Mattel's Board Starts Search for Next CEO

November 02 2016 - 6:50PM

Dow Jones News

Mattel Inc.'s board has started preparing for a CEO transition,

hoping to avoid the difficulties the toy maker had the last time it

changed leaders.

The biggest U.S. toy company hired the search firm Spencer

Stuart this summer to help identify the successor to CEO

Christopher Sinclair, according to people familiar with the matter.

The recruiter is looking inside and outside the company for the

next Mattel leader, the people said.

The board's timeline for making a transition is unclear; Mr.

Sinclair has said he plans to see the company through its

continuing turnaround effort. Corporations often engage with

recruiting firms for long-range succession planning.

"We don't comment on rumors or speculation," Mattel spokesman

Alex Clark said. A Spencer Stuart spokesman declined to

comment.

Mr. Sinclair, 66 years old, was a retired consumer products

executive and Mattel board member when he took command of the

company in January 2015. He stepped in on an interim basis when

Mattel fired his predecessor amid slumping sales of Barbie and

other big brands. He was named permanent CEO three months later,

passing over internal candidates.

The current search raises questions about the future of Mattel's

No. 2 executive, Richard Dickson, who was named president and chief

operating officer when Mr. Sinclair took over. Mr. Dickson, 48,

steered an earlier turnaround of Barbie before leaving for a senior

role at apparel chain Jones Group Inc. He returned to Mattel in

2014. Mattel had in the past used the COO role as a steppingstone

to the corner office. Mr. Dickson declined to comment.

Both Mr. Sinclair and Mr. Dickson are expected to discuss the

company's strategy and financial targets at a meeting with

investors at the company's El Segundo, Calif., headquarters on

Thursday.

Toy industry executives and analysts didn't expect Mr. Sinclair,

who has kept his primary residence in Florida and commutes to

Mattel's headquarters in Southern California, to hold the CEO

position for too long. Mr. Sinclair served as a senior PepsiCo Inc.

executive in the late 1990s, and though he'd been on Mattel's board

for nearly two decades, he didn't have any experience in the toy

industry.

Mr. Sinclair has thrown himself into the role of stabilizing

Mattel's operations. Working closely with Mr. Dickson, the company

has reversed a long slump in sales at Barbie by adding new body

sizes and more diverse skin tones. Barbie sales had fallen more

than 10% for eight straight quarters before bouncing back with

sales up 23% and 16%, respectively, the past two reporting

periods.

Mr. Sinclair also has worked to deepen Mattel's management

bench. It hired a new head of human resources, brought in a new

marketer to oversee global brands and added a chief content officer

to lead the creation of movies and shows that are integral to

selling toys.

In addition, he has kept a tight lid on costs and has preserved

Mattel's dividend.

"This is not the board guy who's just trying to keep the seat

warm," one toy industry executive said.

The turnaround has involved mending a corporate culture that

current and former employees felt was in disarray, with days bogged

down by endless meetings and lengthy PowerPoint presentations. Some

minor changes since the regime change have been cheered by

employees, including allowing them to use social media sites at

work.

While some brands, like Monster High, continue to struggle,

Mattel has largely met carefully laid out investor expectations.

Its sales have exceeded expectations in each of the past four

quarters, and it has been able to plug the hole from losing a

coveted license to make dolls based on Walt Disney Co.'s classic

princesses and characters from the movie "Frozen."

Mattel's rebound has corresponded with two of the strongest

years for the toy industry in decades. The research firm NPD Group

projects that toy sales will rise 6.5% this year, slightly below

last year's pace that was aided by the first "Star Wars" movie in a

decade.

Mattel investors have been rewarded, as shares—which closed

Wednesday at $30.90—have bounced back from a recent low of

$19.45.

Write to Joann S. Lublin at joann.lublin@wsj.com and Paul Ziobro

at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

November 02, 2016 18:35 ET (22:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

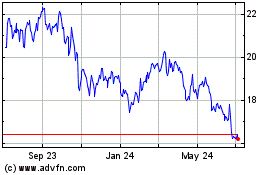

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

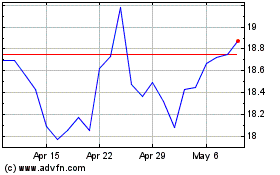

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Apr 2023 to Apr 2024