Artesian Resources Corporation Reports 2016 Third Quarter and Year-to-Date Results

November 02 2016 - 4:05PM

Artesian Resources Corporation (Nasdaq:ARTNA), a leading provider

of water, wastewater services and related services on the Delmarva

Peninsula, announced today that net income for the third quarter of

2016 was $4.4 million, an increase of $0.7 million, or 17.9%,

compared to the $3.7 million in net income reported during the

third quarter of 2015. Diluted net income per share increased

17.1% to $0.48 compared to $0.41 for the third quarter of 2015.

Revenues for the third quarter of 2016 were

$21.8 million, a $1.0 million, or 5.1%, increase over the same

quarter of 2015. Water sales revenue increased $0.8 million,

or 4.5%, to $19.7 million for the third quarter of 2015 compared to

$18.8 million for the third quarter of 2015. The increase is

due primarily to an increase in the Distribution System Improvement

Charge, or DSIC, and overall greater water consumption.

Excluding depreciation and income taxes,

operating expenses increased $0.4 million, or 4.0%, to $11.1

million for the third quarter of 2016 compared to $10.7 million for

the same period in 2015. Utility operating expenses for the

third quarter of 2016 were $9.3 million, a $0.3 million, or 2.8%,

increase from the $9.0 million recorded for the same period in

2015. The increase is primarily the result of increased legal

costs and increased purchased water expense due to the timing of

purchases.

Interest expenses decreased $0.1 million, or

6.1%, to $1.7 million for the third quarter of 2016 compared to

$1.8 million for the same period of 2015 primarily due to a

decrease in the Series S First Mortgage Bond interest rate from

6.73% to 4.45%, effective March 1, 2016, and a decrease in

short-term debt outstanding.

Through the first nine months of 2016, Artesian

had net income of $10.2 million, an increase of 8.0% compared to

net income of $9.5 million recorded for the same period of

2015. Diluted net income per share increased 5.7% to $1.12

for the nine months ended September 30, 2016 from $1.06 for the

same period of 2015.

Revenues during the first nine months of 2016

increased $1.4 million, or 2.4%, to $59.7 million. Water

sales revenue increased $1.1 million, or 2.1%, for the nine months

ended September 30, 2016 from the corresponding period in

2015. The increase in water sales revenue is primarily due to

an increase in the DSIC and an increase in the number of customers

served and resulting fixed customer and fire protection

charges.

Excluding depreciation and income taxes,

operating expenses increased $0.7 million, or 2.3%, to $31.9

million for the nine months ended September 30, 2016 compared to

$31.2 million for the same period of 2015. Utility operating

expenses for the nine months ended September 30, 2016 were $26.6

million, a $0.4 million, or 1.5%, increase from the $26.2 million

recorded for the same period of 2015. The increase is

primarily the result of increased legal, payroll and employee

benefit expenses, somewhat offset by lower purchased power costs

under a new three-year electric generation supply contract

effective May 2016.

Interest expenses decreased $0.3 million, or

4.9%, to $5.0 million for the nine months ended September 30, 2016

compared to $5.3 million for the same period of 2015 primarily due

to a decrease in the Series S First Mortgage Bond interest rate

from 6.73% to 4.45%, effective March 1, 2016, and a decrease in

short-term debt outstanding.

The Company invested $20.0 million in

infrastructure improvements during the first nine months of 2016 to

ensure high quality and reliable service to customers.

Significant infrastructure improvements included the replacement of

aging water mains, upgrade of meter equipment, enhancement of water

treatment facilities, rehabilitation of pumping equipment and the

relocation of mains as mandated by state highway

projects.

“Our ability to continue to control expenses

coupled with increased water consumption during the third quarter

of 2016 contributed to our overall positive results. We are

also able to obtain timely recovery through the Distribution System

Improvement Charge on a portion of our investments made in

infrastructure so that our customers receive reliable and safe

water,” said Dian C. Taylor, Chair, President and CEO.

About Artesian

ResourcesArtesian Resources Corporation operates as a

holding company of wholly-owned subsidiaries offering water,

wastewater services and related services on the Delmarva

Peninsula. Artesian Water Company, the principal subsidiary,

is the oldest and largest investor-owned water utility on the

Delmarva Peninsula and has been providing water service since

1905. Artesian supplies 7.6 billion gallons of water per year

through 1,218 miles of water main to approximately 301,000

people.

| Artesian Resources Corporation |

|

| Condensed Consolidated Statement of Operations |

|

| (In thousands, except per share amounts) |

|

| (Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

|

2016 |

|

|

|

|

2015 |

|

|

|

2016 |

|

|

2015 |

|

| Operating

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| Water

sales |

$ |

|

19,680 |

|

|

$ |

|

18,831 |

|

|

$ |

53,440 |

|

$ |

52,343 |

|

| Other

utility operating revenue |

|

|

976 |

|

|

|

|

861 |

|

|

|

2,752 |

|

|

2,618 |

|

| Non-utility

operating revenue |

|

|

1,172 |

|

|

|

|

1,084 |

|

|

|

3,480 |

|

|

3,313 |

|

| |

|

|

21,828 |

|

|

|

|

20,776 |

|

|

|

59,672 |

|

|

58,274 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Utility

operating expenses |

|

|

9,292 |

|

|

|

|

9,036 |

|

|

|

26,603 |

|

|

26,198 |

|

| Non-utility

operating expenses |

|

|

698 |

|

|

|

|

578 |

|

|

|

1,924 |

|

|

1,705 |

|

| Depreciation

and amortization |

|

|

2,270 |

|

|

|

|

2,196 |

|

|

|

6,835 |

|

|

6,597 |

|

| State and

federal income taxes |

|

|

2,498 |

|

|

|

|

2,497 |

|

|

|

6,473 |

|

|

6,452 |

|

| Property and

other taxes |

|

|

1,125 |

|

|

|

|

1,075 |

|

|

|

3,371 |

|

|

3,270 |

|

| |

|

|

15,883 |

|

|

|

|

15,382 |

|

|

|

45,206 |

|

|

44,222 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Income |

|

|

5,945 |

|

|

|

|

5,394 |

|

|

|

14,466 |

|

|

14,052 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance

for funds used during construction |

|

|

87 |

|

|

|

|

86 |

|

|

|

160 |

|

|

153 |

|

|

Miscellaneous |

|

|

(26 |

) |

|

|

|

(28 |

) |

|

|

598 |

|

|

521 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before

Interest Charges |

|

|

6,006 |

|

|

|

|

5,452 |

|

|

|

15,224 |

|

|

14,726 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

Charges |

|

|

1,646 |

|

|

|

|

1,753 |

|

|

|

4,996 |

|

|

5,256 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Income |

$ |

|

4,360 |

|

|

$ |

|

3,699 |

|

|

$ |

10,228 |

|

$ |

9,470 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

Average Common Shares Outstanding - Basic |

|

|

9,112 |

|

|

|

|

8,960 |

|

|

|

9,090 |

|

|

8,935 |

|

| Net Income

per Common Share - Basic |

$ |

|

0.48 |

|

|

$ |

|

0.41 |

|

|

$ |

1.13 |

|

$ |

1.06 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

Average Common Shares Outstanding - Diluted |

|

|

9,177 |

|

|

|

|

9,000 |

|

|

|

9,154 |

|

|

8,972 |

|

| Net Income

per Common Share - Diluted |

$ |

|

0.48 |

|

|

$ |

|

0.41 |

|

|

$ |

1.12 |

|

$ |

1.06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Artesian Resources Corporation |

|

| Condensed Consolidated Balance Sheet |

|

| (In thousands) |

|

| (Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 30, |

|

December 31, |

|

|

|

|

|

|

|

| |

2016 |

|

2015 |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Utility

Plant, at original cost less |

|

|

|

|

|

|

|

|

|

|

|

|

| accumulated

depreciation |

$ |

|

419,952 |

|

|

$ |

|

405,606 |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

15,879 |

|

|

|

|

14,444 |

|

|

|

|

|

|

|

|

| Regulatory

and Other Assets |

|

|

11,108 |

|

|

|

|

11,576 |

|

|

|

|

|

|

|

|

| |

$ |

|

446,939 |

|

|

$ |

|

431,626 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Capitalization and

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

$ |

|

135,877 |

|

|

$ |

|

132,331 |

|

|

|

|

|

|

|

|

| Long Term

Debt, Net of Current Portion |

|

|

102,599 |

|

|

|

|

103,647 |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

20,893 |

|

|

|

|

22,403 |

|

|

|

|

|

|

|

|

| Net Advances

for Construction |

|

|

8,542 |

|

|

|

|

8,752 |

|

|

|

|

|

|

|

|

|

Contributions in Aid of Construction |

|

|

110,868 |

|

|

|

|

99,847 |

|

|

|

|

|

|

|

|

| Other

Liabilities |

|

|

68,160 |

|

|

|

|

64,646 |

|

|

|

|

|

|

|

|

| |

$ |

|

446,939 |

|

|

$ |

|

431,626 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Contact:

Nicki Taylor

Investor Relations

(302) 453-6900

ntaylor@artesianwater.com

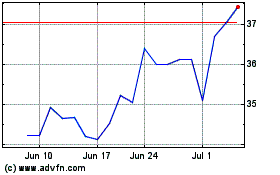

Artesian Resources (NASDAQ:ARTNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

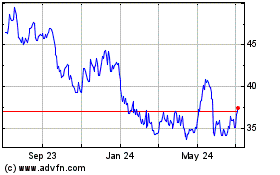

Artesian Resources (NASDAQ:ARTNA)

Historical Stock Chart

From Apr 2023 to Apr 2024