UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT

NO. 1

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Immune

Therapeutics, Inc.

(Name

of small business issuer in our charter)

|

Florida

|

|

0001509957

|

|

59-3226705

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

IRS

Employer

Identification

Number

|

|

37

North Orange Ave, Suite 607,

Orlando,

Florida

|

|

32801

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Telephone:

(888) 613-8802

Noreen

Griffin, Chief Executive Officer

37

North Orange Avenue, Suite 607

Orlando,

FL 32801

(888)

613-8802

(Name,

address and telephone number of agent for service)

Please

send copies of all communications to:

Gina

M. Austin, Esq. or

Arden

E. Anderson, Esq.

Austin

Legal Group, APC

3990

Old Town Ave., Suite A-112

San

Diego, A 92110

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box. [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the

same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company.

|

Large

accelerated filer

|

[ ]

|

Accelerated

Filer

|

[ ]

|

|

Non-accelerated

filer

|

[ ]

|

Smaller

reporting company

|

[X]

|

CALCULATION

OF REGISTRATION FEE

|

Title

of each class of securities to be registered

|

|

Amount

to be

registered [1]

|

|

|

Proposed

maximum

offering price

per unit [2]

|

|

|

Proposed

maximum

aggregate

offering price

|

|

|

Amount

of

registration

fee [3]

|

|

|

Common Stock offered by

the Selling Stockholders

|

|

|

4,015,621

|

|

|

$

|

0.14

|

|

|

$

|

562,187

|

|

|

$

|

56.1

2

|

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional

shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

|

|

|

|

|

(2)

|

Estimated

solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended

(“Securities Act”).

|

|

|

|

|

(3)

|

Calculated

by multiplying the proposed maximum aggregate offering price by .0001007.

|

|

|

|

|

(4)

|

$56.12

previously paid by the Company.

|

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission, of which this prospectus is a part, shall have been declared effective. This

prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where

the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED NOVEMBER 8 , 2016

Immune

Therapeutics, Inc.

4,015,621

Shares of Common Stock

Immune

Therapeutics, Inc. is a biotechnology company developing and seeking to commercialize patented therapies in emerging nations that

combat chronic, life-threatening diseases by stimulating or rebalancing the immune system. Our technology platform is based on

two interrelated cytokine drug therapies-Low-Dose Naltrexone (LDN) and Methionine Enkephalin (MENK)-which work by triggering opioid

receptors on immune cells to activate various cells of the immune system.

This

registration statement relates to the sale of 4,015,621 shares of the Company’s common stock, par value $0.0001, by selling

shareholder, JMJ Financial (“JMJ” or “Selling Shareholder”). Of the shares being offered, 500,000 are

issued and outstanding and the remaining shares are issuable upon the exercise of outstanding warrants issued to JMJ as part of

a securities purchase transaction with the Company in April, 2016. The Selling Shareholder will sell its shares in market transactions

at prevailing market prices or through privately negotiated prices

.

The Company will not receive any proceeds from the

sale of shares by the Selling Shareholder. The Company will pay for all fees relating to filing of this registration statement,

but otherwise will not incur any expense relating to the sale of shares by the Selling Shareholder. The Selling Shareholder will

pay all brokerage commissions and discounts attributable to the sale of the shares, plus brokerage fees, if applicable.

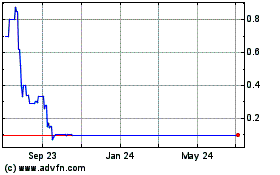

Our

common stock is not now listed on any national securities exchange or the NASDAQ stock market. However, our stock is quoted on

OTCQB under the symbol “IMUN.” While our common stock is on the OTCQB, there has been limited trading volume. There

is no guarantee that a more active trading market will develop in our securities.There is also no guarantee that our securities

will ever trade on any listed exchange or even remain quoted on OTCQB. As of August 16, 2016, our securities were listed on the

OTCQB at a price of $0.111.

We

qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (“JOBS Act”).

This

offering is highly speculative and these securities involve a high degree of risk and should be considered only by persons who

can afford the loss of their entire investment. See “Risk Factors” on Page 9.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This

Prospectus is dated ____________, 2016

TABLE

OF CONTENTS

SUMMARY

INFORMATION

This

summary highlights some of the information in this prospectus. It is not complete and may not contain all of the information that

you may want to consider. To understand this offering fully, you should carefully read the entire prospectus, including the section

entitled “Risk Factors,” before making a decision to invest in our securities. Unless otherwise noted or unless the

context otherwise requires, the terms “we,” “us,” “our,” the “Company,” “Immune

Therapeutics” and “IMUN” refers to Immune Therapeutics, Inc. together with its wholly owned subsidiaries. In

instances where we refer emphatically to “Immune Therapeutics, Inc.” or where we refer to a specific subsidiary of

ours by name, we are referring only to that specific legal entity.

The

Company

Immune

Therapeutics Inc. was incorporated in Florida on December 2, 1993 as Resort Clubs International, Inc. with a principal business

address at 37 North Orange Ave, Suite 607, Orlando, Florida 32801. As of March 21, 2016, the Company has 734 shareholders of record

and 220,989,542 shares of common stock outstanding as of August 12, 2016. Immune Therapeutics, Inc. is publicly traded under the

symbol “IMUN” and quoted on OTCQB.

Business

Overview

Immune

Therapeutics, Inc. was initially incorporated in Florida on December 2, 1993 as Resort Clubs International, Inc. (“Resort

Clubs”). It was formed to manage and market golf course properties in resort markets throughout the United States. Galliano

International Ltd. (“Galliano”) was incorporated in Delaware on May 27, 1998 and began trading in November 1999 through

the filing of a 15C-211. On November 10, 2004, Galliano merged with Resort Clubs. Resort Clubs was the surviving corporation.

On August 23, 2010, Resort Clubs changed its name to pH Environmental Inc. (“pH Environmental”).

On

April 23, 2012, pH Environmental completed a name change to TNI BioTech, Inc., and on April 24, 2012, executed a share exchange

agreement for the acquisition of all of the outstanding shares of TNI BioTech IP, Inc. On September 4, 2014, a majority of our

shareholders approved an amendment to our Amended and Restated Articles of Incorporation, as amended, to change our name to Immune

Therapeutics, Inc. We filed our name change amendment with the Secretary of State of Florida on October 27, 2014 changing our

name to Immune Therapeutics, Inc.

The

Company currently operates out of Orlando, Florida. In July 2012, the Company’s focus turned to acquiring patents that would

protect and advance the development of new uses of opioid-related immune- therapies, such as low dose naltrexone (“LDN”)

and Methionine [Met5]-enkephalin (“MENK”). The Company’s therapies are believed to stimulate and/or regulate

the immune system in such a way that they provide the potential to treat a variety of diseases. We believe our therapies may be

able to correct abnormalities or deficiencies in the immune system in diseases such as HIV infection, autoimmune disease, immune

disorders, or cancer; all of which can lead to disease progression and life-threatening situations when the immune system is not

functioning optimally.

In

October 2012, the Company formed TNI BioTech International, Ltd., a BVI company in Tortola, British Virgin Islands, which was

set up to allow the Company to market and sell LDN in those countries outside the U.S. in which we have been able to obtain approval

to sell the Company’s products.

In

August 2013, the Company formed its United Kingdom subsidiary, TNI BioTech, LTD (the “UK Subsidiary”). The UK Subsidiary

received approval to be considered a micro, small or medium-sized enterprise (“SME”) with the European Medicines Agency

(“EMA”) on August 21, 2013. The designation provides the UK Subsidiary with significant discounts when holding meetings

or submitting filings to the EMA. On September 19, 2013, the UK Subsidiary submitted a pre-submission package to the EMA regarding

Crohn’s Disease. The EMA granted the UK Subsidiary a meeting that took place on September 27, 2013. The UK Subsidiary is

eligible to benefit from the provisions for administrative and financial assistance for SMEs set out in Regulation (EC) No 2049/2005.

The Company will apply to obtain EMA benefits once funding becomes available.

In

December 2013, the Company formed a new subsidiary, Cytocom Inc., to focus on conducting LDN and MENK clinical trials in the United

States. In December 2014, the Company finalized the distribution of common stock of Cytocom Inc. to its shareholders. As part

of the transaction, the Company retained exclusive rights to all international patents, in-country approvals, formulations, trademarks,

manufacturing, marketing, sales, and distributions rights in emerging nations, including

Africa,

Central America, South America, Russia, India, China, Far East, and The Commonwealth of Independent States (former Soviet Union).

The Company will continue to have access to existing clinical data as well as any new data generated by Cytocom Inc. during drug

development. On December 8, 2014, the number of Cytocom Inc. shares of common stock that were issued to our shareholders totaled

113,242,522 shares. In connection with the transaction, Cytocom Inc. issued 140,100,000 shares of its common stock to the Company,

which gave the Company a 55.3% stake in Cytocom Inc. on that date. In April 2016, the Board of Directors and a majority of shareholders

of Cytocom approved a reverse stock split of Cytocom’s outstanding common stock with one new share of stock for each twenty

old shares of common stock. Cytocom effectuated and finalized the reverse split in June 2016. At June 30, 2016, the Company’s

equity interest had been further reduced to 41%, by subsequent issuances of Cytocom common stock to shareholders in settlement

of notes payable.

In

March 2014, the Company incorporated Airmed Biopharma Limited, an Irish corporation with an address in Dublin, Ireland, and Airmed

Holdings Limited, an Irish company domiciled in Bermuda. The Irish companies were set up to benefit from incentives granted by

the Irish government for the establishment of pharmaceutical companies (many of the world’s leading pharmaceutical companies

have located in Ireland), and so that the Company could take advantage of Ireland’s status as a member of the European Union

and the European Economic Area. An Irish limited liability company enjoys a low corporate income tax rate of 12.5%, one of the

lowest in the world. The Irish-domiciled company hopes to qualify for tax incentives for Irish holding/headquartered companies

and to benefit from the network of double tax treaties that reduce withholding taxes. TNI BioTech International, Ltd. will manage

our international distribution, using product that is manufactured in Ireland and elsewhere.

Immune

Therapeutics is focused on the commercialization of affordable non-toxic immunotherapies focused on the activation and rebalancing

of the body’s immune system. Stimulating the body’s immune system remains one of the most promising approaches in

the treatment of Cancers, HIV, Autoimmune Diseases, inflammatory conditions and other opportunistic infections for chronic often

life-threatening diseases through the mobilization of the body’s immune system in Emerging Nations using existing clinical

data.

Cytocom

Inc, is a clinical-stage pharmaceutical company focused on the development of the first affordable non-toxic immunodulator for

the treatment of inflammatory diseases, immune-related disorders, and cancer and is responsible for the development of our patented

therapies with the FDA and EMA.

As

of this date, neither we nor our collaboration partners are permitted to market our drug candidates in the United States until

we receive approval of a New Drug Application from the FDA. Neither we nor our collaboration partners have submitted an application

for or received marketing approval for any of our drug candidates. Obtaining approval of an NDA can be a lengthy, expensive and

uncertain process.

Some

of the Company’s more substantial risks include, but are not limited to, its lack of operating history, its high needs for

capital, strict government regulation, risk of law suits from trial participants and otherwise, requirement for drug approvals

which may never occur, changes in the industry, failure of the Company’s products to make it through trials, reliance on

third parties to conduct trials and manufacture and distribute the Company’s drugs, and fierce competition. All of these

factors and more could affect investors’ investments in the Company.

Emerging

Growth Company

We

qualify as an “emerging growth company” as defined in Section 101 of the Jumpstart our Business Startups Act (“JOBS

Act”), as we do not have more than $1,000,000,000 in annual gross revenue and did not have such amount as of December 31,

2015, the last day of our last fiscal year. We are electing to use the extended transition period for complying with new or revised

accounting standards under Section 102(b)(1) of the JOBS Act.

As

an emerging growth company, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are

otherwise applicable to public companies. These provisions include, but are not limited to:

|

|

●

|

being

permitted to present only two years of audited financial statements and only two years of related “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in this registration statement;

|

|

|

●

|

not

being requested to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended

(“Sarbanes-Oxley Act”);

|

|

|

|

|

|

|

●

|

reduced

disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements;

and

|

|

|

|

|

|

|

●

|

exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden

parachute payments not previously approved.

|

We

will remain an emerging growth company until the earliest to occur of: (i) our reporting $1 billion or more in annual gross revenues;

(ii) the end of fiscal year 2019; (iii) our issuance, in a three-year period, of more than $1 billion in non-convertible debt;

and (iv) the end of the fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million

on the last business day of our second fiscal quarter.

Going

Concern

The

Company has incurred significant net losses since inception and has relied on its ability to fund its operations through private

equity financings. Management expects operating losses and negative cash flows to continue at more significant levels in the future.

As the Company continues to incur losses, transition to profitability is dependent upon the successful development, approval,

and commercialization of its product candidate and the achievement of a level of revenues adequate to support the Company’s

cost structure. The Company may never achieve profitability, and unless and until it does, the Company will continue to need to

raise additional cash. Management intends to fund future operations through additional private or public debt or equity offerings,

and may seek additional capital through arrangements with strategic partners or from other sources. Based on the Company’s

operating plan, existing working capital at December 31, 2015 was not sufficient to meet the cash requirements to fund planned

operations through December 31, 2016 without additional sources of cash. These conditions raise substantial doubt about the Company’s

ability to continue as a going concern. The accompanying financial statements have been prepared assuming that the Company will

continue as a going concern and do not include adjustments that might result from the outcome of this uncertainty. This basis

of accounting contemplates the recovery of the Company’s assets and the satisfaction of liabilities in the normal course

of business.

The

Company experienced a net loss from operations of $7,626,348 and used cash and cash equivalents from operations in the amount

of $1,399,729 during the six months ended June 30, 2016, resulting in stockholders deficit of $6,926,660 at June 30, 2016.

Securities

Purchase Agreement

On

April 12, 2016, we entered into Securities Purchase Agreement (“Purchase Agreement”) with JMJ. Pursuant to the Purchase

Agreement, JMJ loaned the Company $525,000 and was issued a promissory note in the amount of $656,250, 500,000 shares of common

stock, and a warrant exercisable for 3,515,621 additional common shares at a rate of $0.14 per share. The warrants have a cashless

exercise option if the Company were to fail to file this registration statement.

The

Offering

|

Securities

offered

|

|

Up

to 4,015,621 shares of our common stock.

|

|

|

|

|

|

Offering

price

|

|

The

Selling Shareholder will sell at prevailing market prices or through privately negotiated

transactions.

|

|

|

|

|

|

Offering

period

|

|

This

offering is being made on a continuous basis pursuant to Rule 415 under the Securities

Act and will expire two years from the date on which the registration statement related

to this prospectus becomes effective, unless earlier terminated or extended by our Company

by the filing of a post-effective amendment.

|

|

|

|

|

|

Common

stock outstanding before this offering

|

|

220,989,542

shares as of August 12, 2016.

|

|

Common

stock to be outstanding after this offering

|

|

Up

to 224,505,163 provided all outstanding warrants are exercised and no other shares issued.

|

|

|

|

|

|

Use

of

proceeds

|

|

The

Company will not receive any proceeds from this offering.

|

|

|

|

|

|

Risk

factors

|

|

See

“Risk Factors” beginning on page 10 and the other information set forth in this prospectus for a discussion of

factors you should consider before deciding to invest in our securities.

|

|

|

|

|

|

Market

for Common Stock

|

|

Our

common stock is not now listed on any national securities exchange or the NASDAQ stock market. However, our stock is quoted

on OTCQB under the symbol “IMUN.” While our common stock is on the OTCQB, there has been limited trading volume.

There is no guarantee that a more active trading market will develop in our securities.There is also no guarantee that our

securities will ever trade on any listed exchange or even remain quoted on OTCQB.

|

Financial

Summary

Because

this is only a financial summary, it does not contain all the financial information that may be important to you. Therefore, you

should carefully read all the information in this prospectus, including the financial statements and their explanatory notes before

making an investment decision.

|

|

|

For

the year ended

December

31, 2015

|

|

|

For

the year ended

December

31, 2014

|

|

|

Statements Of Operations

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

16,197

|

|

|

$

|

0

|

|

|

Selling, general and administrative

|

|

$

|

2,734,414

|

|

|

$

|

4,072,277

|

|

|

Research and development

|

|

$

|

977,203

|

|

|

$

|

2,413,286

|

|

|

Depreciation and amortization

|

|

$

|

594,785

|

|

|

$

|

2,879,311

|

|

|

Other Expenses

|

|

$

|

11,512,684

|

|

|

$

|

35,899,378

|

|

|

Total Expenses

|

|

$

|

15,819,086

|

|

|

$

|

45,264,252

|

|

|

Loss from Operations

|

|

$

|

(15,802,889

|

)

|

|

$

|

(45,264,252

|

)

|

|

Net Loss

|

|

$

|

(16,949,451

|

)

|

|

$

|

(49,938,213

|

)

|

|

|

|

As

of

December 31, 2015

|

|

|

As

of

December 31, 2014

|

|

|

Balance Sheet

Data

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents

|

|

$

|

23,149

|

|

|

$

|

191,987

|

|

|

Other Assets

|

|

$

|

18,079

|

|

|

$

|

5,863,003

|

|

|

Total Assets

|

|

$

|

41,228

|

|

|

$

|

6,054,990

|

|

|

Total Liabilities

|

|

$

|

5,999,412

|

|

|

$

|

3,702,558

|

|

|

Stockholder’s Equity (Deficit)

|

|

$

|

(5,958,184

|

)

|

|

$

|

2,352,432

|

|

|

|

|

For

the three months

ended

June

30, 2016

(Q2 2016)

|

|

|

For

the three months ended

June

30, 2015

(Q1 2015)

|

|

|

Statements Of

Operations

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

-

|

|

|

$

|

5,648

|

|

|

Selling, general and administrative

|

|

$

|

893,917

|

|

|

$

|

443,585

|

|

|

Research and development

|

|

$

|

67,286

|

|

|

$

|

414,492

|

|

|

Stock issues for services G&A

|

|

$

|

1,194,761

|

|

|

$

|

1,450,334

|

|

|

Depreciation and amortization

|

|

$

|

434

|

|

|

$

|

148,726

|

|

|

Warrant Valuation

|

|

$

|

490,355

|

|

|

|

-

|

|

|

Total Expenses

|

|

$

|

2,646,729

|

|

|

$

|

2,457,137

|

|

|

Loss from Operations

|

|

$

|

(2,646,729

|

)

|

|

$

|

(2,451,789

|

)

|

|

Net Loss

|

|

$

|

(4,038,648

|

)

|

|

$

|

(2,590,645

|

)

|

|

|

|

As

of June 30, 2016

(Q2 2016)

|

|

|

Balance Sheet

Data

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

64,289

|

|

|

Accounts receivable

|

|

$

|

2,661

|

|

|

Prepaids and other current assets

|

|

$

|

11,272

|

|

|

Total Current Assets

|

|

$

|

78,222

|

|

|

Computers and equipment, net of accumulated

depreciation

|

|

$

|

701

|

|

|

Deposits

|

|

$

|

200

|

|

|

Total Assets

|

|

$

|

79,123

|

|

|

Total Liabilities

|

|

$

|

(7,005,783

|

)

|

|

Stockholder’s Equity (Deficit)

|

|

$

|

(6,926,660

|

)

|

ABOUT

THIS PROSPECTUS

We

have prepared this prospectus as part of a registration statement that we filed with the SEC for our offering of securities. The

registration statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed

in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with additional information

described below under “Additional Information.”

You

should rely only on the information contained in this prospectus. Neither we nor any underwriters have authorized any other person

to provide you with any information different from that contained in this prospectus or information furnished by us upon request

as described herein. The information contained in this prospectus is complete and accurate only as of the date of this prospectus,

regardless of the time of delivery of this prospectus or sale of our shares. This prospectus contains summaries of certain other

documents, which summaries contain all material terms of the relevant documents and are believed to be accurate, but reference

is hereby made to the full text of the actual documents for complete information concerning the rights and obligations of the

parties thereto. Such information necessarily incorporates significant assumptions, as well as factual matters. All documents

relating to this offering and related documents and agreements, if readily available to us, will be made available to a prospective

investor or its representatives upon request.

No

information contained herein, nor in any prior, contemporaneous or subsequent communication should be construed by a prospective

investor as legal or tax advice. Each prospective investor should consult its, his or her own legal, tax and financial advisors

to ascertain the merits and risks of the transactions described herein prior to purchasing our shares. This written communication

is not intended to be “written advice,” as defined in Circular 230 published by the U.S. Treasury Department.

INDUSTRY

AND MARKET DATA

The

industry and market data used throughout this prospectus have been obtained from our own research, surveys or studies conducted

by third parties and industry or general publications. Industry publications and surveys generally state that they have obtained

information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. We believe

that each of these studies and publications is reliable.

TAX

CONSIDERATIONS

We

are not providing any tax advice as to the acquisition, holding or disposition of the securities offered herein. In making an

investment decision, investors are strongly encouraged to consult their own tax advisor to determine the U.S. Federal, state and

any applicable foreign tax consequences relating to their investment in our securities.

RISK

FACTORS

In

addition to the other information provided in this prospectus, you should carefully consider the following risk factors in evaluating

our business before purchasing any of our common stock. All material risks are discussed in this section.

Risks

Related to our Business

We

have a limited operating history and are expected to incur significant operating losses during the early stage of our corporate

development.

We

have a limited operating history. Our historical financial information consists only of an audit of our financial results at and

for the years ended December 31, 2015, 2014, 2013 and 2012. There is limited historical financial information upon which to base

an evaluation of our performance. We are an emerging company, and thus our prospects must be considered in light of the uncertainties,

risks, expenses, and difficulties frequently encountered by companies in their early stages of operation, particularly in the

pharmaceutical industry.

Since

inception, we have invested a substantial portion of our time and financial resources in the acquisition and development of our

most advanced drug candidate, LDN. We have generated cumulative losses of approximately $345 million and $6,926,660 stockholders’

deficit since inception, and we expect to continue to incur losses until IRT-103 (LDN) is approved by the FDA and foreign regulatory

authorities. Even if regulatory approval is obtained, there is a risk that we will not be able to generate material sales of IRT-103

(LDN), which would cause us to continue to incur losses.

We

may never generate revenue, are not profitable and may never become profitable.

We

expect to incur substantial losses and negative operating cash flow for the foreseeable future, and we may never achieve or maintain

profitability. Even if we are able to launch IRT-103 (LDN) we expect to incur substantial losses for the foreseeable future and

may never become profitable.

We

do not anticipate that we will generate revenue from the sale of our products for the foreseeable future. In addition, if approved,

we expect to incur significant costs to commercialize our drug candidates and our drugs may never gain market acceptance. If our

drug candidates fail to demonstrate safety and efficacy in clinical trials, do not gain regulatory approval, or do not achieve

market acceptance, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain

profitability in subsequent periods. If we are unable to achieve and sustain profitability, the market value of our common stock

will likely decline. Because of the numerous risks and uncertainties associated with developing pharmaceutical products, we are

unable to predict the extent of any future losses or whether we will become profitable.

We

will see losses from our clinical trials conducted either directly or through our subsidiaries for the foreseeable future, and

if we fail at one or more of our clinical trials, it could affect the value of the Company’s stock.

We

rely on financings to fund and conduct clinical trials directly or through our subsidiaries needed for NDA submission with respect

to IRT-103 (LDN). Any of the following events or factors could have a material adverse effect on our ability to generate revenue

from the commercialization of IRT-103 (LDN):

|

|

●

|

The

Company may be unable to successfully complete the clinical development of IRT-103 (LDN);

|

|

|

|

|

|

|

●

|

The

Company must comply with any possible additional requests and recommendations from the FDA, including additional clinical

trials;

|

|

|

|

|

|

|

●

|

The

Company may not obtain all necessary approvals from the FDA and similar foreign regulatory agencies;

|

|

|

|

|

|

|

●

|

The

Company may not commit sufficient resources to the development, regulatory approval, marketing and distribution of IRT-103

(LDN);

|

|

|

|

|

|

|

●

|

IRT-103

(LDN) must be manufactured in compliance with requirements of the FDA and similar foreign regulatory agencies and in commercial

quantities sufficient to meet market demand;

|

|

|

●

|

IRT-103

(LDN) may not achieve market acceptance by physicians, patients and third party payers;

|

|

|

|

|

|

|

●

|

IRT-103

(LDN) may not successfully compete against alternative products and therapies; and

|

|

|

|

|

|

|

●

|

The

Company or any other pharmaceutical organization may independently develop products that compete with IRT-103 (LDN).

|

To

obtain approval from the FDA of an NDA, for IRT-103 (LDN), The Company will need to demonstrate through evidence of adequate and

well-controlled clinical trials that IRT-103 (LDN) is safe and effective for each proposed indication. However, IRT-103 (LDN)

may not be approved even though it achieved its specified endpoints in future Phase III clinical trials intended to support an

NDA, which may be conducted by the Company. The FDA may disagree with the trial design and the interpretation of data from clinical

trials, may ask the Company to conduct additional costly and time consuming clinical trials in order to obtain marketing approval

or approval to enter into an advanced phase of development, or may change the requirements for approval even after it has reviewed

and commented on the design for our future clinical trials. The FDA may also approve IRT-103 (LDN) for fewer or more limited indications

than the Company may request, or may grant approval contingent on the performance of costly post-approval clinical trials. In

addition, the FDA may not approve the labeling claims that we believe are necessary or desirable for the successful commercialization

of IRT-103 (LDN).

The

Company anticipates that if Cytocom initiates a clinical trial in the next 12 months, Cytocom would need approximately $7-$15

million to fully develop products and for Phase III clinical trials for Crohn’s disease. We expect that two-thirds of this

amount will be spent by Cytocom in the USA, the balance by Immune Therapeutics, Inc. and/or its subsidiaries for international

trials. Cytocom trials are expected to be split evenly between LDN and MENK. The international trials will focus the use of MENK

for treatment of cancer in Africa.

The

development of new drugs is a highly risky undertaking which involves a lengthy process, and therefore our drug discovery and

development activities may not result in products that are approved by the applicable regulatory authorities on the time schedule

we have planned, or at all.

Our

drug candidates are in early stages of drug discovery or clinical trials and are prone to the risks of failure inherent in drug

development. As of the date of this Form 10-K, both of our current drug candidates, IRT-101 (MENK) and IRT-103 (LDN) have been

tested on human beings. We will need to conduct additional clinical trials before we can demonstrate that our drug candidates

are safe and effective to the satisfaction of the FDA and other regulatory authorities. Clinical trials are expensive and uncertain

processes that can take multiple years to complete. We cannot assure you that our ongoing clinical trials or any future clinical

trial of any of our other drug candidates, will be completed on schedule, or at all, or whether our planned clinical trials will

start in a timely manner. The commencement of our planned clinical trials could be substantially delayed or prevented by a number

of factors, including:

|

|

●

|

delays or failures in obtaining sufficient

quantities of the API and/or drug product;

|

|

|

|

|

|

|

●

|

delays or failures in reaching an

agreement on acceptable clinical trial agreement terms or clinical trial protocols with prospective sites and with the FDA

or other foreign regulatory bodies;

|

|

|

|

|

|

|

●

|

delays or failures in obtaining Institutional

Review Board (“IRB”) or Ethics Committee (“EC”) approvals to conduct a clinical trial at a prospective

site;

|

|

|

|

|

|

|

●

|

the need to successfully complete,

on a timely basis, preclinical safety pharmacology studies (for IRT-101 (MENK));

|

|

|

|

|

|

|

●

|

the limited number of, and competition

for, suitable sites to conduct the clinical trials;

|

|

|

|

|

|

|

●

|

the limited number of, and competition

for, suitable patients for enrollment in the clinical trials; and

|

|

|

|

|

|

|

●

|

delays or failures in obtaining regulatory

approval to commence a clinical trial.

|

The

completion of our clinical trials could also be substantially delayed or prevented by a number of factors, including:

|

|

●

|

slower

than expected rates of patient recruitment and enrollment;

|

|

|

|

|

|

|

●

|

failure

of patients to complete the clinical trials;

|

|

|

|

|

|

|

●

|

failure

of our third party vendors to timely or adequately perform their contractual obligations relating to the clinical trials;

|

|

|

|

|

|

|

●

|

inability

or unwillingness of patients or medical investigators to follow our clinical trial protocols;

|

|

|

|

|

|

|

●

|

inability

to monitor patients adequately during or after treatment;

|

|

|

|

|

|

|

●

|

termination

of the clinical trials by one or more clinical trial sites;

|

|

|

|

|

|

|

●

|

unforeseen

safety issues;

|

|

|

|

|

|

|

●

|

lack

of efficacy demonstrated during clinical trial results;

|

|

|

|

|

|

|

●

|

lack

of adequate funding to continue the clinical trials;

|

|

|

|

|

|

|

●

|

the

need for unexpected discussions with the FDA or other foreign regulatory agencies regarding the scope or design of our clinical

trials or the need to conduct additional trials;

|

|

|

|

|

|

|

●

|

unforeseen

delays by the FDA or other foreign regulatory agencies after submission of our results;

|

|

|

|

|

|

|

●

|

an

unfavorable FDA inspection of our contract manufacturers of APIs or drug products; and/or

|

|

|

|

|

|

|

●

|

inspection

of the clinical trial operations or trial sites by the FDA or other regulatory authorities resulting in the imposition of

a clinical hold.

|

Any

failure or significant delay in completing clinical trials for our drug candidates will harm the commercial prospects for our

drug candidates and adversely affect our financial results.

Additionally,

changes in regulatory requirements and guidance may occur and we may need to amend clinical trial protocols to reflect these changes.

Amendments may require us to resubmit our clinical trial protocols to IRBs or ECs for reexamination, which may impact the costs,

timing or successful completion of a clinical trial. If we experience delays in completion of a clinical trial, or if we terminate

any of our clinical trials, the commercial prospects for our drug candidates may be harmed and our ability to generate product

revenues will be delayed. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of

clinical trials may also ultimately lead to the denial of regulatory approval of a drug candidate.

If

we are required to suspend or discontinue clinical trials due to side effects or other safety risks, or if we are required to

conduct studies on the long-term effects associated with the use of our drug candidates, our efforts to commercialize our products

could be delayed or halted.

Our

clinical trials may be suspended or terminated at any time for a number of safety-related reasons. For example, administering

any drug candidate to humans may produce undesirable side effects. We may voluntarily suspend or terminate our clinical trials

if at any time we believe that our drug candidates present an unacceptable safety risk to the clinical trial patients. In addition,

IRBs, ECs or regulatory agencies may order the temporary discontinuation or termination of our clinical trials at any time if

they believe that the clinical trials are not being conducted in accordance with applicable regulatory requirements, including

if they present an unacceptable safety risk to patients. The existence of undesirable side effects resulting from our drug candidates

could cause us or regulatory authorities, such as the FDA, to interrupt, delay or halt clinical trials of our drug candidates

and could result in the FDA or other regulatory agencies denying further development or approval of our drug candidates for any

or all targeted indications.

Further,

cytokine receptors and opiate growth factor receptors are a novel class of targets. As a result, we may experience unforeseen

adverse side effects with our existing and future drug candidates, including IRT-101 (MENK) and IRT-103

(LDN).

As of the date of this registration statement, although we have not observed harmful side effects in prior studies of LDN or MENK,

later trials could reveal such side effects. The pharmacokinetic profile and results of preclinical studies may not be indicative

of results in any clinical trial.

We

have not conducted studies on the long-term effects associated with the use of our drug candidates. Studies of long-term effects

and chronic dosing (approximately 1 year of dosing); will be required for regulatory approval and may delay introduction of our

therapies or our other drug candidates into the market. Additional studies could also be required at any time after regulatory

approval of any of our drug candidates. Some or all of our drug candidates may prove to be unsafe for human use.

Even

if our drug candidates do obtain regulatory approval they may never achieve market acceptance or commercial success.

Even

if we obtain FDA or other regulatory approval, our drug candidates may not achieve market acceptance among physicians, patients

and/or third party payers or they may be used only in applications more restricted than we anticipate, and ultimately, may not

be commercially successful. Our treatments, if successfully developed, will compete with a number of traditional products manufactured

and marketed by major pharmaceutical and biotechnology companies. Our treatments may also compete with new products currently

under development by such companies and others. Physicians will prescribe a product only if they determine, based on experience,

clinical data, side effect profiles and other factors, that it is beneficial as compared to other products currently available

and in use. Physicians also will prescribe a product based on their traditional preferences. Market acceptance of our drug candidates

for which we receive approval depend on a number of factors, including:

|

|

●

|

the

efficacy and safety of our drug candidates as demonstrated in clinical trials;

|

|

|

|

|

|

|

●

|

the

clinical indications for which the drug is approved;

|

|

|

|

|

|

|

●

|

acceptance

by physicians, major operators of clinics and patients of the drug as a safe and effective treatment;

|

|

|

|

|

|

|

●

|

the

potential and perceived advantages of our drug candidates over alternative treatments;

|

|

|

|

|

|

|

●

|

the

safety of drug candidates seen in a broader patient group, including its use outside the approved indications;

|

|

|

|

|

|

|

●

|

the

cost of treatment in relation to alternative treatments;

|

|

|

|

|

|

|

●

|

the

availability of adequate reimbursement and pricing by third parties and government authorities;

|

|

|

|

|

|

|

●

|

relative

convenience and ease of administration;

|

|

|

|

|

|

|

●

|

the

prevalence and severity of adverse side effects; and

|

|

|

|

|

|

|

●

|

the

effectiveness of our sales and marketing efforts.

|

If

our drug candidates that obtain regulatory approval fail to achieve market acceptance or commercial success, the Company’s

financial results will be adversely affected.

The

commercial success of IRT-103 depends, in part, on Cytocom’s ability to develop and market the drug in North America, and

if we fail in these initiatives, our ability to generate future revenue in the United States could be reduced.

If

Cytocom successfully completes the clinical development program in the U.S. for our lead independent drug candidate, IRT-103 (LDN),

we plan to retain commercial rights to IRT-103 as we have exclusive licensing rights. Any of the following events or factors could

have a material adverse effect on both the ability to generate revenue in the U.S. from the commercialization of IRT-103:

|

|

●

|

we

may be unable to successfully complete the clinical development of IRT-103;

|

|

|

●

|

our

lack of experience in commercializing and marketing drug products;

|

|

|

|

|

|

|

●

|

we

may not have or be able to obtain sufficient financial resources to develop and commercialize IRT-103;

|

|

|

|

|

|

|

●

|

we

may not be able to identify a suitable co-development partner;

|

|

|

|

|

|

|

●

|

we,

or any of our future partners, may fail to fulfill our responsibilities in a timely manner or fail to commit sufficient resources

to the development, regulatory approval, and commercialization efforts related to IRT-103;

|

|

|

|

|

|

|

●

|

we,

or any of our future partners, must comply with additional requests and recommendations from the FDA, including additional

clinical trials;

|

|

|

|

|

|

|

●

|

we,

or any of our future partners, may not obtain all necessary approvals from the FDA and similar foreign regulatory agencies;

|

|

|

|

|

|

|

●

|

IRT-103

must be manufactured in compliance with requirements of the FDA and similar foreign regulatory agencies and in commercial

quantities sufficient to meet market demand;

|

|

|

|

|

|

|

●

|

IRT-103

may not achieve market acceptance by physicians, patients and third party payers;

|

|

|

|

|

|

|

●

|

IRT-103

may not compete successfully against alternative products and therapies; and

|

|

|

|

|

|

|

●

|

we,

or any pharmaceutical company, may independently develop products that compete with IRT-103.

|

Changes

in pharmaceutical and biotechnology industry trends could adversely affect the Company’s operating results.

Industry

trends, economic and political factors that affect pharmaceutical, biotechnology, medical device companies and academic/government

entities sponsoring clinical research directly affect the Company’s business. For example, many companies in such industries

and government organizations have been hiring companies (like the Company) to conduct large development projects. The Company’s

operations, financial condition and growth rate could be materially and adversely affected if these industries reduce outsourcing

of such projects. In the past, mergers, product withdrawals, liability lawsuits and other factors in the pharmaceutical industry

have slowed decision making by pharmaceutical companies and correlating government bodies significantly delaying and/or halting

drug development projects. Continuation or increases in such trends could have an adverse effect on the Company’s business.

Additionally, numerous government agencies have undertaken efforts to control growing healthcare costs through legislation, regulation

and voluntary agreements with medical care providers and pharmaceutical companies. If future regulatory cost-containment efforts

limit potential profits derived from new drugs, the Company’s clients may reduce their drug discovery and development spending.

A reduction in drug discovery and development spending could have a material adverse effect on the Company’s results and

operations creating a significant reduction of the Company’s revenue.

We

currently rely on third parties to conduct all our clinical trials. If these third parties do not successfully carry out their

contractual duties or meet expected deadlines, we may be unable to obtain regulatory approval for or commercialize any of our

drug candidates.

We

currently do not have the ability to independently conduct clinical trials. We rely on medical institutions, clinical investigators,

contract laboratories, collaborative partners and other third parties, such as contract research organizations, to conduct clinical

trials on our drug candidates. The third parties with whom we contract for execution of our clinical trials play a significant

role in the conduct of these trials and the subsequent collection and analysis of data. These third parties are not our employees,

and except for contractual duties and obligations, we have limited ability to control the amount or timing of resources that they

devote to our programs. Our IND is being conducted per 21 Code of Federal Regulations Title 21, Part 312. In addition, we follow

ICH guidelines, including good clinical practices (ICH E6) and current good manufacturing practice (ICH Q7) throughout the development

process. After completion of Phase III clinical trials, the Company will file our NDA for LDN (IRT-103) as a 505(b)(2) application.

Although we rely on these third parties to conduct our clinical trials, we remain responsible for ensuring that each of our preclinical

studies and clinical trials is conducted in accordance with its investigational plan and protocol. Moreover, the FDA and foreign

regulatory authorities

require

us to comply with regulations and standards, commonly referred to as current Good Clinical Practices (“cGCPs”) for

conducting, monitoring, recording and reporting the results of clinical trials to ensure that the data and results are scientifically

credible and accurate and that the trial subjects are adequately informed of the potential risks of participating in clinical

trials.

In

addition, the execution of preclinical studies and clinical trials, and the subsequent compilation and analysis of the data produced,

requires coordination among various parties. In order for these functions to be carried out effectively and efficiently, it is

imperative that these parties communicate and coordinate with one another. Moreover, these third parties may also have relationships

with other commercial entities, some of which may compete with us. In most cases, these third parties may terminate their agreements

upon a material breach by us that is not cured within 30 days by providing us with 30 days’ prior written notice. Many of

these agreements may also be terminated by such third parties under certain other circumstances, including our insolvency or our

failure to comply with applicable laws. In general, these agreements require such third parties to reasonably cooperate with us

at our expense for an orderly winding down of services of such third parties under the agreements. If the third parties conducting

our clinical trials do not perform their contractual duties or obligations, experience work stoppages, do not meet expected deadlines,

terminate their agreements with us or need to be replaced, or if the quality or accuracy of the clinical data they obtain is compromised

due to their failure to adhere to our clinical trial protocols or cGCPs, or for any other reason, we may need to enter into new

arrangements with alternative third parties, which could be costly, and our clinical trials may be extended, delayed or terminated

or may need to be repeated, and we may not be able to obtain regulatory approval for or commercialize the drug candidate being

tested in such trials.

If

any of our drug candidates receive marketing approval, and the Company or others later identify undesirable side effects caused

by the drug candidate, our ability to market and derive revenue from the drugs could be compromised.

If

the Company or others identify undesirable side effects caused by one of our drug candidates, any of the following adverse events

could occur:

|

|

●

|

regulatory

authorities may withdraw approval of the drug or seize the drug;

|

|

|

|

|

|

|

●

|

we

may be required to recall the drug or change the way the drug is administered;

|

|

|

|

|

|

|

●

|

additional

restrictions may be imposed on the marketing or the manufacturing processes of the particular drug;

|

|

|

|

|

|

|

●

|

we

may be subject to fines, injunctions or the imposition of civil or criminal penalties;

|

|

|

|

|

|

|

●

|

regulatory

authorities may require the addition of labeling statements, such as a “black box” warning or a contraindication;

|

|

|

|

|

|

|

●

|

we

may be required to create a medication guide outlining the risks of such side effects for distribution to patients;

|

|

|

|

|

|

|

●

|

we

could be sued and held liable for harm caused to patients;

|

|

|

|

|

|

|

●

|

the

drug may become less competitive; and

|

|

|

|

|

|

|

●

|

our

reputation may suffer.

|

Any

of these could result in the loss of significant revenues, which would materially and adversely affect our results of operations

and business.

We

may need additional financing and may be unable to raise capital on acceptable terms, or at all, when needed, which could force

us to delay, reduce or eliminate our research and development programs and other operations or commercialization efforts.

We

are advancing multiple drug candidates through discovery and development and will require substantial funds to conduct development,

including preclinical studies and clinical trials, of our drug candidates. Commercialization of any drug candidate will also require

substantial expenditures. To further the development and commercialization efforts of our drug candidates, we may need additional

financing to hire additional employees to co-promote drug candidates or to commercialize drug candidates that may not be covered

by our current collaboration agreements.

At

December 31, 2015, we had $23,149 in cash and cash equivalents. We do not believe that our available cash and cash equivalents

will be sufficient to fund our anticipated level of operations for the next 12 months and we will likely need to seek outside

sources of funding. Assuming that anticipated investment and revenue does not materialize business operations would not be able

to continue more than 30 days. We believe we require at least $2,000,000 for our operations over the next 12 months. Our future

financing requirements will depend on many factors, some of which are beyond our control, including:

|

|

●

|

the

rate of progress and cost of our clinical trials, preclinical studies and other discovery and research and development activities;

|

|

|

|

|

|

|

●

|

the

timing of, and costs involved in, seeking and obtaining FDA and other regulatory approvals;

|

|

|

|

|

|

|

●

|

the

continuation and success of our strategic alliances and future collaboration partners;

|

|

|

|

|

|

|

●

|

the

exercise of remaining options under current collaborative agreements;

|

|

|

|

|

|

|

●

|

the

costs of preparing, filing, prosecuting, maintaining and enforcing any patent claims and other intellectual property rights,

including litigation costs and the results of such litigation;

|

|

|

|

|

|

|

●

|

our

ability to enter into additional collaboration, licensing, government or other arrangements and the terms and timing of such

arrangements;

|

|

|

|

|

|

|

●

|

potential

acquisition or in-licensing of other products or technologies; and

|

|

|

|

|

|

|

●

|

the

technologies or other adverse market developments.

|

Future

capital requirements will also depend on the extent to which we acquire or invest in additional complementary businesses, products

and technologies. We currently have no understandings, commitments or agreements relating to any of these types of transactions.

Until

we can generate a sufficient amount of product revenue to finance our cash requirements, which we may never do, we expect to finance

future cash needs primarily through public or private equity offerings, debt financings, government grants and contracts and/or

strategic collaborations. Additional financing may not be available to us when we need it or it may not be available on favorable

terms, if at all. If we are unable to obtain adequate financing when needed, we may have to delay, reduce the scope of or eliminate

one or more of our clinical trials or research and development programs or our commercialization efforts. We may be required to

enter into collaborative partnerships for one or more of our drug candidate programs at an earlier stage of development or on

less favorable terms, which may require us to relinquish rights to some of our drug candidates that we would otherwise have pursued

on our own. We may also be required to pursue strategic alternatives that may affect our business or corporate structure in order

to make ourselves more attractive to investors.

In

addition, If the Company or any of its future collaboration partners does not perform in the manner we expect or fulfill its responsibilities

in a timely manner, or at all, the clinical development, regulatory approval, and commercialization efforts related to IRT-103

(LDN) could be delayed or terminated. It may be necessary for us to assume the responsibility at our own expense for the development

of IRT-103 (LDN). In that event, we would likely be required to seek additional funding.

We

may form additional strategic alliances in the future with respect to our independent programs, and we may not realize any benefits

of such alliances.

We

may form strategic alliances, create joint ventures or collaborations or enter into licensing arrangements with third parties

with respect to our independent programs that we believe will complement or augment our existing business. For example, we plan

to find a partner to co-develop and commercialize IRT-101 (MENK) and IRT-103 (LDN) outside North America upon completion of clinical

development of IRT-103 (LDN) for the treatment of pediatric and adult patients with Crohn’s disease. We face significant

competition in seeking appropriate strategic partners. The negotiation process is time-consuming and complex. Moreover, we may

not be successful in our efforts to establish a strategic partnership or other alternative arrangements for any future product

candidates and programs because our research and development pipeline may be

insufficient,

our product candidates and programs may be deemed to be at too early a stage of development for collaborative effort and/or third

parties may not view our product candidates and programs as having the requisite potential to demonstrate safety and efficacy.

We cannot be certain that, following a strategic transaction or license, we will achieve the revenues or specific net income that

justifies such transactions. Any delays in entering into new strategic partnership agreements related to our product candidates

could also delay the development and commercialization of our product candidates and reduce their competitiveness even if they

reach the market.

We

do not currently manufacture IRT-103 Low Dose Naltrexone (LDN) and therefore must rely on third-party manufacturing to supply

the drug for clinical trials. If one of our suppliers or manufacturers fails to perform adequately or fulfill our needs, we may

be required to incur significant costs and devote significant efforts to find new suppliers or manufacturers, which would cause

delays in the development and commercialization of our drug candidates.

The

manufacture of pharmaceutical products in compliance with cGMPs requires significant expertise and capital investment, including

the development of advanced manufacturing techniques and process controls. Manufacturers of pharmaceutical products often encounter

difficulties in production, including difficulties with production costs and yields, quality control, including stability of the

drug candidate and quality assurance testing, shortages of qualified personnel, as well as compliance with strictly enforced FDA

cGMP requirements, other federal and state regulatory requirements, and foreign regulations. If our manufacturers were to encounter

any of these difficulties or otherwise fail to comply with their obligations to us or under applicable regulations, our ability

to provide study drugs in our preclinical studies and clinical trials would be jeopardized. Any delay or interruption in the supply

of preclinical study or clinical trial materials could delay the completion of our preclinical studies and clinical trials, increase

the costs associated with maintaining our preclinical study and clinical trial programs and, depending upon the period of delay,

require us to commence new trials at significant additional expense or terminate the studies and trials completely.

All

manufacturers of our drug candidates must comply with cGMP requirements enforced by the FDA through its facilities inspection

program. These requirements include, among other things, quality control, quality assurance and the maintenance of records and

documentation. Manufacturers of our component materials may be unable to comply with these cGMP requirements and with other FDA,

state and foreign, regulatory requirements. The FDA or similar foreign regulatory agencies at any time may also implement new

standards, or change their interpretation and enforcement of existing standards for manufacture, packaging or testing of products.

We have little control over our manufacturers’ compliance with these regulations and standards. A failure to comply with

these requirements may result in fines and civil penalties, suspension of production, suspension or delay in product approval,

product seizure or recall, or withdrawal of product approval. If the safety of any product supplied is compromised due to our

manufacturers’ failure to adhere to applicable laws or for other reasons, we may not be able to obtain regulatory approval

for or successfully commercialize our products, and we may be held liable for any injuries sustained as a result. Any of these

factors could cause a delay of clinical trials, regulatory submissions, approvals or commercialization of our drug candidates

or entail higher costs or impair our reputation.

We

source the API for IRT-103 (LDN) from a third-party manufacturing vendor. Another pharmaceutical company manufactures the API

for IRT-101. Our current agreements with our suppliers provide for the entire supply of the API necessary for additional clinical

trials or for full-scale commercialization. In the event that we and our suppliers cannot agree to the terms and conditions for

them to continue to provide some or all of our API clinical and commercial supply needs, or if any single source supplier terminates

the agreement in response to a breach by us, we would not be able to manufacture the API on a commercial scale until a qualified

alternative supplier is identified, which could also delay the development of, and impair our ability to commercialize, our drug

candidates.

Although

alternative sources of supplies exist, the number of third party suppliers with the necessary manufacturing and regulatory expertise

and facilities are limited, and it could be expensive and take a significant amount of time to arrange for alternative suppliers,

which could have a material adverse effect on our business. New suppliers of any API would be required to qualify under applicable

regulatory requirements and would need to have sufficient rights to the method of manufacturing such ingredients under applicable

intellectual property laws. Obtaining the necessary FDA approvals or other qualifications under applicable regulatory requirements

and ensuring non-infringement of third party intellectual property rights could result in a significant interruption of supply

and could require the new manufacturer to bear significant additional costs which may be passed on to us.

We

currently have only a limited distribution organization with no sales and marketing staff. If we are unable to develop sales and

marketing and expand distribution capability on our own or through collaborations with marketing partners, we will not be successful

in commercializing our future products.

We

currently have only a limited distribution organization with no sales or marketing staff. If our products are approved for sale

in the United States we will need to execute a number of sales and marketing agreements, but there can be no assurance that the

Company will be able to sign an agreement to market and distribute our products. To the extent we rely on third parties for marketing

and distributing our approved products, any revenue we receive will depend upon the efforts of third parties, which may not be

successful, and are only partially within our control. Our reliance on third parties makes it likely that our product revenue

is likely to be lower than if we directly marketed or sold our products. If we are unable to enter into arrangements with third

parties to commercialize the approved products on acceptable terms or at all, we may not be able to successfully commercialize

our future products or we will have to market these products ourselves, which will be expensive and require us to build our own

sales force, which we do not have experience doing. We cannot assure you we will be successful in any of these initiatives. If

we are not successful in commercializing our future products, either on our own or through collaborations with one or more third

parties, our future product revenue will be materially adversely affected.

We

are dependent on market acceptance of compounding pharmacies and compounded formulations, and physicians may be unwilling to prescribe,

and patients may be unwilling to use, our proprietary LDN compounded formulation.

We

are currently distributing our proprietary LDN formulation through Complete Pharmacy and Medical Solutions, LLC and expect to

distribute such formulation through other compounding pharmacies outside of the U.S. Formulations prepared and dispensed by compounding

pharmacies contain FDA-approved ingredients, but are not themselves approved by the FDA. As a result, our formulation has not

undergone the FDA approval process and only limited data, if any, may be available with respect to the safety and efficiency of

our formulation for any particular indication. Some physicians may be hesitant to prescribe, and some patients may be hesitant

to purchase and use, this non-FDA approved compounded formulation. In addition, certain compounding pharmacies have been the subject

of widespread negative media coverage in recent years, and the actions of these pharmacies have resulted in increased scrutiny

of compounding pharmacy activities from the FDA and state governmental agencies. As a result, physicians may be unwilling to prescribe

a compounded formulation when an FDA-approved alternative is available, even if they believe the compounded formulation to be

superior and less expensive. Other reasons physicians may be unwilling to prescribe or patients may be unwilling to use our proprietary

LDN compounded formulation could include the following, among others: our proprietary formulation is not required to be, and has

not been, approved for marketing and sale by the FDA; there may be limited or no data available with respect to the clinical efficacy

or safety of our compounded formulation the physician is prescribing; and to the extent there is such data available, we are limited

in our ability to discuss the efficacy or safety of our formulation with potential purchasers of our formulation.

Additionally,

some third-party payors, including the government Medicare and Medicaid programs, may not provide reimbursement for compounded

formulations. Physicians who may otherwise be interested in prescribing our formulation or utilizing our compounding pharmacy

services may be unwilling to do so if third party payor reimbursement, including Medicare and Medicaid reimbursement, is not available

for our compounded formulation. Any failure by physicians, patients and/or third-party payors to accept and embrace compounded

formulations could substantially limit our market and cause our operations to suffer.

We

aim to generate revenue from our proprietary LDN formulation through our licensing arrangement with Complete Pharmacy and Medical

Solutions, LLC and potentially other compounding pharmacies outside of the United States, but we may not be successful in our

efforts to generate revenue from such formulation.

One