Current Report Filing (8-k)

November 17 2016 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 12, 2016

DELEK US HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction

of incorporation)

|

001-32868

(Commission File Number)

|

52-2319066

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

7102 Commerce Way

Brentwood, Tennessee

(Address of principal executive offices)

|

37027

(Zip Code)

|

Registrant's telephone number, including area code:

(615) 771-6701

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.01 Completion of Disposition of Assets.

On November 14, 2016, Delek US Holdings, Inc. (“Delek”or the "Company") closed the previously announced transaction (the "Retail Divestiture") to sell its retail related assets to Copec Inc., a U.S. subsidiary of Compañía de Petróleos de Chile COPEC S.A. (“COPEC”). Pursuant to that certain Equity Purchase Agreement dated August 27, 2016 (the "Purchase Agreement"), by and among Delek, Copec Inc. and COPEC, Delek sold 100% of the equity interests in MAPCO Express, Inc. ("MAPCO"), MAPCO Fleet, Inc., Delek Transportation, LLC, NTI Investments, LLC and GDK Bear Paw, LLC (collectively the “Retail Entities”) to Copec Inc. Total cash consideration was $535.0 million, plus the Retail Entities’ estimated cash on hand and a working capital adjustment, totaling approximately $16.3 million. At closing, $156.0 million of debt associated with the Retail Entities was repaid, along with a debt prepayment fee of $13.4 million and an estimated $4.6 million of transaction related costs. Net cash proceeds before taxes related to this transaction are $377.3 million. Amounts disclosed above are subject to final cash and working capital adjustments. The estimated income tax payment related to this transaction will occur in early 2017. At closing, Delek, Delek's wholly owned subsidiary, Lion Oil Company ("Lion"), and MAPCO entered into a supply agreement pursuant to which Lion will supply fuel to MAPCO for a period of 18 months following the closing.

The above description of the Purchase Agreement and the transactions contemplated thereby does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement itself, a copy of which was filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed on September 1, 2016 with the Securities and Exchange Commission and is incorporated herein by reference.

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

On November 12, 2016, Frederec Green was appointed to serve as the Chief Operating Officer of the Company. Mr. Green, 51, has served as the Company’s Executive Vice President since May 2009 and as the primary operational officer for the Company’s refining operations since joining the Company in January 2005. Mr. Green has also served as a member of the board of directors and an executive vice president of Delek Logistics GP, LLC since April 2012 and as a member of the board of directors of Alon USA Energy, Inc. (NYSE: ALJ) since May 2015. Mr. Green has more than 25 years of experience in the refining industry, including 14 years at Murphy Oil USA, Inc., where he served as a senior vice president during his last six years. Mr. Green has experience ranging from crude oil and feedstock supply, through all aspects of managing a refining business to product trading, transportation and sales.

On November 14, 2016, the Company entered into an employment agreement (the "Employment Agreement") effective November 1, 2016 with Mr. Green that expires on October 31, 2020. The Employment Agreement provides that Mr. Green will receive an annualized base salary of at least $375,000 and will be reimbursed for the reasonable costs of professional preparation of his personal income tax return(s) and financial counseling during the term of the Employment Agreement. The Employment Agreement also sets Mr. Green's annual bonus target for the 2016 fiscal year at 75% of his base salary at the end of the bonus year. The annual bonus may be based upon the achievement of performance measures and objectives established by the Board of Directors of the Company.

Upon the termination of Mr. Green’s employment by the Company without Cause (as defined in the Employment Agreement) or by Mr. Green for Good Reason (as defined in the Employment Agreement) other than in the context of a Change in Control (as defined in the Employment Agreement), he will be entitled to receive (i) an amount equal to the sum of his annual base salary and target annual bonus, in each case as in effect immediately prior to the notice of termination (the “Separation Base Amount”), (ii) the costs of continuing COBRA health insurance coverage for his family for 12 months following termination (the “Health Benefit Continuation”), (iii) the annual bonus to which he would have otherwise been entitled if his employment had continued through the end of the bonus year based upon the actual performance of the Company, prorated for the period of actual employment during the bonus year (the “Post-Employment Annual Bonus”), and (iv) the immediate vesting of unvested equity awards granted to him under the Company’s long-term incentive plans but, in the case of performance awards, on a prorated basis through the date of termination and, in the case of other awards, only to the extent that the awards would have otherwise vested within six months following the date of termination or within the remainder of the term of the Employment Agreement. If within two years following a Change in Control the executive's employment is terminated by the Company other than for Cause or by the executive for Good Reason, the terminated executive will be entitled to receive (i) an amount equal to the Separation Base Amount multiplied by two, (ii) the Health Benefit Continuation, (iii) the Post-Employment Annual Bonus and (iv) the immediate vesting of all unvested equity awards granted to the executive under the Company’s long-term incentive plans. If Mr. Green terminates his employment other than for Good Reason and he provides at least three months' advance written notice of termination, he will be entitled to a severance payment equal to 50% of his base salary at the time notice of termination is delivered and the Health Benefit Continuation. The Employment Agreement includes certain customary non-competition and non-interference provisions.

The above description of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the Employment Agreement itself, a copy of which is filed with this report as Exhibit 10.1 and is incorporated herein in its entirety by reference

On November 12, 2016, the Compensation Committee of the Board of Directors of the Company approved a grant of equity awards with an aggregate target grant date fair value of approximately $700,000 to be made to Mr. Green on March 10, 2017 (the “Grant Date”). Approximately

half of the target value of the equity awards to Mr. Green will be in the form of time-vested restricted stock units (“RSUs”) which will vest quarterly, conditioned upon continued employment over three years, provided that the RSUs that would vest in the first quarter following the Grant Date will vest with the RSUs vesting in the second quarter following the Grant Date. The balance of the equity that will be awarded to Mr. Green will be in the form of two tranches of performance RSUs (“PRSUs”). Each tranche of the PRSUs will have a performance period commencing January 1, 2017 with one tranche ending December 31, 2018 and the other ending December 31, 2019. The RSUs and PRSUs will be granted under the Company’s 2016 Long-Term Incentive Plan on the Grant Date and shall be subject to such customary terms and conditions for similar grants under such plan.

|

|

|

|

Item 7.01

|

Regulation FD Disclosure

.

|

On November 14, 2016, Delek issued a press release announcing the closing of the Retail Divestiture. A copy of this press release is attached as Exhibit 99.1.

The information in this Item 7.01 is being furnished, not filed, pursuant to Regulation FD. Accordingly, the information in Item 7.01 of this report will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company or any of its affiliates.

Item 9.01

Financial Statements and Exhibits.

|

|

|

|

(a)

|

Financial statements of businesses acquired.

|

Not applicable.

|

|

|

|

(b)

|

Pro forma financial information.

|

The financial statements required by this Item for the disposition described in Item 2.01 of this report on Form 8-K are included as Exhibit 99.2 to this Form 8-K and are incorporated herein by reference.

|

|

|

|

(c)

|

Shell company transactions.

|

Not applicable.

|

|

|

|

|

|

|

|

2.1

|

^

|

|

Equity Purchase Agreement dated August 27, 2016 by and between Delek US Holdings, Inc., Copec Inc. and Compañía de Petróleos de Chile COPEC S.A. (incorporated by reference to Exhibit 2.1 to the Company's Form 8-K filed on September 1, 2016).

|

|

|

|

|

|

|

10.1

|

§*

|

|

Executive Employment Agreement, effective November 1, 2016, by and between Delek US Holdings, Inc. and Frederec C. Green.

|

|

|

|

|

|

|

99.1

|

#

|

|

Press release of Delek US Holdings, Inc. issued November 14, 2016.

|

|

|

|

|

|

|

99.2

|

§

|

|

Unaudited pro forma condensed consolidated statements of income for the three years ended December 31, 2015, which give effect to the Retail Divestiture as if it had occurred on January 1, 2013 and the unaudited pro forma condensed consolidated balance sheet as of December 31, 2015, which gives effect to the Retail Divestiture as if it had occurred on December 31, 2015.

|

|

|

|

|

^

|

Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of any of the omitted schedules or exhibits upon request by the United States Securities and Exchange Commission, provided, however, that Delek may request confidential treatment pursuant to Rule 24b-2 of the Exchange Act, as amended, for any schedules or exhibits so furnished.

|

|

|

|

|

*

|

Management contract or compensatory plan or arrangement.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Dated: November 17, 2016

|

DELEK US HOLDINGS, INC.

|

|

|

|

|

|

/s/ Assaf Ginzburg

|

|

|

Name: Assaf Ginzburg

|

|

|

Title: EVP / Chief Financial Officer

|

Exhibit Index

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

2.1

|

^

|

|

Equity Purchase Agreement dated August 27, 2016 by and between Delek US Holdings, Inc., Copec Inc. and Compañía de Petróleos de Chile COPEC S.A. (incorporated by reference to Exhibit 2.1 to the Company's Form 8-K filed on September 1, 2016).

|

|

|

|

|

|

|

10.1

|

§*

|

|

Executive Employment Agreement, effective November 1, 2016, by and between Delek US Holdings, Inc. and Frederec C. Green.

|

|

|

|

|

|

|

99.1

|

#

|

|

Press release of Delek US Holdings, Inc. issued November 14, 2016.

|

|

|

|

|

|

|

99.2

|

§

|

|

Unaudited pro forma condensed consolidated statements of income for the three years ended December 31, 2015, which give effect to the Retail Divestiture as if it had occurred on January 1, 2013 and the unaudited pro forma condensed consolidated balance sheet as of December 31, 2015, which gives effect to the Retail Divestiture as if it had occurred on December 31, 2015.

|

|

|

|

|

^

|

Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of any of the omitted schedules or exhibits upon request by the United States Securities and Exchange Commission, provided, however, that Delek may request confidential treatment pursuant to Rule 24b-2 of the Exchange Act, as amended, for any schedules or exhibits so furnished.

|

|

|

|

|

*

|

Management contract or compensatory plan or arrangement.

|

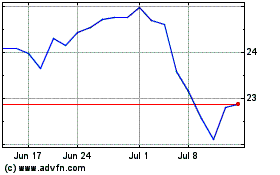

Delek US (NYSE:DK)

Historical Stock Chart

From Mar 2024 to Apr 2024

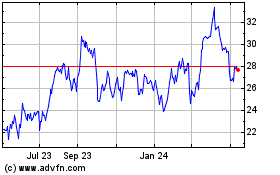

Delek US (NYSE:DK)

Historical Stock Chart

From Apr 2023 to Apr 2024