Dollar Rallies Against Emerging Market-Currencies

November 10 2016 - 5:16PM

Dow Jones News

By Ira Iosebashvili

The dollar rose against emerging-market currencies on Thursday,

as investors unwound bets on developing countries amid expectations

that interest rates will continue to rise in the U.S.

The U.S. currency was recently up 5.3% against the Brazilian

real, while notching a 5.5% gain against the South African rand and

rallying 4.3% against the Mexican peso. The Wall Street Journal

Dollar Index, which measures the U.S. currency against 16 others,

was recently up 0.7% to 89.48, its highest since March.

A selloff in government bonds accelerated momentum on Thursday,

sending interest rates higher, as investors reacted to the prospect

of increased fiscal stimulus under a Donald Trump presidency. The

jump in yields is making it less-profitable for investors to run

carry trades, a strategy in which market participants borrow in

dollars to invest in higher yielding emerging market

currencies.

As a result, some market participants are locking in profits on

currencies that have shown big gains this year, such as the real

and the rand. Many also believe protectionist policies Mr. Trump

has advocated will hurt economies that depend on exports to the

U.S., particularly Mexico.

"High yielding currencies are now feeling the pain from rising

yields," said Paresh Upadhyaya, director of currency strategy at

Pioneer Investments.

A conciliatory victory speech by Republican president elect

Donald Trump on Wednesday and pledges by central banks to intervene

in currency markets if necessary have helped calm investors in the

days since the U.S. election.

If markets remain sanguine, many believe, there will be little

to stop the Federal Reserve from raising rates in December, a move

that would boost the dollar by making it more attractive to

yield-seeking investors.

Federal-funds futures, used to speculate on central bank policy,

on Thursday showed investors assigned a 76.3% likelihood of a rate

increase in December, compared with 71.5% the previous day.

The dollar was up 1.1% at Yen106.86 against the Japanese

currency. The euro was down 0.2% at $1.0891.

Write to Ira Iosebashvili at ira.iDollar Rallies Against

Emerging Market Currencies osebashvili@wsj.com

(END) Dow Jones Newswires

November 10, 2016 17:01 ET (22:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

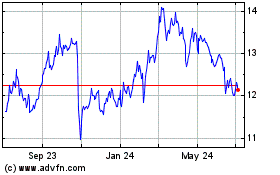

Western Union (NYSE:WU)

Historical Stock Chart

From Mar 2024 to Apr 2024

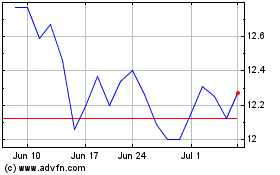

Western Union (NYSE:WU)

Historical Stock Chart

From Apr 2023 to Apr 2024