Revenues up 34% year over year; EBITDA up

54% year over year resulting in Net Profit of $51 million and Cash

from Operations of $86 million

TowerJazz (NASDAQ:TSEM) (TASE:TSEM) today reported results for the

third quarter of 2016 ended September 30, 2016.

Highlights of the Third Quarter of

2016

- Record revenues of $326 million, 34% year over year

growth;

- Record EBITDA of $97 million, up 54% year-over-year;

- Net profit of $51 million with basic earnings per share of

$0.58, as compared with $14 million, or $0.18 basic earnings per

share, in the third quarter of last year;

- Cash from operations of $86 million as compared to $51 million

for the third quarter of 2015, with free cash flow of $31 million

as compared with $10 million for the third quarter of 2015;

- Fourth quarter revenue guidance with mid-range of $340 million,

representing 34% year over year growth; extending to 12 consecutive

quarters of year over year growth.

CEO CommentaryMr.

Russell Ellwanger, Chief Executive Officer of TowerJazz,

commented, “our third quarter is our eleven consecutive

quarter of year over year revenue and EBITDA growth and yielded

approximately $400 million, $340 million and $200 million of

annualized EBITDA, cash from operations and net profit,

respectively. These results speak loudly to our business model and

execution, including acquisitions that provide immediate ROI with

long term revenue and margin guarantees from our seller partners

and incremental growth against fully covered fixed costs. We have

developed a customer base from which we continue to see strong

demand across our different business units for our leading edge

forefront differentiated technology. In addition, our worldwide

operational model allows us to optimize product mix according to

utilization rates, as demonstrated with significant increase in

margins and EPS.”

Ellwanger continued, “We expect

to complete 2016 as the strongest year in our history. Based on our

mid-range guidance, full year revenues would be $1.25 billion, a

foundry leading year-over-year growth of 30% with more than

proportional increase in all related financial metrics.”

Third Quarter Results

OverviewRevenues for the third quarter of

2016 were a record of $326 million, reflecting 34% growth as

compared with $244 million reported for the third quarter of 2015

and 7% higher than the $305 million reported in the immediately

preceding quarter.

Gross profit for the third

quarter of 2016 was $81 million. This represents an increase of 47%

as compared with $55 million in gross profit in the third quarter

of 2015, and an increase of 12% as compared with $73 million gross

profit in the immediately preceding quarter.

Operating profit was $49

million for the third quarter of 2016, as compared with $24 million

as reported in the third quarter of 2015 and $40 million in the

immediately preceding quarter.

Net profit for the third

quarter of 2016 was $51 million, or $0.58 in basic earnings per

share, demonstrating increased net profit as compared with $14

million or $0.18 earnings per share in the third quarter of 2015

and as compared with $38 million, or $0.45 earnings per share in

the second quarter of 2016. Net profit for the third quarter of

2016 included $6.5 million of income tax benefit related to

finalization of the closure of the Japanese subsidiary that held

the fab in Nishiwaki that ceased operations in 2014.

On an adjusted basis, as described and

reconciled in the tables below, adjusted net

profit for the third quarter of 2016 was $49 million, as

compared with $19 million adjusted net profit reported for the

third quarter of 2015 and $40 million reported in the immediately

preceding quarter.

EBITDA for the third quarter of

2016 totaled $97 million. This represents a 54% increase as

compared with $63 million in the third quarter of 2015 and 11%

increase as compared with $87 million in the second quarter of

2016.

Cash and short-term deposits as

of September 30, 2016 were $363 million, as compared with $311

million as of June 30, 2016. The main cash activities during the

third quarter of 2016 were comprised mainly of the following: $86

million cash generated from operations; $22 million from exercise

of warrants and options; $9 million debt received, net; investments

of $55 million in fixed assets, net; and investment of $12 million

in long term deposits. These cash activities resulted in

free cash flow for the third quarter of 2016 of

$31 million, as compared with $10 million in the third quarter of

2015 and $27 million, which included $11 million, net, of received

customer prepayments, in the second quarter of 2016.

Shareholders' equity as of

September 30, 2016 was $636 million, an increase of 65% as compared

with $386 million as of December 31, 2015 and an increase of 14% as

compared with $559 million as of June 30, 2016. Net debt

amounted to $16 million as of September 30, 2016 as compared with

net debt of $51 million as of June 30, 2016.

Nine Months Results Overview

Revenues for the first nine months of 2016 were a

record $909 million, reflecting 29% growth as compared to $706

million in the first nine months of 2015.

Gross and operating profit for

the first nine months of 2016 were $215 million and $120 million,

respectively, reflecting a 53% and 152% increase respectively, as

compared to gross and operating profit of $141 million and $48

million in the first nine months of 2015, respectively.

Net profit for the first nine

months of 2016 was $156 million, or $1.81 in basic earnings per

share. This included $51 million gain from the San Antonio

acquisition and $6.5 million income tax benefit related to the

finalization of the closure of the Nishiwaki Japanese subsidiary,

which were partially offset by $7 million non-cash financing

expenses relating to the Israeli banks’ loans early repayment. This

is compared to a net loss for the nine months ended September 30,

2015 of $52 million which included $74 million in a non-cash

finance expense associated with Series F Bonds accelerated

conversion done in 2015 and $11 million income tax benefit

resulting from expiration of statute of limitations.

Excluding the above described one-time items,

net profit for the first nine months of 2016 was $105 million as

compared with $11 million for the first nine months of 2015, a $94

million improvement against $203 million of higher revenues.

EBITDA for the first nine

months totaled $261 million, representing a 51% increase as

compared to $173 million in the first nine months of 2015.

Cash from operations was $246

million in the first nine months of 2016 with free cash

flow of $79 million, as compared to $117 million and $10

million, respectively, in the first nine months of 2015.

Business OutlookTowerJazz

expects revenues for the fourth quarter of 2016 ending December 31,

2016 to be $340 million, with an upward or downward range of 5%,

representing approximately 34% year over year revenue growth as

compared with the fourth quarter of 2015.

Teleconference and Webcast

TowerJazz will host an investor conference call today, November 15,

2016, at 10:00 a.m. Eastern time (9:00 a.m. Central time, 8:00 a.m.

Mountain time, 7:00 a.m. Pacific time and 5:00 p.m. Israel time) to

discuss the Company’s financial results for the third quarter 2016

and its fourth quarter 2016 outlook.

This call will be webcast and can be accessed

via TowerJazz’s website at www.towerjazz.com, or by calling:

1-888-407-2553 (U.S. Toll-Free), 03-918-0644 (Israel),

+972-3-918-0644 (International). For those who are not

available to listen to the live broadcast, the call will be

archived for 90 days.

Investor and Analyst

ConferenceTowerJazz will be hosting an Investor and

Analyst Conference on Wednesday, November 16, 2016 in New York. The

conference will commence at 10:00am Eastern time and will take

place at NASDAQ MarketSite – Press Conference Area, 4 Times Square,

New York City. The event will follow an opening bell ceremony at

9:30am, in which TowerJazz’s management will formally ring the bell

at the open of the NASDAQ market.

The Investor and Analyst Conference is designed

to provide the Company’s existing and potential investors and

analysts an opportunity to learn more about TowerJazz’s strategy,

business, operations and financials, while demonstrating the

Company’s strength and capabilities that enable value creation.

During the event, TowerJazz will present its

business and financial strategies, performance, achievements and

future goals. Presentation slides will be posted on the day of the

event at www.towerjazz.com under the section: Investors,

Investors Resources, Presentations.

The Company presents its financial statements in

accordance with U.S. GAAP. Some of the financial information in

this release, including in the financial tables below, which we

refer to in this release as “adjusted financial measures”,

are non-GAAP financial measures as defined in Regulation G and

related reporting requirements promulgated by the Securities and

Exchange Commission as they apply to our Company. These adjusted

financial measures are calculated excluding one or more of the

following: (1) amortization of acquired intangible assets; (2)

compensation expenses in respect of equity grants to directors,

officers and employees; (3) gain from acquisition, net; (4) other

non-cash financing expense, net associated with Bonds Series F

accelerated conversion (5) non-cash financing expenses related to

bank loans early repayment and (6) non-recurring income tax

benefit. These adjusted financial measures should be evaluated in

conjunction with, and are not a substitute for, GAAP financial

measures. The tables also present the GAAP financial measures,

which are most comparable to the adjusted financial measures as

well as reconciliation between the adjusted financial measures and

the comparable GAAP financial measures. As used in this release,

the term Earnings Before Interest Tax Depreciation and Amortization

(EBITDA) consists of profit or loss, according to U.S. GAAP,

excluding gain from acquisition, net, interest and other financing

expenses (net), other income (expense), net, taxes, non-controlling

interest, depreciation and amortization and stock based

compensation expenses. EBITDA is reconciled in the tables below

from GAAP operating profit. EBITDA is not a required GAAP financial

measure and may not be comparable to a similarly titled measure

employed by other companies. EBITDA and the adjusted financial

information presented herein should not be considered in isolation

or as a substitute for operating profit, net profit or loss, cash

flows provided by operating, investing and financing activities,

per share data or other profit or cash flow statement data prepared

in accordance with GAAP. Net debt, as presented in this release, is

comprised of the outstanding principal amount of banks’ loans (in

the amounts of approximately $192 million, $175 million and $246

million as of September 30, 2016, June 30, 2016 and December 31,

2015, respectively) and the outstanding principal amount of

debentures (in the amounts of approximately $187 million, $187

million and $65 million as of September 30, 2016, June 30,

2016 and December 31, 2015, respectively), less cash and short-term

deposits (in the amounts of approximately $363 million, $311

million and $206 million as of September 30, 2016, June 30, 2016

and December 31, 2015, respectively).

About TowerJazzTower

Semiconductor Ltd. (NASDAQ:TSEM) (TASE:TSEM) and its fully owned

U.S. subsidiary Jazz Semiconductor, Inc. operate collectively under

the brand name TowerJazz, the global specialty foundry leader.

TowerJazz manufactures integrated circuits, offering a broad range

of customizable process technologies including: SiGe, BiCMOS,

mixed-signal/CMOS, RF CMOS, CMOS image sensor, integrated power

management (BCD and 700V), and MEMS. TowerJazz also provides a

world-class design enablement platform for a quick and accurate

design cycle as well as Transfer Optimization and development

Process Services (TOPS) to IDMs and fabless companies that need to

expand capacity.

To provide multi-fab sourcing and extended

capacity for its customers, TowerJazz operates two manufacturing

facilities in Israel (150mm and 200mm), two in the U.S. (200mm) and

three additional facilities in Japan (two 200mm and one 300mm)

through TowerJazz Panasonic Semiconductor Co. (TPSCo), established

with Panasonic Corporation of which TowerJazz has the majority

holding. Through TPSCo, TowerJazz provides leading edge 45nm CMOS,

65nm RF CMOS and 65nm 1.12um pixel technologies, including the most

advanced image sensor technologies. For more information, please

visit www.towerjazz.com or www.tpsemico.com.

CONTACTS: Noit Levi | TowerJazz

| +972 4 604 7066 | Noit.levi@towerjazz.comGavriel Frohwein | GK

Investor Relations | (646) 688 3559 | towerjazz@gkir.com

This press release includes forward-looking

statements, which are subject to risks and uncertainties. Actual

results may vary from those projected or implied by such

forward-looking statements and you should not place any undue

reliance on such forward-looking statements. Potential risks and

uncertainties include, without limitation, risks and uncertainties

associated with: (i) demand in our customers’ end markets; (ii)

over demand for our foundry services and/or products that exceeds

our capacity; (iii) maintaining existing customers and attracting

additional customers, (iv) high utilization and its effect on cycle

time, yield and on schedule delivery which may cause customers to

transfer their product(s) to other fabs, (v) operating results

fluctuate from quarter to quarter making it difficult to predict

future performance, (vi) impact of our debt and other liabilities

on our financial position and operations, (vii) our ability to

successfully execute acquisitions, integrate them into our

business, utilize our expanded capacity and find new business,

(viii) fluctuations in cash flow, (ix) our ability to satisfy the

covenants stipulated in our agreements with our lender banks and

bondholders, (x) pending litigation, including the shareholder

class actions that were filed against the Company, certain

officers, its directors and/or its external auditor in the US and

Israel, following a short sell thesis report issued by a

short-selling focused firm, which has been dismissed and closed in

the US and is still pending in Israel; (xi) our majority stake in

TPSCo and our acquisition of the San Antonio fabrication facility

by TowerJazz Texas (“TJT”), including new customer

engagements, qualification and production ramp-up, (xii)the closure

of TJP within the scope of restructuring our activities and

business in Japan, settling any future claims or potential claims

from third parties, (xiii) meeting the conditions set in the

approval certificates received from the Israeli Investment Center

under which we received a significant amount of grants in past

years, (xiv) receipt of orders that are lower than the customer

purchase commitments, (xv) failure to receive orders currently

expected, (xvi) possible incurrence of additional

indebtedness, (xvii) effect of global recession, unfavorable

economic conditions and/or credit crisis, (xviii) our ability to

accurately forecast financial performance, which is affected by

limited order backlog and lengthy sales cycles, (xix) possible

situations of obsolete inventory if forecasted demand exceeds

actual demand when we manufacture products before receipt of

customer orders, (xx) the cyclical nature of the semiconductor

industry and the resulting periodic overcapacity, fluctuations in

operating results and future average selling price erosion, (xxi)

the execution of our debt re-financing, restructuring and/or

fundraising to enable the service and/or re-financing of our debt

and other liabilities, (xxii) operating our facilities at high

utilization rates which is critical in order to cover a portion or

all of the high level of fixed costs associated with operating a

foundry, and our debt, in order to improve our results,

(xxiii) the purchase of equipment to increase capacity, the

timely completion of the equipment installation, technology

transfer and raising the funds therefore, (xxiv) the concentration

of our business in the semiconductor industry, (xxv) product

returns, (xxvi) our ability to maintain and develop our technology

processes and services to keep pace with new technology, evolving

standards, changing customer and end-user requirements, new product

introductions and short product life cycles, (xxvii) competing

effectively, (xxviii) use of outsourced foundry services by both

fabless semiconductor companies and integrated device

manufacturers; (xxix) achieving acceptable device yields,

product performance and delivery times, (xxx) our dependence

on intellectual property rights of others, our ability to operate

our business without infringing others’ intellectual property

rights and our ability to enforce our intellectual property against

infringement, (xxxi) retention of key employees and recruitment and

retention of skilled qualified personnel, (xxxii) exposure to

inflation, currency rates (mainly the Israeli Shekel and Japanese

Yen) and interest rate fluctuations and risks associated with doing

business locally and internationally, as well fluctuations in

the market price of our traded securities, (xxxiii) issuance of

ordinary shares as a result of conversion and/or exercise of any of

our convertible securities, as well as any sale of shares by any of

our shareholders, or any market expectation thereof, which may

depress the market price of our ordinary shares and may impair our

ability to raise future capital, (xxxiv) meeting regulatory

requirements worldwide, including environmental and governmental

regulations; and (xxxv) business interruption due to fire and other

natural disasters, the security situation in Israel and other

events beyond our control such as power interruptions.

A more complete discussion of risks and

uncertainties that may affect the accuracy of forward-looking

statements included in this press release or which may otherwise

affect our business is included under the heading "Risk Factors" in

Tower’s most recent filings on Forms 20-F and 6-K, as were filed

with the Securities and Exchange Commission (the “SEC”) and the

Israel Securities Authority. Future results may differ materially

from those previously reported. The Company does not intend to

update, and expressly disclaims any obligation to update, the

information contained in this release.

(Financial tables follow)

| TOWER SEMICONDUCTOR LTD. AND

SUBSIDIARIES |

|

| CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) |

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

June 30, |

|

|

December 31, |

|

|

|

|

|

|

|

|

|

2016 |

|

|

2016 |

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| A S S E T S |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

|

| |

|

Cash and short term deposits |

$ |

362,833 |

|

$ |

311,062 |

|

$ |

205,575 |

|

| |

|

Trade accounts receivable |

|

128,979 |

|

|

126,839 |

|

|

110,065 |

|

| |

|

Other receivables |

|

|

8,935 |

|

|

13,993 |

|

|

7,376 |

|

| |

|

Inventories |

|

|

143,090 |

|

|

136,125 |

|

|

105,681 |

|

| |

|

Other current assets |

|

|

23,916 |

|

|

21,581 |

|

|

18,030 |

|

| |

|

|

Total current assets |

|

|

667,753 |

|

|

609,600 |

|

|

446,727 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

LONG-TERM INVESTMENTS |

|

24,616 |

|

|

11,861 |

|

|

11,737 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

PROPERTY AND EQUIPMENT, NET |

|

643,046 |

|

|

625,163 |

|

|

459,533 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

INTANGIBLE ASSETS, NET |

|

32,687 |

|

|

34,807 |

|

|

34,468 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

GOODWILL |

|

|

7,000 |

|

|

7,000 |

|

|

7,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER ASSETS, NET |

|

|

4,535 |

|

|

4,586 |

|

|

5,903 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

TOTAL ASSETS |

|

$ |

1,379,637 |

|

$ |

1,293,017 |

|

$ |

965,368 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

|

| |

|

Short term debt |

|

$ |

41,646 |

|

$ |

38,174 |

|

$ |

33,259 |

|

| |

|

Trade accounts payable |

|

|

105,745 |

|

|

98,829 |

|

|

91,773 |

|

| |

|

Deferred revenue and customers' advances |

|

25,878 |

|

|

18,802 |

|

|

23,373 |

|

| |

|

Other current liabilities |

|

|

81,248 |

|

|

87,386 |

|

|

62,714 |

|

| |

|

|

|

Total current liabilities |

|

254,517 |

|

|

243,191 |

|

|

211,119 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

LONG-TERM DEBT |

|

|

330,526 |

|

|

320,444 |

|

|

256,019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

LONG-TERM CUSTOMERS' ADVANCES |

|

36,547 |

|

|

48,999 |

|

|

21,102 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

EMPLOYEE RELATED LIABILITIES |

|

14,169 |

|

|

14,029 |

|

|

14,189 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

DEFERRED TAX LIABILITY |

|

107,843 |

|

|

107,585 |

|

|

77,353 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

TOTAL LIABILITIES |

|

|

743,602 |

|

|

734,248 |

|

|

579,782 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

TOTAL SHAREHOLDERS' EQUITY |

|

|

636,035 |

|

|

558,769 |

|

|

385,586 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY |

$ |

1,379,637 |

|

$ |

1,293,017 |

|

$ |

965,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOWER SEMICONDUCTOR LTD. AND

SUBSIDIARIES |

|

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED) |

|

| (dollars and share count in thousands, except

per share data) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

T h r e e

m o n t h s e n d e

d |

|

| |

|

|

|

|

|

|

|

|

September 30, |

|

June 30, |

|

September 30, |

|

| |

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

2016 |

|

|

|

2015 |

|

|

| |

|

|

|

|

|

|

|

|

GAAP |

|

GAAP |

|

GAAP |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

REVENUES |

|

|

$ |

|

326,209 |

|

$ |

|

305,003 |

|

$ |

|

244,181 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF REVENUES |

|

|

|

244,915 |

|

|

|

232,275 |

|

|

|

188,798 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

GROSS PROFIT |

|

|

|

81,294 |

|

|

|

72,728 |

|

|

|

55,383 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Research and development |

|

|

15,547 |

|

|

|

16,030 |

|

|

|

15,980 |

|

|

| |

|

Marketing, general and administrative |

|

|

16,787 |

|

|

|

16,520 |

|

|

|

15,348 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

32,334 |

|

|

|

32,550 |

|

|

|

31,328 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

OPERATING PROFIT |

|

|

48,960 |

|

|

|

40,178 |

|

|

|

24,055 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

INTEREST EXPENSE, NET |

|

|

(3,272 |

) |

|

|

(2,997 |

) |

|

|

(3,567 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER NON CASH FINANCING EXPENSE,

NET |

|

|

(2,210 |

) |

|

|

(7,528 |

) |

(a) |

|

(5,312 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAIN FROM ACQUISITION,

NET |

|

|

-- |

|

|

|

10,158 |

|

|

|

-- |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER INCOME (EXPENSE), NET |

|

|

5,081 |

|

|

|

4,362 |

|

|

|

(247 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

PROFIT BEFORE INCOME TAX |

|

|

48,559 |

|

|

|

44,173 |

|

|

|

14,929 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

INCOME TAX BENEFIT (EXPENSE) |

|

|

3,459 |

|

|

|

(3,826 |

) |

|

|

(927 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

PROFIT BEFORE NON CONTROLLING

INTEREST |

|

|

52,018 |

|

|

|

40,347 |

|

|

|

14,002 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

NON

CONTROLLING INTEREST |

|

|

(805 |

) |

|

|

(1,861 |

) |

|

|

(451 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

NET PROFIT |

|

$ |

|

51,213 |

|

$ |

|

38,486 |

|

$ |

|

13,551 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

BASIC EARNINGS PER ORDINARY SHARE |

$ |

|

0.58 |

|

$ |

|

0.45 |

|

$ |

|

0.18 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average number of ordinary shares

outstanding |

|

|

87,821 |

|

|

|

86,300 |

|

|

|

77,370 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

DILUTED EARNINGS PER ORDINARY SHARE |

$ |

|

0.52 |

|

$ |

|

0.40 |

|

$ |

|

0.16 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net profit used for diluted earnings per

share |

$ |

|

53,318 |

|

$ |

|

40,556 |

|

$ |

|

13,551 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average number of ordinary shares outstanding

- |

|

|

|

|

|

|

|

| |

|

used for diluted earnings per share |

|

|

101,805 |

|

|

|

100,163 |

|

|

|

86,837 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

Included $6,653 relating to the Israeli banks loans

early repayment which has been completed in the three months ended

June 30, 2016. |

|

| TOWER SEMICONDUCTOR LTD. AND

SUBSIDIARIES |

|

| UNAUDITED RECONCILIATION OF CERTAIN FINANCIAL

DATA |

|

| (dollars and share count in thousands, except

per share data) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

T h r e e

m o n t h s e n d e

d |

|

| |

|

|

|

|

|

|

|

September 30, |

|

June 30, |

|

September 30, |

|

| |

|

|

|

|

|

|

|

|

2016 |

|

|

|

2016 |

|

|

2015 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| RECONCILIATION FROM GAAP NET PROFIT TO ADJUSTED NET

PROFIT |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP NET PROFIT |

|

$ |

|

51,213 |

|

$ |

|

38,486 |

|

$ |

13,551 |

|

| |

|

Stock based

compensation |

|

|

|

2,337 |

|

|

|

2,532 |

|

|

2,312 |

|

| |

|

Amortization of acquired intangible

assets |

|

|

|

2,367 |

|

|

|

2,395 |

|

|

1,982 |

|

| |

|

Financing expenses, net associated with Bonds Series F

accelerated conversion |

|

|

-- |

|

|

|

-- |

|

|

696 |

|

| |

|

Non cash financing expense related to bank loan early

repayment (1) |

|

|

|

-- |

|

|

|

6,653 |

|

|

-- |

|

| |

|

Gain from acquisition, net |

|

|

|

-- |

|

|

|

(10,158 |

) |

|

-- |

|

| |

|

Income tax benefit, see (2) below |

|

|

|

(6,472 |

) |

|

|

-- |

|

|

-- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

ADJUSTED NET PROFIT |

|

$ |

|

49,445 |

|

$ |

|

39,908 |

|

$ |

18,541 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

ADJUSTED NET PROFIT PER SHARE |

|

|

|

|

|

|

|

|

| |

|

Basic |

|

$ |

|

0.56 |

|

$ |

|

0.46 |

|

$ |

0.24 |

|

| |

|

Diluted |

|

$ |

|

0.51 |

|

$ |

|

0.42 |

|

$ |

0.21 |

|

| |

|

Fully diluted, see (3) below |

|

$ |

|

0.48 |

|

$ |

|

0.39 |

|

$ |

0.23 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

ADJUSTED NET PROFIT USED TO CALCULATE PER SHARE

DATA: |

|

|

|

|

|

|

|

|

| |

|

Basic |

|

$ |

|

49,445 |

|

$ |

|

39,908 |

|

$ |

18,541 |

|

| |

|

Diluted |

|

|

$ |

|

51,550 |

|

$ |

|

41,978 |

|

$ |

18,541 |

|

| |

|

Fully diluted |

|

$ |

|

51,550 |

|

$ |

|

41,978 |

|

$ |

23,812 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Number of shares and other securities used for the above

calculation: |

|

|

|

|

|

|

|

|

| |

|

Basic |

|

|

|

87,821 |

|

|

|

86,300 |

|

|

77,370 |

|

| |

|

Diluted |

|

|

|

|

101,805 |

|

|

|

100,163 |

|

|

86,837 |

|

| |

|

Fully diluted, see (3) below |

|

|

|

107,147 |

|

|

|

107,056 |

|

|

103,562 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA CALCULATION: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP OPERATING PROFIT |

|

$ |

|

48,960 |

|

$ |

|

40,178 |

|

$ |

24,055 |

|

| |

|

Cost of revenue: |

|

|

|

|

|

|

|

|

| |

|

|

Depreciation of fixed

assets |

|

|

|

43,110 |

|

|

|

41,910 |

|

|

34,518 |

|

| |

|

|

Stock based compensation |

|

|

|

936 |

|

|

|

1,160 |

|

|

732 |

|

| |

|

|

Amortization of acquired intangible

assets |

|

|

|

2,180 |

|

|

|

2,207 |

|

|

1,794 |

|

| |

|

Research and development: |

|

|

|

|

|

|

|

|

| |

|

|

Stock based compensation |

|

|

|

501 |

|

|

|

533 |

|

|

598 |

|

| |

|

Marketing, general and administrative: |

|

|

|

|

|

|

|

|

| |

|

|

Stock based compensation |

|

|

|

900 |

|

|

|

839 |

|

|

982 |

|

| |

|

|

Amortization of acquired intangible

assets |

|

|

|

187 |

|

|

|

188 |

|

|

188 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

EBITDA |

|

|

|

$ |

|

96,774 |

|

$ |

|

87,015 |

|

$ |

62,867 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1 |

) |

In accordance with US GAAP ASC 825-10. |

|

|

|

(2 |

) |

Tax

impact in relation to TJP legal entity closure occurred in the

three months ended September 30, 2016, following Nishiwaki Fab

cessation of operation announced in 2014. |

|

|

|

(3 |

) |

Fully diluted share count includes all issued and

outstanding securities; Outstanding ordinary share count as of

September 30, 2016 was 90,307. |

|

| TOWER SEMICONDUCTOR LTD. AND

SUBSIDIARIES |

|

|

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED) |

|

|

| (dollars and share count in thousands, except

per share data) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Nine months ended |

|

|

| |

|

|

|

|

|

|

|

|

September 30, |

|

|

| |

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

| |

|

|

|

|

|

|

|

|

GAAP |

|

GAAP |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

REVENUES |

|

|

$ |

|

909,255 |

|

$ |

|

705,959 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF REVENUES |

|

|

|

693,886 |

|

|

|

565,124 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

GROSS PROFIT |

|

|

|

215,369 |

|

|

|

140,835 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Research and development |

|

|

46,814 |

|

|

|

45,965 |

|

|

|

| |

|

Marketing, general and administrative |

|

|

49,230 |

|

|

|

47,315 |

|

|

|

| |

|

Nishiwaki Fab restructuring costs and impairment,

net |

|

|

(627 |

) |

|

|

-- |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

95,417 |

|

|

|

93,280 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

OPERATING PROFIT |

|

|

119,952 |

|

|

|

47,555 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

INTEREST EXPENSE, NET |

|

|

(9,627 |

) |

|

|

(10,813 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER NON CASH FINANCING EXPENSE, NET |

|

|

(13,707 |

) |

|

|

(97,179 |

) |

(a) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAIN FROM ACQUISITION,

NET |

|

|

51,298 |

|

|

|

-- |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER INCOME (EXPENSE), NET |

|

|

9,443 |

|

|

|

(260 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

PROFIT (LOSS) BEFORE INCOME TAX |

|

|

157,359 |

|

|

|

(60,697 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

INCOME TAX BENEFIT (EXPENSE) |

|

|

(446 |

) |

|

|

7,499 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

PROFIT (LOSS) BEFORE NON CONTROLLING

INTEREST |

|

|

156,913 |

|

|

|

(53,198 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

NON

CONTROLLING INTEREST |

|

|

(1,270 |

) |

|

|

1,472 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

NET PROFIT (LOSS) |

$ |

|

155,643 |

|

$ |

|

(51,726 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

BASIC EARNINGS (LOSS) PER ORDINARY SHARE |

$ |

|

1.81 |

|

$ |

|

(0.71 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average number of ordinary shares

outstanding |

|

|

86,220 |

|

|

|

72,600 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

Included $73,817 associated with Bonds Series F

accelerated conversion occurred in the nine months ended September

30, 2015 in accordance with US GAAP ASC 470-20. |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOWER SEMICONDUCTOR LTD. AND

SUBSIDIARIES |

|

| CONSOLIDATED SOURCES AND USES REPORT

(UNAUDITED) |

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

T h r e e

m o n t h s e n d e

d |

|

|

|

|

|

| |

|

|

September 30, |

|

June 30, |

|

September 30, |

|

|

|

|

|

| |

|

|

|

2016 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and short term deposits - beginning of

period |

$ |

|

311,062 |

|

$ |

|

244,577 |

|

$ |

|

142,503 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash from

operations |

|

|

86,410 |

|

|

|

81,781 |

|

|

|

50,822 |

|

|

|

|

|

|

| |

Investments in property and

equipment, net |

|

|

(54,947 |

) |

|

|

(54,323 |

) |

|

|

(40,626 |

) |

|

|

|

|

|

| |

Exercise of warrants and

options, net |

|

|

21,918 |

|

|

|

360 |

|

|

|

4,602 |

|

|

|

|

|

|

| |

Debt received (repaid),

net |

|

|

8,554 |

|

|

|

27,444 |

|

|

|

(3,000 |

) |

|

|

|

|

|

| |

Effect of Japanese Yen

exchange rate change and others |

|

|

2,336 |

|

|

|

11,223 |

|

|

|

1,047 |

|

|

|

|

|

|

| |

Long term

deposit |

|

|

(12,500 |

) |

|

|

-- |

|

|

|

-- |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and short term deposits - end of period |

$ |

|

362,833 |

|

$ |

|

311,062 |

|

$ |

|

155,348 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Nine months ended |

|

|

|

|

|

|

|

| |

|

|

September 30, |

|

September 30, |

|

|

|

|

|

|

|

| |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and short term deposits - beginning of

period |

$ |

|

205,575 |

|

$ |

|

187,167 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash from

operations |

|

|

245,633 |

|

|

|

142,033 |

|

|

|

|

|

|

|

|

| |

Investments in property and

equipment, net |

|

|

(166,803 |

) |

|

|

(107,198 |

) |

|

|

|

|

|

|

|

| |

Exercise of warrants and

options, net |

|

|

28,159 |

|

|

|

10,256 |

|

|

|

|

|

|

|

|

| |

Debt received (repaid),

net |

|

|

42,744 |

|

|

|

(51,683 |

) |

|

|

|

|

|

|

|

| |

Nishiwaki's employees

retirement related payments |

|

|

-- |

|

|

|

(24,907 |

) |

|

|

|

|

|

|

|

| |

Effect of Japanese Yen

exchange rate change and others |

|

|

22,588 |

|

|

|

(320 |

) |

|

|

|

|

|

|

|

| |

TPSCo dividend to

Panasonic |

|

|

(2,563 |

) |

|

|

-- |

|

|

|

|

|

|

|

|

| |

Long term

deposit |

|

|

(12,500 |

) |

|

|

-- |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and short term deposits - end of period |

$ |

|

362,833 |

|

$ |

|

155,348 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOWER SEMICONDUCTOR LTD. AND

SUBSIDIARIES |

|

|

|

| CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (UNAUDITED) |

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

|

|

|

|

|

|

September 30, |

|

June 30, |

|

September 30, |

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS - OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net profit for the period |

|

$ |

|

52,018 |

|

$ |

|

40,347 |

|

$ |

|

14,002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Adjustments to reconcile net profit for the period to

net cash provided by operating activities: |

|

|

|

|

|

|

|

| |

|

Income and expense items not involving cash

flows: |

|

|

|

|

|

|

|

| |

|

|

Depreciation and amortization |

|

|

49,194 |

|

|

|

48,117 |

|

|

|

41,754 |

|

|

| |

|

|

Effect of indexation, translation and fair value

measurement on debt |

|

|

2,808 |

|

|

|

6,700 |

|

|

|

918 |

|

|

| |

|

|

Other expense (income) , net |

|

|

(5,081 |

) |

|

|

(4,362 |

) |

|

|

247 |

|

|

| |

|

|

Gain from acquisition |

|

|

-- |

|

|

|

(10,158 |

) |

|

|

-- |

|

|

| |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

| |

|

|

Trade accounts receivable |

|

|

(1,469 |

) |

|

|

(1,916 |

) |

|

|

(7,325 |

) |

|

| |

|

|

Other receivables and other current

assets |

|

|

4,328 |

|

|

|

(5,476 |

) |

|

|

(5,549 |

) |

|

| |

|

|

Inventories |

|

|

(6,245 |

) |

|

|

(6,300 |

) |

|

|

(12,151 |

) |

|

| |

|

|

Trade accounts payable |

|

|

2,624 |

|

|

|

130 |

|

|

|

(508 |

) |

|

| |

|

|

Deferred revenue and customers'

advances |

|

|

(5,377 |

) |

|

|

8,294 |

|

|

|

18,144 |

|

|

| |

|

|

Other current liabilities |

|

|

(6,938 |

) |

|

|

11,194 |

|

|

|

1,597 |

|

|

| |

|

|

Deferred tax liability,

net |

|

|

548 |

|

|

|

(4,789 |

) |

|

|

(307 |

) |

|

| |

|

|

|

Net cash provided by operating activities |

|

|

86,410 |

|

|

|

81,781 |

|

|

|

50,822 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS - INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments in property and equipment,

net |

|

|

(54,947 |

) |

|

|

(54,323 |

) |

|

|

(40,626 |

) |

|

|

|

Decrease (increase) in deposits and other investments,

net |

|

|

(12,500 |

) |

|

|

19,600 |

|

|

|

-- |

|

|

| |

|

|

|

Net cash used in investing activities |

|

|

(67,447 |

) |

|

|

(34,723 |

) |

|

|

(40,626 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS - FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Debt received, net of loans repayment |

|

|

8,554 |

|

|

|

27,444 |

|

|

|

(3,000 |

) |

|

| |

Exercise of warrants and options, net |

|

|

21,918 |

|

|

|

360 |

|

|

|

4,602 |

|

|

| |

|

|

|

Net cash provided by financing activities |

|

|

30,472 |

|

|

|

27,804 |

|

|

|

1,602 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

EFFECT OF FOREIGN CURRENCY EXCHANGE RATE

CHANGE |

|

|

2,336 |

|

|

|

11,623 |

|

|

|

1,047 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCREASE IN CASH AND CASH

EQUIVALENTS |

|

|

51,771 |

|

|

|

86,485 |

|

|

|

12,845 |

|

|

| CASH AND CASH EQUIVALENTS - BEGINNING

OF PERIOD |

|

|

311,062 |

|

|

|

224,577 |

|

|

|

142,503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH AND CASH EQUIVALENTS - END OF PERIOD |

$ |

|

362,833 |

|

$ |

|

311,062 |

|

$ |

|

155,348 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

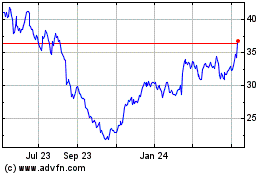

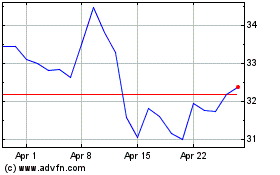

Tower Semiconductor (NASDAQ:TSEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tower Semiconductor (NASDAQ:TSEM)

Historical Stock Chart

From Apr 2023 to Apr 2024