A.M. Best Affirms Credit Ratings of Ameriprise Financial, Inc. and Its Subsidiaries

November 02 2016 - 4:24PM

Business Wire

A.M. Best has affirmed the Financial Strength Rating

(FSR) of A+ (Superior) and the Long-Term Issuer Credit Rating

(Long-Term ICR) of “aa-” of RiverSource Life Insurance

Company (Minneapolis, MN) and its wholly owned subsidiary,

RiverSource Life Insurance Co. of New York (Albany, NY).

A.M. Best also has affirmed the FSR of A (Excellent) and the

Long-Term ICRs of “a+” of IDS Property Casualty Insurance

Company (IDS) and its wholly owned, fully reinsured subsidiary,

Ameriprise Insurance Company (both domiciled in De Pere,

WI). Together, these companies represent the key life/health and

property/casualty insurance subsidiaries of Ameriprise

Financial, Inc. (Ameriprise) (headquartered in Minneapolis, MN)

[NYSE:AMP]. Concurrently, A.M. Best has affirmed the Long-Term ICR

of “a-” and the existing Long-Term Issue Credit Ratings (Long-Term

IR) of Ameriprise. The outlook of these Credit Ratings (ratings) is

stable.

The ratings of the life/health companies primarily reflect their

strong risk-adjusted capital positions, favorable operating

results, effective hedging programs, strong market positions and

brand recognition. Ameriprise continues to benefit from its strong

fee-based businesses, growth in client and advisory activity and

increased sales and deposits in the protection and variable annuity

space. The favorable operating earnings have been able to offset

significant stockholder dividends, which has enabled the

life/health companies to maintain their strong capital positions.

Furthermore, Ameriprise continues to employ effective hedge

programs that are primarily constructed to hedge GAAP income and

economic risk, but also to limit statutory capital volatility. The

group also has reduced the risk of some of its product offerings,

which included the launch of its managed volatility funds that are

now required for all new variable annuities with a living benefit

rider. The managed volatility funds have helped Ameriprise lower

hedge costs and performance volatility, while reducing required

capital.

The ratings also consider Ameriprise’s broad multi-platform

network of financial advisers, its leading market position and

well-developed enterprise risk management (ERM) program. A.M. Best

notes that the number of branded financial advisers remained

relatively flat in recent periods, but overall retention rates on

experienced advisers remain in the mid-90% range. At the holding

company level, Ameriprise maintains a moderate level of financial

leverage of approximately 30% with solid interest coverage. Both

measures are within A.M. Best’s guidelines for Ameriprise’s current

ratings.

A.M. Best notes that Ameriprise’s earnings remain highly

correlated to movements in interest rates and equity markets. More

than two-thirds of Ameriprise’s admitted assets are in separate

accounts that are susceptible to sizable equity market declines.

Earnings also are likely to be materially impacted should the

current low interest rate environment persist, particularly in the

fixed annuity and long-term care insurance lines of business. In

addition, Ameriprise may continue to experience net outflows in its

annuity and asset management businesses due to the ongoing

volatility in the financial markets. Although A.M. Best remains

concerned with the potential earnings volatility, this concern is

somewhat mitigated by Ameriprise’s robust ERM practices that

measure its key risks to ensure decisions are made that will

enhance its overall business profile and performance.

The ratings of IDS and its reinsured subsidiary, Ameriprise

Insurance Company, are based on the consolidated operating results

and financial positions that reflect their contribution to

Ameriprise through diversification of risks and earnings, expanded

product offerings to affinity partners and tax benefits from their

municipal bond portfolio. However, operating performance has

declined over the most recent five-year period, necessitating

strong capital infusions to maintain the companies’ risk-adjusted

capitalization. The companies reported overall operating losses

primarily due to deteriorating underwriting performance as a result

of adverse prior-year loss reserve development and weather-related

catastrophic losses that exceeded the company’s projections.

The following Long-Term IRs have been affirmed:

Ameriprise Financial, Inc.—

-- “a-” on $300 million 7.30% senior unsecured notes, due

2019

-- “a-” on $750 million 5.35% senior unsecured notes, due

2020

-- “a-” on $750 million 4.00% senior unsecured notes, due

2023

-- “a-” on $550 million 3.70% senior unsecured notes, due

2024

-- “a-” on $500 million 2.875% senior unsecured notes, due

2026

The following indicative Long-Term IRs have been affirmed under

the current shelf registration:

Ameriprise Financial, Inc.—

-- “a-” on senior unsecured debt

-- “bbb+” on subordinated debt

-- “bbb” on preferred stock

Ameriprise Capital Trust I, II, III and IV—

-- “bbb” on trust preferred securities

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2016 by A.M. Best Rating

Services, Inc. and/or its subsidiaries. ALL RIGHTS

RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161102006739/en/

A.M. BestEdward Kohlberg, +1 908-439-2200, ext.

5664Associate Director –

L/Hedward.kohlberg@ambest.comorChristopher Sharkey, +1

908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJonathan Harris,

CFA, FRM, +1 908-439-2200, ext. 5771Senior Financial Analyst

– P/Cjonathan.harris@ambest.comorJim Peavy, +1 908-439-2200,

ext. 5644Director, Public

Relationsjames.peavy@ambest.com

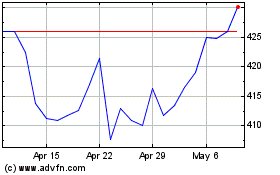

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024