Consolidated Edison Adjusted Earnings Rise

November 03 2016 - 9:22PM

Dow Jones News

By Josh Beckerman

Consolidated Edison Inc.'s (ED) third-quarter profit rose 16%,

as revenue and expenses were both relatively flat and the latest

quarter included a gain on the September sale of a retail electric

supply business.

The company said its utilities and its employees "performed very

well when faced with significantly higher than normal New York

temperatures."

The company's Consolidated Edison Co. of New York utility has

about 3.4 million electric-service customers. Its other businesses

include Orange and Rockland Utilities Inc. and competitive-energy

operations.

The ConEdison Solutions unit sold the assets of its retail

electric supply business to an Exelon Corp. unit for cash

consideration of $235 million, subject to adjustments.

The company expects 2016 adjusted earnings of $3.90 to $4 per

basic share, compared with prior guidance of $3.85 to $4.05.

Over all, the company reported net income of $497 million, or

$1.62 a diluted share, up from $428 million, or $1.45 a share, a

year earlier. Adjusted earnings were $1.51 per basic share, up from

$1.45 a year earlier.

Revenue fell 0.8% to $3.42 billion, while analysts polled by

Thomson Reuters expected $3.41 billion.

Shares were flat in after-hours trading at $73.87.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

November 03, 2016 21:07 ET (01:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

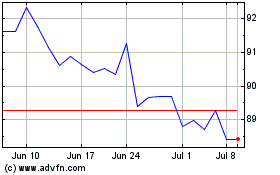

Consolidated Edison (NYSE:ED)

Historical Stock Chart

From Mar 2024 to Apr 2024

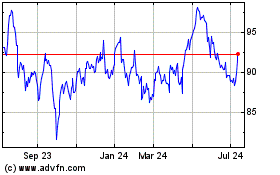

Consolidated Edison (NYSE:ED)

Historical Stock Chart

From Apr 2023 to Apr 2024