principal shareholders and management is based upon information furnished by each person using beneficial ownership‚ concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

The percentages below are calculated based on 16,489,852 shares of our common stock issued and outstanding as of October 11, 2016. We do not have any outstanding options, or other securities exercisable for or convertible into shares of our common stock. Unless otherwise indicated, the address of each person listed is c/o All for One Media Corp., 236 Sarles Street, Mt. Kisco, New York 10549.

|

Name and Address of Beneficial Owner

|

|

Title of Class

|

|

Amount and Nature of Beneficial Ownership (1)

|

|

|

Percent of Class (2)

|

|

|

Brian Lukow (3)

|

|

Common Stock

|

|

|

4,116,641

|

|

|

|

24.96

|

%

|

|

Brian Gold (4)

|

|

Common Stock

|

|

|

4,126,880

|

|

|

|

25.03

|

%

|

|

Aimee Ventura O’Brien (5)

|

|

Common Stock

|

|

|

1,426,580

|

|

|

|

8.65

|

%

|

|

Directors and Officers as a Group

|

|

|

|

|

9,670,101

|

|

|

|

58.64

|

%

|

|

Crazy for the Boys, LLC (6)

|

|

Common Stock

|

|

|

5,201,500

|

|

|

|

31.54

|

%

|

|

Michael Strasser (7)

|

|

Common Stock

|

|

|

1,000,000

|

|

|

|

6.06

|

%

|

____________________

|

1.

|

The number and percentage of shares beneficially owned is determined under the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares, which the individual has the right to acquire within 60 days through the exercise of any stock option or other right. The persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and the information contained in the footnotes to this table.

|

|

2.

|

Based on 16,489,852 issued and outstanding shares of common stock as of October 11, 2016.

|

|

3.

|

Brian Lukow is a director and the Company’s President. Mr. Lukow’s ownership includes his interests in Crazy for the Boys, LLC.

|

|

4.

|

Brian Gold is a director of the Company. Mr. Gold’s ownership includes his interests in Crazy for the Boys, LLC.

|

|

5.

|

Aimee Ventura O’Brien is a director and the Company’s Secretary.

|

|

6.

|

Brian Lukow, the Company’s President and director, is the managing member of Crazy for the Boys, LLC and owns approximately 17% of CFTB. Brian Gold, a director of the Company, owns approximately 20% of CFTB.

|

|

7.

|

Michael Strasser is a member of CFTB.

|

Item 5. Directors and Executive Officers.

Directors and Executive Officers

Set forth below are the names, ages and present principal occupations or employment, and material occupations, positions, offices or employments for the past five years of our current directors and executive officers. Unless otherwise indicated, the address of each person listed is c/o All for One Media Corp., 236 Sarles Street, Mt. Kisco, New York 10549.

|

Name and Business Address

|

|

Age

|

|

Position

|

|

Brian J. Lukow

|

|

57

|

|

President and Director

|

|

Brian Gold

|

|

60

|

|

Director

|

|

Aimee Ventura O’Brien

|

|

52

|

|

Secretary and Director

|

Brian J. Lukow, 57, President and Director.

Brian Lukow has been an officer and director of All For One Media since fall 2015. He has also served as the Co-Managing Member of Crazy For the Boys, LLC since August 2012. Prior to that he worked for Entertainment Brands, Inc. from 2007 to 2012. Mr. Lukow began his professional career on Wall Street. He was a senior vice President of Lehman Brothers from 1984 to 1991 and a managing director of Ladenburg Thalmann from 1992 to 1994. Mr. Lukow was most recently the highly talented co-creator and co-producer of Huckapoo. Prior to that, Mr. Lukow was the co-creator and executive producer of Dream Street, a very successful boy band, and one of the best selling pop music acts in recent years, whose debut album reached number one on the

Billboard Magazine

Independent charts. The original girl group concept is his creation and is built upon his experience and success with Dream Street and Huckapoo. In addition to his production credits, Mr. Lukow is also an accomplished songwriter. Among Mr. Lukow’s writing credits is the song “Jennifer Goodbye“ which was recorded by Dream Street on its first album; that album went on to sell nearly one million units. Mr. Lukow is a co-writer on five of the original Huckapoo recordings as well. Additionally, Mr. Lukow is the associate producer of the motion picture “The Biggest Fan” starring Chris Trousdale, Cindy Williams, and Pat Morita. From 1994 to 1996 Mr. Lukow was President of Brirock Entertainment, a firm specializing in artist management.

Aimee Ventura O’Brien, 60, Secretary and Director.

Aimee Ventura O’Brien has a diverse background in business, including experiences on Wall Street and in the world of architecture. On Wall Street, Ms. O’Brien traded complex equity derivatives for Credit Suisse and Fidelity Investment. She eventually decided to return to school to become an architect. Ms. O’Brien holds a bachelor’s degree in mathematics and business from Skidmore College and a bachelor’s of architecture from NY Institute of Technology, where she studied from 2008-2012. Since graduating in 2012, Ms. O’Brien has worked for two large building envelope firms in New York, learning about the complex design of building skins. From September 2012 to February 2016, Ms. O’Brien worked as a Senior Manager at Hoffman Architects in New York City. From February 2016 to July 2016, she worked as the Director of Business Development at Vidaris, Inc. in New York City. Since July 2016, she has been the Director of Business Development for DIRTT Environmental Solutions in New York City. Ms. O’Brien as won awards from the American Institute of Architects, Henry Adams Certificate, Robert Jensen Memorial Award, and the Maria Bentel Memorial Thesis Travel Grant.

Brian D. Gold, 52, Director.

Brian D. Gold is currently the president and CEO of his family’s business, Sultana Distribution Services, Inc., which is the largest candy re-distributor in the United States, selling to hundreds of wholesalers across the country. Mr. Gold started with the company in 1975, joining Sultana Crackers, Inc., a company started by his father, Bernard, in 1947, that was predominately a specialty cracker supplier and distributor. Brian has long been active in the snack industry and considers himself an original member of the New York City Confectionery Club, who named him their Man of the Year for 1978. Mr. Gold was inducted into the Candy Hall of Fame in 2014.

Board Composition

Our bylaws provide that the Board of Directors shall consist of one or more members. Each director of the Company serves for a term of one year or until the successor is elected at the Company’s annual shareholders’ meeting and is qualified, subject to removal by the Company’s shareholders. Each officer serves, at the pleasure of the Board of Directors, for a term of one year and until the successor is elected at the annual meeting of the Board of Directors and is qualified.

Significant Employees

Other than the above-named officers and directors, we have no full-time employees whose services are materially significant to our business and operations.

Family Relationships

There are no familial relationships among any of our officers or directors. None of our directors or officers is a director in any other reporting companies. The Company is not aware of any proceedings to which any of the Company‚ officers or directors, or any associate of any such officer or director, is a party adverse to the Company or any of the Company‚ subsidiaries or has a material interest adverse to it or any of its subsidiaries.

Involvement in Legal Proceedings

During the past ten years, none of our present or former directors, executive officers or persons nominated to become directors or executive officers:

|

|

·

|

have been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offences);

|

|

|

·

|

had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time;

|

|

|

·

|

have been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity;

|

|

|

·

|

have been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

|

|

|

·

|

have been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or have been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26)), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29)), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

|

Item 6. Executive Compensation.

Summary Table.

The following table sets forth information concerning the annual and long-term compensation awarded to, earned by, or paid to the named executive officer for all services rendered in all capacities to our company, or any of its subsidiaries, for the years ended September 30, 2015 and 2014:

Compensation Table for Executives

|

Name &

Principal Position

|

|

Year

|

|

Salary

($)

|

|

|

Bonus

|

|

|

Stock

Awards

($)

|

|

|

Non-Equity

Incentive

Plan

Compensation

|

|

|

Nonqualified

Deferred

Compensation

Earnings

|

|

|

All Other

Compensation

|

|

|

Total

($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brian Lukow,

|

|

2015

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

President

|

|

2014

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aimee Ventura O’Brien,

|

|

2015

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Secretary

|

|

2014

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

Employment Agreements

The Company has an employment contract with Brian Lukow, its President, which provides for a monthly salary of $5,000 plus 20,000 shares of common stock, issued at a cost basis of $0.25 per share. The employment contract also has customary provisions for other benefits and includes non-competition and non-solicitation clauses. The employment agreement was entered into October 2015, constitutes an “at will” employment arrangement, and may be terminated by either Lukow or the Company upon two months written notice if without cause.

The Company has no other formal employment agreements.

Compensation of Directors

Summary Table.

The following table sets forth information concerning the annual and long-term compensation awarded to, earned by, or paid to the named Directors for all services rendered in all capacities to our company, or any of its subsidiaries, for the year ended September 30, 2015:

Compensation Table for Directors

|

Name

|

|

Fees earned or paid in cash

($)

|

|

|

Stock awards

($)

|

|

|

Option awards

($)

|

|

|

Non-Equity

Incentive

Plan

Compensation

($)

|

|

|

Change in pension value and nonqualified deferred compensation earnings

|

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brian Lukow

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brian Gold

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aimee Ventura O’Brien

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

Item 7. Certain Relationships and Related Transactions, and Director Independence.

Related Party Transactions

Between October 2015 and January 2016, the Company issued 65,806 shares of its common stock to the CEO of the Company as payment for services rendered pursuant to the CEO’s employment agreement with the Company. The Company valued these common shares at the fair value of $16,452, or $0.25 per common share, based on the sale of common stock in a private placement at $0.25 per common share.

Between October 2015 and January 2016, the Company issued an aggregate of 19,740 shares of its common stock to the three directors of the Company as payment for services rendered pursuant to corporate director agreements. The Company valued these common shares at the fair value of $4,935, or $0.25 per common share, based on the sale of common stock in a private placement at $0.25 per common share.

In February 2016, the Company issued 20,000 shares of its common stock to the CEO of the Company as payment for services rendered pursuant to his employment agreement. The Company valued these common shares at the fair value of $5,000, or $0.25 per common share, based on the sale of common stock in a private placement at $0.25 per common share.

In February 2016, the Company issued an aggregate of 6,000 shares of its common stock to the three directors of the Company as payment for services rendered pursuant to corporate director agreements. The Company valued these common shares at the fair value of $1,500, or $0.25 per common share, based on the sale of common stock in a private placement at $0.25 per common share.

Between March 2016 and May 2016, the Company issued 60,000 shares of the Company’s common stock to the CEO of the Company as payment for services rendered pursuant to the Employment agreement. The Company valued these common shares at the fair value ranging from $0.17 to $0.37 per common share or $14,800 based on the quoted trading price on the date of grants.

Between March 2016 and May 2016, the Company issued an aggregate of 18,000 shares of the Company’s common stock to the three directors of the Company as payment for services rendered pursuant to corporate director agreements. The Company valued these common shares at the fair value ranging from $0.17 to $0.37 per common share based on the quoted trading price on the date of grants.

In April 2016, the Company sold 40,000 shares of the Company’s common stock to a director of the Company for gross proceeds of $4,000. The Company recorded stock based compensation of $10,800, which is equal to the fair value of shares issued in excess of the purchase price of $4,000. The Company has determined that the fair value of the common stock is $0.37 per share, which is based on the quoted trading price on the date of grant.

In June 2016, the Company issued 3,000,000 common shares to Brian Lukow, 3,000,000 common shares to Brian Gold, and 1,000,000 common shares to Aimee Ventura O’Brien, at $0.0025 per common share, for proceeds of $10,000 which was paid in and included a settlement of accrued salaries to the CEO of the Company for $7,500. The Company recorded stock based compensation of $1,382,500, which is equal to the fair value of shares issued in excess of the purchase price of $17,500. The Company has determined that the fair value of the common stock is $0.20 per share, which is based on the quoted trading price on the date of grant.

In June 2016, the Company issued 1,000,000 common shares to Michael Strasser at $0.0025 per common share, or $2,500. Mr. Strasser is a member of Crazy for the Boys, LLC. The Company recorded stock based compensation of $197,500, which is equal to the fair value of shares issued in excess of the purchase price of $2,500. The Company has determined that the fair value of the common stock is $0.20 per share, which is based on the quoted trading price on the date of grant.

In June 2016, the Company issued 20,000 shares of the Company’s common stock to the CEO of the Company as payment for services rendered pursuant to the Employment agreement. The Company valued these common shares at the fair value of $15,000 or $0.25 per common share based on the quoted trading price on the date of grant.

In June 2016, the Company issued an aggregate of 6,000 shares of the Company’s common stock to the three directors of the Company as payment for services rendered and to be rendered for future services pursuant to corporate director agreements. The Company valued these common shares at the fair value of $1,500 or $0.25 per common share based on the quoted trading price on the date of grant.

Promoters and Certain Control Person

During the past five fiscal years, we have not had any promoters at any time.

Director Independence

Our securities are not listed on a national securities exchange or on any inter-dealer quotation system which has a requirement that a majority of directors be independent. Our board of directors has undertaken a review of the independence of each director by the standards for director independence set forth in the NASDAQ Marketplace Rules. Under these rules, a director is not considered to be independent if he or she also is an executive officer or employee of the corporation. Our board of directors has determined that the Company does not have any independent directors.

Item 8. Legal Proceedings.

We know of no existing or pending legal proceedings against us, nor are we involved as a plaintiff in any proceeding or pending litigation. There are no proceedings in which any of our directors, officers or any of their respective affiliates, or any beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

Item 9. Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters.

(a) Market Information.

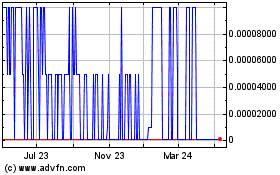

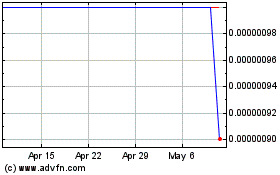

Our common stock was first quoted on an over-the-counter market on September 9, 2009 and is currently listed as an OTC Pink company, trading under the symbol “AFOM.”

(b) Holders.

As of October 11, 2016, there were 16,489,852 shares of our common stock issued and outstanding, held by 73 stockholders of record. Once this registration statement has been effective for 90 days, then all shares held by shareholders that are not affiliates of the Company will be able to sell their shares, as long as they have been held for longer than six months, according to market conditions and if a market develops.

(c) Warrants

We have not issued any derivative securities, nor are there any warrants, options or other convertible securities outstanding.

(d) Dividends.

We have not declared or paid dividends on our common stock since our formation, and we do not anticipate paying dividends in the foreseeable future. Declaration or payment of dividends, if any, in the future, will be at the discretion of our Board of Directors and will depend on our then current financial condition, results of operations, capital requirements and other factors deemed relevant by the Board of Directors. There are no contractual restrictions on our ability to declare or pay dividends.

(e) Securities Authorized for Issuance under Equity Compensation Plans.