Trucker J.B. Hunt Will Add to Fleet in 2017

November 08 2016 - 6:20PM

Dow Jones News

As weak demand sends new heavy-duty truck orders plummeting, at

least one major carrier is planning to put more vehicles on the

road.

Lowell, Ark.-based J.B. Hunt Transport Services Inc., the

third-largest U.S. trucking company by revenue, expects to add 500

to 700 trucks next year to its dedicated contract services business

managing fleets for retailers and manufacturers. It will add 100 to

120 trucks to its truckload segment, the operation that includes

freight transport for customers in the spot market for trucking

service.

The growth strategy comes as the rest of industry is cutting

back shipping capacity after coping with tepid demand and weak

pricing for much of 2016. Orders for heavy-duty commercial trucks

in North America dropped 46% in October, a bellwether month for the

sector, according to ACT Research.

Companies including Swift Transportation Co., Werner Enterprises

Inc. and Covenant Transportation Group Inc. said they had pulled

hundreds of trucks from service in the third quarter to address

overcapacity and falling shipping prices. But J.B. Hunt added 83

trucks last quarter to its truckload segment, where companies sell

the full capacity on a tractor-trailer to a single shipper.

"It appears as if the strategy management has undertaken in

2016, whereby it continues to add assets despite a depressed market

to gain share, will continue into 2017," said an analyst note from

Stifel on the report.

J.B. Hunt, which had $6.2 billion in revenue in 2015, "remains

one of the few, if not the only, player who can sustainably finance

such a strategy thanks to the expansiveness of its operation and

margin agreements with railroads," the note said.

Even with the additional trucks, overall capital expenditures

are projected to drop to $477 million in 2017 from an estimated

$515 million for 2016, J.B. Hunt's presentation said. The company

lists irrational competitive pricing and customer rate behavior

among as potential risks in the coming year.

SJ Consulting Group, an industry research firm, ranked J.B. Hunt

behind only United Parcel Service Inc. and FedEx Corp. in revenue

from all trucking services last year.

Write to Loretta Chao at loretta.chao@wsj.com

(END) Dow Jones Newswires

November 08, 2016 18:05 ET (23:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

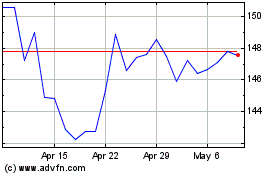

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

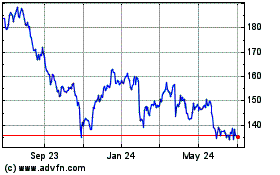

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024