Sharp CEO Doubts Rival Technology -- WSJ

November 02 2016 - 3:03AM

Dow Jones News

By Takashi Mochizuki

TOKYO -- Sharp Corp.'s newly-appointed chief executive voiced

skepticism on Tuesday regarding a rival smartphone screen

technology that the Japanese electronics maker has been late to

invest in.

Sharp, which was bought in August by Taiwanese iPhone assembler

Foxconn Technology Group, on Tuesday reported a net loss of 17.9

billion yen ($170.8 million) during the July-September quarter,

less than the Yen49.6 billion loss it reported in the same period a

year ago due to some asset write-downs. The Osaka-based company,

whose display-panel business has been struggling due to rivals

aggressively cutting prices, said it would return to profitability

in the second half of the current fiscal year, which ends March 31,

with a projected net profit forecast at Yen3.6 billion.

That brings the company's full fiscal-year forecast to a loss of

Yen41.8 billion (nearly $400 million).

Foxconn, Apple Inc.'s main manufacturing partner, has said it

would help Sharp accelerate its efforts to mass-produce flexible

organic light-emitting diode, or OLED, display panels, which have

the potential to be used for bendable screens. Apple is considering

an iPhone model with the technology as early as next year, people

familiar with the matter say.

But, Sharp's newly-appointed chief executive Tai Jeng-wu, who

was dispatched by Foxconn to turn around the ailing company,

stressed his skepticism regarding the technology at an earnings

briefing on Tuesday.

Sharp, a pioneer in liquid-crystal displays, will make OLED

product samples but Mr. Tai said he hasn't yet decided whether his

company will fully commit to the displays, adding that Sharp's LCD

technology is superior. Sharp had said in April it hopes to start

mass-making OLED displays from 2019.

"I am not sure yet whether OLED has a future," said Mr. Tai,

adding that the technology wasn't mature enough to produce a

high-quality product.

Analysts remain skeptical about Sharp's potential in the field

because the technology requires major capital investment and Sharp

is far behind South Korean electronics giants who have invested in

the technology for televisions and smartphones. But Foxconn's

partnership with Apple could give Sharp a helping hand.

At present, iPhone displays are supplied by Sharp, Japan Display

Inc. and LG Display Co., but only Samsung is capable of providing a

mass quantity of OLED displays, analysts say. Apple prefers to

procure components from multiple suppliers.

The Taiwanese leader said his major mission is to quickly

overhaul the troubled Japanese company, with the help of strong

backing from Foxconn, which will support Sharp in reviewing various

business contracts that are unfavorable to Sharp related to

component procurement and brand licensing deals, the chief

executive said.

"I would make the most use of Foxconn power as the world's

largest contract electronics manufacturer since Sharp, if on its

own, is weak," Mr. Tai said.

Write to Takashi Mochizuki at takashi.mochizuki@wsj.com

(END) Dow Jones Newswires

November 02, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

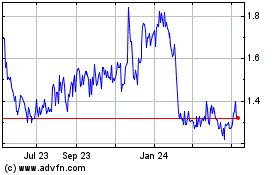

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

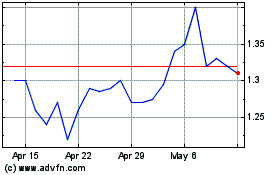

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Apr 2023 to Apr 2024