The Five Stocks That Are Driving the Dow Dow

November 02 2016 - 12:55PM

Dow Jones News

By Corrie Driebusch

Five stocks are responsible for 81% of the gains in the Dow

Jones Industrial Average so far this year.

UnitedHealth Group Inc., Caterpillar Inc., International

Business Machines Corp., Chevron Corp. and 3M Co. have each

contributed more than 100 points to the Dow Jones Industrial

Average's 717-point gain in 2016 through the end of October,

according to WSJ Market Data Group.

There is no similar cluster at the bottom end of the index --

not a single stock took more than 85 points off the Dow

industrials.

Last year, the five worst-performing companies took off more

than 780 points from the Dow industrials, offset by the five

biggest contributors, which added 757 points to the index. (The

index finished 2015 down 398 points, or 2.2%.) Wal-Mart Stores

Inc., Apple Inc. and Caterpillar were the biggest decliners that

year.

"That's the magic of stock picking," said Nicholas Colas, chief

market strategist at global brokerage Convergex. While there are

often outsize winners in the index, the problem is "you just rarely

know which they're going to be in any given year."

One reason for those five stocks' gains this year: a scramble by

investors for securities that generate income. The five companies

have an average annual dividend of about 3.2%, according to

FactSet. That is slightly below the average 3.6% dividend yield for

the S&P 500 utilities sector, which has rallied this year as

investors sought income while bond yields were low. The average

dividend yield for the broader S&P 500 is 2.2%.

Mr. Colas said the lack of impact by Apple's stock on the Dow

may surprise some investors. Apple replaced telecommunications

giant AT&T Inc. in the Dow industrials on March 19, 2015.

Apple's stock is up 5.5% in 2016, more than the broader market, but

it has contributed only 57 points to the index.

It has, however, been a top contributor to the S&P 500,

which is weighted by market capitalization rather than stock price

like the Dow industrials. Apple has the highest market cap in the

U.S., meaning even small shifts in its stock price have a big

impact on the S&P 500.

The S&P 500 has gained 82.21 points or 4% in 2016 through

October, with the biggest contributions coming from Facebook, which

added 5.09 points; Johnson & Johnson, 3.9 points; and Apple,

3.83 points, according to S&P Dow Jones Indices.

Last year, growth stocks Facebook Inc., Amazon.com Inc., Netflix

Inc. and Google parent Alphabet Inc. -- commonly referred to as the

"FANG" stocks -- were outsize gainers in the S&P 500.

In another twist, this year's worst-performing sector in the

S&P 500, health care, includes the Dow industrials' biggest

point contributor.

Shares of U.S. health insurer UnitedHealth have risen 20% this

year as of Monday's close and added 162 points to the Dow

industrials in 2016, even as the broader S&P 500 health-care

sector fell 7% in the same period.

Investors wondering which stocks could swing the Dow industrials

in the last two months of the year should look to the companies

with the biggest weighting, Mr. Colas says. In addition to 3M, IBM

and UnitedHealth, that includes Goldman Sachs Group Inc., which has

a roughly 6.7% weighting, and Boeing Co., with a roughly 5.4%

weighting, he said.

So far this year, those latter two stocks haven't moved the

index much. Both are roughly flat, each taking nearly 15 points off

the index through the end of October.

(END) Dow Jones Newswires

November 02, 2016 12:40 ET (16:40 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

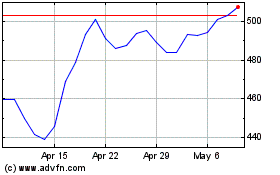

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024