Amended Statement of Beneficial Ownership (sc 13d/a)

November 16 2016 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 10)*

Shake Shack

Inc.

(Name of Issuer)

Common Stock, $0.001 par value per share

(Title of Class of Securities)

819047 101

(CUSIP

Number)

Jennifer Bellah Maguire

Gibson, Dunn & Crutcher LLP

333 South Grand Avenue

Los Angeles, California 90071-3197

(213) 229-7986

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

November 14, 2016

(Date of Event Which Requires Filing of Statement on Schedule 13D)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), checking the following box.

¨

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

2

of

18

Pages

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Name of

Reporting Persons:

I.R.S. Identification No. of Above Persons (entities only):

Green Equity Investors VI, L.P.

|

|

(2)

|

|

Check the Appropriate Box if a Member

of a Group (See Instructions):

(a)

x

(b)

¨

|

|

(3)

|

|

SEC Use Only:

|

|

(4)

|

|

Source of Funds (See

Instructions):

|

|

(5)

|

|

Check Box if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

¨

|

|

(6)

|

|

Citizenship or Place of

Organization:

Delaware

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH

REPORTING PERSON

WITH:

|

|

(7)

|

|

Sole Voting Power

0

|

|

|

(8)

|

|

Shared Voting Power

5,112,135

|

|

|

(9)

|

|

Sole Dispositive Power

0

|

|

|

(10)

|

|

Shared Dispositive Power

5,112,135

|

|

(11)

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

5,103,135

|

|

(12)

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions):

¨

|

|

(13)

|

|

Percent of Class Represented by Amount

in Row (11):

14.0% beneficial ownership of the voting stock based on 36,353,982

shares of Common Stock outstanding as of November 2, 2016

|

|

(14)

|

|

Type of Reporting Person (See

Instructions):

PN

|

Note: All share numbers on these cover pages presented on an as-converted basis.

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

3

of

18

Pages

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Name of

Reporting Persons:

I.R.S. Identification No. of Above Persons (entities only):

Green Equity Investors Side VI, L.P.

|

|

(2)

|

|

Check the Appropriate Box if a Member

of a Group (See Instructions):

(a)

x

(b)

¨

|

|

(3)

|

|

SEC Use Only:

|

|

(4)

|

|

Source of Funds (See

Instructions):

|

|

(5)

|

|

Check Box if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

¨

|

|

(6)

|

|

Citizenship or Place of

Organization:

Delaware

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH

REPORTING PERSON

WITH:

|

|

(7)

|

|

Sole Voting Power

0

|

|

|

(8)

|

|

Shared Voting Power

5,112,135

|

|

|

(9)

|

|

Sole Dispositive Power

0

|

|

|

(10)

|

|

Shared Dispositive Power

5,112,135

|

|

(11)

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

5,103,135

|

|

(12)

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions):

¨

|

|

(13)

|

|

Percent of Class Represented by Amount

in Row (11):

14.0% beneficial ownership of the voting stock based on 36,353,982

shares of Common Stock outstanding as of November 2, 2016

|

|

(14)

|

|

Type of Reporting Person (See

Instructions):

PN

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

4

of

18

Pages

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Name of

Reporting Persons:

I.R.S. Identification No. of Above Persons (entities only):

LGP Malted Coinvest LLC

|

|

(2)

|

|

Check the Appropriate Box if a Member

of a Group (See Instructions):

(a)

x

(b)

¨

|

|

(3)

|

|

SEC Use Only:

|

|

(4)

|

|

Source of Funds (See

Instructions):

|

|

(5)

|

|

Check Box if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

¨

|

|

(6)

|

|

Citizenship or Place of

Organization:

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

(7)

|

|

Sole Voting Power

0

|

|

|

(8)

|

|

Shared Voting Power

5,112,135

|

|

|

(9)

|

|

Sole Dispositive Power

0

|

|

|

(10)

|

|

Shared Dispositive Power

5,112,135

|

|

(11)

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

5,103,135

|

|

(12)

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions):

¨

|

|

(13)

|

|

Percent of Class Represented by Amount

in Row (11):

14.0% beneficial ownership of the voting stock based on 36,353,982

shares of Common Stock outstanding as of November 2, 2016

|

|

(14)

|

|

Type of Reporting Person (See

Instructions):

OO (Limited Liability Company)

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

5

of

18

Pages

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Name of

Reporting Persons:

I.R.S. Identification No. of Above Persons (entities only):

GEI Capital VI, LLC

|

|

(2)

|

|

Check the Appropriate Box if a Member

of a Group (See Instructions):

(a)

¨

(b)

¨

|

|

(3)

|

|

SEC Use Only:

|

|

(4)

|

|

Source of Funds (See

Instructions):

|

|

(5)

|

|

Check Box if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

¨

|

|

(6)

|

|

Citizenship or Place of

Organization:

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

(7)

|

|

Sole Voting Power

0

|

|

|

(8)

|

|

Shared Voting Power

5,112,135

|

|

|

(9)

|

|

Sole Dispositive Power

0

|

|

|

(10)

|

|

Shared Dispositive Power

5,112,135

|

|

(11)

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

5,103,135

|

|

(12)

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions):

¨

|

|

(13)

|

|

Percent of Class Represented by Amount

in Row (11):

14.0% beneficial ownership of the voting stock based on 36,353,982

shares of Common Stock outstanding as of November 2, 2016

|

|

(14)

|

|

Type of Reporting Person (See

Instructions):

OO (Limited Liability Company)

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

6

of

18

Pages

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Name of

Reporting Persons:

I.R.S. Identification No. of Above Persons (entities only):

Green VI Holdings, LLC

|

|

(2)

|

|

Check the Appropriate Box if a Member

of a Group (See Instructions):

(a)

¨

(b)

¨

|

|

(3)

|

|

SEC Use Only:

|

|

(4)

|

|

Source of Funds (See

Instructions):

|

|

(5)

|

|

Check Box if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

¨

|

|

(6)

|

|

Citizenship or Place of

Organization:

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

(7)

|

|

Sole Voting Power

0

|

|

|

(8)

|

|

Shared Voting Power

5,112,135

|

|

|

(9)

|

|

Sole Dispositive Power

0

|

|

|

(10)

|

|

Shared Dispositive Power

5,112,135

|

|

(11)

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

5,103,135

|

|

(12)

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions):

¨

|

|

(13)

|

|

Percent of Class Represented by Amount

in Row (11):

14.0% beneficial ownership of the voting stock based on 36,353,982

shares of Common Stock outstanding as of November 2, 2016

|

|

(14)

|

|

Type of Reporting Person (See

Instructions):

OO (Limited Liability Company)

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

7

of

18

Pages

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Name of

Reporting Persons:

I.R.S. Identification No. of Above Persons (entities only):

Leonard Green & Partners, L.P.

|

|

(2)

|

|

Check the Appropriate Box if a Member

of a Group (See Instructions):

(a)

¨

(b)

¨

|

|

(3)

|

|

SEC Use Only:

|

|

(4)

|

|

Source of Funds (See

Instructions):

|

|

(5)

|

|

Check Box if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

¨

|

|

(6)

|

|

Citizenship or Place of

Organization:

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

(7)

|

|

Sole Voting Power

0

|

|

|

(8)

|

|

Shared Voting Power

5,112,135

|

|

|

(9)

|

|

Sole Dispositive Power

0

|

|

|

(10)

|

|

Shared Dispositive Power

5,112,135

|

|

(11)

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

5,103,135

|

|

(12)

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions):

¨

|

|

(13)

|

|

Percent of Class Represented by Amount

in Row (11):

14.0% beneficial ownership of the voting stock based on 36,353,982

shares of Common Stock outstanding as of November 2, 2016

|

|

(14)

|

|

Type of Reporting Person (See

Instructions):

PN

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

8

of

18

Pages

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Name of

Reporting Persons:

I.R.S. Identification No. of Above Persons (entities only):

LGP Management, Inc.

|

|

(2)

|

|

Check the Appropriate Box if a Member

of a Group (See Instructions):

(a)

¨

(b)

¨

|

|

(3)

|

|

SEC Use Only:

|

|

(4)

|

|

Source of Funds (See

Instructions):

|

|

(5)

|

|

Check Box if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

¨

|

|

(6)

|

|

Citizenship or Place of

Organization:

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

(7)

|

|

Sole Voting Power

0

|

|

|

(8)

|

|

Shared Voting Power

5,112,135

|

|

|

(9)

|

|

Sole Dispositive Power

0

|

|

|

(10)

|

|

Shared Dispositive Power

5,112,135

|

|

(11)

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

5,103,135

|

|

(12)

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions):

¨

|

|

(13)

|

|

Percent of Class Represented by Amount

in Row (11):

14.0% beneficial ownership of the voting stock based on 36,353,982

shares of Common Stock outstanding as of November 2, 2016

|

|

(14)

|

|

Type of Reporting Person (See

Instructions):

CO

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

9

of

18

Pages

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Name of

Reporting Persons:

I.R.S. Identification No. of Above Persons (entities only):

Peridot Coinvest Manager LLC

|

|

(2)

|

|

Check the Appropriate Box if a Member

of a Group (See Instructions):

(a)

¨

(b)

¨

|

|

(3)

|

|

SEC Use Only:

|

|

(4)

|

|

Source of Funds (See

Instructions):

|

|

(5)

|

|

Check Box if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

¨

|

|

(6)

|

|

Citizenship or Place of

Organization:

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

(7)

|

|

Sole Voting Power

0

|

|

|

(8)

|

|

Shared Voting Power

5,112,135

|

|

|

(9)

|

|

Sole Dispositive Power

0

|

|

|

(10)

|

|

Shared Dispositive Power

5,112,135

|

|

(11)

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

5,103,135

|

|

(12)

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions):

¨

|

|

(13)

|

|

Percent of Class Represented by Amount

in Row (11):

14.0% beneficial ownership of the voting stock based on 36,353,982

shares of Common Stock outstanding as of November 2, 2016

|

|

(14)

|

|

Type of Reporting Person (See

Instructions):

OO (Limited Liability Company)

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

10

of

18

Pages

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Name of

Reporting Persons:

I.R.S. Identification No. of Above Persons (entities only):

Jonathan D. Sokoloff

|

|

(2)

|

|

Check the Appropriate Box if a Member

of a Group (See Instructions):

(a)

¨

(b)

¨

|

|

(3)

|

|

SEC Use Only:

|

|

(4)

|

|

Source of Funds (See

Instructions):

|

|

(5)

|

|

Check Box if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

¨

|

|

(6)

|

|

Citizenship or Place of

Organization:

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

(7)

|

|

Sole Voting Power

0

|

|

|

(8)

|

|

Shared Voting Power

5,112,135

|

|

|

(9)

|

|

Sole Dispositive Power

0

|

|

|

(10)

|

|

Shared Dispositive Power

5,112,135

|

|

(11)

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

5,103,135

|

|

(12)

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions):

¨

|

|

(13)

|

|

Percent of Class Represented by Amount

in Row (11):

14.0% beneficial ownership of the voting stock based on 36,353,982

shares of Common Stock outstanding as of November 2, 2016

|

|

(14)

|

|

Type of Reporting Person (See

Instructions):

IN

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

11

of

18

Pages

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Name of

Reporting Persons:

I.R.S. Identification No. of Above Persons (entities only):

J. Kristofer Galashan

|

|

(2)

|

|

Check the Appropriate Box if a Member

of a Group (See Instructions):

(a)

¨

(b)

¨

|

|

(3)

|

|

SEC Use Only:

|

|

(4)

|

|

Source of Funds (See

Instructions):

|

|

(5)

|

|

Check Box if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or 2(e):

¨

|

|

(6)

|

|

Citizenship or Place of

Organization:

Canada

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

(7)

|

|

Sole Voting Power

0

|

|

|

(8)

|

|

Shared Voting Power

5,112,135

|

|

|

(9)

|

|

Sole Dispositive Power

0

|

|

|

(10)

|

|

Shared Dispositive Power

5,112,135

|

|

(11)

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

5,112,135

|

|

(12)

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions):

¨

|

|

(13)

|

|

Percent of Class Represented by Amount

in Row (11):

14.1% beneficial ownership of the voting stock based on 36,353,982

shares of Common Stock outstanding as of November 2, 2016

|

|

(14)

|

|

Type of Reporting Person (See

Instructions):

IN

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

12

of

18

Pages

|

|

ITEM 1.

|

SECURITY AND ISSUER

|

This Amendment No. 10 to Schedule 13D (this

“

Amendment

”) relates to shares of Class A common stock, par value $0.001 per share (the “

A-Common

”) of Shake Shack Inc., a Delaware corporation (the “

Issuer

”). Capitalized terms used in this

Amendment and not otherwise defined herein shall have the meanings ascribed to them in the Schedule 13D.

The address of the Issuer’s

principal executive offices is 24 Union Square East, 5th Floor, New York, NY 10003.

|

ITEM 2.

|

IDENTITY AND BACKGROUND

|

The disclosure provided in Item 2 of the Schedule 13D amended

hereby is updated to include the following additional disclosure:

|

|

(a)

|

The names of the directors and executive officers of LGPM are set forth on Schedule 1, which is incorporated herein by reference.

|

As of November 15, 2016, (i) GEI VI is the record owner of 566,830 shares of A-Common and 2,485,837 shares of the Issuer’s Class B

common stock, par value $0.001 per share (“

B-Common

”), (ii) GEI Side VI is the record owner of 1,819,402 shares of A-Common, and (iii) Malted is the record owner of 36,748 shares of A-Common and 186,067 shares of B-Common.

|

ITEM 4.

|

PURPOSE OF TRANSACTION

|

The disclosure provided in Item 4 of the Schedule 13D amended

hereby is updated to include the following additional disclosure:

On each of August 30, 2016 and October 5, 2016, (i) GEI VI tendered to

the Issuer 292,131 LLC Interests and 292,131 shares of B-Common in exchange for 292,131 shares of A-Common, and (ii) Malted tendered to the Issuer 21,867 LLC Interests and 21,867 shares of B-Common in exchange for 21,867 shares of

A-Common. Prior and subsequent to the August 30, 2016 and October 5, 2016 redemptions, the Reporting Persons executed the transactions set forth in Item 5(c).

|

ITEM 5.

|

INTEREST IN SECURITIES OF THE ISSUER

|

(a) and (b)

|

|

|

|

|

|

|

|

|

|

|

Reporting

Persons

|

|

Number* of

Shares With

Shared Voting

Power

|

|

Sole Beneficial

Ownership

|

|

Shared

Beneficial

Ownership*

|

|

Percentage

of Class

Beneficially

Owned

|

|

GEI VI

|

|

5,112,135

|

|

0

|

|

5,103,135

|

|

14.0%

|

|

GEI Side VI

|

|

5,112,135

|

|

0

|

|

5,103,135

|

|

14.0%

|

|

Malted

|

|

5,112,135

|

|

0

|

|

5,103,135

|

|

14.0%

|

|

Jonathan D. Sokoloff

|

|

5,112,135

|

|

0

|

|

5,103,135

|

|

14.0%

|

|

J. Kristofer Galashan

|

|

5,112,135

|

|

9,000

|

|

5,112,135

|

|

14.1%

|

|

Other Reporting Persons

|

|

5,112,135

|

|

0

|

|

5,103,135

|

|

14.0%

|

|

*

|

All share numbers presented in this table assume full conversion of B-Common to A-Common.

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

13

of

18

Pages

|

|

|

(c)

|

The following table sets forth all transactions with respect to shares of Common Stock effectuated since the most recent filing on Schedule 13D by any of the Reporting Persons. Each day’s sales comprised open

market transactions made on that day, and the price per share reported is the weighted average sale price. The Reporting Persons hereby undertake to provide upon request to the SEC staff, the Issuer, or a security holder of the Issuer full

information regarding the number of shares of Common Stock and prices at which the trades were effected.

|

|

|

|

|

|

|

|

|

|

Reporting Person

|

|

Date of Transaction

|

|

Number of Shares

Sold

|

|

Price per Share

|

|

GEI VI

|

|

September 1, 2016

|

|

29,958

|

|

$35.54

|

|

GEI Side VI

|

|

September 1, 2016

|

|

17,855

|

|

$35.54

|

|

Malted

|

|

September 1, 2016

|

|

2,187

|

|

$35.54

|

|

GEI VI

|

|

September 2, 2016

|

|

29,958

|

|

$35.37

|

|

GEI Side VI

|

|

September 2, 2016

|

|

17,855

|

|

$35.37

|

|

Malted

|

|

September 2, 2016

|

|

2,187

|

|

$35.37

|

|

GEI VI

|

|

September 6, 2016

|

|

29,959

|

|

$35.58

|

|

GEI Side VI

|

|

September 6, 2016

|

|

17,855

|

|

$35.58

|

|

Malted

|

|

September 6, 2016

|

|

2,186

|

|

$35.58

|

|

GEI VI

|

|

September 7, 2016

|

|

29,958

|

|

$36.46

|

|

GEI Side VI

|

|

September 7, 2016

|

|

17,855

|

|

$36.46

|

|

Malted

|

|

September 7, 2016

|

|

2,187

|

|

$36.46

|

|

GEI VI

|

|

September 8, 2016

|

|

29,959

|

|

$36.21

|

|

GEI Side VI

|

|

September 8, 2016

|

|

17,855

|

|

$36.21

|

|

Malted

|

|

September 8, 2016

|

|

2,186

|

|

$36.21

|

|

GEI VI

|

|

November 10, 2016

|

|

29,958

|

|

$37.84

|

|

GEI Side VI

|

|

November 10, 2016

|

|

17,855

|

|

$37.84

|

|

Malted

|

|

November 10, 2016

|

|

2,187

|

|

$37.84

|

|

GEI VI

|

|

November 11, 2016

|

|

29,959

|

|

$37.45

|

|

GEI Side VI

|

|

November 11, 2016

|

|

17,855

|

|

$37.45

|

|

Malted

|

|

November 11, 2016

|

|

2,186

|

|

$37.45

|

|

GEI VI

|

|

November 14, 2016

|

|

29,958

|

|

$38.69

|

|

GEI Side VI

|

|

November 14, 2016

|

|

17,855

|

|

$38.69

|

|

Malted

|

|

November 14, 2016

|

|

2,187

|

|

$38.69

|

|

GEI VI

|

|

November 15, 2016

|

|

29,959

|

|

$38.16

|

|

GEI Side VI

|

|

November 15, 2016

|

|

17,855

|

|

$38.16

|

|

Malted

|

|

November 15, 2016

|

|

2,186

|

|

$38.16

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

14

of

18

Pages

|

|

ITEM 7.

|

MATERIAL TO BE FILED AS EXHIBITS

|

|

|

|

|

|

7.1

|

|

Form of Stockholders Agreement (incorporated by reference to Exhibit 10.4 to Shake Shack Inc.’s Form S-1 Amendment No. 1, filed with the Securities and Exchange Commission on January 20, 2015).

|

|

|

|

|

7.2

|

|

Form of Registration Rights Agreement (incorporated by reference to Exhibit 10.2 to Shake Shack Inc.’s Form S-1, filed with the Securities and Exchange Commission on December 29, 2014).

|

|

|

|

|

7.3

|

|

Form of Tax Receivable Agreement (incorporated by reference to Exhibit 10.1 to Shake Shack Inc.’s Form S-1 Amendment No. 1, filed with the Securities and Exchange Commission on January 20, 2015).

|

|

|

|

|

7.4

|

|

Form of Third Amended and Restated LLC Agreement of SSE Holdings, LLC (incorporated by reference to Exhibit 10.3 to Shake Shack Inc.’s Form S-1 Amendment No. 1, filed with the Securities and Exchange Commission on

January 20, 2015).

|

|

|

|

|

7.5

|

|

Joint Filing Agreement, dated February 9, 2015 (incorporated by reference to Exhibit 7.5 to Green Equity Investors VI, L.P.’s Schedule 13D, filed with the Securities and Exchange Commission on February 9,

2015).

|

|

|

|

|

7.6

|

|

Identification of Members of the Group, dated February 9, 2015 (incorporated by reference to Exhibit 7.6 to Green Equity Investors VI, L.P.’s Schedule 13D, filed with the Securities and Exchange Commission on February 9,

2015).

|

|

|

|

|

7.7

|

|

Power of Attorney, dated February 9, 2015 (incorporated by reference to Exhibit 7.7 to Green Equity Investors VI, L.P.’s Schedule 13D, filed with the Securities and Exchange Commission on February 9, 2015).

|

|

|

|

|

7.8

|

|

Form of Underwriting Agreement (incorporated by reference to Exhibit 1.1 to Shake Shack Inc.’s Form S-1 Amendment No. 1, filed with the Securities and Exchange Commission on August 10, 2015).

|

|

|

|

|

7.9

|

|

Form of Trading Agreement, dated and effective as of November 13, 2015 (incorporated by reference to Exhibit 7.9 to Green Equity Investors VI, L.P.’s Amendment No. 2 to Schedule 13D, filed with the Securities and Exchange

Commission on November 13, 2015).

|

|

|

|

|

7.10

|

|

Power of Attorney, dated September 7, 2016.

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

15

of

18

Pages

|

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, each of the undersigned certifies that the information set forth in this Amendment is true, complete, and correct.

Dated as of November 16, 2016

|

|

|

|

|

Green Equity Investors VI, L.P.

|

|

By:

|

|

GEI Capital VI, LLC, its General Partner

|

|

|

|

|

By:

|

|

/

S

/ A

NDREW

C. G

OLDBERG

|

|

|

|

Andrew C. Goldberg, as Attorney-in-Fact for

|

|

|

|

Jonathan D. Sokoloff

|

|

|

|

Manager

|

|

|

|

Green Equity Investors Side VI, L.P.

|

|

By:

|

|

GEI Capital VI, LLC, its General Partner

|

|

|

|

|

By:

|

|

/

S

/ A

NDREW

C. G

OLDBERG

|

|

|

|

Andrew C. Goldberg, as Attorney-in-Fact for

|

|

|

|

Jonathan D. Sokoloff

|

|

|

|

Manager

|

|

|

|

LGP Malted Coinvest LLC

|

|

By:

|

|

Peridot Coinvest Manager LLC, its Manager

|

|

By:

|

|

Leonard Green & Partners, L.P., its Manager

|

|

By:

|

|

LGP Management, Inc., its General Partner

|

|

|

|

|

By:

|

|

/

S

/ A

NDREW

C. G

OLDBERG

|

|

|

|

Andrew C. Goldberg, as Attorney-in-Fact for

|

|

|

|

Jonathan D. Sokoloff

|

|

|

|

Executive Vice President and Managing Partner

|

|

|

|

GEI Capital VI, LLC

|

|

|

|

|

By:

|

|

/

S

/ A

NDREW

C. G

OLDBERG

|

|

|

|

Andrew C. Goldberg, as Attorney-in-Fact for

|

|

|

|

Jonathan D. Sokoloff

|

|

|

|

Manager

|

|

|

|

Green VI Holdings, LLC

|

|

|

|

|

By:

|

|

/

S

/ A

NDREW

C. G

OLDBERG

|

|

|

|

Andrew C. Goldberg, as Attorney-in-Fact for

|

|

|

|

Jonathan D. Sokoloff

|

|

|

|

Manager

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

16

of

18

Pages

|

|

|

|

|

|

Leonard Green & Partners, L.P.

|

|

By:

|

|

LGP Management, Inc., its General Partner

|

|

|

|

|

By:

|

|

/

S

/ A

NDREW

C. G

OLDBERG

|

|

|

|

Andrew C. Goldberg, as Attorney-in-Fact for

|

|

|

|

Jonathan D. Sokoloff

|

|

|

|

Executive Vice President and Managing Partner

|

|

|

|

LGP Management, Inc.

|

|

|

|

|

By:

|

|

/

S

/ A

NDREW

C. G

OLDBERG

|

|

|

|

Andrew C. Goldberg, as Attorney-in-Fact for

|

|

|

|

Jonathan D. Sokoloff

|

|

|

|

Executive Vice President and Managing Partner

|

|

|

|

Peridot Coinvest Manager LLC

|

|

By:

|

|

Leonard Green & Partners, L.P., its Manager

|

|

By:

|

|

LGP Management, Inc., its General Partner

|

|

|

|

|

By:

|

|

/

S

/ A

NDREW

C. G

OLDBERG

|

|

|

|

v, as Attorney-in-Fact for

|

|

|

|

Jonathan D. Sokoloff

|

|

|

|

Executive Vice President and Managing Partner

|

|

|

|

/

S

/ A

NDREW

C. G

OLDBERG

|

|

Andrew C. Goldberg, as Attorney-in-Fact for

|

|

Jonathan D. Sokoloff

|

|

|

|

/

S

/ A

NDREW

C. G

OLDBERG

|

|

Andrew C. Goldberg, as Attorney-in-Fact for

|

|

J. Kristofer Galashan

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

17

of

18

Pages

|

SCHEDULE 1

Directors and

Executive Officers of LGPM

|

|

|

|

|

Name

|

|

Position with LGPM

|

|

John G. Danhakl

|

|

Executive Vice President and Managing Partner

|

|

Jonathan D. Sokoloff

|

|

Executive Vice President and Managing Partner

|

|

Cody L. Franklin

|

|

Chief Financial Officer and Assistant Secretary

|

|

Andrew C. Goldberg

|

|

Vice President, General Counsel and Secretary

|

|

Lance J.T. Schumacher

|

|

Vice President – Tax and Assistant Secretary

|

|

|

|

|

|

|

|

CUSIP No.

819047 101

|

|

Schedule 13D/A

|

|

Page

18

of

18

Pages

|

EXHIBIT INDEX

|

|

|

|

EXHIBIT

NO.

|

|

DESCRIPTION

|

|

|

|

|

7.1

|

|

Form of Stockholders Agreement (incorporated by reference to Exhibit 10.4 to Shake Shack Inc.’s Form S-1 Amendment No. 1, filed with the Securities and Exchange Commission on January 20, 2015).

|

|

|

|

|

7.2

|

|

Form of Registration Rights Agreement (incorporated by reference to Exhibit 10.2 to Shake Shack Inc.’s Form S-1, filed with the Securities and Exchange Commission on December 29, 2014).

|

|

|

|

|

7.3

|

|

Form of Tax Receivable Agreement (incorporated by reference to Exhibit 10.1 to Shake Shack Inc.’s Form S-1 Amendment No. 1, filed with the Securities and Exchange Commission on January 20, 2015).

|

|

|

|

|

7.4

|

|

Form of Third Amended and Restated LLC Agreement of SSE Holdings, LLC (incorporated by reference to Exhibit 10.3 to Shake Shack Inc.’s Form S-1 Amendment No. 1, filed with the Securities and Exchange Commission on

January 20, 2015).

|

|

|

|

|

7.5

|

|

Joint Filing Agreement, dated February 9, 2015 (incorporated by reference to Exhibit 7.5 to Green Equity Investors VI, L.P.’s Schedule 13D, filed with the Securities and Exchange Commission on February 9, 2015).

|

|

|

|

|

7.6

|

|

Identification of Members of the Group, dated February 9, 2015 (incorporated by reference to Exhibit 7.6 to Green Equity Investors VI, L.P.’s Schedule 13D, filed with the Securities and Exchange Commission on

February 9, 2015).

|

|

|

|

|

7.7

|

|

Power of Attorney, dated February 9, 2015 (incorporated by reference to Exhibit 7.7 to Green Equity Investors VI, L.P.’s Schedule 13D, filed with the Securities and Exchange Commission on February 9, 2015).

|

|

|

|

|

7.8

|

|

Form of Underwriting Agreement (incorporated by reference to Exhibit 1.1 to Shake Shack Inc.’s Form S-1 Amendment No. 1, filed with the Securities and Exchange Commission on August 10, 2015).

|

|

|

|

|

7.9

|

|

Form of Trading Agreement, dated and effective as of November 13, 2015 (incorporated by reference to Exhibit 7.9 to Green Equity Investors VI, L.P.’s Amendment No. 2 to Schedule 13D, filed with the Securities and Exchange

Commission on November 13, 2015).

|

|

|

|

|

7.10

|

|

Power of Attorney, dated September 7, 2016.

|

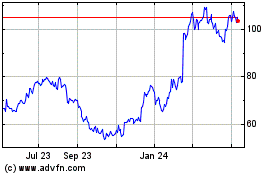

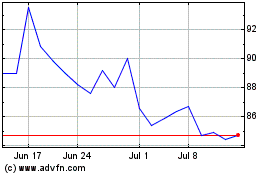

Shake Shack (NYSE:SHAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shake Shack (NYSE:SHAK)

Historical Stock Chart

From Apr 2023 to Apr 2024