Markets Slip as Trump's Startling Victory Unnerves Investors

November 09 2016 - 5:10AM

Dow Jones News

Donald Trump's surprise victory in the U.S. presidential race

upended global markets early Wednesday, concluding one of the most

divisive and unpredictable campaigns on record.

Stocks around the world quickly sold off, gold soared and the

dollar fell sharply as Donald Trump defeated Hillary Clinton to

become the 45th president of the U.S.

Financial markets weren't prepared.

As Mr. Trump took to the stage and vowed to begin the "urgent

task of rebuilding our nation and renewing the American dream,"

risk assets initially set out on their steepest decline in months,

before recovering many of those losses during early European

trading hours.

"There is a bit of surprise, moderated panic even," said Nandini

Ramakrishnan, global strategist at J.P. Morgan Asset Management.

"We knew more or less what we were going to get with Clinton—a

little bit less is certain about Trump."

Investors had largely counted on a narrow victory by Democratic

candidate Hillary Clinton, who had been consistently leading in

polls and betting markets right until roughly 9 p.m. Eastern time

on Tuesday as polling results came in.

"The polls were wrong, but this time on the election of the

president of the largest economy in the world," said Jordan

Rochester, strategist at Nomura.

S&P 500 futures had tumbled as much as 5% as the polls

pointed to a likely surprise victory for Mr. Trump, triggering a

circuit breaker until U.S. markets open again. Brent crude oil shed

over 3% as risk assets sold off, while gold climbed as much as 5%

in a flight to safety before paring gains.

The yield on the 10-year Treasury note fell quickly from 1.896%

to as low as 1.720% before recovering.

Global investors took note.

Japan's Nikkei Stock Average shed 5.4%, its biggest loss since

Britain's June referendum, as the dollar fell to as low as ¥

101.1940 against the yen.

European markets initially opened with a thud, as German's DAX

shed 2.7% while markets in Spain and Italy shed over 3%. The

export-heavy auto sector fared worse in the Stoxx Europe 600,

shedding over 3% as the euro rose 0.9% against the dollar to

$1.1115.

"When I felt the chances of Trump winning were increasing, I

rushed into the office to warn clients," said James Butterfill,

head of research and investment strategy at ETF Securities in

London.

"We're worried of the geopolitical implications," he said, as

well as what it means for the Federal Reserve and rising populist

movements across Europe.

Losses in Europe began to moderate shortly after markets opened,

with the Stoxx Europe 600 trading down just 0.8% midmorning, while

S&P futures pared declines to 1.8%. Gains in gold eased.

Investors were also beginning to question the Federal Reserve's

plans to raise interest rates in December, betting that a period of

market turmoil following the surprise election result could keep

the central bank on hold.

The WSJ Dollar Index fell sharply but recovered to trade flat

after European markets opened.

The Mexican peso, which had moved closely in line with Mr.

Trump's polling success during the election campaign, fell as much

as 11% against the dollar before recovering to trade down 7.3%.

The move in the peso was particularly noteworthy on the trading

floor of Mizuho Financial Group Inc.'s Americas unit in midtown

Manhattan Tuesday night.

"That is a very big move, especially over 3.5 hours," said Dan

Riveira, managing director in foreign-exchange trading at Mizuho

Financial. "The peso is being used as a barometer for the

election."

As the currency's value rapidly flashed in magenta on his

screen, Mr. Riveira said this is the biggest move in the Mexican

peso he can remember.

Chelsey Dulaney contributed to this article.

Write to Riva Gold at riva.gold@wsj.com, Ira Iosebashvili at

ira.iosebashvili@wsj.com and Min Zeng at min.zeng@wsj.com

(END) Dow Jones Newswires

November 09, 2016 04:55 ET (09:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

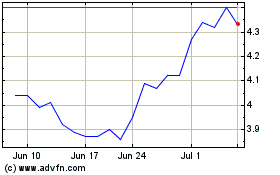

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

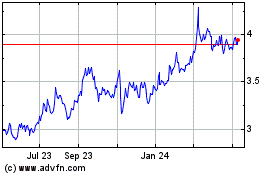

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Apr 2023 to Apr 2024