Amfil Technologies Inc. Files Q1 2016 and Provides Shareholder Update

November 16 2016 - 9:00AM

Access Wire

TORONTO, ON / ACCESSWIRE / November 16, 2016 /

Amfil Technologies Inc. (OTC Pink: AMFE) has filed its Q1 2016

Report with OTC Markets showing Revenues of $28,477, Cost of Goods

Sold of $17,139 leaving a gross profit of $11,338.00. After

Operating Expenses of $43,826.00 the company had a net loss on the

quarter of $32,488.00 This is in comparison to Q1 2015 Revenues of

$78,599.00, Cost of Goods Sold of $25,992.00 leaving a gross profit

of $52,607.00. After Operating Expenses of $40,202.00 the company

had a net profit of $12,405.00.

Our outstanding share count and public float with the DTC did

see a slight increase this quarter to 741,043,098 and 192,859,481

respectively. This was attributable to a combination of debt

reduction mostly related to audit/accounting costs, long standing

funders who believe in the company's success and the acquisition

(bearing restrictive legend). This is quite rare for our company to

anyone that has been following for some time but was necessary to

help clean up some overhanging debt and help our positioning moving

forward. The company has for the vast majority always funded

in-house so to speak through friends, family and close friendly

shareholders and has never in the past or will in the future sign a

toxic financing deal which is one of the major contributing factors

to our public float being 192,859,481 which is cumulative since the

company's inception in 1985. Additionally, the company has also

never had to recapitalize or roll back its shares over the past 31

years and is proud to have every shareholder big or small from the

past, still a part of our company today. Of the $494,297 in

remaining liabilities, $239,171 is loans from management to the

company and non interest bearing, sales tax payable of which the

vast majority has been paid off in Q2, accounts payable and accrued

liabilities from ongoing day to day business and prior audit fees

which a large portion has been paid and will continue to be paid

throughout Q2 as well as a convertible note to a family member of

management and two long standing shareholders of the company.

At first glance, the Q1 year over year reduction in revenue and

profit would appear to be a negative or that the company has

downsized its current revenue generating subsidiary Interloc-Kings

Inc. Quite the opposite is true however and the reduction is

directly attributable to our recent hiring of additional crews for

this subsidiary and an increased amount of larger scale open

projects and work in progress as at September 30th 2016 that will

be rolled over and reflected on our Q2 financial statements. In Q1

we took on two additional crews to help keep up with the increased

demand for stone and wood installations this subsidiary provides

and feel this will help us tremendously throughout the rest of this

season and certainly next year.

There were also some additional expenses related to the recent

acquisition of Snakes & Lagers Inc. however the company feels

it was necessary and minimal in comparison to the benefit this deal

will bring to Amfil Technologies Inc. In the future. Revenues from

this subsidiary will begin to be reflected on our Q2 2016 financial

statement. As stated previously we estimate approx. $2M - $3M in

additional yearly revenues from this subsidiary and is very likely

to be much higher in the future as current deals in progress and

planned expansion comes to fruition.

The first goal of Amfil Technologies Inc. with regards to the

recent acquisition is to assist and help support the team in place

open an additional three Snakes & Lattes locations to add under

the umbrella. We are currently and will be in the near future

working on finalizing the franchising agreements so future would-be

owners can gain access to the brand and help an exponential

expansion. The company has been contacted by various potential

candidates from all across North America looking to get into the

business and wanting to purchase a franchise.

In order to properly meet the across the board demands that we

know is needed to facilitate a large expansion Amfil Technologies

Inc. is looking at potentially acquiring a company that it has been

having discussions with regarding this process. This company

appears to have the knowledge and technical skill to assist the

company to franchise out our existing subsidiaries. It is

potentially a great acquisition for under the Amfil umbrella to

synergize the internal workings of each subsidiary to prepare for

large scale expansion. Specializing in organizing processes that

automate the completion of financial reporting, tax compliance and

streamline the large scale purchasing, accounts receivable /

payables and the many other systems needed for multiple locations

and businesses. This potential addition could prove to be a major

cog in the Amfil wheel of planned expansion and franchising of its

existing subsidiaries.

As for the GROzone initiative, the company has been in

discussions with highly qualified individuals who could be very

capable marketers and lead generators for the GROzone product line.

Previously while the company was having success with the technology

and the GROzone 60 system, we lacked a proper sales network for the

product and being able to showcase the positives the technology

brought to the industry. Having marketers of the products focusing

100% of their time and effort into a space that they know,

understand and are comfortable in we feel will lead to increasing

sales for the subsidiary. North America has been pushing closer and

closer towards full "Medical Marijuana" acceptance with there now

being 36 licensed producers in Canada and with 26 states and the

district of Columbia having legalized marijuana in some form. Three

additional states appears will soon join that list and therefore

while some would say we started early on this product, we feel we

are ahead of the game and will need to use this to our advantage

now to capitalize on this growth for the good of the GROzone

venture.

That being said, we really appreciates all of our shareholders

and we want to thank everyone on board for being a part of our

company. We feel there are going to be some very exciting times

ahead and having laid the groundwork for some large scale expansion

across all of our subsidiaries, we hope you will be a part of the

company as it unfolds. We will have some more detailed information

on each of the respective subsidiaries and the work going on behind

the scenes relating to each one in the very near future. Stay tuned

and we hope you are excited as we are for what the future may hold

for our company.

For more information, feel free to visit our website at

www.amfiltech.com or to contact the company at

ir@amfiltech.com.

Safe Harbor Statement

This news release contains statements that involve expectations,

plans or intentions (such as those relating to future business or

financial results, new features or services, or management

strategies) and other factors discussed from time to time in the

Company's Securities and Exchange Commission filings. These

statements are forward-looking and are subject to risks and

uncertainties, so actual results may vary materially. You can

identify these forward-looking statements by words such as "may,"

"should," "expect," "anticipate," "believe," "estimate," "intend,"

"plan" and other similar expressions. Our actual results, such as

the Company's ability to finance, complete and consolidate

acquisition of IP, assets and operating companies, could differ

materially from those anticipated in these forward-looking

statements as a result of certain factors not within the control of

the company such as a result of various factors, including future

economic, competitive, regulatory, and market conditions. The

company cautions readers not to place undue reliance on any such

forward-looking statements, which speak only as of the date made.

The company disclaims any obligation subsequently to revise any

forward-looking statements to reflect events or circumstances after

the date of such statements or to reflect the occurrence of

anticipated or unanticipated events.

CONTACT:

Roger Mortimer

President

Amfil Technologies Inc.

Telephone: (647) 880-5887

Email: ir@amfiltech.com

SOURCE: Amfil Technologies Inc.

Amfil Technologies (PK) (USOTC:FUNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

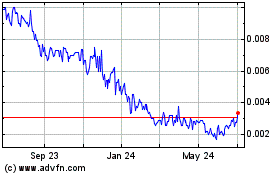

Amfil Technologies (PK) (USOTC:FUNN)

Historical Stock Chart

From Apr 2023 to Apr 2024