Amended Statement of Beneficial Ownership (sc 13d/a)

November 18 2016 - 4:26PM

Edgar (US Regulatory)

SEC

1746

Potential persons who are to respond to the collection of information contained in

this form (2-98) are not required to respond unless the form displays a currently valid OMB control number.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 8)

*

HUDSON TECHNOLOGIES, INC.

(Name of Issuer)

COMMON STOCK, $.01 PAR VALUE

(Title of Class of Securities)

444144-10-9

(CUSIP Number)

Kevin J. Zugibe

Hudson Technologies, Inc

. PO Box 1541, One Blue Hill Plaza

Pearl River, New York 10965

(845) 735-6000

(Name, Address and Telephone Number of Person

Authorized to receive Notices and Communications)

August 9, 2016

(Date of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box

¨

.

Note:

Schedules filed in paper format shall include a signed original and five copies of the Schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page.

The information

required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the

Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

|

1.

|

NAMES

OF REPORTING PERSONS.

Kevin

J. Zugibe

|

|

2.

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

¨

(b)

¨

|

|

3.

|

SEC

USE ONLY

|

|

4.

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS)

Personal

Funds (PF)

|

|

5.

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

¨

|

|

6.

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

NUMBER

OF

SHARES

|

7.

|

SOLE

VOTING POWER

4,521,043

(of which 1,103,000 shares are issuable upon exercise of options)

|

|

BENEFICIALLY

OWNED

BY

EACH

REPORTING

|

8.

|

SHARED

VOTING POWER

0

|

|

PERSON WITH

|

9.

|

SOLE

DISPOSITIVE POWER

4,521,043

(of which 1,103,000 shares are issuable upon exercise of options

|

|

|

10.

|

SHARED

DISPOSITIVE POWER

0

|

|

11.

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,521,043

(of which 1,103,000 shares are issuable upon exercise of options)

|

|

12.

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨

|

|

13.

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.9%

|

|

14.

|

TYPE

OF REPORTING PERSON*

IN

|

|

|

Item 1.

|

Security and Issuer

|

This Amendment No.

8 amends and supplements the Schedule 13D of Kevin J. Zugibe (the “Reporting Person”), as previously amended by Amendment

No. 1, Amendment No. 2, Amendment No. 3, Amendment No. 4, Amendment No. 5, Amendment No. 6 and Amendment No. 7 with respect to

his ownership of the Common Stock, par value $.01 per share ("Common Stock"), of Hudson Technologies, Inc., a New York

corporation (the "Company"), whose principal executive offices are located at PO Box 1541, One Blue Hill Plaza, 14

th

Floor, Pearl River, New York 10965. This Amendment No. 8, the previous amendments to the Reporting Person’s Schedule 13D

and the initial Schedule 13D are hereinafter collectively referred to as the “Statement.” Except as amended and supplemented

hereby, there has been no change in the information contained in the statement.

|

|

Item 2.

|

Identity and Background

|

Item 2 of the Statement is hereby amended

and supplemented as follows:

|

|

(a)

|

This Statement is being filed by Kevin J. Zugibe (the

“Reporting Person”).

|

|

|

(b)

|

The Reporting Person’s business address is PO

Box 1541, One Blue Hill Plaza, Pearl River, New York 10965.

|

|

|

(c)

|

The Reporting Person is presently employed by the Company

as the Company’s Chief Executive Officer. The Reporting Person is also Chairman of the Board of Directors and a director

of the Company.

|

|

|

(d)

|

The Reporting Person has not, during the last five

(5) years been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

|

(e)

|

The Reporting Person has not, during the last five

(5) years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction that resulted in,

or resulted in the Reporting Person being subject to, a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

|

(f)

|

The Reporting Person is a citizen of the United States

of America.

|

|

|

Item 3.

|

Source and Amount of Funds or Others Consideration

.

|

The source and amount

of all funds used for the purchases of the shares reported in Item 5(c) below were the Reporting Person’s personal funds.

|

|

Item 4.

|

Purpose of Transaction.

|

The purpose of the

dispositions of the shares of Common Stock reported in Item 5(c) below were to allow the Reporting Person to diversify his investments

and to satisfy certain debt and tax obligations, and to make gifts to a family member. The shares acquired as reported in Item

5(c) below were acquired by the Reporting Person for investment purposes.

|

|

Item 5.

|

Interest in Securities of the Issuer.

|

Item 5 of the Statement is hereby amended

and supplemented as follows:

(a) According to the

Company there were issued and outstanding 34,057,964 shares of Common Stock as of November 17, 2016. The Reporting Person beneficially

owns 4,521,043 shares of the Company’s Common Stock, comprising 12.9% of the 34,057,964 shares of the Company’s Common

Stock issued and outstanding as of November 16, 2016, such ownership consisting of 3,418,043 shares and 1,103,000 shares that are

issuable upon exercise of options held by the Reporting Person within sixty (60) days.

(b) The

Reporting Person may be deemed to have sole power to vote, direct the vote and to dispose of 4,521,043 shares of Common Stock,

of which 1,103,000 shares are issuable upon exercise of options held by the Reporting Person within sixty (60) days.

(c) On December 12,

2014 the Reporting Person exercised stock options to purchase 112,500 shares of the Company’s Common Stock at exercise prices

ranging from $0.87 to $1.02 per share, as more fully set forth on the attached Schedule A. On October 1, 2014, the Reporting Person

was issued options by the Company to purchase 251,855 shares of the Company’s Common Stock at an exercise price $3.23 per

share, and was issued options by the Company to purchase 28,145 shares of the Company’s Common Stock at an exercise price

of $3.55 per share, as more fully set forth on the attached Schedule A. On December 30, 2014, the Reporting Person gifted 7,500

shares of the Company’s Common Stock to a family member. Between May 6, 2015 and May 7, 2015, the Reporting Person sold a

total of 245,300 shares of the Company’s Common Stock in the open market, as more fully set forth on the attached Schedule

A. On May 8, 2015, the Reporting Person exercised stock options to purchase 37,500 shares of the Company’s Common Stock at

exercise prices ranging from $0.83 and $2.15 per share, as more fully set forth on the attached Schedule A. On December 9, 2015,

the Reporting Person exercised stock options to purchase 123,750 shares of the Company’s Common Stock at an exercise price

of $1.76 per share through a net (cashless) exercise and received 50,415 shares of the Company’s Common Stock, as more fully

set forth on the attached Schedule A. On March 23, 2016, the Reporting Person exercised stock options to purchase 35,000 shares

of the Company’s Common Stock at an exercise price of $1.40 per share, as more fully set forth on the attached Schedule A.

On July 18, 2016, the Reporting Person was issued options by the Company to purchase 521,510 shares of the Company’s Common

Stock at an exercise price $3.51 per share, and was issued options by the Company to purchase 28,490 shares of the Company’s

Common Stock at an exercise price of $3.86 per share. Between August 5, 2016 and August 9, 2016 the Reporting Person sold a total

of 600,000 shares of the Company’s Common Stock in the open market, as more fully set forth on the attached Schedule A. On

October 7, 2016, the Reporting Person exercised stock options to purchase 9,300 shares of the Company’s Common Stock at an

exercise price of $1.02 per share. On October 11, 2016, the Reporting Person made a charitable donation of 18,750 shares of the

Company’s Common Stock. There have been no other transactions in the class of securities reported or that were effected during

the past sixty days by the Reporting Person.

(d) The Reporting Person

affirms that no person other than the Reporting Person has the right to receive, or has power to direct the receipt of, dividends

from, or the proceeds from the sale of, the Common Stock owned by the Reporting Person.

(e) It is inapplicable

for the purposes hereof to state the date on which the Reporting Person ceased to be the owner of more than 5% of the Common Stock

of the Company.

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

November 18,

2016

|

|

|

Date

|

|

|

|

|

|

/s/ Kevin J. Zugibe

|

|

|

Signature

|

|

|

|

|

SCHEDULE A to SCHEDULE 13D, AMENDMENT No.

8

|

|

I.

|

Sales of Hudson Technologies, Inc. $0.01 Common Stock

|

|

Date

|

#

Shares

|

$/Share

|

|

|

|

|

|

5/6/13

|

145,300

|

$4.55*

|

|

5/7/15

|

100,000

|

$4.08

|

|

8/5/16

|

60,525

|

$4.879

|

|

8/8/16

|

173,200

|

$4.778*

|

|

8/9/16

|

366,275

|

$4.873*

|

*Weighted average price

|

|

II

|

Hudson Technologies, Inc. $0.01 Common Stock purchased

through exercise of Stock Options.

|

|

Date Exercised

|

Date Issued

|

# Shares

|

Exercise Price

|

|

|

|

|

|

|

12/12/14

|

1/3/05

|

112,500

|

$1.02

|

|

12/12/14

|

4/1/05

|

18,750

|

$0.87

|

|

5/8/15

|

7/8/05

|

18,750

|

$0.83

|

|

5/18/15

|

9/30/05

|

18,750

|

$2.15

|

|

12/9/15

|

12/29/05

|

123,750

|

$1.76**

|

|

3/23/16

|

3/31/06

|

35,000

|

$1.40

|

|

10/7/16

|

10/10/16

|

9,300

|

$1.02

|

** Net (cashless) exercise, received 50,415 shares

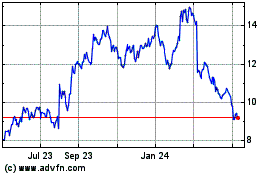

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Apr 2023 to Apr 2024