Securities Registration: Employee Benefit Plan (s-8)

November 15 2016 - 6:23AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on November 14, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

IMMUNOCELLULAR THERAPEUTICS, LTD.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

93-1301885

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

ImmunoCellular Therapeutics, Ltd.

23622 Calabasas Road, Suite 300

Calabasas, California 91302

(Address of principal executive offices)

2016 Equity

Incentive Plan

(Full title of the plan)

Andrew Gengos

Chief

Executive Officer

ImmunoCellular Therapeutics, Ltd.

23622 Calabasas Road, Suite 300

Calabasas, California 91302

(818) 264-2300

(Name and

address of agent for service) (Telephone number, including area code, of agent for service)

Copies to:

Glen Y. Sato

Cooley LLP

3175 Hanover

Street

Palo Alto, California 94304

(650) 843-5000

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☒

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities

to be Registered

|

|

Amount

to be

Registered (1)

|

|

Proposed

Maximum

Offering

Price

per Share (2)

|

|

Proposed

Maximum

Aggregate

Offering Price (2)

|

|

Amount of

Registration Fee

|

|

Common Stock (par value $0.0001 per share)

|

|

10,202,630(3)

|

|

$0.08415

|

|

$858,552

|

|

$99.51

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall cover any additional shares of common stock which become issuable

under the plan covered hereby by reason of any stock split, stock dividend, recapitalization or any other similar transaction without receipt of consideration which results in an increase in the number of shares of the registrant’s outstanding

common stock.

|

|

(2)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) and Rule 457(c). The price per share and aggregate offering price are based upon the average of the

high and low prices of Registrant’s Common Stock on November 9, 2016 as reported on the NYSE MKT.

|

|

(3)

|

Consists of (a) 10,000,000, not previously registered, under the ImmunoCellular Therapeutics, Ltd. 2016 Equity Incentive Plan (the “2016 Plan”), plus (b) 202,630 shares (the “Prior Plan

Shares”) previously subject to outstanding awards under the Registrant’s 2006 Amended and Restated Equity Incentive Plan (the “Prior Plan”) as of February 1, 2016. When equity awards granted under the Prior Plan (a) expire

or terminate for any reason prior to exercise or settlement, (b) are forfeited, cancelled or otherwise returned to the Registrant because of the failure to meet a contingency or condition required to vest the underlying shares, or (c) are reacquired

or withheld (or not issued) by the Registrant to satisfy a tax withholding obligation in connection with a stock award (other than with respect to outstanding options and stock appreciation rights granted under the Prior Plan with respect to which

the exercise or strike price is at least 100% of the fair market value of the underlying common stock subject to the option or stock appreciation right on the date of grant), then in each such event such underlying shares become available for

issuance under the 2016 Plan, and are no longer available for issuance under the Prior Plan. All of the Prior Plan Shares subject to this registration statement have become available for issuance under the 2016 Plan as a result of such events.

|

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

Item 3.

|

Incorporation of Documents by Reference.

|

The following documents have been filed by the Registrant with

the Securities and Exchange Commission (the “Commission”) and are incorporated herein by reference:

|

|

•

|

|

the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the Commission on March 30, 2016 (the “2015 Form 10-K”);

|

|

|

•

|

|

the information specifically incorporated by reference into the 2015 Form 10-K from the Registrant’s definitive proxy statement on Schedule 14A, filed with the Commission on April 29, 2016;

|

|

|

•

|

|

the Registrant’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2016 filed with the Commission on May 13, 2016;

|

|

|

•

|

|

the Registrant’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2016 filed with the Commission on August 22, 2016;

|

|

|

•

|

|

the Registrant’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2016 filed with the Commission on November 10, 2016;

|

|

|

•

|

|

the Registrant’s Current Reports on Form 8-K, filed with the Commission on March 2, 2016, June 7, 2016, June 21, 2016, September 1, 2016, September 16, 2016 and November 4, 2016; and

|

|

|

•

|

|

the description of the Registrant’s Common Stock contained in the Registrant’s registration statement on Form 8-A filed with the Commission on May 25, 2012, including any amendments or reports filed for the

purpose of updating such description.

|

All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items, prior to the

filing of a post-effective amendment to this Registration Statement which indicates that all of the shares of Common Stock offered have been sold or which deregisters all of such shares then remaining unsold, shall be deemed to be incorporated by

reference in this Registration Statement and to be a part hereof from the date of the filing of such documents.

For purposes of this Registration

Statement, any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document

which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration

Statement.

|

Item 4.

|

Description of Securities.

|

Not applicable.

|

Item 5.

|

Interests of Named Experts and Counsel.

|

Not applicable.

|

Item 6.

|

Indemnification of Directors and Officers.

|

The Registrant’s amended and restated certificate of

incorporation provides that no officer or director shall be personally liable to the corporation or its stockholders for monetary damages except as provided pursuant to

Delaware law. The Registrant’s amended and restated certificate of incorporation and the Registrant’s amended and restated bylaws also provide that it shall indemnify and hold harmless

each person who serves at any time as a director, officer, employee or agent of it from and against any and all claims, judgments and liabilities to which such person shall become subject by reason of the fact that he or she is or was a director,

officer, employee or agent of the Registrant and shall reimburse such person for all legal and other expenses reasonably incurred by him or her in connection with any such claim or liability. The Registrant also has the power to defend such person

from all suits or claims in accordance with Delaware law. The rights accruing to any person under the Registrant’s amended and restated certificate of incorporation and the Registrant’s amended and restated bylaws do not exclude any other

right to which any such person may lawfully be entitled, and the Registrant may indemnify or reimburse such person in any proper case, even though not specifically provided for by the Registrant’s amended and restated certificate of

incorporation and the Registrant’s amended and restated bylaws.

The Registrant has entered into an indemnity agreement with each of its directors.

In the Registrant’s employment agreements with Andrew Gengos and Anthony Gringeri, the Registrant agreed to indemnify each of these officers for all claims arising out of performance of his duties, other than those arising out of his breach of

the agreement or his gross negligence or willful misconduct.

Insofar as indemnification for liabilities for damages arising under the Securities Act of

1933, as amended (the “Securities Act”), may be permitted to the Registrant’s directors, officers, and controlling persons pursuant to the foregoing provision, or otherwise, the Registrant has been advised that in the opinion of the

Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

|

Item 7.

|

Exemption from Registration Claimed.

|

Not Applicable.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

Incorporation by Reference

|

|

|

Filed

Herewith

|

|

|

|

Form

|

|

SEC File No.

|

|

Exhibit

|

|

|

Filing Date

|

|

|

|

|

|

|

|

|

|

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation

|

|

8-K

|

|

001-35560

|

|

|

3.1

|

|

|

|

9/24/2013

|

|

|

|

|

|

|

|

|

|

|

|

|

3.2

|

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation

|

|

8-K

|

|

001-35560

|

|

|

3.1

|

|

|

|

11/19/2015

|

|

|

|

|

|

|

|

|

|

|

|

|

3.3

|

|

Amended and Restated Bylaws

|

|

S-8

|

|

333-171652

|

|

|

3.1

|

|

|

|

1/11/2011

|

|

|

|

|

|

|

|

|

|

|

|

|

3.4

|

|

Amendment to the Amended and Restated Bylaws

|

|

8-K

|

|

001-35560

|

|

|

3.1

|

|

|

|

5/25/2012

|

|

|

|

|

|

|

|

|

|

|

|

|

4.1

|

|

Form of Common Stock Certificate of the Registrant

|

|

SB-2

|

|

333-140598

|

|

|

4.1

|

|

|

|

2/12/2007

|

|

|

|

|

|

|

|

|

|

|

|

|

5.1

|

|

Opinion of Cooley LLP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

23.1

|

|

Consent of Marcum LLP, independent registered public accounting firm

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

23.2

|

|

Consent of Cooley LLP (See Exhibit 5.1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

24.1*

|

|

Power of Attorney

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

99.1

|

|

2016 Equity Incentive Plan

|

|

S-1/A

|

|

333-211763

|

|

|

10.60

|

|

|

|

7/11/2016

|

|

|

|

|

|

|

|

|

|

|

|

|

99.2

|

|

Forms of Stock Option Agreement, Notice of Grant of Stock Option, Restricted Stock Unit Grant Notice and Restricted Stock Award Grant Notice under the 2016 Equity Incentive Plan

|

|

S-1/A

|

|

333-211763

|

|

|

10.61

|

|

|

|

7/11/2016

|

|

|

|

|

*

|

Power of Attorney contained on the signature page.

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on

Form S-8

and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of

Calabasas, State of California, on November 14, 2016.

|

|

|

|

|

I

MMUNO

C

ELLULAR

T

HERAPEUTICS

, L

TD

.

|

|

|

|

By:

/s/ Andrew

Gengos

|

|

Andrew Gengos

President and Chief

Executive Officer

(Principal Executive Officer)

|

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints Andrew Gengos and David Fractor, each acting alone, as his true and lawful

attorney-in-fact and agent, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any or all amendments (including post-effective amendments) to this Registration Statement

on Form S-8, and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, full power and authority to do and perform each and

every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute or

substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this

Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Andrew Gengos

Andrew Gengos

|

|

President, Chief Executive Officer and Director

(Principal Executive Officer)

|

|

November 14, 2016

|

|

|

|

|

|

/s/ David Fractor

David Fractor

|

|

Vice President, Finance and Principal Accounting Officer

(Principal Financial and

Accounting Officer)

|

|

November 14, 2016

|

|

|

|

|

|

/s/ Gregg A. Lapointe

Gregg A. Lapointe

|

|

Director

|

|

November 14, 2016

|

|

|

|

|

|

/s/ Mark A. Schlossberg

Mark A. Schlossberg

|

|

Director

|

|

November 14, 2016

|

|

|

|

|

|

/s/ Rahul Singhvi, Sc.D.

Rahul Singhvi, Sc.D.

|

|

Director

|

|

November 14, 2016

|

|

|

|

|

|

/s/ Gary S. Titus

Gary S. Titus

|

|

Director

|

|

November 14, 2016

|

|

|

|

|

|

/s/ John S. Yu, M.D.

John S. Yu, M.D.

|

|

Director

|

|

November 14, 2016

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

Incorporation by Reference

|

|

|

Filed

Herewith

|

|

|

|

Form

|

|

SEC File No.

|

|

Exhibit

|

|

|

Filing Date

|

|

|

|

|

|

|

|

|

|

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation

|

|

8-K

|

|

001-35560

|

|

|

3.1

|

|

|

|

9/24/2013

|

|

|

|

|

|

|

|

|

|

|

|

|

3.2

|

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation

|

|

8-K

|

|

001-35560

|

|

|

3.1

|

|

|

|

11/19/2015

|

|

|

|

|

|

|

|

|

|

|

|

|

3.3

|

|

Amended and Restated Bylaws

|

|

S-8

|

|

333-171652

|

|

|

3.1

|

|

|

|

1/11/2011

|

|

|

|

|

|

|

|

|

|

|

|

|

3.4

|

|

Amendment to the Amended and Restated Bylaws

|

|

8-K

|

|

001-35560

|

|

|

3.1

|

|

|

|

5/25/2012

|

|

|

|

|

|

|

|

|

|

|

|

|

4.1

|

|

Form of Common Stock Certificate of the Registrant

|

|

SB-2

|

|

333-140598

|

|

|

4.1

|

|

|

|

2/12/2007

|

|

|

|

|

|

|

|

|

|

|

|

|

5.1

|

|

Opinion of Cooley LLP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

23.1

|

|

Consent of Marcum LLP, independent registered public accounting firm

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

23.2

|

|

Consent of Cooley LLP (See Exhibit 5.1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

24.1*

|

|

Power of Attorney

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

99.1

|

|

2016 Equity Incentive Plan

|

|

S-1/A

|

|

333-211763

|

|

|

10.60

|

|

|

|

7/11/2016

|

|

|

|

|

|

|

|

|

|

|

|

|

99.2

|

|

Forms of Stock Option Agreement, Notice of Grant of Stock Option, Restricted Stock Unit Grant Notice and Restricted Stock Award Grant Notice under the 2016 Equity Incentive Plan

|

|

S-1/A

|

|

333-211763

|

|

|

10.61

|

|

|

|

7/11/2016

|

|

|

|

|

*

|

Power of Attorney contained on the signature page.

|

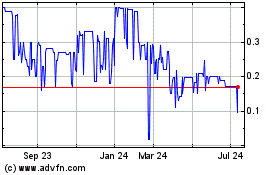

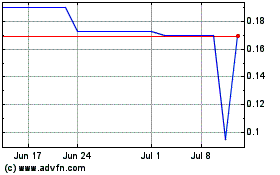

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Apr 2023 to Apr 2024