By Barbara Kollmeyer, MarketWatch , Ryan Vlastelica

Major indexes on track for second straight weekly advance

U.S. stocks pulled back modestly from near record levels on

Friday as investors struggled to maintain upside momentum as the

dollar continued to charge higher.

Major indexes opened higher, with the Nasdaq Composite notching

an intraday record, but they were unable to maintain their rise.

Still, they are on track for their second straight weekly advance,

and the Russell 2000 will chalk its 11th straight daily advance if

it closes higher. The index has hit a series of records of late, as

investors increasingly favor small-cap stocks

(http://www.marketwatch.com/story/stock-market-investors-turn-to-small-caps-after-trump-win-2016-11-15).

The market has been in an uptrend all month, but the gains

accelerated after the unexpected election of Donald Trump. Many

investors think that Trump's policy proposals--including massive

cuts to corporate tax rates and financial and environmental

deregulation--will spur growth, inflation and higher interest

rates. More than half

(http://www.marketwatch.com/story/stock-markets-trump-rally-is-mostly-a-bank-rally-2016-11-17)

of the S&P 500's postelection gains have come from the

financial sector.

Read:Here are Goldman's 2017 forecasts for stocks, oil and

more--in one chart

(http://www.marketwatch.com/story/here-are-goldmans-2017-forecasts-for-stocks-oil-and-more-in-one-chart-2016-11-18)

"You can make the case that we'll have a more business-friendly

environment in Washington, and at the same time, economic data has

already been getting better, so our backdrop seems strong as well,"

said Art Hogan, chief market strategist at Wunderlich

Securities.

While Hogan said that market could pull back in the near term as

investors take profits, he added that "this feels like a rally that

can continue."

The Dow Jones Industrial Average fell 35 points to 18,870, while

the S&P 500 fell 4.8 points to 2,188 and the Nasdaq Composite

Index dipped 12.5 points to 5,322. Earlier, the Nasdaq traded as

high as 5,346.60--an intraday record. All three indexes fell 0.2%

on the day.

For the week, the Dow is up 0.2% while the S&P is up 0.8%

and the Nasdaq is up 1.6%.

Health care stocks were the weakest of the day, with the S&P

health care sector down 1%. Patterson Companies Inc.(PDCO) fell 3%

while Illumina Inc. (ILMN) lost 2.5%.

Energy stocks were the top gainers of the day, up 0.3%. The rise

came despite a drop in the price of crude oil

(http://www.marketwatch.com/story/oil-stumbles-on-dollar-strength-lack-of-faith-in-opec-output-deal-2016-11-18).

Chevron Corp.(CVX) rose 0.4%.

Investors are watching the U.S. dollar, which has seen the ICE

Dollar index hit its highest level since 2003. A stronger dollar

can erode the profitability of large-cap companies, which is one

reason investors have been moving to small-cap stocks

(http://www.marketwatch.com/story/stock-market-investors-turn-to-small-caps-after-trump-win-2016-11-15)

since the election. The index rose 0.5% on Friday, a move that

comes after Federal Reserve Chairwoman Janet Yellen signaled

Thursday that a December interest-rate hike

(http://www.marketwatch.com/story/yellen-says-fed-may-hike-interest-rates-relatively-soon-2016-11-17)

was likely to go ahead.

Need to know:The S&P 500 is also getting ever-so-close to a

record

(http://www.marketwatch.com/story/a-trump-trade-war-why-goldman-thinks-investors-shouldnt-believe-the-hype-2016-11-18)

In a continuation of Thursday's action, the yield on the 10-year

Treasury note rose to 2.34%.

Fed speakers ahead: Investors might look for guidance from more

policy makers on Friday. St. Louis Fed President James Bullard said

at a conference in Frankfurt that he's leaning toward the

likelihood of an interest-rate hike in December, according to a

report from CNBC

(http://www.cnbc.com/2016/11/18/feds-bullard-says-hes-leaning-toward-supporting-a-december-rate-hike.html).

Dallas Fed President Rob Kaplan will speak at 1:30 p.m. Eastern

Time in Houston, while Kansas City Fed President Esther George is

set to talk at the Dallas Fed.

Also on the docket is Fed Gov. Jerome Powell, who is scheduled

to appear at the San Francisco Fed.

Stocks to watch: Abercrombie & Fitch Co.(ANF) shares slid

14% as profit dived and the company announced a rebranding

(http://www.marketwatch.com/story/abercrombie-fitch-profit-tumbles-as-it-rebrands-2016-11-18).

Foot Locker Inc.(FL) rose 0.2% after it announced results

(http://www.marketwatch.com/story/foot-locker-beats-profit-expectations-while-sales-match-2016-11-18).

Salesforce.com Inc.(CRM) rose 3.6% after the cloud-computing

company posted rising revenue and boosted its outlook

(http://www.marketwatch.com/story/salesforce-posts-rising-revenue-lifts-outlook-2016-11-17-1948519).

But shares of Applied Materials Inc.(AMAT) fell 0.3% after the

chip-equipment maker missed expectations for new orders

(http://www.marketwatch.com/story/applied-materials-profit-up-21-new-orders-miss-2016-11-17).

Read:Salesforce sets finish line in race to $10 billion

(http://www.marketwatch.com/story/salesforce-sets-finish-line-in-race-to-10-billion-2016-11-17)

Gap Inc.(GPS) slid 14% after the retailer posted a weak outlook.

late Thursday.

(http://www.marketwatch.com/story/gap-shares-fall-on-weak-outlook-2016-11-17)

Other markets: European stocks

(http://www.marketwatch.com/story/banks-commodity-stocks-slide-put-pressure-on-european-markets-2016-11-18)

pulled back slightly on Friday, led by banking and commodity names.

European Central Bank President Mario Draghi

(http://www.marketwatch.com/story/ecbs-draghi-signals-stimulus-will-be-extended-2016-11-18)

signaled Friday that the central bank's stimulus will be extended

for the region, whose economy remains clouded by risks.

Asian markets

(http://www.marketwatch.com/story/asian-markets-rise-nikkei-hits-10-month-high-in-intraday-trading-2016-11-17)

had a mixed day, though yen weakness gave a boost to the Nikkei 225

index , which rose 0.6%.

The dollar's move higher took a toll on gold

(http://www.marketwatch.com/story/gold-slides-toward-1200-as-us-rate-hike-looks-imminent-2016-11-18),

which dipped 0.8%.

(END) Dow Jones Newswires

November 18, 2016 11:45 ET (16:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

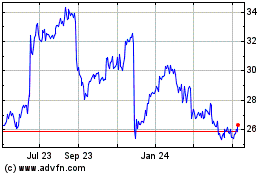

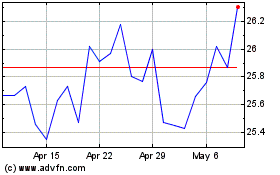

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Apr 2023 to Apr 2024