Total Revenue of $1.0 million

1st Detect Patent Strengthens

IP Portfolio

Astrotech Corporation (NASDAQ:ASTC) reported its financial

results for the first quarter of fiscal year 2017, ended

September 30, 2016.

“The foundational achievements of fiscal year 2016 drove our

continued progress on our government-related subcontract agreements

to $1.0 million in revenue for our first quarter of fiscal 2017,”

said Thomas B. Pickens III, Chairman and CEO of Astrotech

Corporation. “Our 1st Detect subsidiary delivered milestones for a

key government contract to develop next-generation explosive trace

detection (ETD) systems for aviation security and began preparing

to deliver multiple prototype units for integration into Battelle’s

Next Generation Chemical Detection (NGCD) prototype solution. We

believe these two achievements continue to bolster future sales

prospects for 1st Detect, while cost reductions implemented in July

helped the bottom line. Also, we remain actively engaged with our

commercial development partners for application specific chemical

detection solutions for opportunities in healthcare, breath

analysis, food and beverage manufacturing quality control.

“Our Astral Images subsidiary continues to receive very positive

results from critical evaluations by leading studios of its

revolutionary automated image correction and enhancement

technology. With more than 6 billion feet of film in the US needing

conversion to remain relevant in the next generation of digital

distribution, we are pursuing the most attractive

opportunities.

“In summary, we continue to create value with our technological

innovations and protect the unique advantages of our products with

a strong IP portfolio,” concluded Mr. Pickens.

First Quarter Fiscal Year 2017 Financial Highlights

Revenue, costs of goods sold, SG&A, and R&D are expected

to continue to fluctuate based on the timing of contract

revenue.

- During the first quarter 2017, revenue

was $1.0 million, reflecting 1st Detect’s income from

research-based, fixed-price, government-related subcontracts.

- Gross profit was $275 thousand for the

first quarter 2017.

- Corporate realignment is expected to

save the Company approximately $3.5 million for the year.

- Cash and investments at

September 30, 2016, were $22.3 million; there was no debt for

each of the periods ended September 30, 2016, and

June 30, 2016.

- Granted one additional U.S. patent and

one international patent during the first quarter 2017, bringing

the total to 17 U.S. patents and seven international patents.

About Astrotech Corporation

Astrotech Corporation (NASDAQ:ASTC) is an innovative science and

technology development and commercialization company that invents,

acquires, and commercializes technological innovations sourced from

internal research, universities, laboratories, and research

institutions, and then funds, manages, and builds start-up

companies for profitable divestiture to market leaders to maximize

shareholder value. Sourced from Oak Ridge Laboratory’s chemical

analyzer research, 1st Detect develops,

manufactures, and sells chemical analyzers for use in the airport

security, military, food and beverage, research, and breath

analysis markets. Sourced from decades of image research from the

laboratories of IBM and Kodak combined with classified satellite

technology from government laboratories, Astral Images sells

film to digital image enhancement, defect removal and color

correction software, and post processing services providing

economically feasible conversion of television and feature 35mm and

16mm films to the new 4K ultra-high definition (UHD), high-dynamic

range (HDR) format necessary for the new generation of digital

distribution. Sourced from NASA’s extensive microgravity research,

Astrogenetix is applying a fast-track on-orbit discovery

platform using the International Space Station to develop vaccines

and other therapeutics. Demonstrating its entrepreneurial strategy,

Astrotech management sold its state-of-the-art satellite servicing

operations to Lockheed Martin in August 2014. Astrotech has

operations throughout Texas and is headquartered in Austin. For

information, please visit www.astrotechcorp.com.

This press release contains forward-looking statements that are

made pursuant to the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that

could cause actual results to be materially different from the

forward-looking statement. These factors include, but are not

limited to, whether we can successfully develop our proprietary

technologies and whether the market will accept our products and

services, as well as other risk factors and business considerations

described in the Company’s Securities and Exchange Commission

filings including the annual report on Form 10-K. Any

forward-looking statements in this document should be evaluated in

light of these important risk factors. The Company assumes no

obligation to update these forward-looking statements.

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Operations and

Comprehensive Income (In thousands, except per share data)

(Unaudited)

Three Months Ended September 30,

2016 2015 Revenue $ 1,006 $ — Cost of revenue

731 —

Gross profit 275

— Operating expenses: Selling, general

and administrative 2,548 2,286 Research and development

1,292 1,264 Total operating expenses

3,840 3,550

Loss from operations

(3,565 ) (3,550 ) Interest and other

expense, net 98 99

Loss before

income taxes (3,467 ) (3,451 )

Income tax expense — (2 )

Net loss

(3,467 ) (3,453 ) Less: Net loss

attributable to noncontrolling interest (52 ) (89 )

Net loss attributable to Astrotech Corporation $

(3,415 ) $ (3,364 )

Weighted average common shares outstanding: Basic 20,630 20,705

Basic net loss per common share: Net loss

attributable to Astrotech Corporation $ (0.17 ) $ (0.16 )

Other comprehensive income, net of tax: Available-for-sale

securities: Net unrealized gain (loss) $ 41 $ (94 )

Reclassification adjustment for realized losses —

6

Total comprehensive loss $

(3,374 ) $ (3,452 )

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (In thousands, except

share data) (Unaudited)

September 30, June 30,

2016 2016 Assets Current assets Cash and cash

equivalents $ 3,543 $ 4,399 Short-term investments 15,198 17,102

Accounts receivable, net of allowance 1,018 156 Costs and estimated

revenues in excess of billings 155 451 Inventory, net 349 496

Prepaid expenses and other current assets 450

319

Total current assets 20,713 22,923

Property and equipment, net 3,245 3,392 Long-term investments

3,545 4,208

Total assets

$ 27,503 $ 30,523

Liabilities and stockholders’ equity Current liabilities

Accounts payable $ 266 $ 237 Accrued liabilities and other

1,402 1,563

Total current liabilities

1,668 1,800 Other liabilities 80

96

Total liabilities 1,748

1,896 Commitments and

contingencies Stockholders’ equity

Preferred stock, no par value,

convertible, 2,500,000 shares authorized; no shares issued and

outstanding, at September 30, 2016, and June 30, 2016

— —

Common stock, no par value, 75,000,000

shares authorized; 22,555,247 and 21,811,153 shares issued at

September 30, 2016, and June 30, 2016, respectively; 21,179,208 and

20,627,511 shares outstanding at September 30, 2016, and June 30,

2016, respectively

190,138 189,294

Treasury stock, 1,376,039 and 1,183,642

shares at cost at September 30, 2016, and June 30, 2016,

respectively

(3,136 ) (2,828 ) Additional paid-in capital 1,437 1,419

Accumulated deficit (162,532 ) (159,117 ) Accumulated other

comprehensive loss (60 ) (101 )

Equity

attributable to stockholders of Astrotech Corporation

25,847 28,667 Noncontrolling interest (92 )

(40 )

Total stockholders’ equity 25,755

28,627 Total liabilities and

stockholders’ equity $ 27,503 $

30,523

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161110005534/en/

Astrotech CorporationEric Stober, 512-485-9530Chief Financial

OfficerorInvestor Relations:LHA Investor RelationsCathy Mattison or

Kirsten Chapman, 415-433-3777ir@astrotechcorp.com

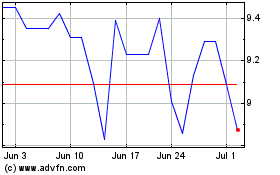

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Apr 2023 to Apr 2024