Additional Proxy Soliciting Materials (definitive) (defa14a)

November 21 2016 - 5:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __)

Filed by the

Registrant ☒ Filed by a Party other than

the Registrant ☐

Check appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☒

|

|

Soliciting Material under Rule 14a-12

|

LATTICE SEMICONDUCTOR

CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the form or schedule and the date of its filing:

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

The following communication was circulated to Lattice Semiconductor Corporation employees on November 21

st

, 2016 to provide employees with responses to frequently asked questions regarding the previously announced proposed acquisition by Canyon Bridge Capital Partners, LLC:

2

EMPLOYEE FAQ #2

TRANSACTION DETAILS

|

|

•

|

|

What are the conditions to completing the transaction?

|

|

|

•

|

|

Completion of the proposed merger is subject to various conditions to closing, and you should review the proxy statement once it has been filed for a more complete description of the terms of the merger

agreement. Among the various closing conditions are: 1) regulatory approvals and clearances; and 2) the affirmative vote of Lattice stockholders holding a majority (50% + 1) of Lattice common stock.

|

|

|

•

|

|

We and Canyon Bridge are working to obtain all required regulatory approvals and clearances and believe that we should be in position to close the transaction in early 2017.

|

|

|

•

|

|

We believe that the 30% premium versus the closing price of the Company’s common stock on the last trading day prior to the date the proposed transaction was announced shows that the transaction provides

significant benefits to our stockholders.

|

|

|

•

|

|

What does Lattice’s board and executive leadership team think of the transaction?

|

|

|

•

|

|

Our board of directors unanimously approved this transaction and believes that the transaction is in the best interests of Lattice and its stockholders and that the transaction also reduces our execution risk.

|

|

|

•

|

|

Our executive leadership team is also very supportive of the transaction as they believe the transaction will allow us to enhance our focus on long-term innovation and growth.

|

|

|

•

|

|

We have also communicated to customers that we are fully committed to ensuring that the transaction is seamless from our customers’ point of view, with no interruptions in service or support.

|

|

|

•

|

|

What happens if the deal does not close?

|

|

|

•

|

|

This transaction was unanimously approved by Lattice’s board of directors and we expect the transaction to close in early 2017.

|

|

|

•

|

|

If the transaction were not to close, we would continue to pursue the path we are laying out in our SLRP and PLBP.

|

|

|

•

|

|

In addition, Lattice would be required to pay a termination fee of $34,180,000 if the transaction were to be terminated under specified circumstances, and Lattice would receive a reverse termination fee of $58,750,000

if the transaction were to be terminated under different specified circumstances. You should review the proxy statement once it has been filed for a more complete description of the terms of the merger agreement, including the circumstances

under which a termination fee could be paid or a reverse termination fee could be received.

|

CANYON BRIDGE

|

|

•

|

|

Is Canyon Bridge a new company or has it been around for a while?

|

|

|

•

|

|

Canyon Bridge is a recently established U.S.-based private-equity buyout fund, and its co-founders, Ben Chow and Ray Bingham, collectively have more than 50 years of experience in the technology, private equity and

M&A markets.

|

|

|

•

|

|

Who are Canyon Bridge’s limited partners?

|

|

|

•

|

|

Currently, Canyon Bridge has one limited partner, a wholly owned subsidiary of China Venture Capital Fund Corporation Limited, a large Chinese investment fund.

|

|

|

•

|

|

Canyon Bridge has an equity commitment in place from its limited partners which should provide the necessary funds to consummate the transaction.

|

|

|

•

|

|

What is Canyon Bridge’s strategy and portfolio plan?

|

|

|

•

|

|

Canyon Bridge is focused on providing strategic capital to enable technology companies to reach their full growth potential. They combine deep knowledge of the global technology industry with experience in the financial

markets to provide world-class investment expertise in creating and maximizing value for their investors.

|

|

|

•

|

|

Canyon Bridge seeks to invest in companies with strong platforms led by experienced management teams. Their investment philosophy is to work closely with company executives to implement best business practices and seek

growth through a global market perspective, including making additional investments and accretive acquisitions.

|

|

|

•

|

|

How many companies does Canyon Bridge have in their portfolio?

|

|

|

•

|

|

While Canyon Bridge’s partners are highly experienced, Lattice will be Canyon Bridge’s first portfolio company.

|

UNTIL THE CLOSE

|

|

•

|

|

Are there any changes to the current no-hire policy for replacement of attrition?

|

|

|

•

|

|

There are 40 positions open on our website today, including requisitions for attrition replacements. We will hire replacements as they align with our PLBP.

|

|

|

•

|

|

Will this impact AOP, budgets, and spending targets?

|

|

|

•

|

|

We are proceeding with aligning our AOP and PLBP. After the transaction there may be changes as Canyon Bridge makes investments in us.

|

|

|

•

|

|

Are we now changing our roadmap or direction?

|

|

|

•

|

|

We are continuing to develop and finalize a course based on PLBP.

|

AFTER THE CLOSE

|

|

•

|

|

What happens to ESPP plan participants?

|

|

|

•

|

|

If the transaction closes before the ESPP purchase date of December 31, 2016, then the current offering period will end at least five days prior to the closing date and each participant’s contributions through the

new end date will be used to purchase shares of the Company’s stock under the ESPP. Current participants in the ESPP may not increase their contributions for the current offering period and no new participants may join the current offering

period.

|

|

|

•

|

|

If the transaction closes after the ESPP purchase date of December 31, 2016, then participants in the offering period will be issued stock on January 2, 2017 per the normal process and the ESPP. The required six month

holding period for ESPP shares is still in operation during this period between when the stock is issued and the transaction closes.

|

|

|

•

|

|

No new offering period will commence after December 31, 2016.

|

|

|

•

|

|

What happens to the current Lattice board of directors?

|

|

|

•

|

|

Upon completion of the merger, the current Lattice board members will be replaced by board members designated by Canyon Bridge.

|

|

|

•

|

|

Will our company name change?

|

|

|

•

|

|

We do not anticipate that the Lattice Semiconductor name will change in the near term. Our product direction, while becoming more focused, is not materially changing and it would be costly in both time and money to

change our name.

|

|

|

•

|

|

How will employees know how we are doing financially once we are private?

|

|

|

•

|

|

We intend to continue our current pattern of communication, including quarterly comm sessions with management that include a discussion of how we are doing versus our financial and other goals.

|

|

|

•

|

|

Are we a Chinese company now?

|

|

|

•

|

|

No. After the transaction closes we will still be a U.S. company headquartered in Portland, OR and will be a subsidiary of a U.S.-based private equity fund.

|

|

|

•

|

|

Will there be any changes to Data Loss Prevention, export control or restrictions on who we ship to?

|

|

|

•

|

|

At this time, we are not anticipating any changes to our existing controls and processes.

|

|

|

•

|

|

The last FAQ mentioned that Canyon Bridge will provide comparable benefits for one year after closing. What happens after one year?

|

|

|

•

|

|

Regardless if we are private or public company, it is premature to speculate on what will happen to compensation in a year.

|

Forward Looking Statements

Certain statements

made herein, including, for example, that if the acquisition (the “Merger”) of Lattice Semiconductor Corporation (“we,” “us,” “our” or the “Company”) by Canyon Bridge Acquisition Company, Inc.

(“Parent”) pursuant to the terms of the Agreement and Plan of Merger by and among the Company, Parent, and Canyon Bridge Merger Sub, Inc. (“Merger Sub”, and such agreement, the “Merger Agreement”) does not occur the

Company plans on continuing to pursue the path laid out in its SLRP and PLBP; that the Company believes that it should be in position to close the transaction in early 2017; that the Company’s board of directors believes that the transaction

also reduces the Company’s execution risk; that the Company’s executive leadership team believes the transaction will allow the Company to enhance its focus on long-term innovation and growth; that the Company is fully committed to

ensuring that there are no interruptions in service or support; that the equity commitment should provide the necessary funds to consummate the transaction; that the Company will hire replacements as they aligned with its PLBP; that there may be

changes to the Company’s AOP and PLBP as Canyon Bridge makes investments in the Company; that the Company is continuing to develop and finalize a course based on PLBP; that upon completion of the merger, the current Company board members will

be replaced by board members designed by Canyon Bridge; that the Company’s product direction is not materially changing; that the Company does not anticipate that the Lattice Semiconductor name will change in the near term; that the Company

intends to continue to hold quarterly comms sessions that include a discussion of performance versus financial and other goals; that at this time, the Company is not expecting any changes to existing controls and processes; and the treatment of

equity plans and compensation after the Merger, are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, within the meaning of the federal securities laws, including Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “will,”

“may,” “would” and similar statements of a future or forward-looking nature may be used to identify forward-looking statements. These forward-looking statements reflect the current analysis of the management of the Company of

existing information as of the date of these forward-looking statements and are subject to various risks and uncertainties, many of which are beyond our control, and are not guarantees of future results or achievements. Consequently, no

forward-looking statements may be guaranteed and there can be no assurance that the actual results or developments anticipated by such forward looking statements will be realized or, even if substantially realized, that they will have the expected

consequences to, or effects on, the Company or its businesses or operations.

As a result, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. Due to known and unknown risks, our actual results

may differ materially from our expectations or projections.

The following factors, among others, could cause actual results to differ materially from

those described in these forward-looking statements: the occurrence of any event, change or other circumstances that could give rise to the delay or termination of the Merger Agreement; the outcome or length of any legal proceedings that have been,

or will be, instituted related to the Merger Agreement; the inability to complete the Merger due to the failure to timely or at all obtain stockholder approval for the Merger or the failure to satisfy other conditions to completion of the Merger,

including the receipt on a timely basis or at all of any required regulatory clearances related to the Merger; the failure of Parent to obtain or provide on a timely basis or at all the necessary financing as set forth in the equity commitment

letter delivered pursuant to the Merger Agreement; risks that the proposed transaction disrupts current plans and operations and the potential difficulties in employee retention as a result of the Merger; the effects of local and national economic,

credit and capital market conditions on the economy in general; and the other risks and uncertainties described herein, as well as those risks and uncertainties discussed from time to time in our other reports and other public filings with the

Securities and Exchange Commission (the “SEC”) as described below. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive.

Additional information concerning these and other factors that may impact our expectations and projections can be found in our periodic filings with the SEC,

including our Annual Report on Form 10-K for the fiscal year ended January 2, 2016, and our Quarterly Reports on Form 10-Q for the quarters ended April 2, 2016, July 2, 2016 and October 1, 2016. Our SEC filings are available publicly on the

SEC’s website at

www.sec.gov

, on the Company’s website at ir.latticesemi.com or upon request from the Company’s Investor Relations Department at lscc@globalirpartners.com. Except to the extent required by applicable law, we

disclaim any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Additional

Information about the Proposed Merger And Where To Find It

In connection with the proposed Merger, the Company will file a proxy statement with

the SEC. Additionally, the Company plans to file other relevant materials with the SEC in connection with the proposed Merger. The definitive proxy statement will be sent or given to the stockholders of the Company and will contain important

information about the proposed Merger and related matters. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT

MATERIALS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE MERGER AND THE PARTIES TO THE MERGER. The materials to be filed by the Company with the SEC may be obtained free of charge at the SEC’s web site at

www.sec.gov

or upon request from the Company’s Investor Relations Department at

lscc@globalirpartners.com.

Participants in the Solicitation

The Company and its directors will, and certain other members of its management and its employees as well as Parent and Merger Sub and their directors and

officers may be deemed to be participants in the solicitation of proxies of Company stockholders in connection with the proposed Merger. Investors and security holders may obtain more detailed information regarding the names, affiliations and

interests of the Company’s executive officers and directors in the solicitation by reading the Company’s Annual Report on Form 10-K for the fiscal year ended January 2, 2016, the Company’s proxy statement on Schedule 14A for its 2016

Annual Meeting of Stockholders and the proxy statement and other relevant materials filed with the SEC in connection with the Merger if and when they become available. Additional information concerning the interests of the Company’s

participants in the solicitation, which may, in some cases, be different than those of the Company’s stockholders generally, will be set forth in the proxy statement relating to the Merger when it becomes available.

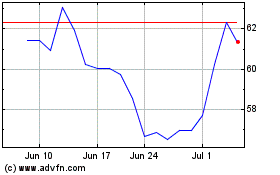

Lattice Semiconductor (NASDAQ:LSCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

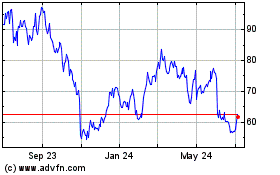

Lattice Semiconductor (NASDAQ:LSCC)

Historical Stock Chart

From Apr 2023 to Apr 2024