Securities Registration: Employee Benefit Plan (s-8)

November 17 2016 - 6:03AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on November 16, 2016

Registration No. 333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Newmont

Mining Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

84-1611629

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

6363 South Fiddlers Green Circle

Greenwood Village, Colorado

|

|

80111

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Newmont Mining Corporation

2013 Stock Incentive Compensation Plan

(Full title of the plan)

Stephen P.

Gottesfeld

Executive Vice President and General Counsel

Newmont Mining Corporation

6363 South Fiddlers Green Circle

Greenwood Village, Colorado 80111

(Name and address of agent for service)

(303)

863-7414

(Telephone number, including area code, of agent for service)

Copy to:

Laura

M. Sizemore

David M. Johansen

White & Case LLP

1155 Avenue of the Americas

New York, New York 10036

Tel: (212) 819-8200

Fax: (212) 354-8113

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer,

a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☒

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of securities

to be registered

|

|

Amount

to be

registered

|

|

Proposed maximum

offering price

per

share

|

|

Proposed maximum

aggregate

offering price

|

|

Amount of

registration fee

|

|

Common Stock, $1.60 par value (the “Common

Stock”)

|

|

12,342,793

(1)(2)

|

|

$31.48

(3)

|

|

$388,551,123.64

(3)

|

|

$45,033.08

|

|

|

|

|

|

(1)

|

Consists of the following shares of Common Stock : (a) 11,300,000 shares, which were reserved for issuance under the Newmont Mining Corporation 2013 Stock Incentive Compensation Plan (the “2013 Incentive

Plan”) but not registered on the Registrant’s registration statement on Form S-8 (File No. 333-188128) filed with the Securities and Exchange Commission on April 25, 2013 (the “2013 Form S-8”); and (b) 1,042,793

shares, which were originally registered on the Registrant’s registration statement on Form S-8 (File No. 333-171298) for issuance under the Newmont Mining Corporation 2005 Stock Incentive Plan filed with the Securities and Exchange

Commission on December 21, 2010 and subsequently carried over for offer or sale under the 2013 Incentive Plan, but not registered on the 2013 Form S-8.

|

|

(2)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also includes an indeterminate number of additional shares which become issuable under

the 2013 Incentive Plan as a result of anti-dilution provisions described therein by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration leading to an increase in the

number of outstanding shares.

|

|

(3)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) and Rule 457(h) under the Securities Act based upon the average of the high and low prices of the Registrant’s

Common Stock as reported on the New York Stock Exchange on November 14, 2016.

|

2

EXPLANATORY NOTE

Newmont Mining Corporation (the “Corporation” or the “Registrant”) has filed with the Securities and Exchange Commission

(the “Commission”) this registration statement on Form S-8 (this “Registration Statement”) to register under the Securities Act of 1933, as amended (the “Securities Act”), 12,342,793 additional shares of common stock,

$1.60 par value per share (the “Common Stock”), of the Registrant under the Newmont Mining Corporation 2013 Stock Incentive Compensation Plan (the “2013 Incentive Plan”), as further explained below.

On February 20, 2013, the Registrant’s board of directors adopted, subject to shareholder approval, the 2013 Incentive Plan, and on

April 24, 2013, the 2013 Incentive Plan was approved by the shareholders at the Registrant’s annual meeting of shareholders. Under the 2013 Incentive Plan, the Registrant authorized for issuance 14,500,000 new shares of Common Stock, plus

up to 7,842,793 shares of Common Stock previously registered on the Registrant’s registration statement on Form S-8 (File No. 333-171298) filed with the Commission on December 21, 2010 (the “2010 Registration Statement”),

which were carried over from the Newmont Mining Corporation 2005 Stock Incentive Plan (the “2005 Incentive Plan”) and were no longer available for new awards under the 2005 Incentive Plan. On April 25, 2013, the Registrant filed with

the Commission a registration statement on Form S-8 (File No. 333-188128) (the “2013 Registration Statement”) registering 10,000,000 shares of Common Stock available for issuance under the 2013 Incentive Plan, consisting of the

following: (i) 3,200,000 shares, which were part of the 14,500,000 new shares reserved by the Registrant under the 2013 Incentive Plan; and (ii) 6,800,000 shares, which were part of the 7,842,793 shares carried over from the 2005 Incentive

Plan and originally registered on the 2010 Registration Statement.

As of November 16, 2016, there were 12,342,793 shares of Common

Stock authorized for issuance under the 2013 Incentive Plan that were not previously registered on the 2013 Registration Statement, consisting of the following: (a) 11,300,000 shares, which were part of the 14,500,000 new shares reserved by the

Registrant under the 2013 Incentive Plan; and (b) 1,042,793 shares, which were part of the 7,842,793 shares carried over from the 2005 Incentive Plan. The purpose of this Registration Statement is for the Registrant to register the additional

12,342,793 shares issuable under the 2013 Incentive Plan. Pursuant to Rule 416(a) under the Securities Act, this Registration Statement also covers any additional shares of the Registrant’s Common Stock that become issuable under the 2013

Incentive Plan as a result of anti-dilution provisions described therein by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without receipt of consideration that increases the number of outstanding

shares of the Registrant’s Common Stock.

Pursuant to Instruction E of Form S-8, the contents of the 2013 Registration Statement are

incorporated herein by reference, and the information required by Part II is omitted, except as supplemented by the information set forth below.

3

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.*

Item 2. Registrant Information and Employee Plan Annual Information.*

|

*

|

As permitted by Rule 428 under the Securities Act, this Registration Statement omits the information specified in Part I of Form S-8. The documents containing the information specified in Part I of this

Registration Statement will be sent or given to each participant in the 2013 Incentive Plan as may be required by Rule 428(b). Such documents are not required to be and are not being filed with the Commission, either as part of this Registration

Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration

Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. The Registrant will provide a written statement to participants advising them of the availability without charge, upon

written or oral request, of the documents incorporated by reference in Item 3 of Part II hereof and including the statement in the preceding sentence. The written statement to participants will also indicate the availability without charge,

upon written or oral request, of other documents required to be delivered pursuant to Rule 428(b) and will include the address and telephone number to which the request is to be directed.

|

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The Corporation hereby incorporates by reference in this Registration Statement the following:

|

|

•

|

|

the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2015 filed with the Commission on February 17, 2016 (the “Annual Report”), including the portions of the

Registrant’s Definitive Proxy Statement on Schedule 14A filed on March 3, 2016 incorporated by reference into the Annual Report;

|

|

|

•

|

|

the Corporation’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2016, June 30, 2016 and September 30, 2016, filed with the Commission on April 20,

2016, July 20, 2016 and October 26, 2016, respectively;

|

|

|

•

|

|

the Corporation’s Current Reports on Form 8-K filed with the Commission on April 22, 2016, July 6, 2016, August 18, 2016 and November 3, 2016; and

|

|

|

•

|

|

the description of the Corporation’s Common Stock contained in the Corporation’s Registration Statement on Form 8-A (File No. 001-31240; Film No. 02550765) filed with the Commission on

February 15, 2002 pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including any amendment or report filed for the purpose of updating such description.

|

All documents subsequently filed by the Corporation pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the

filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to

be a part hereof from the date of filing of such documents. Any statement contained herein or in a document, all or a portion of which is incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for

purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such

statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

4

Notwithstanding the foregoing, no information is incorporated by reference in this Registration

Statement where such information under applicable forms and regulations of the Commission is not deemed to be “filed” under Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, unless the report or

filing containing such information indicates that the information therein is to be considered “filed” under the Exchange Act or is to be incorporated by reference in this Registration Statement.

Item 8. Exhibits.

The exhibits to

this Registration Statement are listed in the Exhibit Index hereto and are incorporated herein by reference.

5

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Greenwood Village, State of Colorado, on the 16th day of

November, 2016.

|

|

|

|

|

NEWMONT MINING CORPORATION

|

|

|

|

|

By:

|

|

/s/ Stephen P. Gottesfeld

|

|

Name:

|

|

Stephen P. Gottesfeld

|

|

Title:

|

|

Executive Vice President

|

|

|

|

and General Counsel

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has

been signed by the following persons in the capacities and on the dates indicated:

|

|

|

|

|

|

|

Signature

|

|

Title of Capacities

|

|

Date

|

|

|

|

|

|

*

Gary J.

Goldberg

|

|

President, Chief Executive Officer and Director (Principal Executive Officer)

|

|

November 16, 2016

|

|

|

|

|

|

*

Nancy K.

Buese

|

|

Executive Vice President and Chief Financial Officer (Principal Financial Officer)

|

|

November 16, 2016

|

|

|

|

|

|

*

John W.

Kitlen

|

|

Vice President, Controller and Chief Accounting Officer (Principal Accounting Officer)

|

|

November 16, 2016

|

|

|

|

|

|

*

Noreen

Doyle

|

|

Non-Executive Chair of the Board and Director

|

|

November 16, 2016

|

|

|

|

|

|

*

Gregory H.

Boyce

|

|

Director

|

|

November 16, 2016

|

|

|

|

|

|

*

Bruce R.

Brook

|

|

Director

|

|

November 16, 2016

|

|

|

|

|

|

*

J. Kofi

Bucknor

|

|

Director

|

|

November 16, 2016

|

|

|

|

|

|

*

Vincent A.

Calarco

|

|

Director

|

|

November 16, 2016

|

|

|

|

|

|

*

Joseph A.

Carrabba

|

|

Director

|

|

November 16, 2016

|

6

|

|

|

|

|

|

|

*

Veronica M.

Hagen

|

|

Director

|

|

November 16, 2016

|

|

|

|

|

|

*

Jane

Nelson

|

|

Director

|

|

November 16, 2016

|

|

|

|

|

|

*

Julio M.

Quintana

|

|

Director

|

|

November 16, 2016

|

|

|

|

|

|

* By:

|

|

/s/ Stephen P. Gottesfeld

|

|

|

|

Name: Stephen P. Gottesfeld, as

|

|

|

|

Attorney-in-Fact

|

7

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description of Documents

|

|

|

|

|

5.1

|

|

Opinion of White & Case LLP with respect to the legality of the Common Stock being registered.

|

|

|

|

|

23.1

|

|

Consent of Ernst & Young LLP.

|

|

|

|

|

23.2

|

|

Consent of PricewaterhouseCoopers LLP.

|

|

|

|

|

23.3

|

|

Consent of White & Case LLP (included in Exhibit 5.1 to this Registration Statement).

|

|

|

|

|

24.1

|

|

Power of Attorney of certain officers and directors.

|

|

|

|

|

99.1

|

|

Newmont Mining Corporation 2013 Stock Incentive Compensation Plan (incorporated by reference to Exhibit 99.1 of the Registrant’s registration statement on Form S-8 (File No. 333-188128), filed with the Commission on April

25, 2013).

|

8

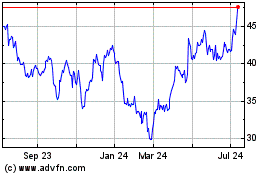

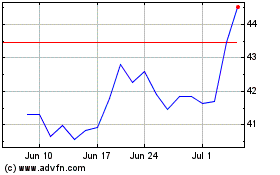

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024