Registration Statement No. 333-165065

Registration Statement No. 333-165566

Registration Statement No. 333-169272

Registration Statement No. 333-171231

Registration Statement No. 333-172069

Registration Statement No. 333-178664

Registration Statement No. 333-188517

Registration Statement No. 333-192806

Registration Statement No. 333-201386

Registration Statement No. 333-208634

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective

Amendment No. 2 to Form S-8 Registration Statement No. 333-165065

Post-Effective Amendment No. 1 to Form S-8

Registration Statement No. 333-165566

Post-Effective Amendment No. 1 to Form S-8 Registration Statement

No. 333-169272

Post-Effective Amendment No. 4 to Form S-8 Registration Statement No. 333-171231

Post-Effective Amendment No. 1 to Form S-8 Registration Statement No. 333-172069

Post-Effective Amendment No. 2 to Form S-8 Registration Statement No. 333-178664

Post-Effective Amendment No. 2 to Form S-8 Registration Statement No. 333-188517

Post-Effective Amendment No. 2 to Form S-8 Registration Statement No. 333-192806

Post-Effective Amendment No. 2 to Form S-8 Registration Statement No. 333-201386

Post-Effective Amendment No. 1 to Form S-8 Registration Statement No. 333-208634

UNDER

THE

SECURITIES ACT OF 1933

Anheuser-Busch InBev SA/NV

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

Belgium

|

|

None

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification Number)

|

Brouwerijplein 1,

3000 Leuven, Belgium

(Address of Principal Executive Offices)

Anheuser-Busch

Deferred Income Stock Purchase and Savings Plan

Discretionary Restricted Stock Units Programme

Share-Based Compensation Plan

Share-Based Compensation Plan Relating to American Depositary Shares of Anheuser-Busch InBev

Long-Term Incentive Plan Relating to Shares of Anheuser-Busch InBev Long-Term Incentive Plan Relating to American Depositary Shares of

Anheuser-Busch InBev

Exceptional Incentive Restricted Stock Units Programme

2020 Dream Incentive Plan

(Full Title of the Plans)

Augusto Lima

Anheuser-Busch InBev SA/NV

250 Park Avenue

New

York, New York 10017

Tel. No.: (212) 503-2891

(Name, Address and Telephone Number of Agent for Service)

Copies to:

George

H. White

Sullivan & Cromwell LLP

1 New Fetter Lane

London

EC4A 1AN

United Kingdom

Tel. No.: 011-44-20-7959-8900

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☒

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐

|

|

Smaller reporting company

|

|

☐

|

2

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities to Be Registered

|

|

Amount to Be

Registered

(1)

|

|

|

Proposed Maximum

Offering Price Per

Share

(1)

|

|

|

Amount of

Registration

Fee

(1)

|

|

|

Ordinary shares of Anheuser-Busch InBev SA/NV without nominal value (“Ordinary Shares”) (granted pursuant to the Anheuser-Busch

Deferred Income Stock Purchase and Savings Plan)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary

Shares (granted pursuant to the Discretionary Restricted Stock Units Programme)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary

Shares (granted pursuant to the Share-Based Compensation Plan)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares (granted pursuant to the Share-Based Compensation Plan Relating to American Depositary Shares of Anheuser-Busch InBev)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary

Shares (granted pursuant to the People Bets Share Purchase Plan)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares (granted pursuant to the Long-Term Incentive Plan Relating to Shares of Anheuser-Busch InBev)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares (granted pursuant to the Long-Term Incentive Plan Relating to American Depositary Shares of Anheuser-Busch InBev)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares (granted pursuant to the Exceptional Incentive Restricted Stock Units Programme)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary

Shares (granted pursuant to the 2020 Dream Incentive Plan)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

No additional securities are to be registered, and the registration fee was paid upon filing of the original Registration Statements on Form S-8

(File Nos. 333-165065,

333-165566, 333-169272, 333-171231, 333-172069, 333-178664, 333-188517, 333-192806, 333-201386 and 333-208634). Therefore, no further registration fee is required.

|

EXPLANATORY STATEMENT

This

Post-Effective Amendment is being filed pursuant to Rule 414 under the Securities Act of 1933, as amended (the “Securities Act”), and constitutes Amendment No. 1 to the registration statements on Form S-8 (File Nos. 333-165065,

333-165566, 333-169272, 333-171231, 333-172069, 333-178664, 333-188517, 333-192806, 333-201386 and 333-208634) (collectively, the “Registration Statements”), by Anheuser-Busch InBev SA/NV, a public limited liability company

(

société anonyme/naamloze vennootschap

) incorporated in Belgium (“Old AB InBev”) and the predecessor of Newbelco SA/NV, a public limited liability company (

société anonyme/naamloze vennootschap

),

which has subsequently been re-named Anheuser-Busch InBev SA/NV (“New AB InBev” or the “Registrant”), relating to the Anheuser-Busch Deferred Income Stock Purchase and Savings Plan, the Discretionary Restricted Stock Units

Programme, the Share-Based Compensation Plan, the Share-Based Compensation Plan Relating to American Depositary Shares of Anheuser-Busch InBev, the People Bets Purchase Plan, the Long-Term Incentive Plan Relating to Shares of Anheuser-Busch InBev,

the Long-Term Incentive Plan Relating to American Depositary Shares of Anheuser-Busch InBev, the Exceptional Incentive Restricted Stock Units Programme and the 2020 Dream Incentive Plan (the “Stock Plans”). New AB InBev succeeded to the

interests of Old AB InBev following the business combination between Old AB InBev and SABMiller plc (“SABMiller”) (the “Transaction”) pursuant to a Co-operation Agreement, dated as of November 11, 2015 (the

“Co-operation Agreement”), between Old AB InBev and SABMiller. The Co-operation Agreement provided for, among other things, the merger of Old AB InBev with and into New AB InBev through a merger by absorption under the Belgian Law of

7 May 1999, setting out the Companies Code (the “Belgian Merger”). The Transaction was approved by the shareholders of Old AB InBev at an extraordinary general meeting of shareholders on September 28, 2016.

As a result of the Belgian Merger, all assets and liabilities of Old AB InBev were transferred to New AB InBev and New AB InBev was automatically substituted

for Old AB InBev in all its rights and obligations by operation of Belgian law. In addition, upon the effective date of the Belgian Merger, (1) each outstanding ordinary share of Old AB InBev without nominal value was automatically converted

into one Ordinary Share of the Registrant and (2) each outstanding and unexercised option or other right to purchase or receive or security convertible into Old AB InBev ordinary shares and/or American Depositary Shares (“ADSs”)

became an option or right to purchase or receive or a security convertible into the Registrant’s Ordinary Shares and/or ADSs on the basis of one Ordinary Share or ADS of the Registrant for each ordinary share or ADS of Old AB InBev issuable

pursuant to any such option, right to purchase or convertible security, on the same terms and conditions and at an exercise price per share equal to the exercise price applicable to any such Old AB InBev option, stock purchase right or convertible

security. Immediately prior to the consummation of the Transaction, the Registrant had as its only assets (i) the minimum capital required under Belgian law and (ii) funds borrowed by it in order to pay the stamp duty in the UK associated

with the Transaction.

3

In accordance with Rule 414 under the Securities Act, the Registrant, as successor issuer to Old AB InBev, hereby

expressly adopts the aforementioned Registration Statements as its own for all purposes of the Securities Act and the Securities Exchange Act of 1934, as amended. The applicable registration fees were paid at the time of the original filing of the

aforementioned Registration Statements.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The document(s) containing the information specified in Part I of Form S-8 will be sent or given to participants in the plans covered by this registration

statement as specified by Rule 428(b)(1) of the Securities Act. Such documents need not be filed with the Commission either as part of this registration statement or as prospectuses or prospectus supplements pursuant to Rule 424. These documents and

the documents incorporated herein by reference pursuant to Item 3 of Part II of this registration statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The following documents filed with the Commission are incorporated in this registration statement by reference and made a part hereof:

|

|

•

|

|

Old AB InBev’s Annual Report on Form 20-F for the year ended 31 December 2015 filed with the Commission on 14 March 2016 (“Annual Report”);

|

|

|

•

|

|

Old AB InBev’s Current Report on Form 6-K filed with the Commission on 29 March 2016, regarding the pricing of EUR 13.25 billion aggregate principal amount of AB InBev’s senior unsecured notes issued

under its Euro Medium Term Notes Programme;

|

|

|

•

|

|

Old AB InBev’s Current Report on Form 6-K filed with the Commission on 4 April 2016, regarding the partial cancellation of committed facilities available under its 2015 Senior Facilities Agreement;

|

|

|

•

|

|

Old AB InBev’s Current Report on Form 6-K filed with the Commission on 12 April 2016, regarding the extension of the shareholders’ agreement among BRC S.à R.L., Eugénie Patri

Sébastian S.A., EPS Participations S.à R.L., Rayvax Société d’Investissements S.A. and the Stichting Anheuser-Busch InBev;

|

|

|

•

|

|

Old AB InBev’s Current Report on Form 6-K filed with the Commission on 27 April 2016, regarding dividend payments by AB InBev;

|

|

|

•

|

|

Old AB InBev’s Current Report on Form 6-K filed with the Commission on 4 May 2016, containing AB InBev’s unaudited interim report for the three-month period ended 31 March 2016;

|

|

|

•

|

|

Old AB InBev’s Current Report on Form 6-K filed with the Commission on 29 July 2016, containing Old AB InBev’s unaudited interim report for the six months ended 30 June 2016 and certain

Transactions-related documents;

|

|

|

•

|

|

Old AB InBev’s Current Reports on Form 6-K filed with the Commission on 14 April 2016, 19 April 2016, 29 April 2016, 13 May 2016, 24 May 2016, 25 May 2016, 31 May 2016,

2 June 2016, 30 June 2016, 20 July 2016, 26 July 2016, 29 July 2016, 1 August 2016, 2 August 2016, 4 August 2016, 8 August 2016, 22 August 2016, 23 August 2016, 26 August 2016,

28 September 2016 and 4 October 2016 relating to the Transaction;

|

|

|

•

|

|

New AB InBev’s Current Reports on Form 6-K filed with the Commission on 4 October 2016, 11 October 2016, 12 October 2016 and 19 October 2016 relating to the Transaction;

|

|

|

•

|

|

New AB InBev’s Current Report on Form 6-K filed with the Commission on 28 October, containing Old AB InBev’s unaudited interim report for the nine months ended 30 September 2016; and

|

4

|

|

•

|

|

the description of the Ordinary Shares and American Depositary Shares contained under the heading “Description of Newbelco Ordinary Shares and Newbelco ADSs” in the Registrant’s Registration Statement on

Form F-4 (File No. 333-213328) filed with the Commission on 26 August 2016 (“Newbelco Form F-4”), as well as any amendment or report filed for the purpose of updating such descriptions.

|

Each document incorporated by reference is current only as of the date of such document, and the incorporation by reference of such document shall not create

any implication that there has been no change in the affairs of New AB InBev since its date or that the information contained in it is current as of any time subsequent to its date.

All documents filed by New AB InBev pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934 subsequent to the date hereof and

prior to the filing of a post-effective amendment that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold shall be deemed to be incorporated by reference herein and to be a part hereof from

the date of filing of such documents. Reports on Form 6-K that New AB InBev furnishes to the Commission subsequent to the date hereof will only be deemed incorporated by reference into this Registration Statement if such Report on Form 6-K expressly

states that it is incorporated by reference herein.

Any statement contained in such a document shall be deemed to be modified or superseded for the

purpose of this Registration Statement to the extent that a subsequent statement contained herein or in a subsequently filed or furnished document incorporated by reference herein, modifies or supersedes that statement. Any such statement so

modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement. In addition, any statement contained in any such document shall be deemed to be superseded for the purpose of this

Registration Statement to the extent that a discussion contained herein covering the same subject matter omits such statement. Any such statement omitted shall not be deemed to constitute a part of this Registration Statement.

Item 4. Description of Securities

Please refer to

“Description of Newbelco Ordinary Shares and Newbelco ADSs—Description of the Rights and Benefits Attached to Newbelco Ordinary Shares” in the Newbelco F-4 for a description of Ordinary Shares.

Please refer to “Description of Newbelco Ordinary Shares and Newbelco ADSs—Description of the Rights and Benefits Attached to Newbelco ADSs” in

the Newbelco F-4 for a description of American Depositary Shares.

Item 5. Interests of Named Experts and Counsel

Not applicable

Item 6. Indemnification of Directors and

Officers

Group Coverage and Policy

New AB InBev is incorporated under the laws of Belgium. Under Belgian law, the directors of a company may be liable for damages to the company

in case of improper performance of their duties. The directors of New AB InBev may be liable to it and to third parties for infringement of its articles of association or Belgian company law. Under certain circumstances, directors may be criminally

liable.

Subject to the provisions of and so far as may be admitted under the laws of Belgium, New AB InBev will undertake to indemnify

its directors, officers and employees against any and all expenses (including, without limitation, attorneys’ fees and any expenses of establishing a right to indemnification by New AB InBev), judgments, fines, penalties, settlements and other

amounts actually and reasonably incurred by any such director, officer and employee in connection with the defense or settlement of any proceeding brought (i) by a third party or (ii) by New AB InBev or by shareholders or other third

parties in the right of New AB InBev. Such indemnification applies if, with respect to the acts or omissions of such director, officer and employee, he or she acted in good faith and in a manner he or she reasonably believed to be in the best

interests of New AB InBev and, in the case of a criminal action or proceeding, he or she had no reason to believe that his or her conduct was unlawful. For these purposes, “proceeding” refers to any threatened, pending or completed action

or proceeding, whether civil, criminal, administrative or investigative to which a director, officer or employee is a party or is threatened to be made a party by reason of the fact that he or she was a director or an agent of New AB InBev or of one

of its subsidiaries or by reason of anything done or not done by him or her in such capacity.

No determination in any proceeding by

judgment, order, settlement or conviction or otherwise shall, of itself, create a presumption that such director, officer or employee did not act in good faith and in a manner which he or she reasonably believed to be in the best interests of New AB

InBev and, with respect to any criminal action or proceeding, he or she had reasonable cause to believe that his or her conduct was unlawful.

5

In addition, New AB InBev has obtained a liability insurance policy that covers all past, present

and future directors and officers of New AB InBev and its subsidiaries, which are those entities in which it holds more than 50% of the voting rights, or of which it can individually, or under a written shareholders’ agreement, appoint the

majority of the board of directors. The insurance covers defense costs and financial damages such directors or officers are legally obliged to pay as a result of any claim against them. A “claim” for these purposes includes all requests

against the directors and officers, including (i) a civil proceeding; (ii) a criminal proceeding; (iii) a formal administrative or regulatory proceeding; and (iv) a written request by a third party.

Item 7. Exemption from Registration Claimed

Not

applicable.

Item 8. Exhibits

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

4.1

|

|

Consolidated Articles of Association of Anheuser-Busch InBev SA/NV (English-language translation) (incorporated by reference to Exhibit 99.4 to Anheuser-Busch InBev SA/NV’s Report on Form 6-K (File No. 001-37911) filed with the

Commission on 11 October 2016).

|

|

|

|

|

4.2

|

|

Amended and Restated Deposit Agreement, by and among Anheuser-Busch SA/NV and The Bank of New York Mellon, as Depositary and Owners and Holders of American Depositary Shares, dated as of 15 September 2009 (incorporated by

reference to Exhibit (a) to Anheuser-Busch InBev SA/NV’s Registration Statement on Form F-6 (File No. 333-214027) filed with the Commission on 7 October 2016).

|

|

|

|

|

4.3

|

|

Terms and Conditions of the Discretionary Restricted Stock Units Programme (incorporated by reference to Exhibit 4.3 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-169272) filed with the

Commission on 8 September 2010).

|

|

|

|

|

4.4

|

|

Terms and Conditions of the Share-Based Compensation Plan (incorporated by reference to Exhibit 4.3 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-172069) filed with the Commission on

4 February 2011).

|

|

|

|

|

4.5

|

|

Terms and Conditions of the Share-Based Compensation Plan Relating to American Depositary Shares of Anheuser-Busch InBev (incorporated by reference to Exhibit 4.4 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form

S-8 (File No. 333-172069) filed with the Commission on 4 February 2011).

|

|

|

|

|

4.6

|

|

Terms and Conditions of the People Bets Share Purchase Plan (incorporated by reference to Exhibit 4.5 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-172069) filed with the Commission on

4 February 2011).

|

|

|

|

|

4.7

|

|

Terms and Conditions of the Long-Term Incentive Plan Relating to Shares of Anheuser-Busch InBev – December 2015 (incorporated by reference to Exhibit 4.3 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8

(File No. 333-208634) filed with the Commission on 18 December 2015).

|

|

|

|

|

4.8

|

|

Terms and Conditions of the Long-Term Incentive Plan Relating to American Depositary Shares of Anheuser-Busch InBev – December 2015 (incorporated by reference to Exhibit 4.4 to Anheuser-Busch InBev SA/NV’s Registration

Statement on Form S-8 (File No. 333-208634) filed with the Commission on 18 December 2015).

|

|

|

|

|

4.9

|

|

Terms and Conditions of the Exceptional Incentive Restricted Stock Units Programme – 2015 (incorporated by reference to Exhibit 4.5 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-208634)

filed with the Commission on 18 December 2015).

|

|

|

|

|

4.10

|

|

Terms and Conditions of the 2020 Dream Incentive Plan (incorporated by reference to Exhibit 4.6 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-208634) filed with the Commission on

18 December 2015).

|

|

|

|

|

5.1

|

|

IRS Determination Letter for the Anheuser-Busch Deferred Income Stock Purchase and Savings Plan (incorporated by reference to Exhibit 5.1 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-165566)

filed with the Commission on 19 March 2010).

|

|

|

|

|

23.1

|

|

Consent of PwC Bedrijfsrevisoren BCVBA, independent registered public accounting firm for Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 15.1 to Anheuser-Busch InBev SA/NV’s Annual Report on Form 20-F filed

with the Commission on 14 March 2015).

|

6

|

|

|

|

|

|

|

|

23.2

|

|

Consent of Deloitte Touche Tohmatsu, independent registered public accounting firm for Ambev S.A. (incorporated by reference to Exhibit 15.2 to Anheuser-Busch InBev SA/NV’s Annual Report on Form 20-F filed with the Commission

on 14 March 2015).

|

|

|

|

|

24.1

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (filed herewith).

|

|

|

|

|

24.2

|

|

Power of Attorney of Authorized Representative in the United States (filed herewith).

|

|

|

|

|

24.3

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on

4 February 2011 to its Registration Statement on Form S-8 filed with the Commission on 25 February 2010).

|

|

|

|

|

24.4

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on 4 February 2011 to

its Registration Statement on Form S-8 filed with the Commission on 25 February 2010).

|

|

|

|

|

24.5

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on

19 March 2010).

|

|

|

|

|

24.6

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on 19 March

2010).

|

|

|

|

|

24.7

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on

8 September 2010).

|

|

|

|

|

24.8

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on 8 September

2010).

|

|

|

|

|

24.9

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 3 filed with the Commission on

18 December 2015 to its Registration Statement on Form S-8 filed with the Commission on 17 December 2010).

|

|

|

|

|

24.10

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 3 filed with the Commission on 18 December 2015 to

its Registration Statement on Form S-8 filed with the Commission on 17 December 2010).

|

|

|

|

|

24.11

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on

4 February 2011).

|

|

|

|

|

24.12

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on 4 February

2011).

|

|

|

|

|

24.13

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on

18 December 2015 to its Registration Statement on Form S-8 filed with the Commission on 21 December 2011).

|

|

|

|

|

24.14

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on 18 December 2015 to

its Registration Statement on Form S-8 filed with the Commission on 21 December 2011).

|

|

|

|

|

24.15

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on

18 December 2015 to its Registration Statement on Form S-8 filed with the Commission on 10 May 2013).

|

|

|

|

|

24.16

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on 18 December 2015 to

its Registration Statement on Form S-8 filed with the Commission on 10 May 2013).

|

7

|

|

|

|

|

|

|

|

24.17

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on

18 December 2015 to its Registration Statement on Form S-8 filed with the Commission on 13 December 2013).

|

|

|

|

|

24.18

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on 18 December 2015 to

its Registration Statement on Form S-8 filed with the Commission on 13 December 2013).

|

|

|

|

|

24.19

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on

18 December 2015 to its Registration Statement on Form S-8 filed with the Commission on 7 January 2015).

|

|

|

|

|

24.20

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on 18 December 2015 to

its Registration Statement on Form S-8 filed with the Commission on 7 January 2015).

|

|

|

|

|

24.21

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on

18 December 2015).

|

|

|

|

|

24.22

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on 18 December

2015).

|

Item 9. Undertakings

|

(a)

|

The undersigned registrant hereby undertakes:

|

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

(i)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a

fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was

registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price

represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

|

|

|

(iii)

|

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the registration statement is on Form S-8, and

the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934 that are incorporated by reference into the registration statement.

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and

the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

(b)

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or

Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference

in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

8

|

(h)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise,

the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for

indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person against the registrant in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a

court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

|

|

(i)

|

The undersigned registrant hereby undertakes that:

|

|

|

(1)

|

For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a

form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

|

|

|

(2)

|

For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

9

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant, Anheuser-Busch InBev SA/NV, certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Leuven, Belgium on 21 November 2016.

|

|

|

|

|

Anheuser-Busch InBev SA/NV

|

|

|

|

|

By:

|

|

/s/ Patricia Frizo

|

|

Name:

|

|

Patricia Frizo

|

|

Title:

|

|

Authorized Signatory

|

|

|

|

|

By:

|

|

/s/ Jan Vandermeersch

|

|

Name:

|

|

Jan Vandermeersch

|

|

Title:

|

|

Authorized Signatory

|

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following

persons, in the capacities indicated, on 21 November 2016.

|

|

|

|

|

Signature

|

|

Title

|

|

|

|

|

*

|

|

Chief Executive Officer

(principal executive officer)

|

|

Carlos Brito

|

|

|

|

|

|

*

|

|

Chief Financial Officer

(principal financial and accounting officer)

|

|

Felipe Dutra

|

|

|

|

|

|

*

|

|

Director

|

|

Maria Asuncion Aramburuzabala

|

|

|

|

|

|

|

*

|

|

Director

|

|

Alexandre Behring

|

|

|

|

|

|

*

|

|

Director

|

|

M. Michele Burns

|

|

|

|

|

|

*

|

|

Director

|

|

Paul Cornet de Ways Ruart

|

|

|

|

|

|

*

|

|

Director

|

|

Stéfan Descheemaeker

|

|

|

|

|

|

*

|

|

Director

|

|

Olivier Goudet

|

|

|

|

|

|

*

|

|

Director

|

|

Paulo Alberto Lemann

|

|

|

|

|

|

*

|

|

Director

|

|

Elio Leoni Sceti

|

|

|

|

|

|

|

*

|

|

Director

|

|

Carlos Alberto Sicupira

|

|

|

|

|

|

|

*

|

|

Director

|

|

Grégoire de Spoelberch

|

|

|

|

|

|

*

|

|

Director

|

|

Marcel Herrmann Telles

|

|

|

|

|

|

|

*

|

|

Director

|

|

Alexandre Van Damme

|

|

10

|

|

|

|

|

*

|

|

Director

|

|

Martin J. Barrington

|

|

|

|

|

|

|

*

|

|

Director

|

|

William F. Gifford, Jr.

|

|

|

|

|

|

|

*

|

|

Director

|

|

Alejandro Santo Domingo Dávila

|

|

|

|

|

|

|

*

|

|

Authorized Representative in the United States

|

|

Augusto Lima

|

|

|

|

|

|

|

|

|

|

|

|

|

*By:

|

|

/s/ Jan Vandermeersch

|

|

|

|

|

|

Attorney-in-Fact

|

|

|

11

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

4.1

|

|

Consolidated Articles of Association of Anheuser-Busch InBev SA/NV (English-language translation) (incorporated by reference to Exhibit 99.4 to Anheuser-Busch InBev SA/NV’s Report on Form 6-K (File No. 001-37911) filed with the

Commission on 11 October 2016).

|

|

|

|

|

4.2

|

|

Amended and Restated Deposit Agreement, by and among Anheuser-Busch SA/NV and The Bank of New York Mellon, as Depositary and Owners and Holders of American Depositary Shares, dated as of 15 September 2009 (incorporated by

reference to Exhibit (a) to Anheuser-Busch InBev SA/NV’s Registration Statement on Form F-6 (File No. 333-214027) filed with the Commission on 7 October 2016).

|

|

|

|

|

4.3

|

|

Terms and Conditions of the Discretionary Restricted Stock Units Programme (incorporated by reference to Exhibit 4.3 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-169272) filed with the

Commission on 8 September 2010).

|

|

|

|

|

4.4

|

|

Terms and Conditions of the Share-Based Compensation Plan (incorporated by reference to Exhibit 4.3 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-172069) filed with the Commission on

4 February 2011).

|

|

|

|

|

4.5

|

|

Terms and Conditions of the Share-Based Compensation Plan Relating to American Depositary Shares of Anheuser-Busch InBev (incorporated by reference to Exhibit 4.4 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form

S-8 (File No. 333-172069) filed with the Commission on 4 February 2011).

|

|

|

|

|

4.6

|

|

Terms and Conditions of the People Bets Share Purchase Plan (incorporated by reference to Exhibit 4.5 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-172069) filed with the Commission on

4 February 2011).

|

|

|

|

|

4.7

|

|

Terms and Conditions of the Long-Term Incentive Plan Relating to Shares of Anheuser-Busch InBev – December 2015 (incorporated by reference to Exhibit 4.3 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8

(File No. 333-208634) filed with the Commission on 18 December 2015).

|

|

|

|

|

4.8

|

|

Terms and Conditions of the Long-Term Incentive Plan Relating to American Depositary Shares of Anheuser-Busch InBev – December 2015 (incorporated by reference to Exhibit 4.4 to Anheuser-Busch InBev SA/NV’s Registration

Statement on Form S-8 (File No. 333-208634) filed with the Commission on 18 December 2015).

|

|

|

|

|

4.9

|

|

Terms and Conditions of the Exceptional Incentive Restricted Stock Units Programme – 2015 (incorporated by reference to Exhibit 4.5 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-208634)

filed with the Commission on 18 December 2015).

|

|

|

|

|

4.10

|

|

Terms and Conditions of the 2020 Dream Incentive Plan (incorporated by reference to Exhibit 4.6 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-208634) filed with the Commission on

18 December 2015).

|

|

|

|

|

5.1

|

|

IRS Determination Letter for the Anheuser-Busch Deferred Income Stock Purchase and Savings Plan (incorporated by reference to Exhibit 5.1 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 (File No. 333-165566)

filed with the Commission on 19 March 2010).

|

|

|

|

|

23.1

|

|

Consent of PwC Bedrijfsrevisoren BCVBA, independent registered public accounting firm for Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 15.1 to Anheuser-Busch InBev SA/NV’s Annual Report on Form 20-F filed

with the Commission on 14 March 2015).

|

|

|

|

|

23.2

|

|

Consent of Deloitte Touche Tohmatsu, independent registered public accounting firm for Ambev S.A. (incorporated by reference to Exhibit 15.2 to Anheuser-Busch InBev SA/NV’s Annual Report on Form 20-F filed with the Commission

on 14 March 2015).

|

|

|

|

|

24.1

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (filed herewith).

|

|

|

|

|

24.2

|

|

Power of Attorney of Authorized Representative in the United States (filed herewith).

|

|

|

|

|

24.3

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on

4 February 2011 to its Registration Statement on Form S-8 filed with the Commission on 25 February 2010).

|

12

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

24.4

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on 4 February 2011 to

its Registration Statement on Form S-8 filed with the Commission on 25 February 2010).

|

|

|

|

|

24.5

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on

19 March 2010).

|

|

|

|

|

24.6

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on 19 March

2010).

|

|

|

|

|

24.7

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on

8 September 2010).

|

|

|

|

|

24.8

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on 8 September

2010).

|

|

|

|

|

24.9

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 3 filed with the Commission on

18 December 2015 to its Registration Statement on Form S-8 filed with the Commission on 17 December 2010).

|

|

|

|

|

24.10

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 3 filed with the Commission on 18 December 2015 to

its Registration Statement on Form S-8 filed with the Commission on 17 December 2010).

|

|

|

|

|

24.11

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on

4 February 2011).

|

|

|

|

|

24.12

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on 4 February

2011).

|

|

|

|

|

24.13

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on

18 December 2015 to its Registration Statement on Form S-8 filed with the Commission on 21 December 2011).

|

|

|

|

|

24.14

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on 18 December 2015 to

its Registration Statement on Form S-8 filed with the Commission on 21 December 2011).

|

|

|

|

|

24.15

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on

18 December 2015 to its Registration Statement on Form S-8 filed with the Commission on 10 May 2013).

|

|

|

|

|

24.16

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on 18 December 2015 to

its Registration Statement on Form S-8 filed with the Commission on 10 May 2013).

|

|

|

|

|

24.17

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on

18 December 2015 to its Registration Statement on Form S-8 filed with the Commission on 13 December 2013).

|

|

|

|

|

24.18

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on 18 December 2015 to

its Registration Statement on Form S-8 filed with the Commission on 13 December 2013).

|

|

|

|

|

24.19

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on

18 December 2015 to its Registration Statement on Form S-8 filed with the Commission on 7 January 2015).

|

13

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

24.20

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Post-Effective Amendment No. 1 filed with the Commission on 18 December 2015 to

its Registration Statement on Form S-8 filed with the Commission on 7 January 2015).

|

|

|

|

|

24.21

|

|

Power of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV (incorporated by reference to Exhibit 24.1 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on

18 December 2015).

|

|

|

|

|

24.22

|

|

Power of Attorney of Authorized Representative in the United States (incorporated by reference to Exhibit 24.2 to Anheuser-Busch InBev SA/NV’s Registration Statement on Form S-8 filed with the Commission on 18 December

2015).

|

14

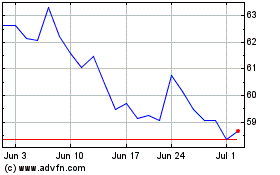

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

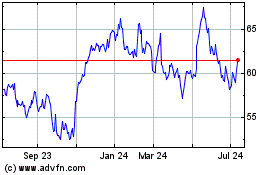

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024