Global Stocks Fall on U.S. Election Jitters

November 02 2016 - 5:50AM

Dow Jones News

Jitters around the U.S. presidential election sent stocks lower

Wednesday while haven assets climbed, just hours ahead of an

interest rate decision from the Federal Reserve.

The Stoxx Europe 600 fell 0.7% in the early minutes of trading,

extending its longest losing streak since February after a downbeat

close on Wall Street. A new Washington Post-ABC News tracking poll

Tuesday showed Republican candidate Donald Trump leading in the

U.S. presidential race, after investors had broadly priced in a

victory for Hillary Clinton.

Shares in Asia were red across the board on Wednesday, with

Japan's Nikkei Stock Average shedding 1.8% and Hong Kong's Hang

Seng falling 1.4%.

As investors shied away from risk, the dollar fell 0.4% against

the yen to ¥ 103.6290, while gold rose 0.7% to $1,296 an ounce,

following on its biggest daily gain since September.

The yield on the 10-year U.S. Treasury note fell to 1.808% from

1.822% on Tuesday, while 10-year German bund yields fell to 0.136%.

Yields move inversely to prices.

Later Wednesday, the U.S. central bank is widely expected to

leave rates unchanged at the conclusion of its November meeting,

but investors will be watching closely to see how strong a signal

the Fed makes about a move higher in December.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

November 02, 2016 05:35 ET (09:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

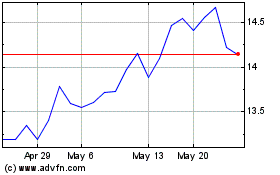

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

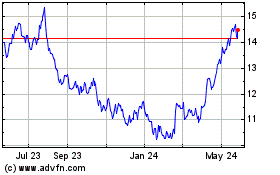

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Apr 2023 to Apr 2024