GMS Announces Amendment to ABL Credit Agreement

November 21 2016 - 4:15PM

Business Wire

GMS Inc. (NYSE:GMS), a leading North American distributor of

gypsum wallboard and suspended ceiling systems, announced today an

amendment to its ABL Credit Agreement (“ABL”). Under the agreement,

the ABL will, among other things, expand to $345 million from $300

million, lower the applicable rate per annum by 0.25%, reduce the

unused line fees and extend the term until November 2021.

Doug Goforth, Chief Financial Officer of GMS, stated, “We are

pleased with the successful extension of our ABL along with the

recent refinancing of our first lien debt. With these changes, we

have further enhanced our capacity to support our sourcing and

integrating of select acquisitions to expand our leadership

positions in the U.S.”

About GMS:

Founded in 1971, GMS operates a network of more than 200

distribution centers across the United States. GMS’s extensive

product offering of wallboard, suspended ceilings systems, or

ceilings, and complementary interior construction products is

designed to provide a comprehensive one-stop-shop for our core

customer, the interior contractor who installs these products in

commercial and residential buildings.

For more information about GMS, please visit www.gms.com.

Forward‐Looking Statements and Information:

This press release includes "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of

1995. You can generally identify forward-looking statements by our

use of forward-looking terminology such as "anticipate," "believe,"

"continue," "could," "estimate," "expect," "intend," "may,"

"might," "plan," "potential," "predict," "seek," or "should," or

the negative thereof or other variations thereon or comparable

terminology. We have based these forward-looking statements on our

current expectations, assumptions, estimates and projections. While

we believe these expectations, assumptions, estimates and

projections are reasonable, such forward-looking statements are

only predictions and involve known and unknown risks and

uncertainties, many of which are beyond our control.

Forward-looking statements involve risks and uncertainties,

including, but not limited to, economic, competitive, governmental

and technological factors outside of our control, that may cause

our business, strategy or actual results to differ materially from

the forward-looking statements. These risks and uncertainties may

include, among other things: changes in the prices, supply, and/or

demand for products which we distribute; general economic and

business conditions in the United States; the activities of

competitors; changes in significant operating expenses; changes in

the availability of capital and interest rates; adverse weather

patterns or conditions; acts of cyber intrusion; variations in the

performance of the financial markets, including the credit markets;

and other factors described in the "Risk Factors" section in our

filings with the SEC. We undertake no obligation to update any of

the forward looking statements made herein, whether as a result of

new information, future events, changes in expectation or

otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161121005904/en/

GMS Inc.Investor Relations:678-353-2883ir@gms.comorMedia

Relations:770-723-3378marketing@gms.com

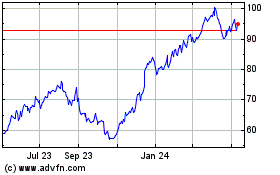

GMS (NYSE:GMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

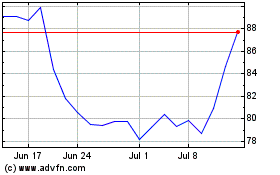

GMS (NYSE:GMS)

Historical Stock Chart

From Apr 2023 to Apr 2024