Deutsche Telekom AG 3Q 2016 -- Forecast

November 08 2016 - 8:59AM

Dow Jones News

FRANKFURT--The following is a summary of analysts' forecasts for

Deutsche Telekom AG (DTE.XE) third-quarter results, based on a poll

of six analysts conducted by Dow Jones Newswires (figures in

million euros, EPS, dividend and target price in euro, according to

IFRS). Earnings figures are scheduled to be released November

10.

===

EBITDA Free

3rd Quarter Revenue adjusted Cashflow

AVERAGE 18,057 5,493 1,452

Prev. Year 17,099 5,165 1,308

+/- in % +5.6 +6.3 +11

MEDIAN 18,073 5,524 1,400

Maximum 18,157 5,702 1,588

Minimum 17,961 5,167 1,328

Amount 6 6 5

Bankhaus Lampe 18,093 5,534 --

Barclays 18,157 5,498 1,400

Deutsche Bank 17,961 5,542 1,546

DZ Bank 17,985 5,514 1,328

Equinet 18,052 5,167 1,400

Jefferies 18,093 5,702 1,588

Germany: USA: Europe:

EBITDA EBITDA EBITDA

3rd Quarter Revenue adj. Revenue adj. Revenue adj.

AVERAGE 5,482 2,252 8,347 2,213 3,146 1,083

Prev. Year 5,593 2,269 7,059 1,702 3,261 1,157

+/- in % -2.0 -0.8 +18 +30 -3.5 -6.4

MEDIAN 5,468 2,251 8,315 2,184 3,137 1,080

Maximum 5,611 2,260 8,437 2,326 3,209 1,101

Minimum 5,373 2,245 8,290 2,159 3,100 1,070

Amount 5 4 5 4 4 4

Barclays 5,546 2,251 8,437 2,159 3,100 1,070

Deutsche Bank 5,373 2,250 8,315 2,168 3,173 1,079

DZ Bank 5,410 2,245 8,400 2,200 3,100 1,080

Equinet 5,611 -- 8,290 -- -- --

Jefferies 5,468 2,260 8,295 2,326 3,209 1,101

System Sol.: GHS (a):

EBITDA EBITDA

3rd Quarter Revenue adjusted Revenue adjusted

AVERAGE 1,981 167 512 -130

Prev. Year 2,031 176 555 -133

+/- in % -2.4 -5.0 -7.7 --

MEDIAN 1,983 167 520 -129

Maximum 2,009 181 534 -110

Minimum 1,950 154 475 -153

Amount 4 4 4 4

Barclays 2,009 181 534 -153

Deutsche Bank 1,950 163 517 -118

DZ Bank 2,000 154 475 -110

Jefferies 1,966 171 522 -140

Target price Rating DPS 2016

AVERAGE 16.61 positive 4 AVERAGE 0.59

Prev. Quarter 16.86 neutral 2 Prev. Year 0.55

+/- in % -1.5 negative 1 +/- in % +7.9

MEDIAN 16.50 MEDIAN --

Maximum 20.00 Maximum 0.61

Minimum 12.10 Minimum 0.58

Amount 7 Amount 3

Bankhaus Lampe 15.00 Hold 0.58

Barclays 20.00 Overweight --

Deutsche Bank 19.00 Buy 0.59

DZ Bank 16.50 Buy --

Equinet 15.50 Neutral --

Jefferies 12.10 Underperform --

UBS 18.20 Buy 0.61

===

Year-earlier figures are as reported by the company.

(a) Group Headquarters and Shared Services.

DJG/mus

(END) Dow Jones Newswires

November 08, 2016 08:44 ET (13:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

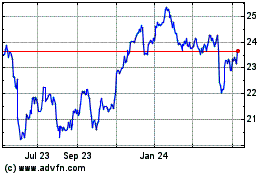

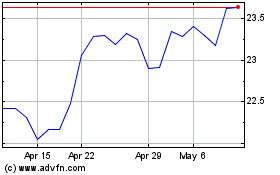

Deutsche Telekom (QX) (USOTC:DTEGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Deutsche Telekom (QX) (USOTC:DTEGY)

Historical Stock Chart

From Apr 2023 to Apr 2024