Securities Registration: Employee Benefit Plan (s-8)

November 04 2016 - 5:02PM

Edgar (US Regulatory)

As filed with the Securities and Exchange

Commission on November 4, 2016

Registration No. 333-______________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KAYA HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

Delaware

(State or other jurisdiction of incorporation or organization)

|

51-0347728

(I.R.S. Employer Identification No.)

|

|

|

|

|

305

S. Andrews Avenue, Suite 209

Fort

Lauderdale, Florida

(Addresses

of Principal Executive Offices)

|

33301

(Zip Code)

|

2011 Stock Incentive Plan

(Full title of the plan)

Craig Frank

Chairman, President and Chief Executive

Officer

305 S. Andrews Avenue, Suite 209

Fort Lauderdale, Florida 33301

(Name and address of agent for service)

(954) 534-7985

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule

12b-2 of the Exchange Act:

|

Large

accelerated filer: [ ]

|

|

Accelerated

filer: [ ]

|

|

Non-accelerated

filer: [ ] (Do not check if a smaller reporting company)

|

|

Smaller

reporting company: [x]

|

Calculation of Registration Fee

Title

of securities

to be registered

|

Amount

to be

registered

(1)

|

Proposed

maximum offering

price per share

(2)

|

Proposed

maximum

aggregate offering

price

(2)

|

Amount

of

registration fee

|

|

|

|

|

|

|

|

Common

Stock, par value $0.001

per

share

|

10,000,000

|

$0.10

|

$1,000,000

|

$115.90

|

|

|

|

|

|

|

|

(1)

|

|

In

addition, pursuant to Rule 416 under the Securities Act of 1933 (the “

Securities Act

”), this Registration

Statement also covers an indeterminate amount of shares of common stock to be offered or sold pursuant to the anti-dilution

provisions contained in the employee benefit plan described herein.

|

|

(2)

|

|

The

proposed maximum offering price per share and the proposed maximum aggregate offering price are estimated for the purpose

of calculating the amount of the registration fee in accordance with Rule 457 under the Securities Act.

|

EXPLANATORY NOTE

This Registration Statement

covers an additional 10,000,000 shares of common stock, par value $0.001 per share of Kaya Holdings, Inc. (the “

Company

”),

which may be offered pursuant to the Company’s 2011 Stock Incentive Plan (the “

Plan

”), as amended on

November 24, 2014 and September 22, 2016. The earlier Registration Statements on Form S-8 filed by the Company with the Securities

and Exchange Commission on July 31, 2015 (File No. 333-205982) and February 11, 2013 (File No. 333-186566) and with respect to

the Plan are hereby incorporated by reference to the Registration Statement. The incorporation by reference is made under General

Instruction E to Form S-8 in respect of the registration of additional securities of the same class as other securities for which

there has been filed a Registration Statement on Form S-8 relating to the same employee benefit plan.

PART I

INFORMATION REQUIRED IN THE SECTION 10(A)

PROSPECTUS

The information specified

in Items 1 and 2 of Part I of the Registration Statement is omitted from this filing in accordance with the provisions of Rule

428 under the Securities Act of 1933, as amended (the “

Securities Act

”) and the introductory note to Part I

of Form S-8. The documents containing the information specified in Part I of Form S-8 will be delivered to the participants

in the Plan covered by the Registration Statement as required by Rule 428 under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

Item 3. Incorporation of Documents by

Reference

The following documents

filed by the Company with the Securities Exchange Commission are incorporated by reference in the Registration Statement (excluding

any portions of such documents that have been “furnished” but not “filed” for purposes of the Securities

Exchange Act of 1934, as amended (the “

Exchange Act

”)):

|

|

|

•

|

|

The

Company’s Annual Report on Form 10-K for the year ended December 31, 2015;

|

|

|

•

|

|

The

Company’s other reports filed pursuant to Sections 13(a) or 15(d) of the Exchange Act since the end of the fiscal year

covered by the document listed in the first bullet above;

|

|

•

|

|

The

description of the Company’s common stock contained in the Company’s final prospectus dated February 7, 2012,

filed pursuant to Rule 424(b)(3) under the Securities Act in connection with the Company’s Registration Statement on

Form S-1, File No. 333-177532); and

|

|

•

|

|

All

other documents filed by the Company under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this

Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement indicating that

all securities offered have been sold or which deregisters all securities then remaining unsold.

|

Any

statement contained in the Reg

istration Statement or a document incorporated or deemed to be incorporated by reference

in the Registration Statement will be deemed to be modified or superseded for purposes of the Registration Statement to the extent

that a statement contained in the Registration Statement or in any other subsequently filed document that is deemed to be incorporated

by reference in the Registration Statement modifies or supersedes the statement. Any statement so modified or superseded

will not be deemed, except as so modified or superseded, to constitute a part of the Registration Statement.

Item 5. Interests of Named Experts and

Counsel

The validity of the common

stock being registered in the Registration Statement has been passed upon by Gutierrez Bergman Boulris, P.L.L.C., Coral Gables,

Florida. The firm beneficially owns 31,772 shares of the Company’s common stock of record and a member of the firm beneficially

owns 31,772 shares of the Company’s common stock, including those shares of common stock beneficially owned by the firm.

_______________

|

*

|

|

Filed

as an Exhibit of the same number to the Company’s Registration Statement Form S-1 (File No. 333-177532), and incorporated

herein by reference.

|

|

**

|

|

Filed

herewith.

|

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, Kaya Holdings, Inc. certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in Fort Lauderdale, Florida on November 4, 2016.

|

|

KAYA

HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/

Craig Frank

|

|

|

|

Craig

Frank, Chairman of the Board, President, Chief Executive Officer, Acting Chief Financial Officer and Director

|

|

|

|

(Principal

Executive, Financial and Accounting Officer)

|

POWER OF ATTORNEY

KNOW ALL MEN BY THESE

PRESENTS

, that each person whose name appears below hereby constitutes and appoints Craig Frank his or her true and lawful

attorney-in-fact and agent, with full power of substitution and re-substitution, for him or her and in his or her name, place

and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to the Registration

Statement, and to file the same, with exhibits thereto, and other documents in connection therewith, with the Securities and Exchange

Commission, granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing

requisite and necessary to be done, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying

and confirming to all that said attorney-in-fact and agent or his substitute or substitutes, may lawfully do or cause to be done

by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following persons in the capacities

and on the dates indicated below.

|

Name

|

Title

|

|

Date

|

|

|

|

|

|

|

/s/

Craig Frank

Craig

Frank

|

Chairman

of the Board, President, Chief Executive Officer, Acting Chief Financial Officer and Director (Principal Executive, Financial

and Accounting Officer)

|

|

November

4, 2016

|

|

|

|

|

|

|

/s/

Carrie Schwarz

Carrie

Schwarz

|

Director

|

|

November

4, 2016

|

|

|

|

|

|

|

/s/

Jodi Armani

Jodi

Armani

|

Director

|

|

November

4. 2016

|

|

|

|

|

|

|

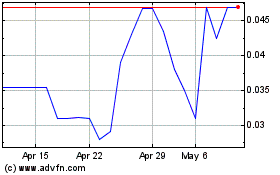

Kaya (QB) (USOTC:KAYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

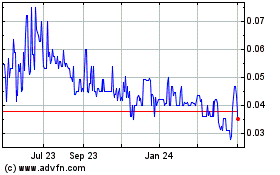

Kaya (QB) (USOTC:KAYS)

Historical Stock Chart

From Apr 2023 to Apr 2024