Amazon Prods Its Sellers to Free Up Warehouse Space

November 04 2016 - 10:40AM

Dow Jones News

Amazon.com Inc. has a holiday message for the millions of

merchants who rely on it to fill their online orders: Don't clutter

its warehouses with stuffed Easter bunnies, Fourth of July banners

or other out-of-season goods.

Though the big online retailer has built more than two dozen new

warehouses this year, increasing its square footage by 30%, it says

it needs all the space it can get to cope with the annual boom in

holiday orders. That is why it is trying to discourage its

third-party sellers from stocking up on items that aren't likely to

sell by the end of the year.

"We're trying to incentivize sellers to wait to send us the

Easter-themed cookie cutter sets," said Cynthia Williams, vice

president of Fulfillment by Amazon, the service that stores

sellers' products and ships their orders to customers. Last year,

600 such sets arrived in the fourth quarter.

Hoping to avoid similar incidents this year, Amazon, for the

first time, is charging its sellers a premium for storing

merchandise in its warehouses during November and December. It is

partly offsetting that increase by lowering its fees for fulfilling

orders, another way to encourage sellers to avoid items likely to

linger on its shelves.

Amazon executives say that its warehouses overflow with

third-party sellers' goods, especially as Christmas nears,

straining its capacity and increasing costs. In recent weeks, the

company has temporarily stopped accepting shipments from new

sellers. Established sellers are required to time their shipments

to arrive by Nov. 9 to guarantee they will be available for the

crucial post-Thanksgiving shopping weekend and by Dec. 2 to be

available in time for Christmas. For the third time this year,

Amazon also offered to remove sellers' goods from its warehouses

free of charge for disposal or return.

The idea is to speed the flow of goods and optimize use of

space, Amazon's chief financial officer, Brian Olsavsky, said last

month on an earnings conference call.

Brad King, whose online apparel retailer Webzom sells via

Amazon, said his costs for using Fulfillment by Amazon might rise

30% over the holidays, based on preliminary calculations. In

response, he said, he is making more frequent but smaller shipments

to Amazon of the about 6,000 products he sells through that

service, instead of the large shipments he previously made every 90

days. "We're trying to be more efficient in what we're sending," he

said.

Amazon says about a quarter of the merchandise sold on its site

are part of its fulfillment program, which charges storage fees

based on volume. Starting this month, storage fees for

standard-size items are due to more than triple to $2.25 per cubic

foot a month, up from 54 cents the rest of the year.

A seller with 500 small Easter baskets in stock, for example,

would pay storage fees of about $124 in November, up from $30 a

month the rest of the year. At the same time, Amazon is lowering

the cost of fulfilling those items by 5% to $2.88 per unit, to help

offset some of the storage increase.

Amazon said it makes considerably more when its fulfillment

customers make a sale than when their goods languish, racking up

storage charges.

"The more the inventory turns, the more fees they drive,"

generating revenue, said John Haber, chief executive of

supply-chain consulting firm Spend Management Experts.

Most sellers will likely struggle to fully understand the impact

to their bottom line until after the holidays, said Eric Heller,

chief executive of seller and brand-strategy consulting firm

Marketplace Ignition. "There's so many moving parts," he said.

"It's going to take sellers a month or two of evaluating their

sales to understand."

The temporary increase in storage fees marks one of Amazon's

first experiments with surge pricing—charging more for goods or

resources when demand is highest. Other companies, including

package-delivery giant United Parcel Service Inc. have introduced

some peak surcharges. UPS's is to encourage shippers to make more

accurate predictions of their package volume.

Jordan Malik, who sells everything from shampoo to used books on

Amazon, said that the prices consumers pay on Amazon's site

typically get a lift during the holidays, something that will help

offset fulfillment price increases. Amazon typically takes about a

30% cut of his merchandise for storing, selling and shipping it

when a customer clicks "buy."

"The people who grumble about the fee increases tend to be the

sellers who kind of are ruining it for everyone else," he adds,

including those leaving merchandise that won't sell sitting in

Amazon's warehouses.

Still, even when the fees rise, most sellers will stay, he says.

"Amazon is the big dog."

Write to Laura Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

November 04, 2016 10:25 ET (14:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

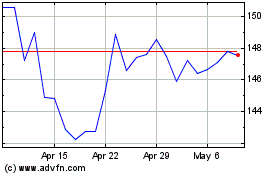

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

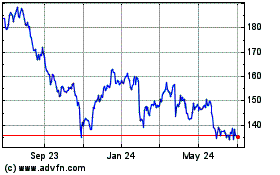

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024