EPAM Reports Results for Third Quarter 2016

November 07 2016 - 6:15AM

Third quarter revenues of $298 million,

up 26% year-over-yearGAAP Diluted EPS of $0.49, up

11% year-over-yearNon-GAAP Diluted EPS of $0.76,

up 19% year-over-year

EPAM Systems, Inc. (NYSE:EPAM), a leading global provider of

product development and software engineering solutions, today

announced results for its third quarter ended September 30,

2016.

Third Quarter 2016 Highlights

- Revenues increased to $298.3 million, a year-over-year increase

of $62.2 million, or 26.4%;

- In constant currency, revenue was up 28.7% year-over-year;

- GAAP income from operations was $33.9 million, an increase of

$6.1 million or 22.1% compared to $27.8 million in the third

quarter of 2015;

- Non-GAAP income from operations was $49.7 million, an increase

of $8.2 million, or 19.9%, from $41.5 million in the third quarter

of 2015;

- Diluted earnings per share (EPS) on a GAAP basis was $0.49, an

increase from $0.44 in the third quarter of 2015;

- Non-GAAP quarterly diluted EPS was $0.76 compared to $0.64 in

the third quarter of 2015.

Cash Flow from Operations

- Cash from operations was $111.2 million for the nine months of

2016, up from $64.6 million as compared to the nine months of 2015;

and was $61.8 million in the third quarter of 2016, up from $55.5

million in the third quarter of 2015;

- As of September 30, 2016, cash and cash equivalents

totaled $330.6 million.

Other Metrics

- As of September 30, 2016, total headcount was 21,720, an

increase of 35.5% from 16,026 at September 30, 2015;

- Total number of delivery professionals increased 36.2% to

19,070 as of the end of the third quarter of 2016 from 14,004 as of

the end of the third quarter of 2015;

- Billed and unbilled Days Sales Outstanding (“DSO”) decreased to

83 days as of the end of the third quarter of 2016 compared to 88

days as of the end of the second quarter of 2016.

2016 Outlook - Full Year and Fourth

Quarter

Full Year

- Revenues will be at least $1,156 million for the full year

2016, representing a growth rate of at least 26.5% over 2015. This

includes approximately 2.5% anticipated currency headwinds, meaning

constant currency growth of at least 29%;

- The full year GAAP diluted EPS will be at least $1.94, with an

effective tax rate of approximately 21%;

- The full year non-GAAP diluted EPS will be at least $2.90;

- The full year weighted average share count is expected to be

approximately 53.6 million diluted shares outstanding.

Fourth Quarter

- Revenues will be at least $310 million for the fourth quarter

of 2016, representing a growth rate of at least 19% over fourth

quarter 2015 revenues. This includes approximately 2% anticipated

currency headwinds, meaning constant currency growth of at least

21%;

- Fourth quarter 2016 GAAP diluted EPS to be at least $0.54;

- Fourth quarter 2016 non-GAAP diluted EPS is expected to be at

least $0.78 and is based on an estimated fourth quarter 2016

weighted average share count of 54.3 million diluted shares

outstanding.

Also effective for the quarter are the following

executive announcements:

“It is with a mix of gratitude and sadness that I announce that

Anthony Conte, the Company’s Senior Vice President, Chief Financial

Officer and Treasurer has notified the Company that he plans to

step down in the third quarter of 2017 in order to pursue personal

and other business interests,” said Arkadiy Dobkin, Chairman, CEO

& President, EPAM. “Over his 10-year career with EPAM,

Anthony’s financial and business leadership has been a key part of

EPAM’s growth and success. The Company will conduct a search to

find a successor. Anthony will participate in selection of his

successor and assist with the transition.”

Mr. Dobkin continued, “We have recently welcomed Larry Solomon

as our Chief People Officer. Larry came to us after spending nearly

30 years at Accenture, most recently as the Senior Managing

Director and Accenture’s North America Operating Officer. Larry

will lead all aspects of Talent Management & Talent

Acquisition, Workforce Planning & Management, as well as other

HR-related functions within EPAM across the globe. We anticipate

that his significant experience and background will help elevate

EPAM’s talent and workforce management capabilities.”

Conference Call Information

EPAM will host a conference call to discuss

results on Monday, November 7, 2016 at 8:00 a.m. Eastern Time. The

live conference call can be accessed by dialing 1-877-407-0784

(domestic) or 1-201-689-8560 (international). A telephonic replay

will also be available approximately one hour after the call and

can be accessed by dialing 1-844-512-2921 (domestic) or

1-412-317-6671 (international). The passcode for the replay is

13648357. The telephonic replay will be available until November

21, 2016. Interested investors and other parties may also listen to

a webcast of the conference call by logging onto the Investor

Relations section of the Company’s website

at http://investors.epam.com.

About EPAM Systems

EPAM Systems, Inc. (NYSE:EPAM), a leading global product

development and platform engineering services company, is focused

on delivering results through best-in-class software engineering,

combined with innovative strategy, consulting and design

capabilities. With 23 years of experience in the information

technology industry, EPAM’s 19,000 people serve our customers in

over 25 countries across North America, Europe, Asia and Australia.

EPAM was ranked #8 in FORBES 25 Fastest Growing Public Tech

Companies and ranked as a top information technology services

company on FORTUNE’S 100 Fastest Growing Companies.

For more information, please visit http://www.epam.com and

follow us on Twitter (@EPAMSYSTEMS) and LinkedIn.

Non-GAAP Financial Measures

EPAM supplements results reported in accordance with United

States generally accepted accounting principles, referred to as

GAAP, with non-GAAP financial measures. Management believes these

measures help illustrate underlying trends in EPAM’s business and

uses the measures to establish budgets and operational goals,

communicated internally and externally, for managing EPAM’s

business and evaluating its performance. Management also believes

these measures help investors compare EPAM’s operating performance

with its results in prior periods. EPAM anticipates that it will

continue to report both GAAP and certain non-GAAP financial

measures in its financial results, including non-GAAP results that

exclude stock-based compensation expense, write-offs and

recoveries, amortization of purchased intangible assets, goodwill

impairment, legal settlements, foreign exchange gains and losses,

acquisition-related costs and the related effect on taxes.

Management may also compare operating results on a basis of

“constant currency", which is also a non-GAAP financial measure.

This measure excludes the effect of foreign currency exchange rate

fluctuations by translating the current period revenues and

expenses into U.S. dollars at the weighted average exchange rates

of the prior period of comparison. Because EPAM’s reported non-GAAP

financial measures are not calculated according to GAAP, these

measures are not comparable to GAAP and may not be comparable to

similarly described non-GAAP measures reported by other companies

within EPAM’s industry. Consequently, EPAM’s non-GAAP financial

measures should not be evaluated in isolation or supplant

comparable GAAP measures, but, rather, should be considered

together with the information in EPAM’s condensed consolidated

financial statements, which are prepared according to GAAP.

Forward-Looking Statements

This press release includes statements which may constitute

forward-looking statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995,

the accuracy of which are necessarily subject to risks,

uncertainties, and assumptions as to future events that may not

prove to be accurate. Factors that could cause actual results to

differ materially from those expressed or implied include general

economic conditions and the factors discussed in our most recent

Annual Report on Form 10-K and other filings with the Securities

and Exchange Commission. EPAM undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise, except as may be required

under applicable securities law.

| EPAM SYSTEMS, INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF INCOME AND

COMPREHENSIVE INCOME |

| (US Dollars

in thousands, except share and per share

data) |

|

|

| |

|

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

| |

|

2016 |

|

2015 |

|

2016 |

|

2015 |

|

Revenues |

|

$ |

298,293 |

|

|

$ |

236,049 |

|

|

$ |

846,607 |

|

|

$ |

653,875 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Cost of revenues (exclusive of

depreciation and amortization) |

|

190,797 |

|

|

148,479 |

|

|

538,960 |

|

|

408,622 |

|

| Selling, general and administrative

expenses |

|

67,491 |

|

|

55,431 |

|

|

193,226 |

|

|

158,345 |

|

| Depreciation and amortization

expense |

|

5,925 |

|

|

4,393 |

|

|

17,150 |

|

|

12,496 |

|

| Other operating expenses/(income),

net |

|

178 |

|

|

(30 |

) |

|

958 |

|

|

210 |

|

| Income from

operations |

|

33,902 |

|

|

27,776 |

|

|

96,313 |

|

|

74,202 |

|

| Interest and other

income, net |

|

1,067 |

|

|

865 |

|

|

3,416 |

|

|

3,322 |

|

| Foreign exchange

(loss)/gain |

|

(1,728 |

) |

|

32 |

|

|

(5,313 |

) |

|

(6,187 |

) |

| Income before

provision for income taxes |

|

33,241 |

|

|

28,673 |

|

|

94,416 |

|

|

71,337 |

|

| Provision for income

taxes |

|

7,067 |

|

|

5,800 |

|

|

19,913 |

|

|

14,519 |

|

| Net

income |

|

$ |

26,174 |

|

|

$ |

22,873 |

|

|

$ |

74,503 |

|

|

$ |

56,818 |

|

| Foreign currency

translation adjustments |

|

358 |

|

|

(8,341 |

) |

|

2,671 |

|

|

(7,397 |

) |

| Comprehensive

income |

|

$ |

26,532 |

|

|

$ |

14,532 |

|

|

$ |

77,174 |

|

|

$ |

49,421 |

|

| |

|

|

|

|

|

|

|

|

| Net income per

share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.51 |

|

|

$ |

0.47 |

|

|

$ |

1.48 |

|

|

$ |

1.17 |

|

| Diluted |

|

$ |

0.49 |

|

|

$ |

0.44 |

|

|

$ |

1.40 |

|

|

$ |

1.10 |

|

| Shares used in

calculation of net income per share: |

|

|

|

|

|

|

|

|

| Basic |

|

51,131 |

|

49,043 |

|

50,172 |

|

48,506 |

| Diluted |

|

53,864 |

|

52,344 |

|

53,159 |

|

51,755 |

| EPAM SYSTEMS, INC. AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (US Dollars in thousands, except share and per

share data) |

| |

| |

As ofSeptember 30,2016 |

|

As of December31, 2015 |

|

Assets |

|

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

$ |

330,627 |

|

|

$ |

199,449 |

|

| Time deposits |

— |

|

|

30,181 |

|

| Accounts receivable, net of

allowance of $2,301 and $1,729, respectively |

187,833 |

|

|

174,617 |

|

| Unbilled revenues |

82,360 |

|

|

95,808 |

|

| Prepaid and other current

assets |

32,205 |

|

|

14,344 |

|

| Employee loans, net of allowance of

$0 and $0, respectively |

2,698 |

|

|

2,689 |

|

| Deferred tax assets |

— |

|

|

11,847 |

|

| Total current assets |

635,723 |

|

|

528,935 |

|

| Property and equipment,

net |

70,284 |

|

|

60,499 |

|

| Restricted cash |

236 |

|

|

238 |

|

| Employee loans, net of

allowance of $0 and $0, respectively |

3,283 |

|

|

3,649 |

|

| Intangible assets,

net |

53,867 |

|

|

46,860 |

|

| Goodwill |

111,722 |

|

|

115,930 |

|

| Deferred tax

assets |

26,598 |

|

|

18,312 |

|

| Other long-term

assets |

7,486 |

|

|

4,113 |

|

| Total

assets |

$ |

909,199 |

|

|

$ |

778,536 |

|

| |

|

|

|

|

Liabilities |

|

|

|

| Current

liabilities |

|

|

|

| Accounts payable |

$ |

4,661 |

|

|

$ |

2,576 |

|

| Accrued expenses and other

liabilities |

34,856 |

|

|

60,749 |

|

| Deferred revenue |

3,685 |

|

|

3,047 |

|

| Due to employees |

34,894 |

|

|

26,703 |

|

| Deferred compensation to

employees |

4,035 |

|

|

5,364 |

|

| Contingent consideration |

800 |

|

|

— |

|

| Taxes payable |

39,499 |

|

|

29,472 |

|

| Total current liabilities |

122,430 |

|

|

127,911 |

|

| Long-term debt |

33,062 |

|

|

35,000 |

|

| Deferred tax liabilities,

long-term |

3,327 |

|

|

2,402 |

|

| Other long-term

liabilities |

268 |

|

|

— |

|

| Total

liabilities |

159,087 |

|

|

165,313 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’

equity |

|

|

|

| Common stock, $0.001 par

value; 160,000,000 authorized; 51,035,509 and 50,177,044

shares issued, 51,016,500 and 50,166,537 shares outstanding at

September 30, 2016 and December 31, 2015, respectively |

50 |

|

|

49 |

|

| Additional paid-in

capital |

363,154 |

|

|

303,363 |

|

| Retained earnings |

419,557 |

|

|

345,054 |

|

| Treasury stock |

(170 |

) |

|

(93 |

) |

| Accumulated other

comprehensive loss |

(32,479 |

) |

|

(35,150 |

) |

| Total

stockholders’ equity |

750,112 |

|

|

613,223 |

|

| Total

liabilities and stockholders’ equity |

$ |

909,199 |

|

|

$ |

778,536 |

|

| EPAM SYSTEMS, INC. AND

SUBSIDIARIES |

| Reconciliations of Non-GAAP Financial Measures

to Comparable GAAP Financial Measures |

| (in thousands, except percent and per share

amounts) |

| (Unaudited) |

|

|

| |

|

Three Months Ended September 30,

2016 |

|

Nine Months Ended September 30,

2016 |

| |

|

GAAP |

|

Adjustments |

|

Non-GAAP |

|

GAAP |

|

Adjustments |

|

Non-GAAP |

| Cost of revenues

(exclusive of depreciation and amortization)(1) |

|

$ |

190,797 |

|

|

$ |

(4,518 |

) |

|

$ |

186,279 |

|

|

$ |

538,960 |

|

|

$ |

(12,600 |

) |

|

$ |

526,360 |

|

| Selling, general and

administrative expenses(2) |

|

$ |

67,491 |

|

|

$ |

(9,315 |

) |

|

$ |

58,176 |

|

|

$ |

193,226 |

|

|

$ |

(25,234 |

) |

|

$ |

167,992 |

|

| Income from operations(3) |

|

$ |

33,902 |

|

|

$ |

15,822 |

|

|

$ |

49,724 |

|

|

$ |

96,313 |

|

|

$ |

44,037 |

|

|

$ |

140,350 |

|

| Operating margin |

|

11.4 |

% |

|

5.3 |

% |

|

16.7 |

% |

|

11.4 |

% |

|

5.2 |

% |

|

16.6 |

% |

| Net income(4) |

|

$ |

26,174 |

|

|

$ |

14,582 |

|

|

$ |

40,756 |

|

|

$ |

74,503 |

|

|

$ |

38,894 |

|

|

$ |

113,397 |

|

| Diluted earnings per

share(5) |

|

$ |

0.49 |

|

|

|

|

$ |

0.76 |

|

|

$ |

1.40 |

|

|

|

|

$ |

2.13 |

|

| |

|

Three Months Ended September 30,

2015 |

|

Nine Months Ended September 30,

2015 |

| |

|

GAAP |

|

Adjustments |

|

Non-GAAP |

|

GAAP |

|

Adjustments |

|

Non-GAAP |

| Cost of revenues

(exclusive of depreciation and amortization)(1) |

|

$ |

148,479 |

|

|

$ |

(3,622 |

) |

|

$ |

144,857 |

|

|

$ |

408,622 |

|

|

$ |

(9,871 |

) |

|

$ |

398,751 |

|

| Selling, general and

administrative expenses(2) |

|

$ |

55,431 |

|

|

$ |

(8,768 |

) |

|

$ |

46,663 |

|

|

$ |

158,345 |

|

|

$ |

(23,968 |

) |

|

$ |

134,377 |

|

| Income from operations(3) |

|

$ |

27,776 |

|

|

$ |

13,680 |

|

|

$ |

41,456 |

|

|

$ |

74,202 |

|

|

$ |

37,581 |

|

|

$ |

111,783 |

|

| Operating margin |

|

11.8 |

% |

|

5.8 |

% |

|

17.6 |

% |

|

11.3 |

% |

|

5.8 |

% |

|

17.1 |

% |

| Net income(4) |

|

$ |

22,873 |

|

|

$ |

10,713 |

|

|

$ |

33,586 |

|

|

$ |

56,818 |

|

|

$ |

33,362 |

|

|

$ |

90,180 |

|

| Diluted earnings per

share(5) |

|

$ |

0.44 |

|

|

|

|

$ |

0.64 |

|

|

$ |

1.10 |

|

|

|

|

$ |

1.74 |

|

| |

|

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

|

Notes: |

|

2016 |

|

2015 |

|

2016 |

|

2015 |

| |

|

|

|

|

|

|

|

|

| Stock-based compensation expenses -

non-acquisition related |

|

$ |

4,518 |

|

|

$ |

3,622 |

|

|

$ |

12,600 |

|

|

$ |

9,871 |

|

| Total

adjustments to GAAP cost of revenues(1) |

|

4,518 |

|

|

3,622 |

|

|

12,600 |

|

|

9,871 |

|

| Stock-based compensation expenses -

Acquisition related |

|

3,890 |

|

|

4,542 |

|

|

9,870 |

|

|

13,985 |

|

| Stock-based compensation expenses -

All other |

|

5,418 |

|

|

3,799 |

|

|

15,050 |

|

|

9,494 |

|

| Other acquisition-related

expenses |

|

7 |

|

|

427 |

|

|

314 |

|

|

489 |

|

| Total

adjustments to GAAP selling, general and administrative

expenses(2) |

|

9,315 |

|

|

8,768 |

|

|

25,234 |

|

|

23,968 |

|

| Amortization of purchased

intangible assets |

|

1,989 |

|

|

1,290 |

|

|

6,203 |

|

|

3,742 |

|

| Total

adjustments to GAAP income from operations(3) |

|

$ |

15,822 |

|

|

$ |

13,680 |

|

|

$ |

44,037 |

|

|

$ |

37,581 |

|

| Foreign exchange loss/(gain) |

|

1,728 |

|

|

(32 |

) |

|

5,313 |

|

|

6,187 |

|

| Tax effect on non-GAAP

adjustments |

|

(2,968 |

) |

|

(2,935 |

) |

|

(10,456 |

) |

|

(10,406 |

) |

| Total

adjustments to GAAP net income(4) |

|

$ |

14,582 |

|

|

$ |

10,713 |

|

|

$ |

38,894 |

|

|

$ |

33,362 |

|

|

|

| (5) There

were no adjustments to GAAP average diluted common shares

outstanding during the three and nine months ended September 30,

2016 and 2015. |

| EPAM SYSTEMS, INC. AND

SUBSIDIARIES |

| Reconciliations of Revenue Growth to Constant

Currency Revenue Growth |

| (in percent) |

| (Unaudited) |

| |

| |

Three MonthsEnded September 30,

2016 |

| Revenue growth

as reported |

26.4 |

% |

| Foreign exchange rates impact |

2.3 |

% |

| Revenue growth at constant

currency(6) |

28.7 |

% |

| |

| (6) Constant currency

revenue results are calculated by translating current period

revenue in local currency into U.S.dollars at the weighted average

exchange rates of the comparable prior period. |

| EPAM SYSTEMS, INC. AND

SUBSIDIARIES |

| Reconciliations of Non-GAAP Guidance Measures

to Comparable GAAP Measures |

| (in percent, except per share

amounts) |

| (Unaudited) |

| |

| Reconciliation of GAAP to Non-GAAP diluted earnings per

share is presented in the table below: |

| |

| |

| |

FourthQuarter |

|

Full Year |

| GAAP diluted

earnings per share (at least) |

$ |

0.54 |

|

|

$ |

1.94 |

|

| Stock-based

compensation expenses |

0.25 |

|

|

0.95 |

|

| Included in cost of revenues |

0.08 |

|

|

0.32 |

|

| Included in selling, general and

administrative expenses |

0.17 |

|

|

0.63 |

|

| Other

acquisition-related expenses |

— |

|

|

0.01 |

|

| Amortization of

purchased intangible assets |

0.04 |

|

|

0.15 |

|

| Foreign exchange

loss |

0.02 |

|

|

0.12 |

|

| Tax effect on non-GAAP

adjustments |

(0.07 |

) |

|

(0.27 |

) |

| Non-GAAP diluted earnings

per share (at least) |

$ |

0.78 |

|

|

$ |

2.90 |

|

| Reconciliation of projected revenue growth in constant

currency is presented in the table below: |

| |

| |

Fourth QuarterGuidance |

|

Full

YearGuidance |

| Revenue growth

(at least) |

19.0 |

% |

|

26.5 |

% |

| Foreign exchange rates impact |

2.0 |

% |

|

2.5 |

% |

| Revenue growth at constant

currency (at least)(7) |

21.0 |

% |

|

29.0 |

% |

| |

| (7) Constant currency

revenue results are calculated by translating current period

projected revenue in local currencyinto U.S. dollars at the

weighted average exchange rates of the comparable prior

period. |

Contact:

EPAM Systems, Inc.

Anthony J. Conte, Chief Financial Officer

Phone: +1-267-759-9000 x64588

Fax: +1-267-759-8989

investor_relations@epam.com

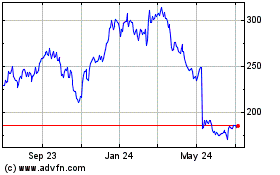

EPAM Systems (NYSE:EPAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

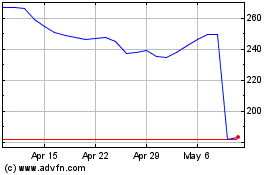

EPAM Systems (NYSE:EPAM)

Historical Stock Chart

From Apr 2023 to Apr 2024