Current Report Filing (8-k)

November 07 2016 - 5:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED):

November 2, 2016

SURMODICS, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

MINNESOTA

|

0-23837

|

41-1356149

|

|

(STATE OR OTHER JURISDICTION OF INCORPORATION)

|

(COMMISSION FILE NUMBER)

|

(IRS EMPLOYER

IDENTIFICATION NO.)

|

|

9924 West 74th Street

EDEN PRAIRIE, MN 55344

|

|

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES, INCLUDING ZIP CODE)

|

(952) 500-7000

(REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE)

N/A

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On November 2, 2016, Surmodics, Inc. (the "

Company

") amended and restated its secured revolving credit facility pursuant to an Amended and Restated Credit Agreement (the "

Credit Agreement

") with Wells Fargo Bank, National Association (the "

Bank

"). The Credit Agreement increases availability under the secured revolving line of credit from $20 million to $30 million and extends the maturity of the previous facility by three years. The Company's obligations under the Credit Agreement are secured by substantially all of its and its subsidiaries' assets, other than intellectual property and real estate. The Company has also pledged the stock of its subsidiaries to secure such obligations.

Interest expense under the Credit Agreement was reduced as compared to the Company's prior secured revolving credit facility as specified in an amended and restated revolving line of credit note (the "

Note

") executed by the Company in favor of the Bank. Interest under the Credit Agreement accrues at a rate per annum equal to (i) LIBOR (as defined in the Note) for an interest period of one month, reset daily, plus a margin ranging from 1.00% to 1.75% or (ii) LIBOR for an interest period of either one, three or six months as selected by the Company, reset at the end of the selected interest period, plus a margin ranging from 1.00% to 1.75%. A facility fee is payable on unused commitments at a rate of 0.15% per annum. The interest rate margins are determined based on the Company's ratio of total funded debt to EBITDA (as defined in the Credit Agreement).

The Credit Agreement contains affirmative and negative covenants customary for a transaction of this type which, among other things, require the Company to meet certain financial tests, including a total leverage ratio of not greater than 3.00 to 1.00 as of the end of each fiscal quarter and EBITDA of not less than $10,000,000, determined on a rolling four-quarter basis. The Credit Agreement also contains covenants which, among other things, limit the Company's ability to: incur unfinanced capital expenditures in an amount greater than $10,000,000 in the aggregate during any fiscal year; incur additional debt; make certain investments; create or permit certain liens; create or permit restrictions on the ability of subsidiaries to pay dividends or make other distributions; consolidate or merge; and engage in other activities customarily restricted in such agreements, in each case subject to exceptions permitted by the Credit Agreement. The Credit Agreement also contains customary events of default, the occurrence of which would permit the Bank to terminate its commitment and accelerate the loans.

The Bank has performed and may continue to perform commercial banking and financial services for the Company and its subsidiaries for which they have received and will continue to receive customary fees.

The foregoing descriptions of the Credit Agreement and the Note are qualified in its entirety by reference to such documents, which are attached hereto as Exhibits 10.1 and 10.2 and are incorporated herein by reference.

|

Item 1.02

|

Termination of a Material Definitive Agreement.

|

In connection with the execution of the Credit Agreement discussed in Item 1.01 above, the Company terminated its existing credit facility with the Bank on November 2, 2016.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth under Item 1.01 above is hereby incorporated by reference into this Item 2.03.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

Exhibit

Number

|

|

Description

|

|

|

10.1

|

|

Amended and Restated Credit Agreement dated November 2, 2016, by and between Surmodics, Inc. and Wells Fargo Bank, National Association.

|

|

|

|

|

|

|

|

10.2

|

|

Amended and Restated Revolving Line of Credit Note dated November 2, 2016.

|

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

SURMODICS, INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

November 7, 2016

|

|

/s/ Bryan K. Phillips

|

|

|

|

Bryan K. Phillips

Sr. Vice President, General Counsel and Secretary

|

EXHIBIT INDEX

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Amended and Restated Credit Agreement dated November 2, 2016, by and between Surmodics, Inc. and Wells Fargo Bank, National Association.

|

|

|

|

|

|

10.2

|

|

Amended and Restated Revolving Line of Credit Note dated November 2, 2016.

|

|

|

|

|

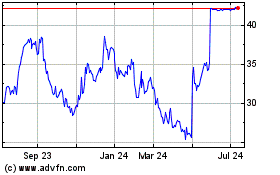

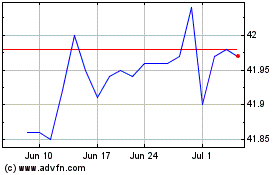

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Apr 2023 to Apr 2024