Ross Stores Profit Rises 13%

November 17 2016 - 5:44PM

Dow Jones News

By Tess Stynes

Ross Stores Inc. said its earnings rose 13% in the three months

ended October as the off-price retailer benefited from

better-than-expected revenue growth and stronger margins.

Shares rose 3.5% to $67.85 in recent after-hours trading as the

results beat expectations and the company raised its annual

guidance.

For the year ending in January, Ross Stores projected per-share

earnings of $2.78 to $2.81, compared with its previous estimate for

per-share profit of $2.69 to $2.75.

For the holiday quarter, the company forecast per-share earnings

of 72 cents to 75 cents, mostly below estimates of analysts polled

by Thomson Reuters for per-share profit of 75 cents.

Off-price retailers such as Ross Stores and TJX Cos. -- parent

of T.J. Maxx and Marshalls -- have been faring better than

department stores as consumers have remained price-conscious.

For the period ended Oct. 29, Ross Stores' comparable sales --

or sales at stores open more than 14 months -- rose 7%.

In all, Ross Stores reported a profit of $244.5 million, or 62

cents a share, up from $215.7 million, or 53 cents a share, a year

earlier. The company expected per-share profit of 52 cents to 55

cents.

Revenue increased 11% to $3.09 billion. Analysts expected

revenue of $2.96 billion, according to FactSet.

Operating margin rose 0.55 percentage point to 12.6%, mostly on

stronger merchandise margins.

On Tuesday, rival TJX Cos. and other off-price chains, reported

better-than-expected results for the three months ended in October,

though the company's guidance for the holiday quarter fell short of

expectations.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

November 17, 2016 17:29 ET (22:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

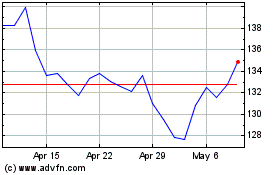

Ross Stores (NASDAQ:ROST)

Historical Stock Chart

From Mar 2024 to Apr 2024

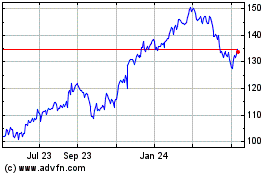

Ross Stores (NASDAQ:ROST)

Historical Stock Chart

From Apr 2023 to Apr 2024