Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

November 18 2016 - 6:02AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Dated November 17, 2016

Registration Statement No. 333-202508

FINAL TERM SHEET

2.350% Notes due 2019

|

Issuer:

|

|

Abbott Laboratories

|

|

|

|

|

|

Principal Amount:

|

|

$2,850,000,000

|

|

|

|

|

|

Coupon:

|

|

2.350%

|

|

|

|

|

|

Maturity:

|

|

November 22, 2019

|

|

|

|

|

|

Price to Public:

|

|

99.902%

plus accrued interest, if any, from November 22, 2016

|

|

|

|

|

|

Yield to maturity:

|

|

2.384%

|

|

|

|

|

|

Benchmark Treasury:

|

|

1.000% due November 15, 2019

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+105 bps

|

|

|

|

|

|

Treasury Price and Yield:

|

|

99-00 ¾ / 1.334%

|

|

|

|

|

|

Coupon Dates:

|

|

Semiannually on May 22 and November 22

|

|

|

|

|

|

First Coupon:

|

|

May 22, 2017

|

|

|

|

|

|

Settlement Date:

|

|

November 22, 2016

|

|

|

|

|

|

Optional Redemption Provisions:

|

|

Abbott may redeem the notes, at any time at its option, in whole or from time to time in part, at a redemption price equal to the sum of: the greater of (1) 100% of the principal amount of the notes being redeemed, or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the notes being redeemed, discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at a rate equal to the Treasury Yield plus 20 basis points, plus, in either case, accrued and unpaid interest, if any, to the redemption date on the principal amount of the notes being redeemed.

|

|

|

|

|

|

Special Mandatory

|

|

As described in the Preliminary Prospectus Supplement dated

|

1

|

Redemption Provisions:

|

|

November 17, 2016.

|

|

|

|

|

|

CUSIP:

|

|

002824 BC3

|

|

|

|

|

|

Joint Bookrunning Managers:

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Barclays Capital Inc.

Morgan Stanley & Co. LLC

SG Americas Securities, LLC

|

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas Securities Corp.

Citigroup Global Markets Inc.

Deutsche Bank Securities Inc.

MUFG Securities Americas Inc.

Santander Investment Securities Inc.

HSBC Securities (USA) Inc.

Standard Chartered Bank

Goldman, Sachs & Co.

BBVA Securities Inc.

ING Financial Markets LLC

Mizuho Securities USA Inc.

RBC Capital Markets, LLC

U.S. Bancorp Investments, Inc.

The Williams Capital Group, L.P.

|

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Merrill Lynch, Pierce, Fenner & Smith Incorporated, at 1-800-294-1322, Barclays Capital Inc. at (888) 603-5847, or Morgan Stanley & Co. LLC, toll-free at (866) 718-1649.

2

FINAL TERM SHEET

2.900% Notes due 2021

|

Issuer:

|

|

Abbott Laboratories

|

|

|

|

|

|

Principal Amount:

|

|

$2,850,000,000

|

|

|

|

|

|

Coupon:

|

|

2.900%

|

|

|

|

|

|

Maturity:

|

|

November 30, 2021

|

|

|

|

|

|

Price to Public:

|

|

99.823%

plus accrued interest, if any, from November 22, 2016

|

|

|

|

|

|

Yield to maturity:

|

|

2.938%

|

|

|

|

|

|

Benchmark Treasury:

|

|

1.250% due October 31, 2021

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+120 bps

|

|

|

|

|

|

Treasury Price and Yield:

|

|

97-22 ¼ / 1.738%

|

|

|

|

|

|

Coupon Dates:

|

|

Semiannually on May 30 and November 30

|

|

|

|

|

|

First Coupon:

|

|

May 30, 2017

|

|

|

|

|

|

Settlement Date:

|

|

November 22, 2016

|

|

|

|

|

|

Optional Redemption Provisions:

|

|

Abbott may redeem the notes, at any time at its option, in whole or from time to time in part, at a redemption price equal to the sum of: the greater of (1) 100% of the principal amount of the notes being redeemed, or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the notes being redeemed, discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at a rate equal to the Treasury Yield plus 20 basis points, plus, in either case, accrued and unpaid interest, if any, to the redemption date on the principal amount of the notes being redeemed.

Notwithstanding the foregoing, if the notes are redeemed on or after October 30, 2021, the redemption price will be 100% of the principal amount of the notes to be redeemed plus accrued and unpaid interest, if any, to, but excluding, the redemption date on the principal amount of the notes being redeemed.

|

|

|

|

|

|

CUSIP:

|

|

002824 BD1

|

3

|

Joint Bookrunning Managers:

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Barclays Capital Inc.

Morgan Stanley & Co. LLC

Citigroup Global Markets Inc.

|

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas Securities Corp.

Deutsche Bank Securities Inc.

SG Americas Securities, LLC

MUFG Securities Americas Inc.

Santander Investment Securities Inc.

HSBC Securities (USA) Inc.

Standard Chartered Bank

Goldman, Sachs & Co.

BBVA Securities Inc.

ING Financial Markets LLC

Mizuho Securities USA Inc.

RBC Capital Markets, LLC

U.S. Bancorp Investments, Inc.

The Williams Capital Group, L.P.

|

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Merrill Lynch, Pierce, Fenner & Smith Incorporated, at 1-800-294-1322, Barclays Capital Inc. at (888) 603-5847, or Morgan Stanley & Co. LLC, toll-free at (866) 718-1649.

4

FINAL TERM SHEET

3.400% Notes due 2023

|

Issuer:

|

|

Abbott Laboratories

|

|

|

|

|

|

Principal Amount:

|

|

$1,500,000,000

|

|

|

|

|

|

Coupon:

|

|

3.400%

|

|

|

|

|

|

Maturity:

|

|

November 30, 2023

|

|

|

|

|

|

Price to Public:

|

|

99.529%

plus accrued interest, if any, from November 22, 2016

|

|

|

|

|

|

Yield to maturity:

|

|

3.476%

|

|

|

|

|

|

Benchmark Treasury:

|

|

1.625% due October 31, 2023

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+140 bps

|

|

|

|

|

|

Treasury Price and Yield:

|

|

97-03 / 2.076%

|

|

|

|

|

|

Coupon Dates:

|

|

Semiannually on May 30 and November 30

|

|

|

|

|

|

First Coupon:

|

|

May 30, 2017

|

|

|

|

|

|

Settlement Date:

|

|

November 22, 2016

|

|

|

|

|

|

Optional Redemption Provisions:

|

|

Abbott may redeem the notes, at any time at its option, in whole or from time to time in part, at a redemption price equal to the sum of: the greater of (1) 100% of the principal amount of the notes being redeemed, or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the notes being redeemed, discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at a rate equal to the Treasury Yield plus 25 basis points, plus, in either case, accrued and unpaid interest, if any, to the redemption date on the principal amount of the notes being redeemed.

Notwithstanding the foregoing, if the notes are redeemed on or after September 30, 2023, the redemption price will be 100% of the principal amount of the notes to be redeemed plus accrued and unpaid interest, if any, to, but excluding, the redemption date on the principal amount of the notes being redeemed.

|

|

|

|

|

|

Special Mandatory

|

|

As described in the Preliminary Prospectus Supplement dated

|

5

|

Redemption Provisions:

|

|

November 17, 2016.

|

|

|

|

|

|

CUSIP:

|

|

002824 BE9

|

|

|

|

|

|

Joint Bookrunning Managers:

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Barclays Capital Inc.

Morgan Stanley & Co. LLC

Deutsche Bank Securities Inc.

|

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas Securities Corp.

Citigroup Global Markets Inc.

SG Americas Securities, LLC

MUFG Securities Americas Inc.

Santander Investment Securities Inc.

HSBC Securities (USA) Inc.

Standard Chartered Bank

Goldman, Sachs & Co.

BBVA Securities Inc.

ING Financial Markets LLC

Mizuho Securities USA Inc.

RBC Capital Markets, LLC

U.S. Bancorp Investments, Inc.

The Williams Capital Group, L.P.

|

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Merrill Lynch, Pierce, Fenner & Smith Incorporated, at 1-800-294-1322, Barclays Capital Inc. at (888) 603-5847, or Morgan Stanley & Co. LLC, toll-free at (866) 718-1649.

6

FINAL TERM SHEET

3.750% Notes due 2026

|

Issuer:

|

|

Abbott Laboratories

|

|

|

|

|

|

Principal Amount:

|

|

$3,000,000,000

|

|

|

|

|

|

Coupon:

|

|

3.750%

|

|

|

|

|

|

Maturity:

|

|

November 30, 2026

|

|

|

|

|

|

Price to Public:

|

|

99.256%

plus accrued interest, if any, from November 22, 2016

|

|

|

|

|

|

Yield to maturity:

|

|

3.840%

|

|

|

|

|

|

Benchmark Treasury:

|

|

2.000% due November 15, 2026

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+155 bps

|

|

|

|

|

|

Treasury Price and Yield:

|

|

97-13+ / 2.290%

|

|

|

|

|

|

Coupon Dates:

|

|

Semiannually on May 30 and November 30

|

|

|

|

|

|

First Coupon:

|

|

May 30, 2017

|

|

|

|

|

|

Settlement Date:

|

|

November 22, 2016

|

|

|

|

|

|

Optional Redemption Provisions:

|

|

Abbott may redeem the notes, at any time at its option, in whole or from time to time in part, at a redemption price equal to the sum of: the greater of (1) 100% of the principal amount of the notes being redeemed, or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the notes being redeemed, discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at a rate equal to the Treasury Yield plus 25 basis points, plus, in either case, accrued and unpaid interest, if any, to the redemption date on the principal amount of the notes being redeemed.

Notwithstanding the foregoing, if the notes are redeemed on or after August 30, 2026, the redemption price will be 100% of the principal amount of the notes to be redeemed plus accrued and unpaid interest, if any, to, but excluding, the redemption date on the principal amount of the notes being redeemed.

|

|

|

|

|

|

Special Mandatory

|

|

As described in the Preliminary Prospectus Supplement dated

|

7

|

Redemption Provisions:

|

|

November 17, 2016.

|

|

|

|

|

|

CUSIP:

|

|

002824 BF6

|

|

|

|

|

|

Joint Bookrunning Managers:

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Barclays Capital Inc.

Morgan Stanley & Co. LLC

Deutsche Bank Securities Inc.

|

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas Securities Corp.

Citigroup Global Markets Inc.

SG Americas Securities, LLC

MUFG Securities Americas Inc.

Santander Investment Securities Inc.

HSBC Securities (USA) Inc.

Standard Chartered Bank

Goldman, Sachs & Co.

BBVA Securities Inc.

ING Financial Markets LLC

Mizuho Securities USA Inc.

RBC Capital Markets, LLC

U.S. Bancorp Investments, Inc.

The Williams Capital Group, L.P.

|

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Merrill Lynch, Pierce, Fenner & Smith Incorporated, at 1-800-294-1322, Barclays Capital Inc. at (888) 603-5847, or Morgan Stanley & Co. LLC, toll-free at (866) 718-1649.

8

FINAL TERM SHEET

4.750% Notes due 2036

|

Issuer:

|

|

Abbott Laboratories

|

|

|

|

|

|

Principal Amount:

|

|

$1,650,000,000

|

|

|

|

|

|

Coupon:

|

|

4.750%

|

|

|

|

|

|

Maturity:

|

|

November 30, 2036

|

|

|

|

|

|

Price to Public:

|

|

99.360%

plus accrued interest, if any, from November 22, 2016

|

|

|

|

|

|

Yield to maturity:

|

|

4.800%

|

|

|

|

|

|

Benchmark Treasury:

|

|

2.250% due August 15, 2046

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+175 bps

|

|

|

|

|

|

Treasury Price and Yield:

|

|

84-14 / 3.050%

|

|

|

|

|

|

Coupon Dates:

|

|

Semiannually on May 30 and November 30

|

|

|

|

|

|

First Coupon:

|

|

May 30, 2017

|

|

|

|

|

|

Settlement Date:

|

|

November 22, 2016

|

|

|

|

|

|

Optional Redemption Provisions:

|

|

Abbott may redeem the notes, at any time at its option, in whole or from time to time in part, at a redemption price equal to the sum of: the greater of (1) 100% of the principal amount of the notes being redeemed, or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the notes being redeemed, discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at a rate equal to the Treasury Yield plus 30 basis points, plus, in either case, accrued and unpaid interest, if any, to the redemption date on the principal amount of the notes being redeemed.

Notwithstanding the foregoing, if the notes are redeemed on or after May 30, 2036, the redemption price will be 100% of the principal amount of the notes to be redeemed plus accrued and unpaid interest, if any, to, but excluding, the redemption date on the principal amount of the notes being redeemed.

|

|

|

|

|

|

Special Mandatory

|

|

As described in the Preliminary Prospectus Supplement dated

|

9

|

Redemption Provisions:

|

|

November 17, 2016.

|

|

|

|

|

|

CUSIP:

|

|

002824 BG4

|

|

|

|

|

|

Joint Bookrunning Managers:

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Barclays Capital Inc.

Morgan Stanley & Co. LLC

MUFG Securities Americas Inc.

|

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas Securities Corp.

Citigroup Global Markets Inc.

Deutsche Bank Securities Inc.

SG Americas Securities, LLC

Santander Investment Securities Inc.

HSBC Securities (USA) Inc.

Standard Chartered Bank

Goldman, Sachs & Co.

BBVA Securities Inc.

ING Financial Markets LLC

Mizuho Securities USA Inc.

RBC Capital Markets, LLC

U.S. Bancorp Investments, Inc.

The Williams Capital Group, L.P.

|

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Merrill Lynch, Pierce, Fenner & Smith Incorporated, at 1-800-294-1322, Barclays Capital Inc. at (888) 603-5847, or Morgan Stanley & Co. LLC, toll-free at (866) 718-1649.

10

FINAL TERM SHEET

4.900% Notes due 2046

|

Issuer:

|

|

Abbott Laboratories

|

|

|

|

|

|

Principal Amount:

|

|

$3,250,000,000

|

|

|

|

|

|

Coupon:

|

|

4.900%

|

|

|

|

|

|

Maturity:

|

|

November 30, 2046

|

|

|

|

|

|

Price to Public:

|

|

99.221%

plus accrued interest, if any, from November 22, 2016

|

|

|

|

|

|

Yield to maturity:

|

|

4.950%

|

|

|

|

|

|

Benchmark Treasury:

|

|

2.250% due August 15, 2046

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+190 bps

|

|

|

|

|

|

Treasury Price and Yield:

|

|

84-14 / 3.050%

|

|

|

|

|

|

Coupon Dates:

|

|

Semiannually on May 30 and November 30

|

|

|

|

|

|

First Coupon:

|

|

May 30, 2017

|

|

|

|

|

|

Settlement Date:

|

|

November 22, 2016

|

|

|

|

|

|

Optional Redemption Provisions:

|

|

Abbott may redeem the notes, at any time at its option, in whole or from time to time in part, at a redemption price equal to the sum of: the greater of (1) 100% of the principal amount of the notes being redeemed, or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the notes being redeemed, discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at a rate equal to the Treasury Yield plus 30 basis points, plus, in either case, accrued and unpaid interest, if any, to the redemption date on the principal amount of the notes being redeemed.

Notwithstanding the foregoing, if the notes are redeemed on or after May 30, 2046, the redemption price will be 100% of the principal amount of the notes to be redeemed plus accrued and unpaid interest, if any, to, but excluding, the redemption date on the principal amount of the notes being redeemed.

|

|

|

|

|

|

Special Mandatory

|

|

As described in the Preliminary Prospectus Supplement dated

|

11

|

Redemption Provisions:

|

|

November 17, 2016.

|

|

|

|

|

|

CUSIP:

|

|

002824 BH2

|

|

|

|

|

|

Joint Bookrunning Managers:

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Barclays Capital Inc.

Morgan Stanley & Co. LLC

BNP Paribas Securities Corp.

|

|

|

|

|

|

Co-Managers:

|

|

Citigroup Global Markets Inc.

Deutsche Bank Securities Inc.

SG Americas Securities, LLC

MUFG Securities Americas Inc.

Santander Investment Securities Inc.

HSBC Securities (USA) Inc.

Standard Chartered Bank

Goldman, Sachs & Co.

BBVA Securities Inc.

ING Financial Markets LLC

Mizuho Securities USA Inc.

RBC Capital Markets, LLC

U.S. Bancorp Investments, Inc.

The Williams Capital Group, L.P.

|

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Merrill Lynch, Pierce, Fenner & Smith Incorporated, at 1-800-294-1322, Barclays Capital Inc. at (888) 603-5847, or Morgan Stanley & Co. LLC, toll-free at (866) 718-1649.

12

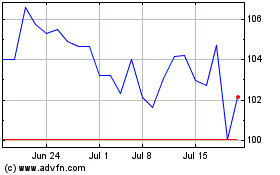

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

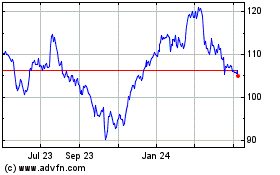

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024