Insurers Beat Estimates on 'Super Day,' Though AIG Disappoints -- 2nd Update

November 02 2016 - 6:43PM

Dow Jones News

By Leslie Scism, Nicole Friedman and Tess Stynes

American International Group Inc. swung to a quarterly profit

but suffered a setback in its turnaround effort for its

property-casualty insurance unit, while four other big insurers

posted stronger-than-expected operating results for the third

quarter.

Analysts at Evercore ISI dubbed Wednesday as "Insurance Super

Day" with life insurers MetLife Inc., Prudential Financial Inc. and

Lincoln National Corp., along with car and home insurer Allstate

Corp. and AIG, reporting results after the closing bell.

The improved results at the three life insurers come despite a

tough environment for sales of many of their interest-rate-related

products. The property casualty insurers, meanwhile, reported

higher catastrophe losses from storms versus an unusually placid

hurricane season the prior year.

AIG's shares tumbled 3.4% after hours, while Allstate gained

4.1% and MetLife added 1.3%. The others were unchanged.

MetLife, in one of its last few quarters as the U.S.'s biggest

life insurer by assets, said its results were buoyed by a 6%

increase in net investment income to $5.2 billion. That gain was

driven by strong performance of private-equity holdings and the

sale of a real-estate joint venture interest. MetLife is spinning

off part of its U.S. retail life-insurance operations into a new

company as early as the first quarter.

Prudential, which is set to succeed MetLife as the biggest life

insurer, highlighted strength in its international business, along

with new business in its retirement and asset management

divisions.

Smaller peer Lincoln National Corp. said its operating earnings

for the quarter marked a record, citing expense and capital

management as factors. And Allstate reported higher

property-liability insurance premiums but a big increase in

catastrophe losses.

"There's been a lot of different storms," Allstate Chief

Executive Tom Wilson said in an interview. But he predicted the

company's losses due to Hurricane Matthew in October will likely

below its competitors' as Allstate has a lower market share in

Florida.

At AIG, results fell below the expectation of Wall Street

analysts, though they did top the poor performance of the

year-earlier quarter, when the company took a restructuring

charge.

"There's volatility here and we expect it going forward, but

there is some underlying improvement toward AIG's previously

outlined strategic goals and we're encouraged to see that," said

Rob Haines, a senior insurance analyst with credit-research firm

CreditSights.

AIG posted operating income of $1.1 billion, or $1 a share, up

from $691 million, or 52 cents a share, the year before when

results fueled activism from billionaire investors Carl Icahn and

John Paulson. Mr. Paulson and a deputy to Mr. Icahn were added to

AIG's board in May. Analysts expected $1.21 a share in operating

earnings.

The latest results were hurt by a charge of $404 million, or 37

cents a share, to recognize losses in a portfolio of "structured

settlements" that the company has designated for sale as part of

its effort to streamline and return more capital to

shareholders.

AIG's setback was a $306 million strengthening of reserves for

policies sold to U.S. businesses in years past. AIG, which didn't

specify the years, said the strengthening related to casualty and

property lines written by managing general agents.

The reserve boost drove AIG's "loss ratio" -- which reflects the

percentage of each premium dollar that goes to pay claims and

related expenses -- to 77.7%, up from 72.8% the year before. It

comes on top of a $3.6 billion pretax strengthening in last year's

fourth quarter, as AIG sought then to get reserves in shape.

As part of its turnaround, AIG is committed to returning at

least $25 billion to shareholders through buybacks and dividends in

2016 and 2017. It said it has returned $10.8 billion to

shareholders year-to-date through Nov. 2. AIG's board authorized an

additional increase in repurchase authorization of $3 billion.

Results By Company

-- At MetLife, operating earnings more than doubled to $1.4 billion, or

$1.28 a share, easily beating the $1.14 expected by analysts. It net

results, however, included $683 million in mostly mark-to-market

derivative losses reflecting changes in interest rates, equity markets

and foreign currencies, along with a $223 million write-down tied to

Brighthouse Financial, the new name for its life-insurance operations.

-- Prudential's operating earnings, meanwhile, rose 7.3% to $1.19 billion,

or $2.66 a share, above Street expectations for $2.49.

-- Lincoln Financial's operating earnings rose 53% to $441 million, or $1.89

a share. Revenue decreased 5.1% to $3.53 billion. Analysts expected a

per-share operating profit of $1.62 and revenue of $3.44 billion.

Lincoln's board also approved a 16% increase in the company's quarterly

dividend.

-- At Allstate, operating earnings fell 22% to $474 million, or $1.26 a

share. Premiums written increased 2.1% to $8.31 billion. Analysts

expected a per-share operating profit of $1.25 and net premiums written

of $8.35 billion. Pretax net catastrophe losses increased 78% to $481

million, mostly from wind and hail storms.

Write to Leslie Scism at leslie.scism@wsj.com, Nicole Friedman

at nicole.friedman@wsj.com and Tess Stynes at

tess.stynes@wsj.com

(END) Dow Jones Newswires

November 02, 2016 18:28 ET (22:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

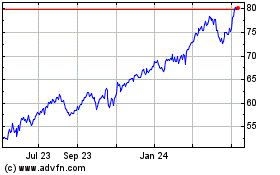

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

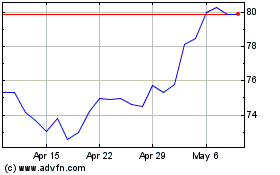

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024