- 3Q16 total sales nearly tripled from

3Q15 to record $3.4 million

- Affirms outlook to reach positive

adjusted cash flow from operations in December 2016

- Regained compliance with NYSE

listing requirements

Conference call begins today at 4:30 p.m.

Eastern time

NovaBay® Pharmaceuticals, Inc. (NYSE MKT: NBY), a

biopharmaceutical company focusing on commercializing its

prescription Avenova® lid and lash hygiene product for the domestic

eye care market, reports financial results for the three and nine

months ended September 30, 2016, and provides a business

update.

“This is an exceptional time at NovaBay as we achieved yet

another quarter of record Avenova sales, growing 176% over the

third quarter of 2015 and up 20% from the second quarter of 2016,

and putting us on an estimated annualized run rate of $12 million,”

said Mark M. Sieczkarek, NovaBay’s President and CEO. “Importantly,

68% of Avenova sales came from the higher-margin prescription

ophthalmology channel. This is a 25% increase in prescription sales

from the second quarter as we continue to execute on our channel

strategy.

“This positive change in sales channel mix contributed to the

gross margin on Avenova product sales expanding to 88%. We reduced

our adjusted use of cash from operations from $5.8 million for the

fourth quarter of last year when we implemented a restructuring to

$1.2 million for the third quarter of 2016,” he added. “All in all,

we believe we are well on our way to achieving our goal of positive

adjusted cash flow from operations in December 2016.

“Importantly, during the quarter and with the support of our

investors we implemented a warrant exercise that boosted our cash

position to $9.4 million, the highest level in three years. The

additional funds were essential to keeping our listing on the NYSE

MKT exchange, which allows us to maintain greater visibility with

the investment community. We expect to use these additional funds

to support the continued growth of our commercial activities and

drive Avenova sales in this largely untapped market of

approximately 41 million Americans.”

NovaBay defines adjusted cash flow from operations as GAAP cash

flow from operations less changes in operating assets and

liabilities.

Key Third Quarter Avenova Metrics

- Avenova sales of $3.1 million increased

nearly three-fold (176%) year-over-year and 20% over 2Q16;

- Prescription sales into the pharmacy

channel of $2.1 million were more than six-fold (550%) higher

year-over-year and up 25% over 2Q16;

- New prescribers increased by more than

1,100;

- Total number of medical professionals

who have prescribed Avenova increased by 17%, to more than

7,700.

Third Quarter 2016 Financial Results

Net sales for the third quarter of 2016 of $3.4 million, were

nearly three times the $1.2 million reported for the third quarter

of 2015 and up 29% from $2.7 million for the second quarter of

2016. Product revenue, which includes sales of Avenova and

NeutroPhase®, was $3.3 million, up 187% from $1.1 million for the

third quarter of 2015 and up 23% from $2.7 million for the second

quarter of 2016. Total gross profit margin was 84% for the third

quarter of 2016, compared with 78% for the prior-year period and

82% for the preceding quarter, with the increase mainly due to

higher sales of Avenova and the recognition of revenue upon the

termination of a collaborative agreement. The gross profit margin

on Avenova sales increased to 88%, up from 85% in the preceding

quarter.

Operating loss for the third quarter of 2016 was $2.0 million,

representing improvements of 62% from $5.3 million for the third

quarter of 2015 and 9% from $2.2 million for the second quarter of

2016. R&D expenses were $4 thousand for the third quarter of

2016 versus $1.6 million for the third quarter of 2015 and $278

thousand for the second quarter of 2016. The decreases are

primarily due to lower spending on clinical trials that were

completed, the Company’s focus of resources on Avenova

commercialization and the exchange of laboratory equipment for

R&D services in the third quarter of 2016 that were valued in

excess of the net book value of the equipment. G&A expenses for

the third quarter of 2016 of $2.2 million compared with $1.7

million for the prior-year period and $1.3 million for the second

quarter of 2016. The increase is primarily due to modification of

the exercise price for warrants issued in May 2015, higher

stock-based compensation expense and costs associated with

subleasing the Company’s previous headquarters location. Sales and

marketing expenses for the third quarter of 2016 decreased 12% to

$2.7 million from $3.0 million for the third quarter of 2015 and

decreased 7% from $2.9 million for the second quarter of 2016,

primarily due to reduced sales force expenses.

Non-cash loss on the change of fair value of warrant liability

for the three months ended September 30, 2016 was $1.7 million,

compared with a gain of $139 thousand for the three months ended

September 30, 2015. The non-cash loss on changes in fair value of

warrant liability was primarily due to the increase in the price of

the Company’s common stock during the quarter.

The net loss for the third quarter of 2016 was $3.7 million, or

$0.34 per share, compared with a net loss for the third quarter of

2015 of $5.2 million, or $1.77 per share. The net loss for the

third quarter of 2016 increased by $1 million or 39% from the

second quarter of 2016, primarily due to a non-cash charge related

to a revaluation of warrant liabilities.

Nine-Month 2016 Financial Results

Net sales for the nine months ended September 30, 2016 were $7.8

million, up 185% from $2.7 million for the nine months ended

September 30, 2015, with the increase primarily attributable to

significantly higher sales of Avenova. Product revenue for the

first nine months of 2016 increased 196% to $7.6 million. Gross

profit margin was 79% for the first nine months of 2016, compared

with 76% for the first nine months of 2015. Gross profit margin on

Avenova sales was 85% for the nine months ended September 30,

2016.

Operating loss for the first nine months of 2016 narrowed by 41%

to $8.8 million from $14.9 million for the comparable period in

2015. R&D expenses for the first nine months of 2016 declined

73% to $1.2 million from the prior-year period, and G&A

expenses were relatively unchanged. Sales and marketing expenses

for the nine months ended September 30, 2016 were $8.7 million, an

increase of 19% from the prior-year period.

Non-cash loss on the change of fair value of warrant liability

for the first nine months of 2016 was $2.5 million, compared with a

gain of $173 thousand for the first nine months of 2015. The

non-cash loss on changes in fair value of warrant liability was

primarily due to the increase in the price of the Company’s common

stock since December 31, 2015.

The net loss for the nine months ended September 30, 2016 was

$11.5 million, or $1.54 per share, compared with a net loss for the

nine months ended September 30, 2015 of $14.8 million, or $5.68 per

share.

NovaBay reported cash of $9.4 million as of September 30, 2016,

compared with $2.4 million as of December 31, 2015. On May 5, 2016,

the Company closed the first tranche of a financing for gross

proceeds of $7.8 million and on July 31, 2016, the Company closed

the second and final tranche for gross proceeds of $4.0 million.

During the third quarter of 2016, warrants were exercised for net

proceeds to the Company for approximately $6.6 million.

The Company used approximately $3.8 million in cash to fund

operations during the third quarter of 2016, compared with $4.1

million used during the third quarter of 2015 and $2.7 million used

during the second quarter of 2016. The decrease in cash to fund

operations in the third quarter of 2016 from the prior year was

primarily due to higher gross profit from Avenova sales and lower

operating expenses achieved through companywide cost-reduction

programs.

Conference Call

NovaBay management will host an investment community conference

call today beginning at 4:30 p.m. Eastern time (1:30 p.m. Pacific

time) to discuss the Company’s financial and operational results

and to answer questions. Shareholders and other interested parties

may participate in the conference call by dialing 800-608-8202 from

within the U.S. or 702-495-1913 from outside the U.S., with the

conference identification number 936110901.

A live webcast of the call will be available at

http://novabay.com/investors/events and will be archived for 90

days.

A replay of the call will be available beginning two hours after

call completion through 11:59 p.m. Eastern time December 10, by

dialing 855-859-2056 from within the U.S. or 404-537-3406 from

outside the U.S. and entering the conference identification number

936110901.

About NovaBay Pharmaceuticals, Inc.: Going Beyond

Antibiotics®

NovaBay Pharmaceuticals is a biopharmaceutical company focusing

on the commercialization of prescription Avenova® lid and lash

hygiene for the eye care market. Avenova is formulated with

Neutrox™, which is cleared by the U.S. Food and Drug Administration

(FDA) as a 510(k) medical device. Neutrox is NovaBay’s pure

hypochlorous acid. Laboratory tests show that pure hypochlorous

acid has potent antimicrobial activity in solution yet is non-toxic

to mammalian cells and neutralizes bacterial toxins. Data from a

multicenter clinical study show that Avenova reduced bacterial

load, the underlying cause of blepharitis, on ocular skin surface

by more than 90%. Avenova is marketed to optometrists and

ophthalmologists throughout the U.S. by NovaBay’s direct medical

salesforce. It is accessible from more than 90% of retail

pharmacies in the U.S. through agreements with McKesson

Corporation, Cardinal Health and AmerisourceBergen.

Forward-Looking Statements

This release contains forward-looking statements that are based

upon management's current expectations, assumptions, estimates,

projections and beliefs. These statements include, but are not

limited to, statements regarding our ability to become cash flow

positive by the end of 2016, future sales of our products, our

current “run rate,” and the Company’s expected future financial

results. Forward-looking statements can be identified with words

like (and variations of): “estimate,” “believe,” and “expect.”

These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or achievements to be

materially different and adverse from those expressed in or implied

by the forward-looking statements. Factors that might cause or

contribute to such differences include, but are not limited to,

risks and uncertainties relating to difficulties or delays in

manufacturing, distributing, and selling the Company's products,

unexpected adverse side effects or inadequate therapeutic efficacy

of our product, the uncertainty of patent protection for the

Company's intellectual property, and any potential regulatory

violations. Other risks relating to NovaBay’s business,

including risks that could cause results to differ materially from

those projected in the forward-looking statements in this press

release, are detailed in NovaBay's latest Form 10-K and Form 10-Q

filings with the Securities and Exchange Commission, especially

under the heading "Risk Factors." The forward-looking

statements in this release speak only as of this date, and NovaBay

disclaims any intent or obligation to revise or update publicly any

forward-looking statement except as required by law.

Stay informed on NovaBay's

progress:Download our Mobile InvestorApp from

the Apple Store or Google PlayLike us

on FacebookFollow us on TwitterConnect

with NovaBay on LinkedInJoin us on

Google+Visit NovaBay's Website

NOVABAY PHARMACEUTICALS, INC. CONDENSED CONSOLIDATED

BALANCE SHEETS (Unaudited) (In thousands, except per

share data) September 30,

December 31, 2016 2015

ASSETS Current assets: Cash $ 9,430 $ 2,385 Accounts

receivable, net of allowance for doubtful accounts ($14 and $40 at

September 30, 2016 and December 31, 2015, respectively) 2,079 536

Inventory, net of allowance for obsolete inventory and lower cost

of market ($77 and $45 at September 30, 2016 and December 31, 2015,

respectively) 1,084 1,345 Prepaid expenses and other current assets

1,827 261 Total current assets 14,420

4,527 Property and equipment, net 282 395 Other assets 439

155 TOTAL ASSETS $ 15,141 $ 5,077

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

Liabilities: Current liabilities: Accounts payable $ 387 $ 2,483

Accrued liabilities 1,880 1,980 Deferred revenue 1,461

170 Total current liabilities 3,728 4,633

Deferred revenues - non-current 1,913 2,248 Deferred rent 248 189

Notes payable, related party - 1,655 Warrant liability 2,336 1,450

Other Liabilities 198 Total liabilities

8,423 10,175 Stockholders' Equity

(deficit): Common stock, $0.01 par value; 240,000,000 shares

authorized 14,865,507 and 3,486,232 shares issued and outstanding

at September 30, 2016 and December 31, 2015, respectively 149 35

Additional paid-in capital 108,592 85,387 Accumulated

deficit (102,023 )

(90,520

)

Total stockholders' equity (deficit) 6,718

(5,098

)

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) $ 15,141

$ 5,077

NOVABAY PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS (Unaudited) (In thousands, except

per share data)

Three Months Ended

Nine Months Ended

September 30,

September 30, 2016 2015

2016 2015 Sales: Product revenue $

3,262 $ 1,136 $ 7,571 $ 2,559 Other revenue 176

64 249

187

Total net sales 3,438 1,200 7,820 2,746 Product cost

of goods sold 566 269 1,656

670 Gross profit 2,872

931 6,164 2,076 Research

and development 4 1,563 1,215 4,503 Sales and marketing 2,663 3,035

8,660 7,260 General and administrative 2,218

1,681 5,131 5,181 Total

operating expenses 4,885 6,279

15,006 16,944 Operating Loss (2,013 ) (5,348 )

(8,842 ) (14,868 ) Non cash (loss) gain on changes in fair

value of warrant liability (1,671 ) 139 (2,480 ) 173 Other expense,

net (52 ) (31 ) (179 ) (64 )

Loss before provision for income taxes (3,736 ) (5,240 ) (11,501 )

(14,759 ) Provision for income tax - (2 )

(2 ) (10 ) Net loss and comprehensive loss $ (3,736 )

$ (5,242 ) $ (11,503 ) $ (14,769 ) Net loss per share

attributable to common stock (basic and diluted) $ (0.34 ) $ (1.77

) $ (1.54 ) $ (5.68 ) Weighted-average shares of common

stock outstanding used in computing net loss per share of common

stock 10,912,616 2,957,477 7,480,985 2,598,052

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161110006401/en/

NovaBay ContactsFor NovaBay

Avenova purchasing information, please

contact:800-890-0329www.Avenova.comorFrom

the CompanyNovaBay Pharmaceuticals, Inc.Thomas J.

PaulsonChief Financial Officer510-899-8809Contact TomorInvestor ContactLHAJody

Cain310-691-7100Jcain@lhai.com

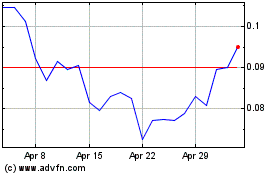

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Apr 2023 to Apr 2024