U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant

x

Filed by a Party other than the Registrant

¨

Check the Appropriate Box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

x

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Under Rule 14a-12

|

ARNO THERAPEUTICS,

INC.

(Name of Registrant as Specified in Its

Charter)

(Name of Person(s) Filing Proxy Statement

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

¨

|

Fee paid previously with preliminary materials:

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

ARNO THERAPEUTICS, INC.

200 Route 31 North, Suite 104

Flemington, NJ 08822

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

DECEMBER 22,

2016

To Our Stockholders:

You are cordially invited to attend a

Special Meeting of Stockholders of Arno Therapeutics, Inc., a Delaware corporation. The Special Meeting will be held

at our offices located at 200 Route 31 North, Suite 104, Flemington, New Jersey 08822, on Thursday, December 22, 2016, at

9:00 a.m. (EST), or at any adjournment or postponement

thereof.

There are two matters scheduled for a vote

at the Special Meeting. Stockholders are being asked:

|

|

1.

|

to authorize the amendment of our certificate of incorporation to effect a combination (reverse split) of our common stock

at a ratio of 1-for-10; and

|

|

|

2.

|

to authorize the amendment of our certificate of incorporation to reduce the number of authorized shares of common stock from

500,000,000 to 200,000,000.

|

Our Board of Directors has fixed the close

of business on November 11, 2016, as the record date for the determination of stockholders entitled to notice

of and to vote at the Special Meeting and at any adjournments or postponement thereof.

All stockholders are invited to attend

the Special Meeting in person. Whether or not you plan to attend the meeting, please complete, date and sign the enclosed

proxy and return it in the enclosed envelope, as promptly as possible. If you attend the meeting, you may withdraw the

proxy and vote in person. If you have any questions regarding the completion of the enclosed proxy or would like directions

to the Special Meeting, please call (862) 703-7170.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

ARNO THERAPEUTICS, INC.

|

|

|

|

|

|

/s/ Alexander A. Zukiwski

|

|

|

|

|

|

Alexander A. Zukiwski, M.D.

|

|

|

Chief Executive Officer

|

Flemington, New Jersey

November 18,

2016

PROXY STATEMENT

OF

ARNO THERAPEUTICS, INC.

SPECIAL MEETING OF STOCKHOLDERS TO BE

HELD

DECEMBER 22,

2016

The enclosed proxy is

solicited on behalf of the Board of Directors (the “Board”) of Arno Therapeutics, Inc., a Delaware

corporation (the “Company,” “we,” “us,” or “our”), for use at the Special

Meeting of Stockholders to be held

on Thursday, December 22, 2016 at 9:00 a.m. (EST) (the “Special Meeting”), or at any

adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Special Meeting. The

Special Meeting will be held at

our offices located at 200 Route 31 North, Suite 104, Flemington, New Jersey 08822.

We intend to first mail this proxy statement and the enclosed proxy card on or

about November 18, 2016, to

all stockholders entitled to vote at the Special Meeting.

|

Important Notice Regarding the Availability

of Proxy Materials for the Special Meeting:

The proxy statement and the enclosed

proxy card are available at

http://www.arnothera.com/ir_sec.html

|

QUESTIONS AND ANSWERS ABOUT THIS PROXY

MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement, as

well as the enclosed proxy card, because our Board of Directors is soliciting your proxy to vote at the Special

Meeting. You are invited to attend the Special Meeting to vote on the proposals described in this proxy

statement. The Special Meeting will be held

on Thursday, December 22,

2016, at 9:00 a.m. (EST) at

our offices located at 200 Route 31 North, Suite 104, Flemington, New Jersey 08822. However,

you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the

enclosed proxy card.

We intend to mail this proxy statement and

accompanying proxy card on or about November 18,

2016, to all stockholders entitled to vote at the Special Meeting.

What am I voting on?

There are two matters scheduled for a vote

at the Special Meeting. Stockholders are being asked:

|

|

1.

|

to authorize the amendment of our certificate of incorporation to effect a combination (reverse split) of our common stock

at a ratio of 1-for-10;

|

|

|

2.

|

to authorize the amendment of our certificate of incorporation to reduce the number of authorized shares of common stock from

500,000,000 to 200,000,000; and

|

|

|

3.

|

t

o authorize the adjournment of the Special Meeting, if necessary or appropriate, if

a quorum is present, to solicit additional proxies if there are insufficient votes at the Special Meeting in favor of Proposals

1 and 2.

|

We refer to matters contemplated by Proposal

Nos. 1 and 2 collectively throughout this Proxy Statement as the Charter Amendment Proposals.

How many votes are needed to approve the Charter Amendment

Proposals?

To be approved, each of the Charter Amendment

Proposals must receive affirmative votes from the holders of a majority of our outstanding shares of common stock. If

you do not vote or “Abstain” from voting, it will have the same effect as an “Against” vote. “Broker

non-votes,” which occur when brokers are prohibited from exercising discretionary voting authority for beneficial owners

who have not provided voting instructions, will also have the same effect as “Against” votes.

Who can vote at the Special Meeting?

Only stockholders of record at the close

of business on November 11, 2016, will be entitled to vote at the Special Meeting. On this record

date, there were 49,349,749 shares of our common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered

in Your Name

If on November 11,

2016, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC,

then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether

or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered

in the Name of a Broker or Bank

If on November 11,

2016, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization,

then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to

you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting

at the Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote

the shares in your account. You are also invited to attend the Special Meeting. However, since you are not

the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from

your broker or other agent.

How do I vote?

You may vote “For” or “Against”

or “Abstain” from voting on each of the Charter Amendment Proposals. The procedures for voting are as follows:

Stockholder of Record: Shares Registered

in Your Name

If you are a stockholder of record, you

may vote in person at the Special Meeting, or vote by proxy using the enclosed proxy card. Whether or not you plan to

attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and

vote in person if you have already voted by proxy.

|

|

·

|

To vote in person, come to the Special Meeting, where a ballot will be made available to you.

|

|

|

·

|

To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope

provided. If you return your signed proxy card to us before the Special Meeting, we will vote your shares as you direct.

|

Beneficial Owner: Shares Registered

in the Name of Broker or Bank

If you are a beneficial owner of shares

registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with

these proxy materials from that organization rather than from us. Simply complete and mail the proxy card to ensure

that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker

or bank, if your broker or bank makes telephone or Internet voting available. To vote in person at the Special Meeting,

you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank

included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

You have one vote for each share of common

stock you own as of the close of business on November 11, 2016.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card

without marking any voting selections, your shares will be voted “For” the Charter Amendment Proposals at the Special

Meeting. If any other matter is properly presented at the meeting, your proxy (the individual named on your proxy card)

will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting

proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person,

by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation

for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy

materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card,

your shares are registered in more than one name or are registered in different accounts. Please complete, sign and

return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy

at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy

in any one of three ways:

|

|

·

|

You may submit another properly completed proxy card with a later date.

|

|

|

·

|

You may send a written notice that you are revoking your proxy addressed to our Secretary at Arno Therapeutics, Inc., 200 Route 31 North, Suite 104, Flemington, NJ 08822.

|

|

|

·

|

You may attend the meeting and vote in person. Simply attending the Special Meeting will not, by itself, revoke

your proxy.

|

If your shares are held by your broker or

bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of

election appointed for the meeting, who will separately count “For” and “Against” votes, “Abstentions”

and broker non-votes. Abstentions and broker non-votes will have the same effect as “Against” votes.

If your shares are held by your broker as

your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your

shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not

give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with

respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New

York Stock Exchange on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary

items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

What is the quorum requirement?

A quorum of stockholders is necessary to

hold a valid meeting. A quorum will be present if the holders of at least a majority of the voting power of the outstanding

shares of common stock are present at the meeting in person or by proxy. On the record date, there were 49,349,749 shares

of common stock outstanding and entitled to vote. Your shares will be counted towards the quorum only if you submit a valid proxy

(or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting.

Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairman

of the meeting or a majority of the votes present may adjourn the meeting to another date.

How can I find out the results of the voting at the Special

Meeting?

Preliminary voting results will be announced

at the Special Meeting. Final voting results will be disclosed in a Current Report on Form 8-K within four business

days of the Special Meeting.

Who can help answer my other questions?

If you have any questions about the Special

Meeting or the Charter Amendment Proposals, or need assistance voting your shares, please call (862) 703-7170.

PROPOSAL NO. 1

APPROVAL OF AN AMENDMENT TO THE

COMPANY’S CERTIFICATE OF INCORPORATION

TO EFFECT A REVERSE STOCK SPLIT

Overview

If approved and enacted, the reverse stock

split will result in the combination of our common stock at a ratio of 1-for-10. This means that every 10 shares of

common stock outstanding prior to the effective time of the reverse stock split will represent only one share of common stock after

the stock split. The reverse split will not result in any further change in the number of authorized shares of common

stock other than the reduction from 500,000,000 to 200,000,000 common shares in connection with Proposal No. 2, discussed below. The

par value of our common stock would remain unchanged at $0.0001 per share following the reverse split. Except for any

changes resulting from the treatment of fractional shares as discussed below, each stockholder will hold the same percentage of

common stock outstanding immediately after the reverse stock split as such stockholder did immediately prior to the reverse stock

split.

Reasons for the Reverse Stock Split

The Board believes that a reverse stock

split may be desirable and should be approved by stockholders for a number of reasons, including:

|

|

·

|

Increase in Eligible Investors.

We believe a reverse stock split would allow a broader range of institutions

to invest in our stock (namely, funds that are prohibited from buying stocks whose price is below a certain threshold), potentially

increasing the trading volume and liquidity of our common stock.

|

|

|

·

|

Increased Analyst and Broker Interest.

We believe

a reverse stock split may help increase analyst

and broker interest in our stock as their policies can discourage them from following or recommending companies with low stock

prices. Because of the trading volatility often associated with low-priced stocks, many brokerage houses and institutional investors

have adopted internal policies and practices that either prohibit or discourage them from investing in such stocks or recommending

them to their customers. Some of those policies and practices may also function to make the processing of trades in low-priced

stocks economically unattractive to brokers. Additionally, because brokers’ commissions on transactions in low-priced stocks

generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price

per share of our common stock can result in individual stockholders paying transaction costs representing a higher percentage of

their total share value than would be the case if the share price were substantially higher.

|

|

|

·

|

Increased Possibility of Obtaining Nasdaq Listing.

Our

common stock is currently eligible for trading on the OTCQB tier of the OTC Markets, an automated quotation system. Stocks

traded on the OTCQB and other electronic over-the-counter markets are often less liquid than stocks traded on national securities

exchanges, not only in terms of the number of shares that can be bought and sold at a given price, but also in terms of delays

in the timing of transactions and reduced coverage of us by security analysts and the media. Among other things, one

hurdle to our ability to obtain an initial listing on a national securities exchange such as the Nasdaq Capital Market is the

requirement that the closing bid price of our common stock, which was $0.40 on

the record date for the Special Meeting, must exceed $4.00 per share. By potentially increasing our stock price, the

reverse stock split may increase the possibility that our stock could be listed on the Nasdaq Capital Market.

|

Certain Risks Associated With the Reverse Stock Split

There can be no assurance that the

total market capitalization of our common stock after the proposed reverse stock split will be equal to or greater than the total

market capitalization before the proposed reverse stock split or that the per share market price of our common stock following

the reverse stock split will either exceed or remain higher than the current per share market price.

There can be no assurance that the

market price per new share of our common stock after the reverse stock split will rise or remain constant in proportion to

the reduction in the number of old shares of our common stock outstanding before the reverse stock split. For example, based

on the market price of our common stock on November 11, 2016 of $0.40 per share, following a 1-for-10 reverse split there can

be no assurance that the post-split market price of our common stock would be $4.00 per share or

greater. Accordingly, the total market capitalization of our common stock after the proposed reverse stock split

may be lower than the total market capitalization before the proposed reverse stock split and, in the future, the

market price of our common stock following the reverse stock split may not exceed or remain higher than the market price

prior to the proposed reverse stock split. In many cases, the total market capitalization of a company following a reverse

stock split is lower than the total market capitalization before the reverse stock split.

A decline in the market price for

our common stock after the reverse stock split may result in a greater percentage decline than would occur in the absence of a

reverse stock split, and the liquidity of our common stock could be adversely affected following a reverse stock split.

The market price of our common stock will

also be based on our performance and other factors, some of which are unrelated to the number of shares outstanding. If a reverse

stock split is effected and the market price of our common stock declines, the percentage decline as an absolute number and as

a percentage of our overall market capitalization may be greater than would occur in the absence of a reverse stock split. In many

cases, both the total market capitalization of a company and the market price of a share of such company’s common stock following

a reverse stock split are lower than they were before the reverse stock split. Furthermore, the liquidity of our common stock could

be adversely affected by the reduced number of shares that would be outstanding after the reverse stock split. If approved

and effected, the reverse stock split will result in some stockholders owning “odd lots” of less than 100 shares of

our common stock. Brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs

of transactions in “round lots” of even multiples of 100 shares.

The proposed reverse stock split

may not increase our stock price, which would prevent us from realizing some of the anticipated benefits of the reverse stock

split, including the possibility of obtaining an initial listing on the Nasdaq Capital Market.

The effect of a reverse stock split upon

the market price of our common stock cannot be predicted with any certainty, and the history of similar stock splits for companies

in like circumstances is varied. It is possible that the per share price of our common stock after the reverse stock split

will not rise in proportion to the reduction in the number of shares of our common stock outstanding resulting from the reverse

stock split. In particular, there can be no assurance that the market price per post-reverse split share will exceed

the $4.00 minimum bid price that is required to obtain an initial listing on the Nasdaq Capital Market. Even if the

market price per post-reverse split share does exceed $4.00, there can be no assurance that we will be able to satisfy the other

listing standards of the Nasdaq Capital Market.

Principal Effects of the Reverse Stock Split

Corporate Matters

.

If approved

by our stockholders, and assuming our Board of Directors determines to enact it, the reverse split will have the following effects:

|

|

·

|

every 10 shares of common stock outstanding prior to the effective time of the reverse split will be automatically combined

into one share of common stock;

|

|

|

·

|

the number of issued and outstanding shares of our common stock will be reduced proportionately based on the 1-for-10 split

ratio;

|

|

|

·

|

based on the 1-for-10 ratio, proportionate adjustments will be made to the per share exercise price and the number of shares

issuable upon the exercise of all outstanding options and warrants entitling the holders thereof to purchase shares of our common

stock, which will result in approximately the same aggregate price being required to be paid for such options or warrants upon

exercise of such options or warrants immediately preceding the reverse stock split; and

|

|

|

·

|

the number of shares of common stock reserved for issuance under our existing stock option plans will be reduced proportionately

based on the 1-for-10 split ratio.

|

Because the proposed reduction in

the number of authorized shares of our common stock, which is described under Proposal No. 2, is not being effected on a

1-for-10 basis, the reverse stock split will have the effect of providing us with an increased number of shares of common

stock available for future issuance. Given the nature of our company as a research and development company without

any commercial products or other means of generating recurring revenue, we will need to raise additional capital in order

to continue funding our near-term and long-term operating activities. To date, we have raised such additional

capital through the sale of shares of our common stock and securities convertible into or exercisable for common

stock. We anticipate that we will need to continue to issue and sell shares of our common stock and such

convertible securities in the future in order to meet our capital requirements. To the extent we do so, our

stockholders are likely to experience significant dilution. Such additional dilution would afford our current stockholders a

smaller percentage interest in the voting power, liquidation value and aggregate book value of the Company. However, we

currently do not have any plans or understandings with respect to the issuance of the additional shares that would be

authorized for issuance if Proposal No. 1 is approved by our stockholders. The following table contains approximate

information related to our common stock, comparing current information as of the record date to an estimated scenario

following stockholder approval of the Charter Amendment Proposals.

|

|

|

Pre Charter

Amendments

|

|

|

Post Charter

Amendments

|

|

|

Authorized

|

|

|

500,000,000

|

|

|

|

200,000,000

|

|

|

Outstanding

|

|

|

49,349,749

|

|

|

|

4,934,975

|

|

|

Reserved for future issuance pursuant to outstanding warrants

|

|

|

59,679,834

|

|

|

|

5,967,983

|

|

|

Reserved for future issuance pursuant to outstanding awards under equity incentive plans

|

|

|

11,010,086

|

|

|

|

1,101,008

|

|

|

Reserved for future issuance pursuant to awards available for grant under equity incentive plans

|

|

|

5,007,743

|

|

|

|

500,774

|

|

|

Authorized and unreserved

|

|

|

374,952,588

|

|

|

|

187,495,260

|

|

|

|

(1)

|

Assumes the stockholders approve each of Proposal Nos. 1 and 2.

|

When effected, the reverse stock split will

be effected simultaneously for all of our common stock and the ratio will be the same for all of our common stock. The reverse

stock split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interest

in our company, except to the extent that the reverse stock split results in any of our stockholders owning a fractional share.

As described below, stockholders holding fractional shares will be entitled to cash payments in lieu of such fractional shares.

Such cash payments would reduce the number of post-split stockholders to the extent there are stockholders presently holding fewer

than ten shares. However, this is not the purpose for which we are effecting the reverse stock split. Common stock outstanding

following the reverse stock split will remain fully paid and non-assessable. We will continue to be subject to the periodic reporting

requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Fractional Shares

.

No scrip

or fractional certificates will be issued in connection with any reverse stock split. Stockholders who otherwise would be entitled

to receive fractional shares because they hold, as of a date prior to the effective time of the reverse split, a number of shares

of our common stock not evenly divisible by the reverse split ratio will be entitled, upon surrender of certificate(s) representing

such shares, to a cash payment in lieu thereof. The cash payment will equal the product obtained by multiplying (a) the fraction

to which the stockholder would otherwise be entitled by (b) the last quoted bid price of our common stock on the day immediately

prior to the effective time of the reverse stock split, as reported on the OTCQB. The ownership of a fractional interest will not

give the holder thereof any voting, dividend or other rights except to receive payment therefore as described herein.

Stockholders should be aware that, under

the escheat laws of the various jurisdictions where our stockholders reside, where we are domiciled and where the funds will be

deposited, sums due for fractional interests that are not timely claimed after the effective time may be required to be paid to

the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to

seek to obtain them directly from the state to which they were paid.

Accounting Matters

.

Any reverse

stock split would not affect the par value of our common stock, which is $.0001 per share. As a result, as of the effective time

of any reverse stock split, the stated capital on our balance sheet attributable to our common stock will be reduced proportionately

based on reverse split ratio, and the additional paid-in capital account will be credited with the amount by which the stated capital

is reduced. The per share net income or loss and net book value of our common stock will be restated because there will be fewer

shares of common stock outstanding.

Procedure for Effecting Reverse Stock Split and Exchange

of Stock Certificates

In order to effect a reverse split, we will

file an amendment to our certificate of incorporation with the Secretary of State of Delaware to amend our existing certificate

of incorporation in substantially the form attached hereto as

Appendix A

. The reverse stock split will become effective

at the time specified in the amendment, which is referred to in this proxy statement as the effective time of the amendment. Beginning

at the effective time, each certificate representing shares of common stock prior to the effective time of the reverse split will

be deemed for all corporate purposes to evidence ownership of resulting combined number of shares following such reverse split.

As soon as practicable after the effective

time, stockholders will be notified that the reverse stock split has been effected. We expect that our transfer agent, American

Stock Transfer & Trust Company, LLC, will act as exchange agent for purposes of implementing the exchange of stock certificates.

Holders of pre-split common shares will be asked to surrender to the exchange agent certificates representing such shares in exchange

for certificates representing post-split shares of common stock in accordance with the procedures to be set forth in the letter

of transmittal that we send to our stockholders. No new certificates will be issued to a stockholder until such stockholder has

surrendered such stockholder's outstanding certificate(s), together with the properly completed and executed letter of transmittal,

to the exchange agent. Any pre-split share certificates submitted for transfer, whether pursuant to a sale, other disposition or

otherwise, will automatically be exchanged for certificates representing post-split shares. STOCKHOLDERS SHOULD NOT DESTROY ANY

STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Federal

Income Tax Consequences of the Reverse

Stock Split

The following is a summary of certain material

federal income tax consequences of the reverse stock split, does not purport to be a complete discussion of all of the possible

federal income tax consequences of the reverse stock split and is included for general information only. Further, it does not address

any state, local or foreign income or other tax consequences. Also, it does not address the tax consequences to holders that are

subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, foreign

entities, nonresident alien individuals, broker-dealers and tax-exempt entities. The discussion is based on the provisions of the

United States federal income tax law as of the date hereof, which is subject to change retroactively as well as prospectively.

This summary also assumes that the pre-split shares of common stock were, and the post-split shares of common stock will be, held

as a “capital asset,” as defined in the Internal Revenue Code of 1986, as amended (i.e., generally, property held for

investment). The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder.

Each stockholder is urged to consult with such stockholder's own tax advisor with respect to the tax consequences of the reverse

stock split.

Other than the cash payments for fractional

shares discussed below, no gain or loss should be recognized by a stockholder upon such stockholder's exchange of certificates

representing pre-split shares for post-split shares pursuant to the reverse stock split. The aggregate tax basis of the post-split

shares received in the reverse stock split (including any fraction of a post-split share deemed to have been received) will be

the same as the stockholder's aggregate tax basis in the pre-split shares exchanged therefore. In general, stockholders who receive

cash in exchange for their fractional share interests in the post-split shares as a result of the reverse stock split will recognize

gain or loss based on their adjusted basis in the fractional share interests redeemed. The stockholder's holding period for the

post-split shares will include the period during which the stockholder held the pre-split shares surrendered in the reverse stock

split.

Our view regarding the tax consequences

of the reverse stock split is not binding on the Internal Revenue Service or the courts. ACCORDINGLY, EACH STOCKHOLDER SHOULD CONSULT

WITH HIS OR HER OWN TAX ADVISOR WITH RESPECT TO ALL OF THE POTENTIAL TAX CONSEQUENCES TO HIM OR HER OF THE REVERSE STOCK SPLIT.

Effective Date of Amendment to Certificate of Incorporation

As discussed above under “Procedure

for Effecting Reverse Stock Split and Exchange of Stock Certificates,” if approved by the stockholders, it is anticipated

that the amendment to the certificate of incorporation contemplated by Proposal No. 1 will become effective upon the filing of

a certificate of amendment, in substantially the form attached hereto as Appendix A, with the Secretary of State of the State of

Delaware. We expect to make such filing as soon as practicable after the Special Meeting. However, our board

of directors may determine to delay such filing if it believes the timing of implementing the reverse split may adversely affect

the trading price of our common stock or if it otherwise believes the timing is not then appropriate.

Reservation of Rights by the Board of Directors

If approved, the Board reserves

the right to abandon the amendment contemplated by Proposal No. 1 for any reason, including if the amendment contemplated by

Proposal No. 2 is not also approved by the stockholders.

No Appraisal or Dissenters’ Rights

Under the Delaware General Corporation Law,

our stockholders are not entitled to appraisal or dissenters’ rights with respect to Proposal No. 1, and we will not independently

provide stockholders with any such right.

Vote Required

The amendment to our certificate of incorporation

contemplated by Proposal No. 1 requires the affirmative vote from the holders of a majority of the outstanding shares of our common

stock. A stockholder who abstains or who does not give authority to a proxy to vote, or withholds authority to vote on this proposal,

shall have the effect of voting against the proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT YOU VOTE “

FOR

”

PROPOSAL NO. 1.

PROPOSAL NO. 2

APPROVAL OF AN AMENDMENT TO THE

COMPANY’S CERTIFICATE OF INCORPORATION TO REDUCE THE

NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

Background and Purpose of the Amendment

We are seeking stockholder approval of the

amendment of our certificate of incorporation to reduce the number of authorized shares of common stock from 500,000,000 to 200,000,000. See

“Proposal No. 1 — Approval of an Amendment to the Company’s Certificate of Incorporation to Effect a Reverse

Stock Split,” above, for a comparison of our capital structure as of the record date to an estimated scenario following stockholder

approval of the Charter Amendment Proposals.

The Board’s primary reason

for approving the amendment of our Certificate of Incorporation to reduce the number of authorized shares of common stock is

to reduce the amount of our annual franchise tax in the State of Delaware, while still maintaining a sufficient number

of authorized shares of common stock to meet our anticipated needs for capital-raising transactions, issuances of

equity-based compensation and, to the extent opportunities may arise in the future, strategic transactions that may involve

our issuance of stock-based consideration. Each year, we are required to make franchise tax payments to the State

of Delaware in an amount determined, in part, by the total number of shares of stock we are authorized to issue. Therefore,

the amount of this tax will be decreased if we reduce the number of authorized shares of our common stock (unless

before and after such reduction, we are subject to the maximum tax amount). While the exact amount of such cost savings will

depend on a number of factors, and could change year to year, we estimate that we would have saved an average of $60,000 per

year based on current Delaware franchise tax rates during the three years from 2013 to 2015.

Certain Risks Associated With the Amendment

The proposed reduction in the number of

authorized shares of common stock could have adverse effects on us. Our Board will have less flexibility to issue shares of common

stock, including in connection with a potential merger or acquisition, stock dividend or capital-raising transaction. In

the event that our Board determines that it would be in our best interest to issue a number of shares of common stock in excess

of the number of then authorized but unissued and unreserved shares, we would be required to seek the approval of our stockholders

to increase the number of shares of authorized common stock. If we are not able to obtain the approval of our stockholders for

such an increase in a timely fashion, we may be unable to take advantage of opportunities that might otherwise be advantageous

to us and our stockholders.

Effective Date of Amendment to Certificate of Incorporation

If approved by the stockholders, it is anticipated

that the amendment to the certificate of incorporation contemplated by Proposal No. 2 will become effective upon the filing of

a certificate of amendment, in substantially the form attached hereto as

Appendix A

, with the Secretary of State

of the State of Delaware, which filing is expected to occur as soon as practicable after the Special Meeting.

Reservation of Rights by the Board of Directors

If approved, the Board reserves the right

to abandon the amendment contemplated by Proposal No. 2 if the amendment contemplated by Proposal No. 1 is not also approved by

the stockholders.

No Appraisal or Dissenters’ Rights

Under the Delaware General Corporation Law,

our stockholders are not entitled to appraisal or dissenters’ rights with respect to Proposal No. 1, and we will not independently

provide stockholders with any such right.

Vote Required

The amendment to our certificate of incorporation

contemplated by Proposal No. 2 requires the affirmative vote from the holders of a majority of the outstanding shares of our common

stock. A stockholder who abstains or who does not give authority to a proxy to vote, or withholds authority to vote on this proposal,

shall have the effect of voting against the proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT YOU VOTE “

FOR

”

PROPOSAL NO. 2.

PROPOSAL NO. 3

ADJOURNMENT

PROPOSAL

If at the Special

Meeting the number of shares of common stock present or represented and voting in favor of one or both of the Charter Amendment

Proposals is insufficient to approve such proposals, management may move to adjourn, postpone or continue the Special Meeting in

order to enable the Board of Directors to continue to solicit additional proxies in favor of these proposals.

In this Proposal

No. 3, we are asking you to authorize the holder of any proxy solicited by the Board of Directors to vote in favor of adjourning,

postponing or continuing the Special Meeting and any later adjournments. If the stockholders approve Proposal No. 3, we could adjourn,

postpone or continue the Special Meeting, and any adjourned session of the Special Meeting, to use the additional time to solicit

additional proxies in favor of the Charter Amendment Proposals. Among other things, approval of this Proposal No. 3 could mean

that, even if proxies representing a sufficient number of votes against one or both of the Charter Amendment Proposals have been

received, we could adjourn, postpone or continue the Special Meeting without a vote on such proposal(s) and seek to convince the

holders of those shares to change their votes to votes in their favor.

Vote Required

The affirmative

vote of holders of a majority of our common stock voting at the Special Meeting is required to approve an adjournment. Abstentions

and broker non-votes will not be counted as votes cast and, therefore, will have no impact on the approval of this proposal. No

proxy that is specifically marked AGAINST either Charter Amendment Proposal will be voted in favor of this Proposal No. 3, unless

it is specifically marked FOR the discretionary authority to adjourn, postpone or continue the Special Meeting to a later date.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “

FOR

” THE ADJOURNMENT PROPOSAL.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table summarizes certain

information regarding the beneficial ownership (as such term is defined in Rule 13d-3 under the Exchange Act) of our common

stock as of November 11, 2016 by: (i) each of our current directors, (ii) each of our “named executive officers,”

as defined in our Annual Report on Form 10-K for the year ended December 31, 2015, which we filed with the SEC on March 30,

2016, (iii) all of our current directors and executive officers as a group, and (iv) each person known by us to be the

beneficial owner of more than 5% of our common stock. Except as indicated in the footnotes below, the security and

stockholders listed below possess sole voting and investment power with respect to their shares. Except as otherwise

indicated, the address of each of our executive officers and directors identified below is 200 Route 31 North, Suite 104,

Flemington, New Jersey 08822.

|

Name of Beneficial Owner

|

|

No. Shares of

Common Stock

Beneficially

Owned (1)

|

|

|

Percent of

Class (1)

|

|

|

Directors and Named Executive Officers

|

|

|

|

|

|

|

|

|

|

Arie S. Belldegrun, M.D. (2)

|

|

|

8,648,020

|

|

|

|

15.6

|

|

|

Alexander A. Zukiwski (3)

|

|

|

1,798,974

|

|

|

|

3.5

|

|

|

Stefan Proniuk, Ph.D. (4)

|

|

|

295,304

|

|

|

|

*

|

|

|

David M. Tanen (5)

|

|

|

930,960

|

|

|

|

1.9

|

|

|

William F. Hamilton, Ph.D. (6)

|

|

|

237,099

|

|

|

|

*

|

|

|

Tomer Kariv (7)

|

|

|

6,433,713

|

|

|

|

12.6

|

|

|

Yacov Reizman (8)

|

|

|

203,792

|

|

|

|

*

|

|

|

Steven B. Ruchefsky (9)

|

|

|

8,324,643

|

|

|

|

15.6

|

|

|

Jay Moorin (10)

|

|

|

669,945

|

|

|

|

1.3

|

|

|

Directors and officers as a group (9 persons)

|

|

|

27,542,450

|

|

|

|

42.6

|

|

|

Greater than 5% stockholders

|

|

|

|

|

|

|

|

|

|

Pontifax (7)

|

|

|

6,433,713

|

|

|

|

12.2

|

|

|

S. Donald Sussman (11)

|

|

|

9,396,070

|

|

|

|

17.5

|

|

|

Bonderman Family Limited Partnership (12) (13)

|

|

|

7,360,147

|

|

|

|

9.9

|

|

|

Green Fields Offshore, Inc. (14)

|

|

|

3,140,328

|

|

|

|

6.1

|

|

|

OPKO Health, Inc. (15)

|

|

|

4,549,619

|

|

|

|

8.8

|

|

|

Perceptive Life Sciences Master Fund Ltd. (12)(16)

|

|

|

15,171,679

|

|

|

|

9.9

|

|

|

Quantum Partners LP (12)(17)

|

|

|

16,820,324

|

|

|

|

9.9

|

|

|

Sabby Management, LLC (12)(18)

|

|

|

5,612,576

|

|

|

|

9.9

|

|

|

Ronald I. Dozoretz (19)

|

|

|

4,532,153

|

|

|

|

9.0

|

|

_______________________

* represents less than 1%.

|

|

(1)

|

Based upon 49,349,749 issued and outstanding

shares of our common stock as of November 11, 2016. Beneficial ownership is determined in accordance with Rule 13d-3

under the Securities Act, and includes any shares as to which the security or stockholder has sole or shared voting power or

investment power, and also any shares which the security or stockholder has the right to acquire within 60 days of the date

hereof, whether through the exercise or conversion of any stock option, convertible security, warrant or other

right. The indication herein that shares are beneficially owned is not an admission on the part of the security or

stockholder that he, she or it is a direct or indirect beneficial owner of those shares.

|

|

|

(2)

|

Beneficial ownership includes: (i) 3,115 shares of our common stock and 3,810,837 shares issuable upon the exercise of stock options held by Dr. Belldegrun; (ii) 379,294 shares of our common stock, 516,359 shares issuable upon the exercise of 2012 Series A Warrants, and 434,379 shares issuable upon the exercise of 2013 Series D Warrants held by Arie and Rebecka Belldegrun as Trustees of the Belldegrun Family Trust dated February 18, 1994; (iii) 2,262,838 shares of our common stock and 295,061 shares issuable upon the exercise of 2012 Series A Warrants, and 357,142 shares issuable upon the exercise of 2016 Series F Warrants held by the Arie S. Belldegrun M.D. Inc. Profit Sharing Plan (“PSP); and (iv) 174,644 shares of our common stock, 221,295 shares issuable upon the exercise of 2012 Series A Warrants, and 193,056 shares issuable upon the exercise of 2013 Series D Warrants held by MDRB Partnership, L.P. (“MDRB”). Dr. Belldegrun is the managing partner of MDRB and the plan administrator of the PSP and holds voting and/or dispositive power over the shares held by such entities. Beneficial ownership does not include 1,112,982 shares of our common stock, and 925,232 shares issuable upon the exercise of outstanding warrants, held by two independent trusts to which Dr. Belldegrun is a beneficiary. Such trusts are managed by independent third parties who hold voting and dispositive power over the shares held by such trusts.

|

|

|

(3)

|

Beneficial ownership includes 261,832 shares of our common stock, 221,295 shares issuable upon the exercise of 2012 Series A Warrants, 96,526 shares issuable upon the exercise of 2013 Series D Warrants, and 1,219,321 shares issuable upon the exercise of stock options.

|

|

|

(4)

|

Beneficial ownership includes 10,047 shares of our common stock, 29,504 shares issuable upon the exercise of 2012 Series A Warrants, and 255,753 shares issuable upon the exercise of stock options.

|

|

|

(5)

|

Beneficial ownership includes: (i) 314,569 shares of our common stock and 235,685 shares issuable upon the exercise of stock options and warrants held by Mr. Tanen; (ii) 362,015 shares of our common stock held by the David M. Tanen Revocable Trust (the “Tanen Trust”); and (iii) 18,691 shares held by Mr. Tanen’s minor children. Gregory Kiernan, the trustee of the Tanen Trust, holds voting and/or dispositive power over the shares held by the Tanen Trust.

|

|

|

(6)

|

Beneficial ownership includes 22,079 shares of our common stock, 48,263 shares issuable upon the exercise of 2013 Series D Warrants, and 166,757 shares issuable upon the exercise of stock options.

|

|

|

(7)

|

Beneficial ownership includes: (i) 165,507 shares issuable upon the exercise of stock options held by Mr. Kariv; and (ii) 3,470,468 shares of our common stock and 2,797,738 shares issuable upon the exercise of warrants held by affiliates of Pontifax, of which Mr. Kariv is chief executive officer. Mr. Kariv and Ran Nussbaum hold voting and/or dispositive power over the shares held by Pontifax. The business address for Pontifax is 14 Shenkar Street, Herzeliya 46140 Israel.

|

|

|

(8)

|

Beneficial ownership includes: (i) 165,507 shares issuable upon the exercise of stock options held by Mr. Reizman; and (ii) 38,285 shares of our common stock held by FCC Ltd., of which Mr. Reizman is chairman and chief executive officer.

|

|

|

(9)

|

Beneficial ownership includes: (i) 414,869 shares issuable upon the exercise of stock options held by Mr. Ruchefsky; and (ii) 4,472,905 shares of our common stock and 3,436,869 shares issuable upon the exercise of warrants held by Commercial Street Capital, LLC, of which Mr. Ruchefsky is president. Mr. Ruchefsky is co-managing member of, and shares voting and/or dispositive power over the shares held by, Commercial Street Capital, LLC.

|

|

|

(10)

|

Beneficial ownership includes 27,087 shares of our common issuable upon the exercise of a stock option.

|

|

|

(11)

|

Beneficial ownership includes (i) 714,285 shares of our common stock and 357,142 shares issuable upon the exercise of Series F Warrants held by Mr. Sussman, and (ii) 4,472,905 shares of our common stock and 3,436,869 shares issuable upon the exercise of warrants held by Commercial Street Capital, LLC. Mr. Sussman is co-managing member of, and shares voting and/or dispositive power over the shares held by, Commercial Street Capital, LLC (“CSC”). CSC has a contractual right to appoint one member to our board of directors, and pursuant to such right, has designated Mr. Ruchefsky for appointment. Mr. Sussman’s beneficial ownership also includes 414,869 shares issuable upon the exercise of stock options held by Mr. Ruchefsky, which according to a Schedule 13D jointly filed by Mr. Sussman, Mr. Ruchefsky and CSC on September 8, 2016, are held by Mr. Ruchefsky for the benefit of CSC and therefore may be deemed to be beneficially owned by CSC. The business address for Mr. Sussman and CSC is 800 Westchester Avenue, Rye Brook, NY 10573.

|

|

|

(12)

|

Notwithstanding the number of shares of our common stock shown as beneficially owned by the security holder in the table above, the warrants held by the security holder provide that the security holder may not exercise such warrants to the extent that the security holder would beneficially own in excess of 9.99% of our outstanding common stock immediately after giving effect to such exercise.

|

|

|

(13)

|

Beneficial ownership includes 3,253,005 shares issuable upon the exercise of warrants. Leonard Potter holds voting and/or dispositive power over the shares held by Bonderman Family Limited Partnership. The business address for Bonderman Family LP is 301 Commerce Street, Suite 3000, Fort Worth, TX 76102.

|

|

|

(14)

|

The business address for Green Fields Offshore, Inc. is Four Seasons Residences, Spring 19D, Jl. Setiabudi Tengah, Jakarta, 12910 Indonesia. Beneficial ownership includes 2,039,848 shares issuable upon the exercise of warrants. Anton Linderum holds voting and/or dispositive power over the shares held by Green Fields Offshore, Inc.

|

|

|

(15)

|

The business address for OPKO Health, Inc. is 4400 Biscayne Blvd., Miami, FL 33137. Beneficial ownership includes 2,287,716 shares issuable upon the exercise of warrants. Steven Rubin holds voting and/or dispositive power over the shares held by OPKO Health, Inc.

|

|

|

(16)

|

The business address for Perceptive Life Sciences Master Fund Ltd. is 499 Park Avenue, 25th Floor New York, NY 10022. Beneficial ownership includes 11,186,959 shares issuable upon the exercise of warrants. Joseph Edelman holds voting and/or dispositive power over the shares held by Perceptive Life Sciences Master Fund Ltd.

|

|

|

(17)

|

The business address for Quantum Partners LP is 888 Seventh Avenue, New York, NY 10106. Beneficial ownership includes 12,746,909 shares issuable upon the exercise of warrants. Soros Fund Management LLC (“SFM”) serves as principal investment manager to Quantum Partners LP. As such, SFM has been granted investment discretion over portfolio investments, including the shares reported in the table above, held for the account of Quantum Partners LP. George Soros serves as Chairman of SFM and Robert Soros serves as President and Deputy Chairman of SFM.

|

|

|

(18)

|

The business address for Sabby Management, LLC is 10 Mountainview Road, Suite 205, Upper Saddle River, NJ 07458. Beneficial ownership includes: (i) with respect to Sabby Healthcare Master Fund, Ltd., 1,339,517 shares of our common stock, 1,844,145 shares issuable upon the exercise of 2012 Series A Warrants, 723,965 shares issuable upon the exercise of 2013 Series D Warrants and 357,143 shares issuable upon the exercise of 2016 Series F Warrants; and (ii) with respect to Sabby Volatility Warrant Master Fund, Ltd., 1,106,487 shares issuable upon the exercise of 2012 Series A Warrants, and 241,319 shares issuable upon the exercise of 2013 Series D Warrants. Sabby Management, LLC serves as the investment manager of each of Sabby Healthcare Master Fund, Ltd. and Sabby Volatility Warrant Master Fund, Ltd. (collectively, the “Sabby Funds”). Hal Mintz is the manager of Sabby Management, LLC. Each of Sabby Management, LLC and Hal Mintz disclaims beneficial ownership over the shares held by the Sabby Funds except to the extent of its pecuniary interest therein.

|

|

|

(19)

|

Mr. Dozoretz’s business address is 240 Corporate Blvd., Suite 110, Norfolk, VA 23502. Beneficial ownership includes: (i) 357,142 shares issuable upon the exercise of warrants held by Mr. Dozoretz, and (ii) 2,736,761 shares of our common stock, 723,965 shares issuable upon the exercise of 2013 Series D Warrants, and 357,143 shares issuable upon the exercise of 2016 Series F Warrants held by FHC Stock Holdings, LLC. Mr. Dozoretz holds voting and/or dispositive power over the shares held by FHC Stock Holdings, LLC.

|

OTHER MATTERS

The Board of Directors does not intend to

present at the Special Meeting any other matter not referred to above and does not presently know of any matter that may be presented

at the Special Meeting by others. However, if other matters properly come before the Special Meeting, it is the intention of the

person named in the enclosed proxy to vote the proxy in accordance with his best judgment.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

ARNO THERAPEUTICS, INC.

|

|

|

|

|

|

/s/ Alexander A. Zukiwski

|

|

|

|

|

|

Alexander A. Zukiwski, M.D.

|

|

|

Chief Executive Officer

|

Appendix A

FORM OF

CERTIFICATE OF AMENDMENT

OF THE

CERTIFICATE OF INCORPORATION

OF

ARNO THERAPEUTICS, INC.

Pursuant to Section 242 of the General

Corporation Law of the State of Delaware

It is hereby certified that:

FIRST:

The original Certificate

of Incorporation of Arno Therapeutics, Inc., formerly known as Laurier International, Inc., was filed with the Secretary of State

of the State of Delaware on March 8, 2000, and was amended and restated on August 11, 2010, and further amended on November 21,

2012 and October 28, 2013 (the “Certificate of Incorporation”).

SECOND:

The Certificate

of Incorporation is hereby amended by deleting the text of Article IV in its entirety and replacing it with the following:

“

ARTICLE

IV

A. The

total number of shares of all classes of stock that the Corporation shall have authority to issue is Two Hundred Thirty-Five Million

(235,000,000) shares consisting of: Two Hundred Million (200,000,000) shares of common stock, $0.0001 par value per share (“Common

Stock”); and Thirty-Five Million (35,000,000) shares of preferred stock, $0.0001 par value per share (“Preferred Stock”).

B. Effective

4:01 p.m. EST on (the “Effective Time”),

every share of Common Stock of the Corporation issued and outstanding immediately prior to the Effective Time shall automatically

be combined, without any action on the part of the holder thereof, into one-tenth (1/10) of a share of fully paid and nonassessable

Common Stock of the Corporation, subject to the treatment of fractional shares interests described as follows. No fractional shares

of Common Stock shall be issued. No stockholder of the Corporation shall transfer any fractional shares of Common Stock. The Corporation

shall not recognize on its stock record books any purported transfer of any fractional share of Common Stock. A holder of Common

Stock immediately prior to the Effective Time who, after the Effective Time, would otherwise be entitled to a fraction of a share

of Common Stock as a result of such combination shall, in lieu thereof, be entitled to receive a cash payment in an amount equal

to the fraction to which the holder would otherwise be entitled multiplied by the last reported per share sale price of the Common

Stock as of immediately prior to the Effective Time, as reported on an over-the-counter market quotation system (or if such price

is not available, then such other price as determined by the Board of Directors) and as appropriately adjusted for such combination.

C. The

Preferred Stock may be divided into, and may be issued from time to time in one or more series. The Board is authorized from time

to time to establish and designate any such series of Preferred Stock, to fix and determine the variations in the relative rights,

preferences, privileges and restrictions as between and among such series and any other class of capital stock of the Corporation

and any series thereof, and to fix or alter the number of shares comprising any such series and the designation thereof. The authority

of the Board from time to time with respect to each such series shall include, but not be limited to, determination of the following:

(1) The

designation of the series;

(2) The

number of shares of the series and (except where otherwise provided in the creation of the series) any subsequent increase or decrease

therein;

(3) The

dividends, if any, for shares of the series and the rates, conditions, times and relative preferences thereof;

(4) The

redemption rights, if any, and price or prices for shares of the series;

(5) The

terms and amounts of any sinking fund provided for the purchase or redemption of the series;

(6) The

relative rights of shares of the series in the event of any voluntary or involuntary liquidation, dissolution or winding up of

the affairs of the Corporation;

(7) Whether

the shares of the series shall be convertible into shares of any other class or series of shares of the Corporation, and, if so,

the specification of such other class or series, the conversion prices or rate or rates, any adjustments thereof, the date or dates

as of which such shares shall be convertible and all other terms and conditions upon which such conversion may be made;

(8) The

voting rights, if any, of the holders of such series; and

(9) Such

other designations, powers, preference and relative, participating, optional or other special rights and qualifications, limitations

or restrictions thereof.”

THIRD:

This amendment

to the Certificate of Incorporation has been duly adopted in accordance with Section 242 of the General Corporation Law of the

State of Delaware.

IN WITNESS WHEREOF,

the Corporation has caused this Certificate of Amendment to be signed by its Chief Executive Officer, as of .

|

|

ARNO THERAPEUTICS, INC.

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

|

Name: Alexander A.

Zukiwski, M.D.

|

|

|

|

|

Title: Chief Executive Officer

|

|

|

PROXY

|

ARNO THERAPEUTICS, INC.

|

PROXY

|

|

|

|

|

|

|

THIS PROXY IS SOLICITED ON BEHALF OF

THE BOARD OF DIRECTORS

|

|

The undersigned, a stockholder of

Arno Therapeutics, Inc., hereby appoints Alexander A. Zukiwski as proxy, with full power of substitution, to vote on behalf

of the undersigned the number of shares which the undersigned is then entitled to vote, at the Special Meeting of

Stockholders of Arno Therapeutics, Inc. to be held at 200 Route 31 North, Suite 104, Flemington, New Jersey 08822 at 9:00

a.m. (EST), on December 22, 2016, and at any and all adjournments thereof, with all the powers which the undersigned would

possess if personally present, in the manner directed herein.

This proxy will be voted as directed, or if no direction

is indicated, will be voted “

FOR

” each of the proposals listed below. The Board of Directors recommends a vote

“

FOR

” each of the Proposals described below.

1. To authorize the amendment of our certificate

of incorporation to effect a combination (reverse split) of our common stock at a ratio in the range of 1-for-10.

|

|

¨

FOR

|

¨

AGAINST

|

¨

ABSTAIN

|

2. To authorize the amendment of our certificate

of incorporation to reduce the number of authorized shares of common stock from 500,000,000 to 200,000,000.

|

|

¨

FOR

|

¨

AGAINST

|

¨

ABSTAIN

|

3.

To authorize

the adjournment of the Special Meeting, if necessary or appropriate, if a quorum is present, to solicit additional proxies if there

are insufficient votes at the Special Meeting in favor of Proposals 1 and 2.

|

|

¨

FOR

|

¨

AGAINST

|

¨

ABSTAIN

|

In his discretion, the Proxy is authorized to vote upon such

other business as may come before the Meeting.

|

|

Dated:

, 2016

|

|

|

|

|

|

|

|

|

Signature

|

|

|

|

|

|

|

|

|

Signature of jointly held

|

Mark, sign and date your proxy card and

return it in the postage-paid envelope provided.

|

Important Notice Regarding the Availability

of Proxy Materials for the Special Meeting:

The proxy statement and proxy card are

available at

http://www.arnothera.com/ir_sec.html

|

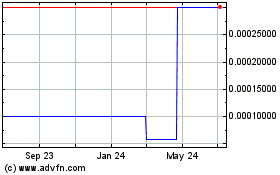

Arno Therapeutics (CE) (USOTC:ARNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

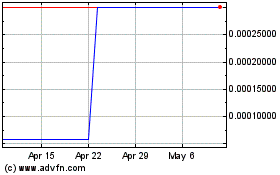

Arno Therapeutics (CE) (USOTC:ARNI)

Historical Stock Chart

From Apr 2023 to Apr 2024