Long Canyon adds profitable production and strengthens

Newmont’s track record of delivering projects safely, ahead of

schedule and below budget

Newmont Mining Corporation (NYSE: NEM) (Newmont or the Company)

has reached commercial production at Long Canyon, a higher grade

oxide mine in an emerging gold district located less than 100 miles

from its existing Nevada operations. The Company declared

commercial production based on sustaining plant availability of

more than 85 percent, and achieving a minimum of 70 percent of

modeled leach recovery. The project was completed two months ahead

of schedule for an investment of just under $225 million, which is

about $50 million or 18 percent below budget.

The first phase of development is expected to produce between

100,000 and 150,000 ounces of gold per year over an eight year mine

life at estimated costs applicable to sales of between $400 and

$500 per ounce, and all-in sustaining cost of between $500 and $600

per ounce1. The project was optimized by taking a phased

development approach, relying on refurbished instead of new

equipment, and building a leach facility rather than a mill. At

current gold prices, the project is expected to generate a 26

percent rate of return with a payback period of just under four

years.

The operation includes a surface mine and heap leach pad which

currently holds one million tons of ore at an average estimated

grade of 1.13 grams of gold per ton. The project was funded through

free cash flow and available cash balances, and leverages Newmont’s

existing infrastructure, expertise and strong stakeholder

relationships in Nevada.

“Long Canyon marks the fourth profitable new operation we’ve

added to the portfolio in the last three years, including Merian in

Suriname last month, Cripple Creek & Victor in Colorado last

year, and Akyem in Ghana in late 2013,” said Gary Goldberg,

President and Chief Executive Officer. “We have completed these

organic growth projects on or ahead of schedule and at or below

budget; delivered a profitable expansion at Cripple Creek &

Victor earlier this year; and are on track to complete value-adding

expansions at Tanami by 2017 and at Carlin by 2018. These portfolio

improvements set the stage for Newmont to continue generating

superior free cash flow, which gives us the means to continue

investing in profitable growth, retiring debt and returning cash to

shareholders.”

Long Canyon is the most significant oxide gold discovery in

Nevada in more than a decade, with characteristics similar to the

Carlin Trend where Newmont has been operating for more than 50

years. The Company has grown the resource base at Long Canyon by 30

percent in two years; from an initial resource of 2.6 million

ounces in 2013 to reserves and resources of 3.4 million ounces as

of the end of 20152. Newmont geologists have also increased the

mineralized strike by 70 percent to a length of more than five

kilometers and oxide mineralization remains open in all

directions.

Long Canyon Phase 2 studies are underway and Newmont expects to

complete these and secure the necessary permits to proceed before

Phase 1 is depleted.

About Newmont

Newmont is a leading gold and copper producer. The Company’s

operations are primarily in the United States, Australia, Ghana,

Peru, and Suriname. Newmont is the only gold producer listed in the

S&P 500 Index and was named the mining industry leader by the

Dow Jones Sustainability World Index in 2015 and 2016. The Company

is an industry leader in value creation, supported by its leading

technical, environmental, social and safety performance. Newmont

was founded in 1921 and has been publicly traded since 1925.

Cautionary Statement Regarding Forward Looking

Statements:

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

which are intended to be covered by the safe harbor created by such

sections and other applicable laws. Such forward-looking statements

may include, without limitation, estimates of annual gold

production, estimates of mine life and development, estimates of

future costs, including costs applicable to sales and all-in

sustaining costs, expectations regarding future returns and upside.

Where the Company expresses or implies an expectation or belief as

to future events or results, such expectation or belief is

expressed in good faith and believed to have a reasonable basis.

However, such statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed, projected or implied by

the “forward-looking statements.” Such risks include, but are not

limited to, gold and other metals price volatility, increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans, political and operational risks,

community relations risks, changes in governmental and

environmental regulations and judicial outcomes. For a more

detailed discussion of other risks that may impact the Company’s

future performance, see the Company’s 2015 Annual Report on Form

10-K, filed on February 17, 2016, with the Securities and Exchange

Commission (SEC), Form 10-Q for the quarter ended September 30,

2016, filed with the SEC on October 26, 2016, and other SEC

filings. The Company does not undertake any obligation to release

publicly revisions to any “forward-looking statement” to reflect

events or circumstances after the date of this news release, or to

reflect the occurrence of unanticipated events, except as may be

required under applicable securities laws. Investors should not

assume that any lack of update to a previously issued

“forward-looking statement” constitutes a reaffirmation of that

statement. Continued reliance on “forward-looking statements” is at

investors' own risk.

____________________________________

i All-in sustaining costs (AISC) as used above is a

forward-looking non-GAAP metric defined as the sum of costs

applicable to sales (including all direct and indirect costs

related to current gold production incurred to execute on the

current mine plan), remediation costs (including operating

accretion and amortization of asset retirement costs), G&A,

exploration expense, advanced projects and R&D, treatment and

refining costs, other expense, net of one-time adjustments and

sustaining capital. Please refer to pages 14-20 of the Company’s

most recent earnings release for the quarter ended September 30,

2016, filed with the SEC, on Form 8-K on October 26, 2016, which is

also available on www.newmont.com, for additional information

regarding AISC and for reconciliations to the nearest GAAP metric

of certain historical results and the Company’s consolidated 2016

gold AISC outlook.

ii Reserves were 1.2 Moz (16.3Mt @ 2.3 g/t Au) as of December

31, 2015 and resources were 2.2 Moz (22.1Mt @ 3.1 g/t Au) as of

December 31, 2015. Resources include measured and indicated

(0.9Moz) and inferred (1.3Moz) resources. U.S. investors are

reminded that reserves were prepared in compliance with Industry

Guide 7 published by the SEC. Whereas, the terms resource, measured

and indicated resource and inferred resource are not SEC recognized

terms. Newmont has determined that such resources would be

substantively the same as those prepared using the Guidelines

established by the Society of Mining, Metallurgy and Exploration

and defined as Mineral Resource. Estimates of resources are subject

to further exploration and development, are subject to additional

risks, and no assurance can be given that they will eventually

convert to future reserves. Inferred resources, in particular, have

a great amount of uncertainty as to their existence and their

economic and legal feasibility. Investors are cautioned not to

assume that any part or all of the inferred resource exists, or is

economically or legally mineable. For more information regarding

the Company’s proven and probable reserves prepared in compliance

with the SEC’s Industry Guide 7, see the Company’s 2015 Annual

Report filed with the SEC on February 17, 2016, which is available

at www.sec.gov or www.newmont.com. Additional information regarding

the Company’s resource estimates is available on the Company’s

website at

http://www.newmont.com/investor-relations/reserves-and-resources.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161115006745/en/

Newmont Mining CorporationMedia

ContactOmar Jabara,

303-837-5114omar.jabara@newmont.comorInvestor

ContactMeredith Bandy,

303-837-5143meredith.bandy@newmont.com

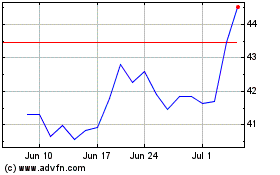

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

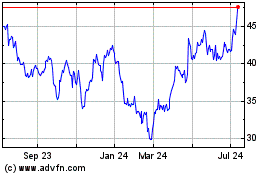

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024