Lifeway Foods, Inc., (Nasdaq:LWAY), the leading U.S. supplier of

kefir cultured dairy products, today reported financial results for

the third quarter ended September 30, 2016.

“Our third quarter results reflects our

commitment to drive growth and better position Lifeway for future

success,” said Julie Smolyansky, CEO of Lifeway Foods, Inc. “I am

pleased to report that Lifeway’s total household penetration is up

28% compared to last year, a strong indication that the strategic

marketing and trade investments we have made are attracting a

broader consumer base. Today, Lifeway’s brand is stronger than ever

and we believe there are still tremendous white space opportunities

for us to further expand distribution of our diverse portfolio of

products across all retail sales channels. Looking forward, we will

continue to prioritize our key initiatives to drive sales, improve

profitability and create long-term value for our shareholders.”

Third Quarter Results

Third quarter of 2016 net sales increased 1.3%

to $30.0 million from $29.6 million in the third quarter of 2015

reflecting higher volumes of private label and organic products

partially offset by an increased investment in trade programs.

Gross profit as a percent of net sales decreased

to 26.6% from 30.2% in the same period last year. The

decrease in gross margin reflects increased trade promotion and

unfavorable mix.

Selling expenses increased by $1.6 million to

$4.3 million during the third quarter of 2016 from $2.7 million in

the third quarter of 2015. The increase in selling expenses

reflects an increase in advertising costs associated with a

six-week advertising campaign in the third quarter. As a percentage

of net sales, selling expenses increased to 14.4% compared to 9.1%

in the same period last year.

General and administrative expenses decreased by

$0.7 million or 17.3% to $3.3 million reflecting lower professional

fees partially offset by higher compensation levels.

The effective tax rate for third quarter of 2016 exceeded 100%

compared to 50.9% in the third quarter of 2015. The higher

tax rate in the third quarter of 2016 reflects the relatively low

level of profits in the third quarter of 2016.

Net loss was approximately $64,000, or $0.00 per

diluted share for the quarter ended September 30, 2016, compared to

net income of $893,000, or $0.05 per diluted share for the quarter

ended September 30, 2015.

First Nine Months of Fiscal

2016

Total consolidated net sales increased by $4.6

million, or approximately 5.2%, to $93.7 million during the

nine-month period ended September 30, 2016 reflecting volume gains

in private label and organic products and lower trade spending

compared to last year.

Gross profit as a percent of net sales increased

to 28.2% from 26.2% in the same period last year. The increase

reflects lower input costs, primarily milk, and lower trade

spending.

Selling expenses increased approximately 24.4%

to $10.7 million during the first nine months of 2016 from $8.6

million in the first nine months of 2015, reflecting additional

advertising campaigns in the 2016 period. As a percentage of net

sales, selling expenses increased to 11.5% compared to 9.7% in the

same period last year.

General and administrative expenses decreased by

$0.3 million or 3.2% to $10.3 million reflecting lower professional

fees partially offset by higher compensation.

The effective tax benefit for the first nine

months of 2016 was 33.0% compared to 50.8% in the same period last

year, primarily reflecting the implementation of tax planning

strategies in 2016.

Net income was $3.0 million or $0.19 per diluted

share for the nine-month period ended September 30, 2016 compared

to $1.6 million or $0.10 per diluted share in the same period in

2015.

Balance Sheet

Cash and cash equivalents were approximately

$9.2 million as of September 30, 2016 compared to cash and cash

equivalents of $5.6 million as of December 31, 2015.

The Company did not repurchase any shares of

common stock during the third quarter of 2016. Approximately 1.2

million shares remain available to repurchase under the company’s

authorized program as of September 30, 2016. The stock

repurchase program has no expiration date and may be suspended or

discontinued at any time.

Conference Call

The Company will host a conference call to

discuss these results with additional comments and details on

Thursday, November 10, 2016 at 10:00 a.m. ET. The call will be

broadcast live over the Internet hosted at the Investor Relations

section of Lifeway Foods’ website at www.lifewaykefir.com, and will

be archived online. In addition, listeners may dial 877-407-3982 in

North America, and international listeners may dial 201-493-6780.

Participants from the Company will be Julie Smolyansky, President

and Chief Executive Officer, Ed Smolyansky, Chief Operating

Officer, and John Waldron, Chief Financial Officer.

About Lifeway Foods

Lifeway Foods, Inc. (LWAY), recently named one

of Forbes’ Best Small Companies, is America’s leading supplier of

the probiotic fermented beverage known as kefir. In addition to its

line of drinkable kefir, the company also produces frozen kefir,

specialty cheeses and a ProBugs line for kids. Lifeway’s tart and

tangy cultured dairy products are available throughout the United

States and on a small, but growing basis, in Canada, Latin America

and the United Kingdom. Learn how Lifeway is good for more than

just you at www.lifewaykefir.com.

Find Lifeway Foods, Inc. on Facebook:

www.facebook.com/lifewaykefirFollow Lifeway Foods on Twitter:

http://twitter.com/lifeway_kefirYouTube:

http://www.youtube.com/user/lifewaykefir

Forward-Looking Statements

All statements in this release (and oral

statements made regarding the subjects of this release) other than

historical facts are forward-looking statements within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements rely on a number of assumptions

concerning future events and are subject to a number of

uncertainties and factors, many of which are outside the Company’s

control, which could cause actual results to differ materially from

such statements. Forward-looking statements often address our

expected future business and financial performance, and often

contain words such as “believe,” “expect,” “anticipate,” “intend,”

“plan,” or “will.” By their nature, forward-looking statements

address matters that are subject to risks and uncertainties. Any

such forward-looking statements may involve risk and uncertainties

that could cause actual results to differ materially from any

future results encompassed within the forward-looking statements.

Examples of such forward-looking statements include, but are not

limited to, statements regarding our expectations with regard to

any restated amount in our financial statements for the Restated

Period or our anticipated financial results for the three months

ended March 31, 2016. Factors that could cause or contribute to

such differences include: the review of the Company’s accounting,

accounting policies and internal control over financial reporting;

the preparation of and review of the Amended Form 10-Q; and the

subsequent discovery of additional adjustments to the Company’s

previously issued financial statements. Actual events or results

may differ materially from the Company’s expectations. In addition,

our financial results and stock price may suffer as a result of

this review and any subsequent determinations from this process or

any actions taken by governmental or other regulatory bodies as a

result of this process.

These forward-looking statements are also

affected by the risk factors, forward-looking statements and

challenges and uncertainties described in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2015, and

Lifeway’s other filings with the SEC, which are available at

www.lifewaykefir.com. Except as required by law, the Company

expressly disclaims any intention or obligation to revise or update

any forward-looking statements, whether as a result of new

information, future events or otherwise.

| |

| LIFEWAY FOODS, INC. AND

SUBSIDIARIES |

| Consolidated Balance Sheets |

| September 30, 2016 and December 31,

2015 |

| (In thousands) |

| |

|

|

|

|

|

|

| |

|

September 30,

2016(Unaudited) |

|

|

December 31,

2015 |

|

| Current

assets |

|

|

|

|

|

|

| Cash and cash

equivalents |

|

$ |

9,164 |

|

|

$ |

5,646 |

|

| Investments, at fair

value |

|

|

— |

|

|

|

2,216 |

|

| Certificates of

deposits in financial institutions |

|

|

— |

|

|

|

513 |

|

| Inventories |

|

|

9,186 |

|

|

|

7,664 |

|

| Accounts receivable,

net of allowance for doubtful accounts and discounts &

allowances of $1,800 at September 30, 2016 and December 31,

2015 |

|

|

10,426 |

|

|

|

9,604 |

|

| Prepaid expenses and

other current assets |

|

|

550 |

|

|

|

201 |

|

| Deferred income

taxes |

|

|

509 |

|

|

|

556 |

|

| Refundable income

taxes |

|

|

521 |

|

|

|

449 |

|

| Total current

assets |

|

|

30,356 |

|

|

|

26,849 |

|

| |

|

|

|

|

|

|

|

|

| Property and

equipment, net |

|

|

21,603 |

|

|

|

21,375 |

|

| |

|

|

|

|

|

|

|

|

| Intangible

assets |

|

|

|

|

|

|

|

|

| Goodwill &

indefinite-lived intangibles |

|

|

14,068 |

|

|

|

14,068 |

|

| Other intangible

assets, net |

|

|

1,815 |

|

|

|

2,344 |

|

| Total

intangible assets |

|

|

15,883 |

|

|

|

16,412 |

|

| |

|

|

|

|

|

|

|

|

| Other

Assets |

|

|

368 |

|

|

|

282 |

|

| Total

assets |

|

$ |

68,210 |

|

|

$ |

64,918 |

|

| |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

| Current maturities of

notes payable |

|

$ |

840 |

|

|

$ |

840 |

|

| Accounts payable |

|

|

8,762 |

|

|

|

8,393 |

|

| Accrued expenses |

|

|

2,002 |

|

|

|

1,538 |

|

| Accrued income

taxes |

|

|

267 |

|

|

|

52 |

|

| Total current

liabilities |

|

|

11,871 |

|

|

|

10,823 |

|

| |

|

|

|

|

|

|

|

|

| Notes

payable |

|

|

6,489 |

|

|

|

7,119 |

|

| |

|

|

|

|

|

|

|

|

| Deferred income

taxes |

|

|

2,162 |

|

|

|

1,719 |

|

| Total

liabilities |

|

|

20,522 |

|

|

|

19,661 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders'

equity |

|

|

|

|

|

|

|

|

| Common stock, no par

value; 40,000 shares authorized; |

|

|

|

|

|

|

|

|

| 17,274,

shares issued; 16,141 and 16,210 shares |

|

|

|

|

|

|

|

|

|

outstanding at September 30, 2016 and December 31, 2015

respectively |

|

|

6,509 |

|

|

|

6,509 |

|

| Paid-in-capital |

|

|

2,133 |

|

|

|

2,033 |

|

| Treasury stock, at

cost |

|

|

(10,468 |

) |

|

|

(9,730 |

) |

| Retained earnings |

|

|

49,514 |

|

|

|

46,516 |

|

| Accumulated other

comprehensive income (loss), net of taxes |

|

|

— |

|

|

|

(71 |

) |

| Total

stockholders' equity |

|

|

47,688 |

|

|

|

45,257 |

|

| |

|

|

|

|

|

|

|

|

| Total

liabilities and stockholders' equity |

|

$ |

68,210 |

|

|

$ |

64,918 |

|

| |

|

|

|

|

|

|

|

|

| LIFEWAY FOODS, INC. AND

SUBSIDIARIES |

| Consolidated Statements of Income (Loss) and

Comprehensive Income (Loss) |

| For the Three Months and Nine Months ended

September 30, 2016 and 2015 |

| (Unaudited) |

| (In thousands, except per share

data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September

30, |

|

|

|

Nine Months Ended September

30, |

|

|

|

|

|

|

|

|

|

(Revised) |

|

|

|

|

|

|

|

(Revised) |

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

sales |

|

|

$ |

|

29,990 |

|

|

|

$ |

29,599 |

|

|

$ |

93,691 |

|

|

$ |

89,042 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

|

|

|

21,478 |

|

|

|

|

20,049 |

|

|

|

65,480 |

|

|

|

63,916 |

|

| Depreciation

expense |

|

|

|

|

533 |

|

|

|

|

614 |

|

|

|

1,797 |

|

|

|

1,809 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of goods

sold |

|

|

|

|

22,011 |

|

|

|

|

20,663 |

|

|

|

67,277 |

|

|

|

65,725 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

|

|

7,979 |

|

|

|

|

8,936 |

|

|

|

26,414 |

|

|

|

23,317 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling expenses |

|

|

|

|

4,306 |

|

|

|

|

2,706 |

|

|

|

10,733 |

|

|

|

8,626 |

|

| General and

administrative |

|

|

|

|

3,308 |

|

|

|

|

3,998 |

|

|

|

10,300 |

|

|

|

10,643 |

|

| Amortization

expense |

|

|

|

|

176 |

|

|

|

|

179 |

|

|

|

529 |

|

|

|

537 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating

expenses |

|

|

|

|

7,790 |

|

|

|

|

6,883 |

|

|

|

21,562 |

|

|

|

19,806 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from

operations |

|

|

|

|

189 |

|

|

|

|

2,053 |

|

|

|

4,852 |

|

|

|

3,511 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

|

|

(56 |

) |

|

|

|

(55 |

) |

|

|

(161 |

) |

|

|

(179 |

) |

| Gain / (Loss) on sale

of investments, net reclassified from OCI |

|

|

|

|

12 |

|

|

|

|

1 |

|

|

|

(15 |

) |

|

|

(21 |

) |

| Impairment of

investments |

|

|

|

— |

|

|

|

|

(205 |

) |

|

|

— |

|

|

|

(385 |

) |

| (Loss) / Gain on sale

of property and equipment |

|

|

|

|

(156 |

) |

|

|

|

— |

|

|

|

(307 |

) |

|

|

243 |

|

| Other income (expense),

net |

|

|

|

|

28 |

|

|

|

|

26 |

|

|

|

105 |

|

|

|

173 |

|

| Total other income

(expense) |

|

|

|

|

(172 |

) |

|

|

|

(233 |

) |

|

|

(378 |

) |

|

|

(169 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before

provision for income taxes |

|

|

|

|

17 |

|

|

|

|

1,820 |

|

|

|

4,474 |

|

|

|

3,342 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income

taxes |

|

|

|

|

81 |

|

|

|

|

927 |

|

|

|

1,476 |

|

|

|

1,697 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

|

$ |

|

(64 |

) |

|

|

$ |

893 |

|

|

$ |

2,998 |

|

|

$ |

1,645 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings

(loss) per common share |

|

|

$ |

|

(0.00 |

) |

|

|

$ |

0.05 |

|

|

$ |

0.19 |

|

|

$ |

0.10 |

|

| Diluted

earnings (loss) per common share |

|

|

$ |

|

(0.00 |

) |

|

|

$ |

0.05 |

|

|

$ |

0.19 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares outstanding – Basic |

|

|

|

|

16,141 |

|

|

|

|

16,346 |

|

|

|

16,159 |

|

|

|

16,346 |

|

| Weighted

average number of shares outstanding – Diluted |

|

|

|

|

16,161 |

|

|

|

|

16,346 |

|

|

|

16,181 |

|

|

|

16,346 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE

INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

|

$ |

|

(64 |

) |

|

|

$ |

893 |

|

|

$ |

2,998 |

|

|

$ |

1,645 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains (losses) on investments, net of taxes |

|

|

|

|

6 |

|

|

|

|

(183 |

) |

|

|

62 |

|

|

|

(247 |

) |

| Reclassifications to

earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

than temporary impairment of investments, net of taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Realized

(gains) losses on investments, net of taxes |

|

|

|

|

(8 |

) |

|

|

|

124 |

|

|

|

9 |

|

|

|

247 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive

income (loss) |

|

|

$ |

|

(66 |

) |

|

|

$ |

834 |

|

|

$ |

3,069 |

|

|

$ |

1,645 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIFEWAY FOODS, INC. AND

SUBSIDIARIES |

| Consolidated Statements of Cash

Flows |

| For the Nine Months Ended September 30, 2016

and 2015 |

| (Unaudited) |

| (In thousands) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

2016 |

|

|

2015 |

|

| Net

income |

|

$ |

2,998 |

|

|

$ |

1,645 |

|

| Adjustments to

reconcile net income to operating cash flow: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

2,326 |

|

|

|

2,346 |

|

| Loss on

sale of investments, net |

|

|

15 |

|

|

|

21 |

|

|

Impairment of investments |

|

|

— |

|

|

|

385 |

|

| Deferred

income taxes |

|

|

444 |

|

|

|

(472 |

) |

| Reserve

for inventory obsolescence |

|

|

89 |

|

|

|

— |

|

| Stock

based compensation |

|

|

100 |

|

|

|

— |

|

| Loss

(Gain) on sale of property and equipment |

|

|

307 |

|

|

|

(243 |

) |

| (Increase)

decrease in operating assets: |

|

|

|

|

|

|

|

|

| Accounts

receivable |

|

|

(823 |

) |

|

|

(540 |

) |

|

Inventories |

|

|

(1,611 |

) |

|

|

(1,118 |

) |

|

Refundable income taxes |

|

|

(72 |

) |

|

|

1,011 |

|

| Prepaid

expenses and other current assets |

|

|

(310 |

) |

|

|

252 |

|

| Increase

(decrease) in operating liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

|

370 |

|

|

|

(396 |

) |

| Accrued

expenses |

|

|

465 |

|

|

|

1,038 |

|

| Accrued

income taxes |

|

|

215 |

|

|

|

449 |

|

| Net cash

provided by operating activities |

|

|

4,513 |

|

|

|

4,378 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

| Purchases of

investments |

|

|

(559 |

) |

|

|

(1,369 |

) |

| Proceeds from sale of

investments |

|

|

2,751 |

|

|

|

1,230 |

|

| Redemption of

certificates of deposits |

|

|

513 |

|

|

|

250 |

|

| Investments in

certificates of deposit |

|

|

— |

|

|

|

(635 |

) |

| Purchases of property

and equipment |

|

|

(2,481 |

) |

|

|

(1,619 |

) |

| Proceeds from sale of

property and equipment |

|

|

149 |

|

|

|

343 |

|

| Net cash

provided by (used in) investing activities |

|

|

373 |

|

|

|

(1,800 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

| Purchase of treasury

stock |

|

|

(738 |

) |

|

|

— |

|

| Repayment of notes

payable |

|

|

(630 |

) |

|

|

(827 |

) |

| Net cash used

in financing activities |

|

|

(1,368 |

) |

|

|

(827 |

) |

| |

|

|

|

|

|

|

|

|

| Net increase in

cash and cash equivalents |

|

|

3,518 |

|

|

|

1,751 |

|

| Cash and cash

equivalents at the beginning of the period |

|

|

5,646 |

|

|

|

3,260 |

|

| Cash and cash

equivalents at the end of the period |

|

$ |

9,164 |

|

|

$ |

5,011 |

|

| Supplemental

cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for income taxes, net of refunds |

|

$ |

886 |

|

|

$ |

795 |

|

|

Cash paid for interest |

|

$ |

162 |

|

|

$ |

178 |

|

| |

|

|

|

|

|

|

|

|

Contact:

Lifeway Foods, Inc.

Phone: 877.281.3874

Email: info@Lifeway.net

Investor Relations:

ICR

Katie Turner

Hunter Wells

646.277.1228

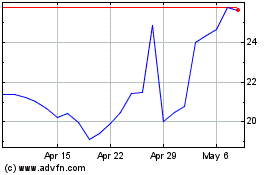

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

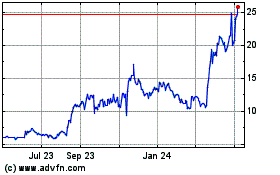

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Apr 2023 to Apr 2024