Amended Statement of Beneficial Ownership (sc 13d/a)

November 18 2016 - 4:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 5)

*

HUDSON TECHNOLOGIES, INC.

(Name of Issuer)

COMMON STOCK, $.01 PAR VALUE

(Title of Class of Securities)

444144-10-9

(CUSIP Number)

Stephen P. Mandracchia

Hudson Technologies, Inc.

1 Blue Hill Plaza

PO Box 1541

Pearl River, New York 10965

(845) 735-6000

(Name, Address and Telephone Number of Person

Authorized to receive Notice and Communications)

August 9, 2016

(Date of Event which Requires Filing of this Statement)

if the filing

person has previously filed a statement on schedule 13g to report the acquisition that is the subject of this schedule 13d, and

is filing this schedule because of §§

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g),

check

the following box

¨

.

Note:

Schedules filed in paper format shall include a signed original and five copies of the Schedule, including all exhibits. See

RULE

13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page.

The information

required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities

Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

1.

|

NAMES

OF REPORTING PERSONS.

Stephen

P. Mandracchia

|

|

2.

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(A)

¨

(B)

¨

|

|

3.

|

SEC

USE ONLY

|

|

4.

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS)

Personal

Funds (PF)

|

|

5.

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

¨

|

|

6.

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States

|

|

NUMBER

OF

SHARES

|

7.

|

SOLE

VOTING POWER

1,628,961

(of which 747,961 shares are held of record in the name of Reporting Person’s spouse and 438,000 Shares are issuable

upon exercise of options)

|

|

BENEFICIALLY

OWNED

BY

EACH

REPORTING

|

8.

|

SHARED

VOTING POWER

0

|

|

PERSON

WITH

|

9.

|

SOLE

DISPOSITIVE POWER

811,000

(of which 438,000 shares are issuable upon exercise of options)

|

|

|

10.

|

SHARED

DISPOSITIVE POWER

747,961

shares that are held of record in the name of Reporting Person’s spouse

|

|

11.

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,628,961

(of which 747,961 shares are held of record in the name of Reporting Person’s spouse and 438,000 Shares are issuable

upon exercise of options)

|

|

12.

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨

|

|

13.

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.7%

|

|

14.

|

TYPE

OF REPORTING PERSON*

IN

|

|

|

Item 1.

|

Security and Issuer

|

This Amendment No.

5 amends and supplements the Schedule 13D, as previously amended by Amendment Nos. 1, 2, 3 and 4 (the “Schedule 13D”),

of Stephen P. Mandracchia (the “Reporting Person”) with respect to his beneficial ownership of the common stock, par

value $.01 per share ("Common Stock"), of Hudson Technologies, Inc., a New York corporation (the "Company"),

whose principal executive offices are located at PO Box 1541, One Blue Hill Plaza, 14

th

Floor, Pearl River, New York

10965. Except as amended hereby, there has been no change in the information contained in the Schedule 13D.

|

|

Item 2.

|

Identity and Background

|

Item 2 of the Statement is hereby amended

and supplemented as follows:

|

|

(a)

|

This Statement is being filed by Stephen P. Mandracchia

(the “Reporting Person”).

|

|

|

(b)

|

The Reporting Person’s business address is PO

Box 1541, One Blue Hill Plaza, Pearl River, New York 10965.

|

|

|

(c)

|

Reporting Person is presently employed by the Company

and serves as Vice President Legal, Regulatory and as Secretary of the Company.

|

|

|

(d)

|

The Reporting Person has not, during the last five

(5) years been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

|

(e)

|

The Reporting Person has not, during the last five

(5) years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction that resulted in,

or resulted in the Reporting Person being subject to, a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

|

(f)

|

The Reporting Person is a citizen of the United States

of America.

|

|

|

Item 3.

|

Source and Amount of Funds or Others Consideration

.

|

The source and amount

of all funds used for the purchases of the shares reported in Item 5(c) below were the Reporting Person’s personal funds.

|

|

Item 4.

|

Purpose of Transaction.

|

The purpose of the

dispositions of the shares of Common Stock reported in Item 5(c) below were to allow the Reporting Person to diversify his investments

and to establish a fund for payment of college tuition for his children, and to make gifts to certain family members. The shares

acquired as reported in Item 5(c) below were acquired by the Reporting Person for investment purposes.

|

|

Item 5.

|

Interest in Securities of the Issuer.

|

(a) According to the

Company there were issued and outstanding 34,057,964 shares of Common Stock as of November 17, 2016. The Reporting Person beneficially

owns 1,628,961 shares of the Company’s Common Stock, comprising 4.7% of the 34,057,964 shares of the Company’s Common

Stock issued and outstanding as of November 15, 2016, such ownership consisting of (i) 1,190,961 shares of Common Stock, of which

443,000 shares are held of record by the Reporting Person and 747,961 shares are held of record in the name of the Reporting Person’s

spouse, and (ii) 438,000 shares that are issuable upon exercise of options held by the Reporting Person within sixty (60) days.

(b) The

Reporting Person may be deemed to have (i) sole power to vote or direct the vote of 1,628,961 shares, consisting of 443,000 shares

held of record by the reporting person, 747,961 shares held of record in the name of the Reporting Person’s spouse, and 438,000

shares that are issuable upon the exercise of options held by the Reporting Person within sixty (60) days; (ii) sole dispositive

power over 881,000 shares consisting of the 443,000 shares owned of record by the reporting person and the 438,000 shares that

are issuable upon the exercise of options held by the Reporting Person within sixty (60) days, and (iii) shared power to dispose

of the 747,961 shares held of record in the name of the Reporting Person’s spouse.

(c) Between June 19,

2013 and December 30, 2013, the Reporting Person and his spouse collectively made charitable donations of 50,000 shares of the

Company’s Common Stock. On October 1, 2014, the Reporting Person was issued options by the Company to purchase 76,855 shares

of the Company’s Common Stock at an exercise price $3.23 per share, and was issued options by the Company to purchase 28,145

shares of the Company’s Common Stock at an exercise price of $3.55 per share. On December 19, 2014, the Reporting Person

exercised stock options to purchase 37,500 shares of the Company’s Common Stock at exercise prices ranging from $0.87 to

$1.02 per share as more fully set forth on attached Schedule A. Between December 29, 2014 and March 12, 2015, the Reporting Person

and his spouse collectively gifted 58,750 shares of the Company’s Common Stock to certain family members and made a charitable

donation of 5,000 shares of the Company’s Common Stock. Between March 10, 2015 and May 16, 2015, the Reporting Person and

his spouse collectively sold a total of 142,284 shares of the Company’s Common Stock in the open market, as more fully set

forth on the attached Schedule A. On June 11, 2015, the Reporting Person exercised stock options to purchase 91,900 shares of the

Company’s Common Stock at exercise prices ranging from $0.83 to $2.15 per share as more fully set forth on attached Schedule

A. Between July 9, 2015 and June 24, 2016, the Reporting Person and his spouse collectively gifted 21,000 shares of the Company’s

Common Stock to certain family members and made charitable donations of 25,000 shares of the Company’s Common Stock. On July

18, 2016, the Reporting Person was issued options by the Company to purchase 121,510 shares of the Company’s Common Stock

at an exercise price $3.51 per share, and was issued options by the Company to purchase 28,490 shares of the Company’s Common

Stock at an exercise price of $3.86 per share. Between August 9, 2016 and August 10, 2016, the Reporting Person and his spouse

collectively sold a total of 300,000 shares of the Company’s Common Stock in the open market, as more fully set forth on

the attached Schedule A. Between September 23, 2016 and September 26, 2016, the Reporting Person and his spouse collectively

gifted 15,700 shares of the Company’s Common Stock to certain family members. There have been no other transactions in the

class of securities reported or that were effected during the past sixty days by the Reporting Person.

(d) Except for the

Reporting Person’s spouse, no person other than the Reporting Person has the right to receive dividends on, and any proceeds

from the disposition of, any Shares reported as owned by him in Item 5 above.

(e) On August 10, 2016,

the reporting person ceased to be the owner of more than five percent (5%) of the Common Stock.

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

November 18,

2016

|

|

|

Date

|

|

|

|

|

|

/s/ Stephen P. Mandracchia

|

|

|

Signature

|

|

|

|

|

SCHEDULE A to SCHEDULE 13D, AMENDMENT No.

4

|

|

I.

|

Sales of Hudson Technologies, Inc. $0.01 Common Stock

|

|

Date

|

# Shares

|

$/Share

|

|

|

|

|

|

3/10/15

|

1,800

|

$4.52

|

|

3/12/15

|

60,457

|

$4.29*

|

|

3/13/15

|

14,927

|

$4.26*

|

|

5/6/15

|

65,100

|

$4.493*

|

|

8/9/16

|

271,742

|

$4.9*

|

|

8/10/16

|

28,258

|

$4.973*

|

*Weighted average price

|

|

II

|

Hudson Technologies, Inc. $0.01 Common Stock purchased

through exercise of Stock Options.

|

|

Date Exercised

|

Date Issued

|

# Shares

|

Exercise Price

|

|

|

|

|

|

|

12/19/14

|

4/1/05

|

6,250

|

$0.87

|

|

12/19/14

|

1/3/05

|

31,250

|

$1.02

|

|

6/11/15

|

7/8/05

|

6,250

|

$0.83

|

|

6/11/15

|

9/30/05

|

6,250

|

$2.15

|

|

6/11/15

|

12/29/05

|

6,250

|

$1.76

|

|

6/11/15

|

12/29/05

|

45,000

|

$1.76

|

|

6/11/15

|

3/31/06

|

20.750

|

$1.40

|

|

6/11/15

|

10/10/06

|

7,400

|

$1.02

|

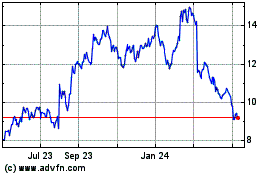

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Apr 2023 to Apr 2024