Current Report Filing (8-k)

November 03 2016 - 6:22AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 3, 2016 (October 28, 2016)

MGT

Capital Investments, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-32698

|

|

13-4148725

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

500

Mamaroneck Avenue, Suite 320

Harrison,

NY 10528

(Address

of principal executive offices, including zip code)

(914)

630-7430

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item

1.01 Entry into a Material Definitive Agreement

On

October 28, 2016, MGT Capital Investments, Inc. (the “

Company

”) entered into a Note Exchange Agreement

(“Note Exchange Agreement”) and a Warrant Exchange Agreement (the “Warrant Exchange Agreement”) with

the holder (“Holder”) of certain 12% unsecured promissory notes in the aggregate principal amount of $1,500,000

(the “Notes”) previously issued by the Company pursuant to a Securities Purchase Agreement dated August 2, 2016

(the “Purchase Agreement”). Pursuant to the Note Exchange Agreement, the Company and the Holder agreed to

exchange the Notes, including accrued but unpaid interest thereon, for an 8% Senior Unsecured Promissory Note in the

aggregate principal amount of $1,500,000 (the “New Note”). The New Note is convertible, at the option of the

holder thereof, into shares of the Company’s common stock at a conversion price of $1.00 per share, subject to

adjustments as set forth in the New Note.

Pursuant to the Warrant Exchange Agreement,

t

he Company and the Holder also agreed to exchange certain

warrants to purchase three hundred thousand (300,000) shares of common stock issued to the Holder under the Purchase Agreement

for three hundred thousand (300,000) shares of the Company’s restricted stock.

The Company has offered to other holders

of promissory notes issued under the Purchase Agreement, in the aggregate principal amount of $800,000, the opportunity to

exchange such notes under the same terms described above.

Please

refer to the Note Exchange Agreement and the Warrant Exchange Agreement attached as Exhibits 10.1 and 10.2, respectively, for

a more detailed description of the transactions contemplated thereby.

Item

3.02 Unregistered Sales of Equity Securities.

See

Item 1.01 above.

ITEM

9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d)

Exhibits

The

following exhibits are furnished herewith:

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Form

of Notes Exchange Agreement

|

|

|

|

|

|

10.2

|

|

Form

of Warrant Exchange Agreement

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

Dated:

November 3, 2016

|

|

MGT

Capital Investments, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Robert B. Ladd

|

|

|

Name:

|

Robert

B. Ladd

|

|

|

Title:

|

President

and Chief Executive Officer

|

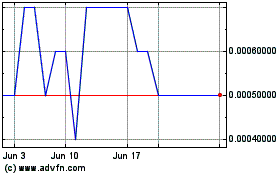

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

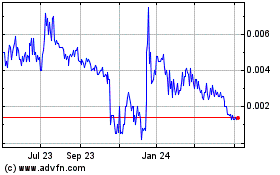

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024