The sleepy movie-theater industry rarely is a player in

big-ticket deals. But after working for months to get skeptical

investors on board, AMC Entertainment Holdings Inc. appears poised

to win shareholder approval for an acquisition that would make it

the largest exhibitor in the world.

AMC, which currently is the second-biggest theater chain in the

U.S., plans to pay $1.2 billion to acquire Carmike Cinemas Inc., a

tie-up that Carmike shareholders are expected to vote on Tuesday.

The initial deal, announced in March, was met with investor

backlash and forced a delay of the vote.

Meanwhile, AMC Chief Executive Adam Aron is pursuing a second

acquisition that would expand the company to Europe. The deal is

expected to close by the end of the year.

"Two acquisitions at the same time," said Mr. Aron in a recent

interview shortly after completing a roadshow to raise a debt

offering to help fund the deals. "We have a capital expenditure for

each, so we need to make sure we raise the funds."

AMC's deals—the $650 million purchase of Europe's Odeon &

UCI Cinemas Group, in addition to the Carmike acquisition—are

expected to take AMC's theatrical footprint to about 900 locations,

from about 388. Its stateside merger with Carmike, currently the

nation's No. 4 exhibitor with 273 theaters, is considered the

largest possible tie-up in exhibition that would pass Justice

Department scrutiny.

The deal combines AMC, an urban-centric chain that has drawn

attention for its recent state-of the-art auditorium renovations,

with Carmike, which largely has operated lower-cost multiplexes in

rural parts of the country.

It has been a long eight months for AMC, majority-owned by

Beijing-based Dalian Wanda Group Co., since the Carmike deal was

announced. Shareholder blowback to the initial offer—$30 a share in

a $1.1 billion deal—forced the company to delay votes on the

acquisition, and political opposition began mounting because of

AMC's Chinese ownership.

But now that AMC has come back with an offer of $33.06 a share

and some AMC stock, enough support is expected to win shareholder

approval, according to people familiar with the matter. The

improved terms helped convince some major investors and proxy

advisory firms to reverse course and endorse the deal.

New shareholders who have come on board since the initial offer

also are helping to muster enough votes to complete the deal, say

people familiar with the matter.

Several investment firms specializing in arbitrage bets have

bought into Carmike since March and now appear likely to see

short-term gains because of the sweetened terms. They include

Magnetar Financial LLC and Driehaus Capital Management LLC, which

didn't have Carmike stock a month before the acquisition's

announcement but is now the company's largest shareholder, with a

stake of just under 10%.

Those late-arriving shareholders have annoyed investors such as

Chris Mittleman, whose Mittleman Brothers LLC is Carmike's

second-largest shareholder with a 9.5% stake. He said his firm

would vote against the deal.

"Most of the major shareholders now are newcomers who came in

when it was announced at $30. Making 10% in a very short period of

time? They're probably dancing about it," Mr. Mittleman said.

Among his grievances: Carmike didn't shop itself around to other

companies that could have run up the bid, and a premium should be

offered because Carmike represents the biggest possible company

that AMC likely could acquire under antitrust rules. Irate about

AMC's valuation of Carmike, Mr. Mittleman argued that $40 a share

was a minimum fair value.

Carmike declined to comment.

Resistance to the deal also has come from Washington, D.C.,

operative Richard Berman, a prominent lobbyist who has waged a

campaign against AMC's controlling stakeholder, Wanda, which

includes opinion articles, lobbying Congress, and paying for

billboards that refer to AMC as "China's Red Puppet." He also has

organized demonstrations outside some Carmike theaters.

Even if the deal goes through, Mr. Berman said he would be

fighting a long-term battle against Chinese intrusion into U.S.

media holdings. "It's building up steam to affect future deals in

Hollywood and the media space," he said.

Mr. Aron rejected the claim that Wanda controlled the operations

of his company. AMC is an "American company led by American

management from Leawood, Kan., which is about as American as you

can get," Mr. Aron said.

If the Carmike deal goes through, AMC plans to invest "hundreds

of millions of dollars" in upgrading Carmike theaters and bringing

the chain into its growing loyalty program, Mr. Aron said.

Odeon patrons in Europe also will soon see theater upgrades that

include the installation of AMC's signature reclining seats and

expanded food-and-drink options.

Carmike renovations will run from extensive—wholesale changes

that take up to three years—to smaller improvements, such as the

installation of Coca-Cola "Freestyle" machines that dispense 100

different flavors of soda. The soft-drink machines represent a $25

million investment and could start appearing in lobbies by

mid-2017, Mr. Aron said.

AMC will operate Carmike under a "two-brand strategy" that will

label some theaters as AMC and others as something different, Mr.

Aron noted. Sticking with the Carmike name remains an option for

those locations, he added.

(END) Dow Jones Newswires

November 13, 2016 20:15 ET (01:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

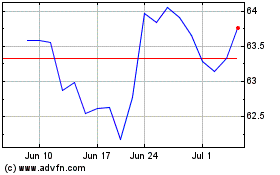

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024