Q3 2016 OVERVIEW

- Revenue totaled $14.4 million, compared

to $14.8 million in Q3 2015.

- Selling, general and administrative

expenses decreased 20% to $3.0 million, or 21% of revenue, from

$3.8 million, or 26% of revenue, in Q3 2015.

- Adjusted EBITDA increased to

approximately $605,000 from approximately $75,000 in Q3 2015.

- Operating income rose to $0.4 million,

which included restructuring charges of approximately $85,000, from

an operating loss of $3.6 million, which included including

restructuring charges of $1.6 million and write-down of capitalized

software development costs of $1.5 million, in Q3 2015.

- Net income grew to $0.2 million, or

$0.01 per diluted share, compared to a net loss of $3.8 million, or

$(0.21) per diluted share, in Q3 2015.

- Adjusted net income, excluding the

impact of gain/loss from the change in fair value of contingent

consideration, restructuring charges, stock-based compensation

expense and consulting support for finance restructuring, increased

to $0.4 million, or $0.02 per basic and diluted share, from an

adjusted net loss of $1.7 million, or $(0.10) per basic and diluted

share, in Q3 2015.

- New orders more than doubled to $13.8

million from $5.3 million in Q3 2015, driven by two international

projects to modernize nuclear simulators in the UK and Japan.

At September 30, 2016

- Cash and equivalents of $17.4 million,

or $0.94 per diluted share, including $3.3 million of restricted

cash.

- Working capital of $11.9 million and

current ratio of 1.5x.

- $0 long-term debt.

- Backlog totaled $69.3 million, up 45%

compared to year-end 2015 backlog of $47.9 million.

- Year-to-date cash flow from operations

increased 197% year over year to $3.9 million.

GSE Systems, Inc. (“GSE” or “the Company”) (NYSE

MKT:GVP), the world leader in real-time high-fidelity

simulation systems and training solutions to the power and process

industries, today announced financial results for the third quarter

(“Q3”) ended September 30, 2016.

Kyle J. Loudermilk, GSE’s President and Chief Executive Officer,

said, “We are pleased to report GSE’s fifth consecutive quarter of

positive adjusted EBITDA, which grew significantly on a year over

year basis in Q3 2016, driven by our efforts to increase our

backlog, reduce costs and streamline operations. This quarter we

continued to win important new projects, including two contracts to

modernize nuclear simulators in the UK and Japan, which demonstrate

the global strength of our innovative simulation solutions. Our

backlog remains strong, we have enhanced our leadership team and

Board, and we are actively pursuing exciting organic and inorganic

growth opportunities. We are focused on generating positive revenue

growth in 2017 while continuing to generate strong cash flow and

improved profitability. Our increasingly strong balance sheet and

operational performance put us in a great position to affect our

growth strategy.”

Q3 2016 RESULTS

Q3 2016 revenue totaled $14.4 million, compared to $14.8 million

in Q3 2015, reflecting a 5% increase in Performance Improvement

Solutions revenue and a 17% decrease in Nuclear Industry Training

and Consulting revenue due to a strategic shift in sales focus to

higher margin assignments. However, the slight decrease in Nuclear

Industry Training and Consulting gross profit percentage during the

three months ended Q3 2016 was primarily due to $1.3 million of

revenue recognized from a large customer that had lower than normal

margins of approximately 9%.

Three Months ended

Nine Months ended

(in thousands)

September 30,

September 30,

Revenue:

2016

2015

2016

2015

(unaudited) (unaudited) (unaudited) (unaudited) Performance

Improvement Solutions $ 10,215 $ 9,751 $ 27,382 $ 26,798 Nuclear

Industry Training and Consulting 4,213 5,058

12,438 15,678 Total Revenue $

14,428 $ 14,809 $ 39,820 $ 42,476

Performance Improvement Solutions new orders totaled $10.2

million in Q3 2016 compared to $3.8 million in Q3 2015. Nuclear

Industry Training and Consulting new orders totaled $3.6 million in

Q3 2016 compared to $1.5 million in Q3 2015.

Q3 2016 gross profit was $3.7 million, or 25.8% of revenue,

compared to $2.1 million, or 13.9% of revenue, in Q3 2015.

(in thousands)

Three Months ended

Nine Months ended

September 30,

September 30,

Gross Profit:

2016

%

2015

%

2016

%

2015

% (unaudited) (unaudited) (unaudited)

(unaudited) Performance Improvement Solutions $ 3,233

31.6 % $ 2,919 29.9 % $ 9,287 33.9 % $ 7,993 29.8 % Nuclear

Industry Training and Consulting 491 11.7 %

676 13.4 % 1,620 13.0 % 1,782

11.4 % Total Gross Profit 3,724 25.8 % 3,595 24.3 % 10,907 27.4 %

9,775 23.0 %

Less: Write-down of Capitalized Software

Development Costs

- - 1,538 10.4 % - -

1,538 3.6 % Consolidated Gross Profit $ 3,724

25.8 % $ 2,057 13.9 % $ 10,907 27.4 % $ 8,237

19.4 %

Performance Improvement Solutions gross profit for Q3 2016 was

$3.2 million, or 31.6% gross margin, compared to $2.9 million, or

29.9% gross margin, in Q3 2015. Nuclear Industry Training and

Consulting gross profit for Q3 2016 was approximately $491,000, or

11.7% gross margin, compared to approximately $676,000, or 13.4%

gross margin, in Q3 2015. Gross profit in Q3 2015 included a

write-down of capitalized software development costs totaling $1.5

million; no such charges were recorded in Q3 2016.

Selling, general and administrative expenses in Q3 2016

decreased 20% to $3.0 million, or 21.1% of revenue, from $3.8

million, or 25.7% of revenue, in Q3 2015.

Operating income for Q3 2016 was approximately $433,000 compared

to an operating loss of $3.6 million in Q3 2015.

Net income for Q3 2016 was approximately $168,000, or $0.01 per

basic and diluted share, compared to a net loss of $3.8 million, or

$(0.21) per basic and diluted share, in Q3 2015.

Adjusted net income, excluding the impact of gain/loss from the

change in fair value of contingent consideration, restructuring

charges, stock-based compensation expense and consulting support

for finance restructuring, increased to $0.4 million, or $0.02 per

basic and diluted share, from an adjusted net loss of $1.7 million,

or $(0.10) per basic and diluted share, in Q3 2015.

Earnings before interest, taxes, depreciation and amortization

(“EBITDA”) for Q3 2016 was approximately $400,000 compared to an

EBITDA loss of $3.5 million in Q3 2015.

Adjusted EBITDA, which excludes the impact of restructuring

charges, write-down of capitalized software development costs,

gain/loss from the change in fair value of contingent

consideration, consulting support for finance restructuring and

stock-based compensation expense, increased to approximately

$605,000 in Q3 2016 from approximately $75,000 in Q3 2015.

Backlog at September 30, 2016, increased 45% to $69.3 million

from $47.9 million at December 31, 2015. Backlog at September 30,

2016, included $63.5 million of Performance Improvement Solutions

backlog and $5.8 million of Nuclear Industry Training and

Consulting backlog.

GSE’s cash position at September 30, 2016, was $17.4 million,

including $3.3 million of restricted cash, as compared to $14.6

million, including $3.6 million of restricted cash, at December 31,

2015.

CONFERENCE CALL

Management will host a conference call today at 4:30 pm Eastern

Time to discuss Q3 results and other matters.

Interested parties may participate in the call by dialing:

- (877) 407-9753 (Domestic)

- (201) 493-6739 (International)

The conference call will also be accessible via the following

link:http://www.investorcalendar.com/IC/CEPage.asp?ID=175387

For those who cannot listen to the live broadcast, an online

webcast replay will be available at www.gses.com or through

February 14, 2017 at the following

link:http://www.investorcalendar.com/IC/CEPage.asp?ID=175387

ABOUT GSE SYSTEMS,

INC.

GSE Systems, Inc. is a world leader in real-time high-fidelity

simulation, providing a wide range of simulation, training and

engineering solutions to the power and process industries. Its

comprehensive and modular solutions help customers achieve

performance excellence in design, training and operations. GSE’s

products and services are tailored to meet specific client

requirements such as scope, budget and timeline. The Company has

over four decades of experience, more than 1,100 installations, and

hundreds of customers in over 50 countries spanning the globe. GSE

Systems is headquartered in Sykesville (Baltimore), Maryland, with

offices in Huntsville, Alabama; Chennai, India; Nyk�ping, Sweden;

Stockton-on-Tees, UK; and Beijing, China. Information about GSE

Systems is available at www.gses.com.

FORWARD LOOKING

STATEMENTS

We make statements in this press release that are considered

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934. These statements reflect our

current expectations concerning future events and results. We use

words such as “expect,” “intend,” “believe,” “may,” “will,”

“should,” “could,” “anticipates,” and similar expressions to

identify forward-looking statements, but their absence does not

mean a statement is not forward-looking. These statements are not

guarantees of our future performance and are subject to risks,

uncertainties, and other important factors that could cause our

actual performance or achievements to be materially different from

those we project. For a full discussion of these risks,

uncertainties, and factors, we encourage you to read our documents

on file with the Securities and Exchange Commission, including

those set forth in our periodic reports under the forward-looking

statements and risk factors sections. We do not intend to update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

GSE SYSTEMS, INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of

Operations

(in thousands, except share and per share

data)

Three Months ended Nine

Months ended September 30, September 30,

2016 2015 2016 2015

(unaudited) (unaudited) (unaudited) (unaudited) Revenue $ 14,428 $

14,809 $ 39,820 $ 42,476 Cost of revenue 10,704 11,214 28,913

32,701 Write-down of capitalized software dev. costs -

1,538 - 1,538

Gross profit 3,724 2,057 10,907 8,237 Selling,

general and administrative 3,043 3,811 9,032 11,031 Restructuring

charges 85 1,600 487 1,746 Depreciation 91 119 294 383 Amortization

of definite-lived intangible assets 72 123

219 370 Operating expenses

3,291 5,653 10,032

13,530 Operating income (loss) 433 (3,596 ) 875

(5,293 ) Interest income, net 11 19 52 67 Loss on derivative

instruments, net (211 ) 20 (346 ) (59 ) Other income (expense), net

15 (156 ) 112 (235 )

Income (loss) before income taxes 248 (3,713 ) 693 (5,520 )

Provision for income taxes 80 50

275 211 Net income (loss) $ 168

$ (3,763 ) $ 418 $ (5,731 ) Basic earnings

(loss) per common share $ 0.01 $ (0.21 ) $ 0.02 $

(0.32 ) Diluted earnings (loss) per common share $ 0.01 $

(0.21 ) $ 0.02 $ (0.32 ) Weighted average shares

outstanding - Basic 18,230,148 17,894,272

18,052,019

17,890,020 Weighted average shares outstanding

- Diluted 18,470,117 17,894,272

18,287,870 17,890,020

GSE SYSTEMS, INC AND

SUBSIDIARIES

Selected Balance Sheet Data (in

thousands)

(unaudited) (audited)

September 30,

2016 December 31, 2015 Cash and cash equivalents

$

14,093

$

11,084

Restricted cash – current 1,601 1,771 Current assets 34,839 28,414

Long-term restricted cash 1,735 1,779 Total assets 45,132 39,371

Current liabilities $ 22,943 $ 19,708 Long-term liabilities

2,076 1,295 Stockholders' equity 20,113 18,368

EBITDA and Adjusted EBITDA

Reconciliation (in thousands)

EBITDA and Adjusted EBITDA are not measures of financial

performance under generally accepted accounting principles

(“GAAP”). Management believes EBITDA and Adjusted EBITDA, in

addition to operating profit, net income and other GAAP measures,

are useful to investors to evaluate the Company’s results because

it excludes certain items that are not directly related to the

Company’s core operating performance that may, or could, have a

disproportionate positive or negative impact on our results for any

particular period. Investors should recognize that EBITDA and

Adjusted EBITDA might not be comparable to similarly-titled

measures of other companies. This measure should be considered in

addition to, and not as a substitute for or superior to, any

measure of performance prepared in accordance with GAAP. A

reconciliation of non-GAAP EBITDA and Adjusted EBITDA to the most

directly comparable GAAP measure in accordance with SEC Regulation

G follows:

Three Months ended Nine Months ended

September 30, September 30, 2016

2015 2016 2015 Net income (loss) $ 168

$ (3,763 ) $ 418 $ (5,731 ) Interest income, net (11 ) (19 ) (52 )

(67 ) Provision for income taxes 80 50 275 211 Depreciation and

amortization 163 242 513

753 EBITDA 400 (3,490 ) 1,154 (4,834 ) Write-down of

capitalized software development costs - 1,538 - 1,538 Gain/Loss

from the change in fair value of contingent consideration (524 )

306 (370 ) 739 Restructuring charges 85 1,600 487 1,746 Stock-based

compensation expense 412 121 900 392 Consulting support for finance

restructuring 232 - 310

- Adjusted EBITDA $ 605 $ 75 $ 2,481

$ (419 )

Adjusted Net Income and Adjusted EPS

Reconciliation (in thousands, except per share amounts)

Adjusted Net Income and adjusted earnings (loss) per share

(“adjusted EPS”) are not measures of financial performance under

generally accepted accounting principles (“GAAP”). Management

believes adjusted net income and adjusted EPS, in addition to other

GAAP measures, are useful to investors to evaluate the Company’s

results because they exclude certain items that are not directly

related to the Company’s core operating performance that may, or

could, have a disproportionate positive or negative impact on our

results for any particular period. These measures should be

considered in addition to, and not as a substitute for or superior

to, any measure of performance prepared in accordance with GAAP. A

reconciliation of non-GAAP adjusted net income and adjusted EPS to

GAAP net income, the most directly comparable GAAP financial

measure, is as follows:

Three Months ended Nine Months ended

September 30, September 30, 2016

2015 2016 2015 Net income

(loss) $ 168 $ (3,763 )

$ 418 $ (5,731 ) Gain/loss from

the change in fair value of contingent consideration (524 ) 306

(370 ) 739 Restructuring charges 85 1,600 487 1,746 Stock-based

compensation expense 412 121 900 392 Consulting support for finance

restructuring 232 - 310

- Adjusted net income $ 373 $ (1,736 ) $ 1,745 $

(2,854 ) Earnings (loss) per share - diluted $ 0.01 $ (0.21

) $ 0.02 $ (0.32 ) Adjusted earnings (loss) per share -

diluted $ 0.02 $ (0.10 ) $ 0.10 $ (0.16 ) Weighted average

shares outstanding - Diluted 18,470,117 17,894,272 18,287,870

17,890,020

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161114006461/en/

CompanyGSE Systems, Inc.Chris Sorrells, 410-970-7802Chief

Operating OfficerorThe Equity Group Inc.Devin Sullivan,

212-836-9608Senior Vice

Presidentdsullivan@equityny.comorKalle Ahl, CFA,

212-836-9614Senior Associatekahl@equityny.com

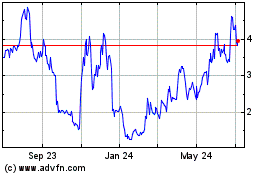

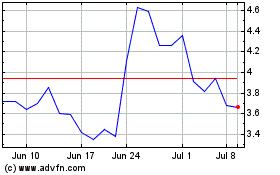

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Apr 2023 to Apr 2024