Report of Foreign Issuer (6-k)

November 16 2016 - 9:48AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For November 10, 2016

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP

Corporate Taxpayer’s ID (CNPJ) 43.776.517/0001-80 State Registry (NIRE) 35300016831

APPENDIX 30-XXXIII

Notice on transactions with related parties

Pursuant to the provisions of CVM Instruction No. 480/09, as amended, the Companhia de Saneamento Básico do Estado de São Paulo (“

Company

” or “

SABESP

”),

hereby

announces to its shareholders and to the market in general the information required in Appendix 30-XXXIII of the said Instruction concerning the Particular Instrument of the Transaction and Other Agreements (“

Transaction

”) with the Empresa Metropolitana de Águas e Energia S.A. – EMAE (“

EMAE

”), a mixed-capital company also controlled by the Government of the State of São Paulo, which was the subject of a disclosure through a Material Fact issued on October 28, 2016.

|

|

|

|

Parties

|

SABESP and EMAE

|

|

|

Companies under common control of the

|

|

Relationship of the parties with

the

|

Government of the State of São Paulo.

|

|

Company

|

|

|

Transaction's Subject

|

Extrajudicial transaction entered between

|

|

the parties in order to definitively end the

|

|

litigation involving both companies

|

|

regarding the use and capture of water by

|

|

SABESP and the apportionment of the

|

|

costs with the maintenance, the operation

|

|

and the monitoring of the Guarapiranga

|

|

and the Billings Reservoirs, which are

|

|

also used by EMAE for the generation of

|

|

electricity.

|

|

Main Terms and Conditions of the

|

The Transaction establishes the payment

|

|

Transaction

|

by SABESP to EMAE of the following

|

|

|

amounts: (i) R$ 6,610,000.00 (six million six hundred and ten thousand reais) annually, adjusted for inflation as of the execution date of this instrument, as measured by the IPCA or any other index that may replace it, always up to the last workday of October of each fiscal year, with (i) the first of such annual payments due up to the last workday of October 2017 and (ii) the last payment due up to the last workday of October 2042; and (ii) R$ 46,270,000.00 (forty six million two hundred and seventy thousand reais), in five annual and successive installments, adjusted for inflation as measured by the IPCA or any other index that may replace it, with the first installment of R$ 9,254,000.00 (nine million two hundred and fifty four thousand reais) due on April 30, 2017 and the subsequent ones in 4 (four) installments of same amount, due on every April 30 of the subsequent years, or on the first following workday.

The non-payment of part of the amount or of the entire amount will immediately lead to the early maturity of the remaining amounts due.

The Transaction is subject to the precedent condition of approval by the responsible corporate bodies of the Company and of EMAE, as well as by ANEEL – National Agency of Electric Energy (or Agência Nacional de Energia Elétrica) (“

Precedent Conditions

”)

The implementation of the Precedent Conditions will lead to the extinction of all currently existing legal procedures concerning disputes between SABESP and EMAE.

|

|

The possible participation of the counterparty, its partners or managers in the decision-making process of the Company concerning the Transaction or the negotiation of the Transaction as representatives of the Company

|

The existence of litigations concerning the use of the Guarapiranga and the Billings Reservoirs is not new, having already been the subject of recurring disclosures in the Reference Form and in the Financial Statements of the Company.

As well as the information that both companies were “in negotiations for a future agreement”, as reported through the Notice to the Market issued on April 10, 2014.

EMAE did not participate in any aspect of SABESP's decision-making process concerning the Transaction, nor did the Government of the State of São Paulo.

The Company and EMAE do not have managers in common.

|

|

Detailed justification of the reasons why the issuer's management believes that the transaction observes commutative conditions or provides for a proper compensatory payment

|

SABESP's choice in favor of the Transaction stems from the fact that the arguments developed by the Company at the court are not being taken into account in the arbitration procedure under way in the American Chamber of Commerce of São Paulo – Amcham. In addition, this proceeding is in the hands of a single arbitrator and an expert appointed by him, and the arbitrator has made it very clear that the arbitration proceeding is limited to calculating the indemnity owed.

In this sense, although the Company believes that it should be exempted from any burden on the bestowals granted by the responsible bodies, which have authorized the water capture carried out at the Guarapiranga and Billings Reservoirs and, therefore, no compensation is due, but given: (i) recent developments in the arbitration proceedings have gone against Sabesp; (ii) these reservoirs are essential for the

|

|

|

supply of water to the Metropolitan Region of São Paulo; and (iii) water would have to be taken from more distant locations at a high cost if these reservoirs were not available for the Company, Sabesp considers that it is reasonable to use the sharing of costs for the maintenance and operation of these reservoirs as a parameter to eliminate the risk of possible condemnation in the arbitration proceeding and in the other cases being heard by the courts.

In summary, SABESP understood that it would be more fruitful and cheaper to sign an extrajudicial agreement with EMAE, in order to end these disputes involving the two companies.

In this sense, the conclusion of the Transaction has the following assumptions: i) payments by Sabesp must not exceed the amount necessary to reimburse EMAE for the costs of maintaining and operating the Guarapiranga and Billings reservoirs, in proportion to its offtake from the natural flow of each of them; ii) payment should continue to be made as long as the Sabesp and EMAE concessions remain in force, and for as long as Sabesp continues to take water from these reservoirs, subject to the period of prescription of the purpose of the actions; iii) Sabesp shall apply to ARSESP for these expenses to be included in the tariff review now in progress.

As a parameter to establish the amount of the Transaction, as explained in the terms of the Technical Note, accessible through a link in the Material Fact disclosed by the Company on October 28, 2016, was considered the estimated costs for the maintenance and preservation of the hydraulic and heritage structures of the

|

|

|

Guarapiranga and Billings Reservoirs.

To ensure the interchangeability of the Transaction and the consistency of the estimated amount with those practiced in transactions with independent parties, such amount was compared to the costs actually incurred by Sabesp for the maintenance and preservation of the hydraulic and equity structures of the reservoirs belonging to an equivalent production system (Alto Tietê System).

After comparison, it was concluded that the amounts would be compatible to those practiced in SABESP's ongoing agreement.

|

São Paulo, November 9, 2016.

Rui de Britto Álvares Affonso

Chief Financial Officer and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: November 10, 2016

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

|

|

|

|

|

|

By:

|

/s/

Rui de Britto Álvares Affonso

|

|

|

|

Name: Rui de Britto Álvares Affonso

Title: Chief Financial Officer and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

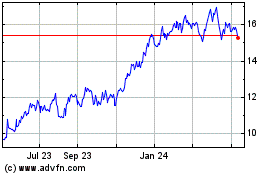

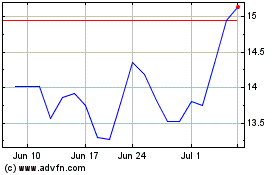

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024