Filed Pursuant to Rule 424(b)(7)

Registration No. 333-214592

The information in this preliminary prospectus supplement is not

complete and may be changed. This preliminary prospectus supplement is part of an effective registration statement filed with the Securities and Exchange Commission. This preliminary prospectus supplement and the accompanying prospectus are not an

offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated November 14, 2016

Preliminary prospectus supplement to prospectus dated November 14, 2016

12,000,000 shares

TTM Technologies, Inc.

Common stock

The selling stockholder named in this

prospectus supplement is offering 12,000,000 shares of our common stock, par value $0.001 per share. We will not receive any proceeds from the sale of our common stock by the selling stockholder.

Our common stock is listed on the NASDAQ Global Select Market, or the NASDAQ, under the symbol “TTMI.” The last reported sale price of our common stock

on NASDAQ on November 11, 2016, was $14.49 per share.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share

|

|

|

Total

|

|

|

|

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

|

|

|

|

Underwriting discounts and commissions(1)

|

|

$

|

|

|

|

$

|

|

|

|

|

|

|

|

Proceeds, before offering expenses, to the selling stockholder

|

|

$

|

|

|

|

$

|

|

|

|

|

|

|

(1)

|

|

We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting.”

|

The selling stockholder has granted the underwriters an option to purchase up to an additional 1,800,000 shares at the public offering price less the

underwriting discounts and commissions.

Investing in our common stock involves a high degree of risk. You should carefully consider the risks

described under “

Risk factors

” beginning on page S-11 of this prospectus supplement before making a decision to invest in our common stock. You should also consider the risks factors described in the documents

incorporated by reference in this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any

state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock against payment in New York, New York on or

about , 2016.

Sole book-running manager

Co-managers

Prospectus supplement

dated , 2016.

Table of contents

Prospectus supplement

Prospectus

S-i

We are responsible for the information contained in this prospectus supplement, the accompanying prospectus,

including the information incorporated by reference herein as described herein and therein, and any free writing prospectus we prepare or authorize. None of the Company, the selling stockholder or the underwriters have authorized anyone to provide

you with different information, and neither we, the selling stockholder nor the underwriters take responsibility for any other information others may give you. This prospectus supplement and the accompanying prospectus does not constitute an offer

to sell or a solicitation of an offer to buy any securities other than the registered securities to which they relate, and neither we, the selling stockholder nor the underwriters are making an offer to sell these securities in any jurisdiction

where the offer or sale is not permitted. You should not assume that the information contained in this prospectus supplement and the accompanying prospectus is accurate as of any date other than its date.

About this prospectus supplement

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf” registration process.

This prospectus supplement provides you with specific information about our common stock that the selling stockholder is selling in this offering. Both this prospectus supplement and the accompanying prospectus include important information about

us, the selling stockholder and other information you should know before investing. Since the accompanying prospectus provides general information about us, some of the information may not apply to this offering. This prospectus supplement describes

the specific details regarding the offering and adds to, updates and changes information contained in the accompanying prospectus. To the extent the information in this prospectus supplement is different from that in the accompanying prospectus, you

should rely on the information in this prospectus supplement. You should read both this prospectus supplement and the accompanying prospectus, together with the additional information described in the sections entitled “Where you can find more

information” and “Incorporation of certain information by reference” of this prospectus supplement, before investing in our common stock.

Market and industry data

Market data and industry statistics and forecasts used in

this prospectus supplement and in the information incorporated herein by reference are based on independent industry publications and other publicly available information. Although we believe that these sources and estimates are reliable, we do

not guarantee the accuracy or completeness of this information and we have not independently verified this information. We obtained this information and these statistics from various third-party sources and our own internal estimates. The estimates

in such information involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk factors.” Accordingly, investors should not place undue reliance on this information.

S-ii

Prospectus supplement summary

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus supplement and does not contain all of the

information you need to consider in making your investment decision. You should carefully read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, including the section

entitled “Risk factors,” and read our consolidated financial statements and the notes thereto before making an investment decision. Unless the context requires otherwise, references to “our company,” “we,”

“us” and “our” refer to TTM Technologies, Inc. and its subsidiaries. Fiscal 2015, fiscal 2014, and fiscal 2013 refer to the 52 weeks ended on December 28, 2015, December 29, 2014 and December 30, 2013, respectively.

Our company

We are a leading global printed

circuit board, or PCB, manufacturer, focusing on quick-turn and volume production of technologically complex PCBs and electro-mechanical solutions, or E-M Solutions. We are the largest PCB manufacturer in North America and one of the largest PCB

manufacturers in the world, in each case based on revenue, according to the 2015 rankings from N.T. Information LTD, or NTI. We generated approximately $2.1 billion and $1.8 billion in net sales for fiscal 2015 and the nine months ended September

26, 2016, respectively, and as of December 28, 2015, we had approximately 29,570 employees worldwide. We operate a total of 25 specialized facilities in North America and the People’s Republic of China. We focus on providing time-to-market and

volume production of advanced technology products and offer a one-stop manufacturing solution to our customers from engineering support to prototype development through final mass production. This one-stop manufacturing solution allows us to align

technology development with the diverse needs of our customers and to enable them to reduce the time required to develop new products and bring them to market. We serve a diversified customer base consisting of over 1,500 customers in various

markets throughout the world, including manufacturers of networking/communications infrastructure products, smartphones and tablets, as well as aerospace and defense, automotive components, high-end computing, and medical, industrial and

instrumentation related products. Our customers include both original equipment manufacturers, or OEMs and electronic manufacturing services, or EMS, providers.

On May 31, 2015, we completed the acquisition of Viasystems Group, Inc., or Viasystems, for total consideration of $248.8 million in cash and 15.1 million shares of TTM common stock with a fair value of $149.0

million, to acquire all of the outstanding shares of capital stock and other equity rights of Viasystems. Additionally, in connection with the completion of the acquisition, we assumed and refinanced Viasystems’ debt, which was approximately

$669.0 million as of May 31, 2015. Viasystems was a worldwide provider of complex multi-layer rigid, flexible, and rigid-flex PCBs and custom electronic assemblies. The acquisition has increased our revenue base and brought more diversity to our

business, particularly with the addition of the automotive end market to the markets we serve. The acquisition of Viasystems has had and will continue to have a significant effect on our operations and financial results, which demonstrates the

benefits of diversification along with our strong operational execution and realization of synergies from the transaction.

Industry overview

PCBs are manufactured in panels from sheets of laminated material. Each panel is typically subdivided into multiple PCBs, each consisting of a

pattern of electrical circuitry etched from copper to provide an electrical connection between the components mounted to it. PCBs serve as the foundation for virtually all electronic products, including the electronic components integrated into

automobiles, consumer electronics products

S-1

(smartphones and touchscreen tablets), high-end commercial electronic equipment (such as medical equipment, data communication routers, switches, and servers) and aerospace and defense electronic

systems.

In recent years, the demand for smaller sized electronic devices with more features and functionality has been increasing. Products designed to

offer faster data transmission, thinner and more lightweight packaging, and reduced power consumption generally require increasingly complex PCBs to meet these criteria. By using High Density Interconnect, or HDI technology, circuit densities can be

increased, thereby providing for smaller products with higher packaging densities. Furthermore, flexible circuit technology, which includes flexible circuits, rigid-flex circuits, and flexible assemblies, can be found in small and lightweight end

products, such as smartphones and touchscreen tablets, and increasingly in other end markets such as automotive, industrial, and aerospace and defense. We collectively refer to these new technologies as “advanced technologies,” and they

have growth rates which are higher than conventional technologies. In addition, most of our markets have low volume requirements during the prototype stage that demand a highly flexible manufacturing environment which later transitions to a volume

requirement during product ramp.

According to estimates in an August 2016 report by Prismark Partners LLC, or Prismark Partners, worldwide demand for

PCBs was approximately $55.3 billion in 2015. Of the worldwide demand for production in 2015, PCB production in the Americas accounted for approximately 5% (approximately $2.8 billion), PCB production in China accounted for approximately 48%

(approximately $26.7 billion), and PCB production in the rest of the world accounted for approximately 47% (approximately $25.8 billion), according to estimates by Prismark Partners. According to the same report by Prismark Partners, worldwide

demand for PCBs is forecast to grow at a 2% CAGR from 2015 to 2020 driven by above average growth expected in the automotive and aerospace and defense end markets offset by below average growth expected in the networking communications end market.

While Prismark Partners expects long-term growth to occur in all PCB technologies, it forecasts more robust growth in the HDI, flexible and rigid-flex segments. This growth expectation stems from the increase in the number of applications that can

utilize, and in many cases require, smaller, denser interconnects.

We believe that several trends impacting the PCB manufacturing industry will benefit

us in the future. These trends include:

|

•

|

|

Shorter electronic product life cycles,

which create opportunities for PCB manufacturers that can offer engineering support in the prototype stage

and manufacturing scalability throughout the production life cycle.

|

|

•

|

|

Increasing complexity of electronic products,

which requires technologically complex PCBs that can accommodate higher speeds and component

densities, including HDI, flexible, and substrate PCBs.

|

|

•

|

|

Growing trend towards sophisticated safety systems, automated driving, electric/hybrid vehicles and miniaturization of electronic devices in the automotive

industry,

which is driving increasing electronic content and higher PCB usage in automobiles, particularly increased demand for advanced technologies like HGI, rigid-flex and radar.

|

|

•

|

|

Increasing concentration of global PCB production in Asia.

In recent years, China has emerged as a global production center for electronics

manufacturers. We believe that the expected continued concentration of consumer electronic production in China should result in additional commercial market share potential for PCB manufacturers with a strong presence and reputation in China.

|

|

•

|

|

Supply chain consolidation by commercial OEMs,

which we believe presents an opportunity for those PCB manufacturers that can offer one-stop

manufacturing capabilities—from prototype to volume production.

|

S-2

Our competitive strengths

We believe that our key competitive strengths include:

|

•

|

|

Leading global PCB manufacturer.

The Company is one of the largest and most diversified PCB manufacturers in the world and

enjoys significant economies of scale, with net sales in excess of $2.1 billion for fiscal 2015 and $1.8 billion for the nine months ended September 26, 2016. The PCB industry is highly fragmented with the top 20 PCB providers comprising

approximately 47% of market share in 2015, according to NTI. As our customers consolidate their supply base, we offer the technology breadth and scale to emerge as a preferred partner.

|

|

•

|

|

Breadth of technology and products.

We offer a wide range of PCB products and electro-mechanical solutions, including HDI

PCBs, conventional PCBs, flexible PCBs, rigid-flex PCBs, custom assemblies, and IC substrates. We also offer certain value-added services to support our customers’ needs. These include design for manufacturability, or DFM, PCB layout design,

simulation and testing services, and quick turnaround, or QTA, services. By providing these value-added services to customers, we are able to provide our customers with a “one-stop” manufacturing solution, which we believe enhances our

relationships with our customers.

|

|

•

|

|

Diversified business model.

Our sales are diversified by the well-balanced portfolio of end markets which we serve and by

the customers we sell to within those end markets. We believe this diversity reduces our exposure to, and reliance on, any single end market or customer. We enjoy a large and diverse customer base with over 1,500 customers, as well as long-term

relationships in excess of ten years with our ten largest customers. For fiscal 2015, net sales to our top five customers represented approximately 37% of our total net sales. Furthermore, for fiscal 2015, our largest five customers are not

concentrated in any single end market, but rather are represented across four of our end markets.

|

|

•

|

|

Focused on attractive growth end markets including automotive with a favorable growth outlook and dependence on sophisticated product

capabilities.

We believe that our global manufacturing footprint and breadth of capabilities enables us to serve several of the key end markets for the PCB industry. The automotive industry in particular provides an

opportunity for us as we combine our traditional market strength in core automotive engine controls with the advanced technologies we offer for growing requirements in safety systems, automated driving and infotainment.

|

|

•

|

|

One-stop solution for customers with low volume, high-mix capabilities and an ability to seamlessly transition volume requirements to

Asia.

We are capable of providing a one-stop manufacturing solution to our customers from engineering support and prototype development through final volume production around the globe. This one-stop manufacturing

solution allows us to better serve our customers, many of whom are based in time-critical high growth markets, enabling our customers to reduce the time required to develop new products and bring them to market. We utilize a facility specialization

strategy in which each customer is directed to the facility best suited to the customer’s product type, delivery time, complexity and volume needs, which enables us to reduce the time from order placement to delivery. As our customers ramp to

volume, we are positioned to seamlessly transition them to one of our volume facilities in China.

|

|

•

|

|

Leading aerospace and defense supplier.

We provide the aerospace and defense industry with products in North America from

our broad North American footprint. We have passed OEM and government certification processes, and administrative requirements associated with participation in government and commercial aerospace programs. When supplying various departments and

agencies of the U.S. government, we are required to maintain facility security clearances under the National Industrial Security Program Operating

|

S-3

|

|

Manual and International Traffic in Arms Regulations. Along with supply of traditional PCBs, we offer our engineering services and assembly capabilities which allow us to bring additional value

to our customers.

|

Our business strategy

Our goal is to be the leading global provider of time-critical, one-stop manufacturing services for highly complex PCBs. Our core strategy includes the following elements:

|

•

|

|

Maintain our customer-driven culture and provide superior service to our customers in our core markets of networking communications, automotive, cellular

phones, aerospace and defense, medical, industrial and instrumentation, and computing and storage.

Our customer-oriented culture is designed to achieve extraordinary service, competitive differentiation, and superior

execution. Our customer-oriented strategies include engaging in co-development of new products, capturing new technology products for next generation equipment, and continuing to invest in and enhance our broad offering of PCB technologies. We

believe our ability to anticipate and meet customers’ needs is critical to retaining existing customers and attracting leading companies as new customers.

|

|

•

|

|

Drive operational efficiency and productivity.

We are constantly focused on improving our operational execution to increase

efficiency, productivity and yields. We strongly believe in the benefits of sharing best practices across our extensive manufacturing footprint and rely on stringent goals for throughput, quality and customer satisfaction to measure our

effectiveness. The fast paced nature of our business requires a disciplined approach to manufacturing that is rooted in continuous improvement.

|

|

•

|

|

Accelerate customer and end-market diversification through strategic mergers and acquisitions.

We have a history of

executing successful acquisitions that have been key to our growth and profitability. We continuously look for strategic opportunities that could facilitate our efforts to diversify into other growing end markets including automotive, aerospace and

defense and medical/industrial/instrumentation end markets. Our recent acquisition of Viasystems, which has increased our diversification into the automotive and medical/industrial/instrumentation end markets, demonstrates the benefits of this

strategy.

|

|

•

|

|

Accelerate our expansion into the automotive and other growing markets using our advanced technology position to differentiate our

operations.

With rising requirements for faster data transmission, shrinking features (i.e., lightweight and thin), and lower power consumption, many PCB designs have migrated to more complex HDI PCBs from conventional

multi-layer PCB technologies. This trend began with PCBs used in portable devices such as smartphones and tablets but has become an increasing trend in other end markets, such as automotive, networking/communications, medical, and aerospace and

defense. We are focused in particular on the automotive opportunity where the combination of our strength in highly reliable conventional PCBs and our advanced technology capabilities allows us to meet our automotive customers’ growing demand

in such areas as infotainment, radar systems, cameras for advanced driver assistance systems and electric vehicles. As our customers consolidate their supply chain, our objective is to differentiate ourselves as a supplier with the technology

breadth to meet most, if not all, of our automotive customers PCB requirements.

|

|

•

|

|

Address customer needs in all stages of the product life cycle.

By providing a one-stop solution, we work to service our

customers’ needs from the earliest stages of product development through volume production. We believe that by servicing our customers early in the development process, we are able to demonstrate our capabilities and establish an incumbent

position early in the product development cycle, which translates into additional opportunities as our customers move into volume production. We believe our expertise is

|

S-4

|

|

enhanced by our ability to deliver highly complex PCBs to customers in significantly compressed lead times. This rapid delivery service enables OEMs to develop sophisticated electronic products

more quickly and reduce their time to market.

|

|

•

|

|

Deliver strong financial performance.

Our strategy is to deliver industry-leading financial performance. We expect to

achieve this by servicing our customers’ needs in higher-growth end markets—meeting their product needs in a cost-efficient and effective manner. We believe that this strategy will allow us to generate strong cash flows, which will enable

us to reduce financial leverage over time while at the same time providing us with the financial flexibility to continue to invest in our business.

|

Our customers and markets

Our customers include both OEMs and EMS companies that primarily serve the

automotive, networking/communications, cellular phone, computing, aerospace and defense, and medical/industrial/instrumentation end markets of the electronics industry. Included in the end markets that our OEM and EMS customers serve is the U.S.

government. As a result, we are a supplier, primarily as a subcontractor, to the U.S. government.

The following table shows the percentage of our net

sales attributable to each of the principal end markets we served for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months

ended

September 26,

2016

|

|

|

Year ended

|

|

|

End markets(1)(2)(3)

|

|

|

December 28,

2015

|

|

|

December 29,

2014

|

|

|

December 30,

2013

|

|

|

Aerospace and Defense

|

|

|

15%

|

|

|

|

14%

|

|

|

|

16%

|

|

|

|

15%

|

|

|

Automotive(2)

|

|

|

20

|

|

|

|

13

|

|

|

|

2

|

|

|

|

2

|

|

|

Cellular Phone(4)

|

|

|

12

|

|

|

|

21

|

|

|

|

23

|

|

|

|

20

|

|

|

Computing/Storage/Peripherals(4)

|

|

|

13

|

|

|

|

12

|

|

|

|

13

|

|

|

|

20

|

|

|

Medical/Industrial/Instrumentation/Other

|

|

|

15

|

|

|

|

13

|

|

|

|

10

|

|

|

|

8

|

|

|

Networking/Communications

|

|

|

23

|

|

|

|

25

|

|

|

|

33

|

|

|

|

32

|

|

|

Other(2)(4)

|

|

|

2

|

|

|

|

2

|

|

|

|

3

|

|

|

|

3

|

|

|

|

|

|

|

|

|

Total

|

|

|

100%

|

|

|

|

100%

|

|

|

|

100%

|

|

|

|

100%

|

|

|

|

|

|

(1)

|

|

Sales to EMS companies are classified by the end markets of their OEM customers.

|

|

(2)

|

|

Certain reclassifications of prior year end market percentages have been made to conform to the current year presentation. Beginning 2015, Automotive has been reclassified from

the Other end market. Additionally, beginning in the first quarter of 2013, we reclassified substrate PCBs, which were included in the Other end market, into the end markets that the substrate PCBs are sold into—predominantly Cellular Phone.

|

|

(3)

|

|

Amounts include activity of Viasystems, which we acquired on May 31, 2015.

|

|

(4)

|

|

Smartphones are included in the Cellular Phone end market, tablets are included in the Computing/Storage/Peripherals end market and other mobile devices such as e-readers are

included in the Other end market.

|

Recent developments

On September 27, 2016, we amended and restated our term loan credit agreement dated May 31, 2015, or the New Term Loan, which resulted in a net decrease of $66.1 million in our outstanding term loan debt. Under the

New Term Loan, we incurred $775.0 million in term loan debt at an interest rate of LIBOR plus 4.25%, a reduction of 75 basis points from our previous term loan, and repaid in full the $841.1 million outstanding amount under our previous term loan.

Quarterly principal payments under the New Term Loan are due beginning in April 2020 with the remaining principal amount due on May 31, 2021. On September 27, 2016, we

S-5

also amended and restated our U.S. ABL credit facility dated May 31, 2015 to increase the amount available thereunder to $200.0 million, reduce the applicable margin by 0.25% for both Eurodollar

loans and ABR loans, and reduce the letters of credit facilities to $50.0 million. See “Incorporation of certain information by reference” for additional information.

Selling stockholder

In connection with our acquisition of the PCB business of Meadville Holdings Limited in

April 2010, Mr. Tang Hsiang Chien, Mr. Tang Ying Yen, or Henry Tang, Mein et Moi Limited and Su Sih (BVI) Limited, or the selling stockholder, first became beneficial owners of our common stock. As of September 26, 2016, on a fully diluted basis,

(i) the selling stockholder owned 21.6% of our outstanding common stock and (ii) after giving effect to this offering, the selling stockholder owned 12.2% (or 10.8% if the underwriters exercise their option to purchase additional shares from the

selling stockholder in full) of our common stock. As of September 26, 2016, on a non-diluted basis, (i) the selling stockholder owned 27.5% of our outstanding common stock and (ii) after giving effect to this offering, the selling stockholder owned

15.5% (or 13.7% if the underwriters exercise their option to purchase additional shares from the selling stockholder in full) of our outstanding common stock. See “Selling stockholder” for additional information.

Corporate information

We were originally incorporated in

Washington in 1978 and reincorporated in Delaware in 2005. We maintain our principal executive offices at 1665 Scenic Avenue, Suite 250, Costa Mesa, California 92626. Our telephone number is (714) 327-3000. Our website is located

at

www.ttm.com

. The information on, or that can be accessed through, our website is not incorporated by reference in this prospectus supplement, and you should not consider it to be a part of this prospectus supplement. Our website

address is included as an inactive textual reference only.

S-6

The offering

|

Common stock offered by the selling stockholder

|

12,000,000 shares (or 13,800,000 shares if the underwriters exercise their option to purchase additional shares from the selling stockholder in full)

|

|

Common stock outstanding after this offering

|

100,393,160 shares

|

|

Use of proceeds

|

The selling stockholder will receive all of the net proceeds from this offering. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholder. See “Use of

proceeds” for additional information.

|

|

Dividend policy

|

We do not anticipate paying any dividends on our common stock in the foreseeable future. However, we may change this policy in the future. See “Dividend policy.”

|

|

Risk factors

|

You should carefully consider the risk factors set forth in the section entitled “Risk factors” beginning on page S-11 of this prospectus supplement, in the accompanying prospectus, in any free

writing prospectus prepared by or on behalf of us, and the documents incorporated by reference herein and therein before making any decision to invest in our common stock.

|

|

The NASDAQ Global Select Market Symbol

|

“TTMI”

|

Unless otherwise indicated, all information in this prospectus supplement

relating to the number of shares of our common stock outstanding immediately after the closing of this offering is based on approximately 100.3 million shares outstanding as of September 26, 2016, and excludes:

|

•

|

|

209,300 shares issuable upon exercise of stock options outstanding as of September 26, 2016 at a weighted average exercise price of $11.19 per share;

|

|

•

|

|

627,588 shares issuable upon the vesting of performance-based restricted stock units outstanding as of September 26, 2016;

|

|

•

|

|

3,109,580 shares issuable upon the vesting of restricted stock units outstanding as of September 26, 2016;

|

|

•

|

|

an aggregate of 5,710,444 shares reserved for future grants under our 2014 Incentive Compensation Plan as of September 26, 2016;

|

|

•

|

|

25,940,325 shares issuable upon the exercise of outstanding warrants as of September 26, 2016 at an exercise price of $14.26 per share;

|

|

•

|

|

25,940,325 shares issuable upon the conversion of our 1.75% convertible senior notes due December 15, 2020, as of September 26, 2016; and

|

|

•

|

|

any exercise of the underwriters’ option to purchase additional shares of common stock from the selling stockholder.

|

S-7

Summary consolidated financial data

The summary consolidated statements of operations data and the cash flow data for the years ended December 30, 2013, December 29, 2014 and

December 28, 2015 and the summary consolidated balance sheet data as of December 28, 2015, are derived from our audited consolidated financial statements that are incorporated by reference into this prospectus supplement. The summary unaudited

interim consolidated statements of operations data and the cash flow data for the nine months ended September 28, 2015 and September 26, 2016 and the summary unaudited interim consolidated balance sheet data as of September 26, 2016 are derived from

our unaudited interim consolidated financial statements that are incorporated by reference into this prospectus supplement. The unaudited interim consolidated financial statements were prepared on a basis consistent with our audited consolidated

financial statements and include, in the opinion of management, all adjustments, consisting only of normal and recurring adjustments, necessary for a fair statement of the financial information set forth herein. The interim financial results

presented below are not necessarily indicative of financial results to be achieved for the full year or any future reporting period.

The following

selected consolidated financial data should be read in conjunction with our consolidated financial statements, the related notes and our “Management’s discussion and analysis of financial condition and results of operations” included

in our annual and quarterly reports which are incorporated by reference into this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

|

|

|

Nine months ended

|

|

|

|

|

December 28,

2015(1)

|

|

|

December 29,

2014

|

|

|

December 30,

2013

|

|

|

September 26,

2016

|

|

|

September 28,

2015(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

|

|

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

Consolidated statements of operations data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$

|

2,095,488

|

|

|

$

|

1,325,717

|

|

|

$

|

1,368,215

|

|

|

$

|

1,826,825

|

|

|

$

|

1,426,614

|

|

|

Cost of goods sold

|

|

|

1,785,351

|

|

|

|

1,131,028

|

|

|

|

1,150,372

|

|

|

|

1,536,055

|

|

|

|

1,224,747

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

310,137

|

|

|

|

194,689

|

|

|

|

217,843

|

|

|

|

290,770

|

|

|

|

201,867

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing

|

|

|

57,361

|

|

|

|

36,919

|

|

|

|

37,149

|

|

|

|

49,518

|

|

|

|

39,398

|

|

|

General and administrative

|

|

|

167,669

|

|

|

|

100,999

|

|

|

|

105,924

|

|

|

|

108,249

|

|

|

|

126,031

|

|

|

Amortization of definite-lived intangibles(3)

|

|

|

18,888

|

|

|

|

8,387

|

|

|

|

9,332

|

|

|

|

17,845

|

|

|

|

12,205

|

|

|

Gain on sale of assets(4)

|

|

|

(2,504

|

)

|

|

|

—

|

|

|

|

(17,917

|

)

|

|

|

—

|

|

|

|

(2,504

|

)

|

|

Restructuring charges(5)

|

|

|

7,381

|

|

|

|

—

|

|

|

|

3,445

|

|

|

|

8,005

|

|

|

|

1,936

|

|

|

Impairment of long-lived assets(6)

|

|

|

—

|

|

|

|

1,845

|

|

|

|

10,782

|

|

|

|

3,346

|

|

|

|

—

|

|

|

|

|

|

|

|

|

Total operating expenses:

|

|

|

248,795

|

|

|

|

148,150

|

|

|

|

147,715

|

|

|

|

186,963

|

|

|

|

177,066

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

61,342

|

|

|

|

46,539

|

|

|

|

69,128

|

|

|

|

103,807

|

|

|

|

24,801

|

|

|

|

|

|

|

|

|

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(59,753

|

)

|

|

|

(23,830

|

)

|

|

|

(24,031

|

)

|

|

|

(60,741

|

)

|

|

|

(39,545

|

)

|

|

Loss on extinguishment of debt(7)

|

|

|

(802

|

)

|

|

|

(506

|

)

|

|

|

(10,743

|

)

|

|

|

—

|

|

|

|

(802

|

)

|

|

Other, net

|

|

|

8,189

|

|

|

|

88

|

|

|

|

5,418

|

|

|

|

8,330

|

|

|

|

4,264

|

|

|

|

|

|

|

|

|

Total other expense, net

|

|

|

(52,366

|

)

|

|

|

(24,248

|

)

|

|

|

(29,356

|

)

|

|

|

(52,411

|

)

|

|

|

(36,083

|

)

|

|

Income (loss) before income taxes

|

|

|

8,976

|

|

|

|

22,291

|

|

|

|

39,772

|

|

|

|

51,396

|

|

|

|

(11,282

|

)

|

|

Income tax provision

|

|

|

(34,594

|

)

|

|

|

(7,598

|

)

|

|

|

(15,879

|

)

|

|

|

(14,011

|

)

|

|

|

(23,993

|

)

|

|

|

|

|

|

|

|

Net (loss) income

|

|

|

(25,618

|

)

|

|

|

14,693

|

|

|

|

23,893

|

|

|

|

37,385

|

|

|

|

(35,275

|

)

|

|

Less: Net income attributable to the non-controlling interest(8)

|

|

|

(264

|

)

|

|

|

—

|

|

|

|

(2,016

|

)

|

|

|

(519

|

)

|

|

|

(128

|

)

|

|

|

|

|

|

|

|

Net (loss) income attributable to TTM Technologies, Inc. stockholders

|

|

$

|

(25,882

|

)

|

|

$

|

14,693

|

|

|

$

|

21,877

|

|

|

$

|

36,866

|

|

|

$

|

(35,403

|

)

|

|

|

|

S-8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

|

|

|

Nine months ended

|

|

|

|

|

December 28,

2015(1)

|

|

|

December 29,

2014

|

|

|

December 30,

2013

|

|

|

September 26,

2016

|

|

|

September 28,

2015(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

|

|

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

(Loss) earnings per common stock attributable to TTM Technologies, Inc. stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.28

|

)

|

|

$

|

0.18

|

|

|

$

|

0.27

|

|

|

$

|

0.37

|

|

|

$

|

(0.39

|

)

|

|

Diluted

|

|

$

|

(0.28

|

)

|

|

$

|

0.18

|

|

|

$

|

0.26

|

|

|

$

|

0.36

|

|

|

$

|

(0.39

|

)

|

|

|

|

|

|

|

|

|

Weighted average common stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

92,675

|

|

|

|

83,238

|

|

|

|

82,506

|

|

|

|

100,004

|

|

|

|

90,522

|

|

|

Diluted

|

|

|

92,675

|

|

|

|

83,941

|

|

|

|

83,132

|

|

|

|

101,094

|

|

|

|

90,522

|

|

|

|

|

|

|

|

|

|

Cash flow data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating activities

|

|

|

237,462

|

|

|

|

129,810

|

|

|

|

71,388

|

|

|

|

200,686

|

|

|

|

97,632

|

|

|

Investing activities

|

|

|

(247,660

|

)

|

|

|

(108,571

|

)

|

|

|

(35,689

|

)

|

|

|

(57,467

|

)

|

|

|

(226,631

|

)

|

|

Financing activities

|

|

|

(5,756

|

)

|

|

|

(77,141

|

)

|

|

|

12,985

|

|

|

|

(106,359

|

)

|

|

|

(3,350

|

)

|

|

Capital expenditures

|

|

|

77,565

|

|

|

|

76,782

|

|

|

|

128,271

|

|

|

|

59,109

|

|

|

|

52,364

|

|

|

|

|

|

|

|

|

|

Other financial data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation of property, plant and equipment

|

|

$

|

133,508

|

|

|

$

|

95,349

|

|

|

$

|

92,120

|

|

|

$

|

117,690

|

|

|

$

|

94,403

|

|

|

|

|

|

(1)

|

|

Our results for fiscal 2015 include 211 days of activity of Viasystems Group, Inc., which we acquired on May 31, 2015. Additionally, our results include $34.4 million of bank

fees and legal, accounting and other professional service costs associated with the acquisition of Viasystems.

|

|

(2)

|

|

Our results for the nine months ended September 28, 2015 include 120 days of activity of Viasystems Group, Inc., which we acquired on May 31, 2015. Additionally, our results

include $32.9 million of bank fees and legal, accounting and other professional service costs associated with the acquisition of Viasystems.

|

|

(3)

|

|

Intangible assets include customer relationships, trade name, and licensing agreements, which are being amortized over their estimated useful lives using straight-line and

accelerated methods. The estimated useful lives of such intangibles range from three years to ten years.

|

|

(4)

|

|

Gain on sale of assets represents our sale of Meadville Aspocomp (Suzhou) Electronic Co., Ltd. subsidiary, which held its Suzhou, China manufacturing facility, for $21.3 million

recognizing a gain of $2.5 million in 2015. For fiscal 2013, gain on sale of assets represents our sale of a 70.2% controlling equity interest in Dongguan Shengyi Electronics Ltd. (SYE) for $114.5 million recognizing a gain of $17.9 million.

|

|

(5)

|

|

For fiscal 2013 the restructuring charges consist of employee separation costs related to the shutdown of the Company’s Meadville Aspocomp (Suzhou) Electronic Co., Ltd.

manufacturing facility. For the three quarters ended September 28, 2015 and September 26, 2016, restructuring charges represented employee separation and contract termination costs associated with our announced consolidation plan that resulted in

the closure of the Company’s facilities in Cleveland, Ohio, Milpitas, California and Juarez, Mexico. Accrued restructuring costs related to employee separation costs are included as a component of accrued salaries, wages and benefits in the

balance sheet.

|

|

(6)

|

|

For fiscal 2013 and fiscal 2014, the impairment of long-lived assets of $10.8 million and $1.8 million, respectively, related to the shut-down of the Company’s Meadville

Aspocomp (Suzhou) Electronic Co., Ltd. subsidiary and primarily related to machinery and equipment held for sale.

|

|

(7)

|

|

During fiscal 2013 and fiscal 2014, the Company repurchased convertible senior notes due 2015 and recognized losses of approximately $10.7 million and $506,000 for fiscal 2013

and fiscal 2014, respectively. The losses represented the premium paid to repurchase the convertible senior notes and the recognition of related unamortized debt discount and issuance costs. Additionally, in fiscal 2015, the Company paid in full the

remaining outstanding amount of $225.7 million of an existing 2012 credit agreement. As a result, the Company recognized a loss of approximately $802,000 during the year ended 2015 resulting from the write off of the remaining unamortized debt

issuance costs.

|

|

(8)

|

|

For fiscal 2013 the amount consisted of net income attributable to our minority interest holder in two PCB manufacturing subsidiaries. For the three quarters ended September 28,

2015 and September 26, 2016, the amount consisted of net income attributable to our 5% equity interest holder in a manufacturing facility in Huiyang, China.

|

S-9

Our consolidated balance sheet data as of December 28, 2015 and September 26, 2016 is presented below.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of

|

|

|

|

|

December 28,

2015

|

|

|

September 26,

2016

|

|

|

|

|

(unaudited)

|

|

|

|

|

(in thousands)

|

|

|

|

|

|

|

Consolidated balance sheet data:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

259,100

|

|

|

$

|

291,783

|

|

|

Working capital

|

|

|

277,526

|

|

|

|

309,121

|

|

|

Total assets(1)

|

|

|

2,640,133

|

|

|

|

2,607,226

|

|

|

Long-term debt, including current maturities(1)(3)

|

|

|

1,170,786

|

|

|

|

1,081,850

|

|

|

TTM Technologies, Inc. stockholders’ equity(2)(3)

|

|

|

819,105

|

|

|

|

845,032

|

|

|

|

|

|

(1)

|

|

Reflects adoption of Financial Accounting Update 2015-03 Imputation of Interest which requires that debt issuance costs related to debt be reported as a direct reduction from the

face amount of the debt. Beginning in fiscal 2016, the Company reclassified approximately $31.2 million of unamortized debt issuance costs that had been presented as other non-current assets as of December 28, 2015.

|

|

(2)

|

|

TTM Technologies, Inc. stockholders’ equity excludes noncontrolling interest.

|

|

(3)

|

|

As of September 26, 2016, after giving effect to the amendment and restatement of the New Term Loan and the payment of amounts outstanding under our previous term loan,

long-term debt, including current maturities was $1.093 billion and TTM Technologies, Inc. stockholders’ equity was $797.3 million.

|

S-10

Risk factors

Investing in our common stock involves risks. Before making an investment in our common stock, you should carefully consider, among other factors, the risks described below and elsewhere in this prospectus

supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. Please see “Statement regarding forward-looking statements” on page S-15 of this prospectus supplement. Please also see the risks

described in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, including those identified under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 28,

2015, and in our Quarterly Report on Form 10-Q for the quarterly period ended September 26, 2016. The risks described in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein are not

the only ones we face. Additional risks not presently known or that we currently deem immaterial could also materially adversely affect our business, financial condition, results of operations and prospects. Our business, financial condition and

results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our common stock could decline due to the materialization of any of these risks, and you may lose all or part of your

investment.

Risks relating to this offering and our common stock

The market price of our common stock may decline after the offering.

The price per share of common

stock sold in this offering may be more or less than the market price of our common stock on the date the offering is consummated. If the purchase price is greater than the market price at the time of sale, purchasers may experience an immediate

decline in the market value of the common stock purchased in this offering. If the actual purchase price is less than the market price for the shares of common stock, some purchasers in the offering may be inclined to immediately sell shares of

common stock to attempt to realize a profit. Any such sales, depending on the volume and timing, could cause the price of our common stock to decline. Additionally, because stock prices generally fluctuate over time, there is no assurance that

purchasers of our common stock in the offering will be able to sell shares after the offering at a price that is equal to or greater than the actual purchase price. Purchasers should consider these possibilities in determining whether to purchase

shares in the offering and the timing of any sales of shares of common stock.

Our stock price could be extremely volatile, and, as a result, you

may not be able to resell your shares at or above the price you paid for them.

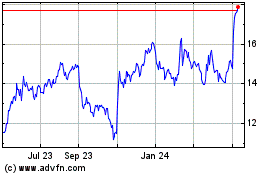

Since the beginning of our last fiscal year, the price of our

common stock, as reported by the NASDAQ, has ranged from a low of $4.67 on February 5, 2016 to a high of $14.69 on November 7, 2016. In addition, in recent years the stock market in general has been highly volatile. As a result, the market

price and trading volume of our common stock is likely to be similarly volatile, and investors in our common stock may experience a decrease, which could be substantial, in the value of their stock, including decreases unrelated to our results of

operations or prospects, and could lose part or all of their investment. The price of our common stock could be subject to wide fluctuations in response to a number of factors, including those described elsewhere in this prospectus supplement and

the accompanying prospectus and others such as:

|

•

|

|

variations in our operating performance and the performance of our competitors;

|

|

•

|

|

actual or anticipated fluctuations in our quarterly or annual operating results;

|

|

•

|

|

publication of research reports by securities analysts about us or our competitors or our industry;

|

|

•

|

|

the public’s reaction to our press releases, our other public announcements and our filings with the SEC;

|

S-11

|

•

|

|

our failure or the failure of our competitors to meet analysts’ projections or guidance that we or our competitors may give to the market;

|

|

•

|

|

additions and departures of key personnel;

|

|

•

|

|

strategic decisions by us or our competitors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic investments or changes in business

strategy;

|

|

•

|

|

the passage of legislation or other regulatory developments affecting us or our industry;

|

|

•

|

|

speculation in the press or investment community;

|

|

•

|

|

changes in accounting principles;

|

|

•

|

|

terrorist acts, acts of war or periods of widespread civil unrest;

|

|

•

|

|

natural disasters and other calamities; and

|

|

•

|

|

changes in general market and economic conditions.

|

In the past, securities class action litigation has often been initiated against companies following periods of volatility in their stock price. This type of litigation could result in substantial costs and divert

our management’s attention and resources, and could also require us to make substantial payments to satisfy judgments or to settle litigation.

Because we do not expect to pay any cash dividends for the foreseeable future, you may not receive any return on investment unless you sell your common stock

for a price greater than that which you paid for it.

We have not declared or paid any dividends since 2000 and do not anticipate paying any cash

dividends on our common stock in the foreseeable future. Any payment of cash dividends will be at the discretion of our board of directors and will depend on our financial condition, anticipated cash needs, capital requirements, legal requirements,

earnings and other factors. Our ability to pay dividends is restricted by the terms of our debt agreements and might be restricted by the terms of any indebtedness that we incur in the future. Consequently, you should not rely on dividends in order

to receive a return on your investment. See “Dividend policy.”

Provisions of our corporate governance documents and Delaware Law could

make an acquisition of our Company more difficult and may prevent attempts by our stockholders to replace or remove our current management, even if beneficial to our stockholders.

Our certificate of incorporation and bylaws and the Delaware General Corporation Law, or the DGCL, contain provisions that could make it more difficult for a third party to acquire us, even if doing so might be

beneficial to our stockholders. These provisions include:

|

•

|

|

the division of our board of directors into three classes and the election of each class for three-year terms;

|

|

•

|

|

advance notice requirements for stockholder proposals and director nominations;

|

|

•

|

|

the ability of the board of directors to fill a vacancy created by the expansion of the board of directors;

|

|

•

|

|

the ability of our board of directors to issue new series of, and designate the terms of, preferred stock, without stockholder approval, which could be used to,

among other things, institute a rights plan that would have the effect of significantly diluting the stock ownership of a potential hostile acquirer, likely preventing acquisitions that have not been approved by our board of directors;

|

|

•

|

|

limitations on the ability of stockholders to call special meetings and to take action by written consent; and

|

S-12

|

•

|

|

the required approval of holders of at least 80% of the voting power of the outstanding shares of our capital stock to adopt, amend or repeal certain provisions

of our certificate of incorporation and bylaws.

|

In addition, Section 203 of the DGCL may affect the ability of an

“interested stockholder” to engage in certain business combinations, for a period of three years following the time that the stockholder becomes an “interested stockholder.”

Because our board of directors is responsible for appointing the members of our management team, these provisions could in turn affect any attempt to replace

current members of our management team. As a result, you may lose your ability to sell your stock for a price in excess of the prevailing market price due to these protective measures, and efforts by stockholders to change the direction or

management of the Company may be unsuccessful. See “Description of capital stock” in the accompanying prospectus.

A significant portion

of our total outstanding shares are restricted from immediate resale but may be sold into the market in the near future. This could cause the market price of our common stock to drop significantly, even if our business is doing well.

Sales of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in the

market that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock. In connection with this offering, we and the selling stockholder will enter into 90-day lock-up agreements with the

underwriters. After the lock-up period, these shares will, however, be freely transferrable pursuant to Rule 144 under the Securities Act, except for shares held by our “affiliates,” who are subject to additional conditions under Rule 144.

We have also filed a Form S-8 under the Securities Act to register shares of common stock that we may issue under our equity compensation plans. In addition, the selling stockholder has demand registration rights that could require us in the future

to file registration statements in order to sell their common stock. Such sales could be significant. Once we register these shares, they can be freely sold in the public market upon issuance, subject to the lock-up agreements described in the

“Underwriting” section of this prospectus supplement. As restrictions on resale end, the market price of our stock could decline if the holders of currently restricted shares sell them or are perceived by the market as intending to sell

them.

Future sales of our common stock or other securities may dilute the value and adversely affect the market price of our common stock.

In the future, we may issue additional equity securities, through public or private offerings, in order to raise additional capital. Pursuant to

our certificate of incorporation, our board of directors has the authority, without action by stockholders, to designate and issue preferred stock in one or more series. Our board of directors may also designate the rights, preferences and

privileges of each series of preferred stock, any or all of which may be superior to the rights of the common stock. Any such issuance would reduce your influence over matters on which our stockholders vote, would dilute the percentage of ownership

interest of existing stockholders and may dilute the per share book value of the common stock. In addition, option holders may exercise their options at a time when we would otherwise be able to obtain additional equity capital on more favorable

terms. Any issuances of preferred stock would likely result in your interest being subject to the prior rights of holders of that preferred stock. The market price of our common stock could decline as a result of this offering as well as sales of

shares of our common stock made after this offering or the perception that such sales could occur.

Our ability to use net operating loss

carryforwards to offset future taxable income for U.S. federal income tax purposes is subject to limitation, and future transfers of shares could cause us to experience an “ownership change” that could further limit our ability to utilize

our net operating losses.

Under U.S. federal income tax law, a corporation’s ability to utilize its net operating losses, or NOLs, to

offset future taxable income may be significantly limited if it experiences an “ownership change” as defined in

S-13

Section 382 of the Internal Revenue Code of 1986, as amended, which we refer to as the Code. In general, an ownership change will occur if there is a cumulative change in a

corporation’s ownership by “5-percent shareholders” that exceeds 50 percentage points over a rolling three-year period. A corporation that experiences an ownership change will generally be subject to an annual limitation on its

pre-ownership change NOLs equal to the value of the corporation immediately before the ownership change, multiplied by the long-term tax-exempt rate (subject to certain adjustments). The annual limitation for a taxable year generally is increased by

the amount of any “recognized built-in gains” for such year and the amount of any unused annual limitation in a prior year. As a result of our acquisition of Viasystems, the NOLs acquired were subject to this limitation. If we experience a

change in ownership, our NOLs could be further limited.

S-14

Statement regarding forward-looking statements

This prospectus supplement, the accompanying prospectus, any related free writing prospectus and the documents incorporated by reference herein and therein may

contain forward-looking statements regarding future events or our future financial and operational performance, within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act.

Forward-looking statements include statements regarding markets for our products; trends in net sales, gross profits and estimated expense levels; liquidity and anticipated cash needs and availability; and any statement that contains the words

“anticipate,” “believe,” “plan,” “forecast,” “foresee,” “estimate,” “project,” “expect,” “seek,” “target,” “intend,” “goal” and

other similar expressions.

The forward-looking statements included in this prospectus supplement, the accompanying prospectus, any related free writing

prospectus and the documents incorporated by reference herein and therein reflect our current expectations and beliefs, and we do not undertake publicly to update or revise these statements, even if experience or future changes make it clear that

any projected results expressed in this prospectus, any prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein and therein will not be realized. In addition, the inclusion of any statement in

this prospectus, any prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein and therein does not constitute an admission by us that the events or circumstances described in such statement are

material. Furthermore, we wish to caution and advise readers that these statements are based on assumptions that may not materialize and may involve risks and uncertainties, many of which are beyond our control that could cause actual events or

performance to differ materially from those contained or implied in these forward-looking statements.

Among the factors that could cause actual results

to differ materially are the factors discussed under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 28, 2015 and each subsequently filed Quarterly Report on Form 10-Q. We also will include or

incorporate by reference in each prospectus supplement important factors that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Some additional factors that could cause actual

results to differ include:

|

•

|

|

our ability to minimize design or manufacturing defects in our products;

|

|

•

|

|

changes in our industry, interest rates, or the general economy;

|

|

•

|

|

the effects of economic cycles and fluctuations in the worldwide demand for electronic products;

|

|

•

|

|

our ability to adapt to changing laws and regulations in China;

|

|

•

|

|

our ability to manage the risks associated with manufacturing facilities inside and outside of the United States;

|

|

•

|

|

our ability to respond to technological change and process development;

|

|

•

|

|

our ability to compete successfully against other manufacturers;

|

|

•

|

|

our reliance on a relatively small number of OEMs for a large portion of our net sales;

|

|

•

|

|

our reliance on raw materials suppliers to satisfy our product quality standards;

|

|

•

|

|

our ability to comply with environmental laws;

|

|

•

|

|

our reliance on the U.S. government for a substantial portion of our business;

|

S-15

|

•

|

|

our ability to retain our employees who have important industry experience, including our key senior executives;

|

|

•

|

|

our future sources of, and needs for, liquidity and capital resources;

|

|

•

|

|

our ability to repay our debt obligations as they come due;

|

|

•

|

|

our ability to successfully integrate acquisitions;

|

|

•

|

|

our exposure to intellectual property infringement claims and litigation;

|

|

•

|

|

the effect of climate change initiatives on our business and operations; and

|

|

•

|

|

our reliance on OEMs to outsource their PCB manufacturing and backplane assemble needs for us.

|

Should one or more known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially

from past results and those anticipated, estimated, projected, or implied by these forward-looking statements. You should consider these factors and the other cautionary statements made in this prospectus supplement, the accompanying prospectus, any

related free writing prospectus and the documents incorporated by reference herein or therein as being applicable to all related forward-looking statements wherever they appear in this prospectus supplement, the accompanying prospectus, any related

free writing prospectus and the documents incorporated by reference herein and therein. While we may elect to update forward-looking statements wherever they appear in this prospectus supplement, the accompanying prospectus, any related free writing

prospectus and the documents incorporated by reference herein, we do not assume, and specifically disclaim, any obligation to do so, whether as a result of new information, future events, or otherwise, except as required by law. Because of these

uncertainties, you should not place undue reliance on these forward-looking statements.

S-16

Use of proceeds

The selling stockholder will receive all of the net proceeds from this offering. We will not receive any of the proceeds from the sale of shares of common stock

offered by the selling stockholder. We will, however, bear certain costs associated with the sale of shares by the selling stockholder, other than any underwriting compensation and any costs the selling stockholder has agreed to bear pursuant to the

underwriting agreement and the relevant registration rights agreement.

S-17

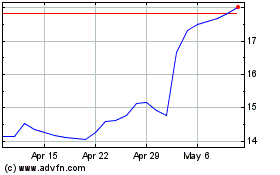

Price range of our common stock

Our common stock, par value $0.001 per share, is traded on the NASDAQ Global Select Market under the symbol “TTMI.” The following table represents the

range of high and low sale prices for our common stock. Such prices reflect interdealer prices, without retail mark-up, mark-down or commission, and may not necessarily represent actual transactions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

|

Low

|

|

|

2016

|

|

Fourth Quarter (through November 11, 2016)

|

|

$

|

14.69

|

|

|

$

|

10.85

|

|

|

|

|

Third Quarter

|

|

$

|

11.58

|

|

|

$

|

6.93

|

|

|

|

|

Second Quarter

|

|

$

|

8.16

|

|

|

$

|

6.22

|

|

|

|

|

First Quarter

|

|

$

|

6.97

|

|

|

$

|

4.67

|

|

|

|

|

|

|

|

2015

|

|

Fourth Quarter

|

|

$

|

8.31

|

|

|

$

|

5.96

|

|

|

|

|

Third Quarter

|

|

$

|

10.18

|

|

|

$

|

6.09

|

|

|

|

|

Second Quarter

|

|

$

|

10.93

|

|

|

$

|

8.77

|

|

|

|

|

First Quarter

|

|

$

|

9.27

|

|

|

$

|

6.87

|

|

|

|

|

|

|

|

2014

|

|

Fourth Quarter

|

|

$

|

7.73

|

|

|

$

|

5.59

|

|

|

|

|

Third Quarter

|

|

$

|

8.44

|

|

|

$

|

6.72

|

|

|

|

|

Second Quarter

|

|

$

|

8.49

|

|

|

$

|

7.24

|

|

|

|

|

First Quarter

|

|

$

|

8.75

|

|

|

$

|

7.33

|

|

|

|

|