AT&T Inc.'s practice of exempting its streaming video

services from data-usage caps is rankling competitors and shaping

up as a major issue for regulators set to weigh the telecom giant's

proposed $85.4 billion acquisition of Time Warner Inc.

When AT&T rolls out its $35-a-month DirecTV Now online TV

service this month, its wireless subscribers will be able to stream

as much as they want without it counting toward their monthly data

caps. But if the same customers binge on outside services like

Netflix or Hulu, those bits will add up—potentially leading to

surcharges.

Streaming services like Netflix, Hulu, Sling TV, Major League

Baseball spinoff BAMTech, as well as media companies like 21st

Century Fox, are likely to press regulators to scrutinize the

practice—known as "zero rating"—in their review of the

AT&T-Time Warner deal, people familiar with the matter said. TV

networks that have streaming apps, like CBS and ESPN, also may have

a stake in the matter. (21st Century Fox and Wall Street Journal

owner News Corp share common ownership.)

Several companies are likely to argue that AT&T's DirecTV

Now approach is anticompetitive, and will push for conditions on

the merger, the people say.

Some Federal Communications Commission staffers already view

AT&T's DirecTV Now exemption as an example of improper

zero-rating, people familiar with the situation said, because it

disadvantages AT&T's streaming rivals.

The agency is considering how to address zero-rating and whether

to raise it as a merger issue, the people said. Other options the

agency is weighing include industrywide guidelines on

zero-rating.

AT&T says zero-rating promotes competition. It says it

offers any company that wants to be zero-rated the same payment

terms available to its DirecTV subsidiary. But critics argue that

the in-house payments made by DirecTV don't require any net outlays

by the parent company, and so can't be compared to AT&T's

rivals paying for the same privilege.

FCC spokeswoman Shannon Gilson said: "Conversations to help

commission staff understand new offerings are ongoing."

AT&T officials also say zero-rating benefits consumers, a

view shared by some groups representing minority and low-income

communities. The practice helps streaming services and traditional

TV providers "compete nationwide with cable TV's bundle of TV and

broadband," said Bob Quinn, AT&T's senior executive vice

president for external and legislative affairs.

Current and former regulatory officials in Washington believe

that zero-rating could become the central internet policy issue in

the AT&T-Time Warner deal review—just as "net neutrality"

played a starring role during Comcast Corp.'s 2011 acquisition of

NBCUniversal and its failed 2015 bid to buy Time Warner Cable

Inc.

More than a week after the AT&T deal was announced, Wall

Street appears skeptical it will pass muster in Washington. Shares

of media giant Time Warner are trading about 17% below AT&T's

offer price of $107.50 a share.

AT&T began allowing companies to pay for zero-rating in

2014, but it isn't alone in doing so. Verizon Communications Inc.

zero-rates its go90 mobile video app and National Football League

games. So far, streaming services like Netflix, Amazon.com Inc.'s

video service and Spotify haven't paid, and so count toward both

carriers' data caps.

The FCC's net neutrality rules, issued in February 2015,

regulate the internet like a utility and require all traffic to be

treated equally. The agency didn't restrict zero-rating, but

reserved the right to police it.

Now, the AT&T-Time Warner deal could give regulators the

impetus to do so. The merger would link AT&T's massive

wireless, broadband and pay-TV businesses with content providers

like HBO, TNT and Warner Bros.

Some streaming companies and regulatory officials have come to

view T-Mobile US Inc.'s "Binge On" program as a more acceptable

form of zero-rating. Under that program, any video provider can be

exempted from T-Mobile's data caps free of charge if they agree to

have their video delivered at lower quality, taking up less

bandwidth. Moreover, customers and content companies can easily opt

out.

FCC Chairman Tom Wheeler has called the program

"innovative."

Jon Klein, a former CNN executive whose company TAPP operates

niche streaming services, said he would likely call for scrutiny of

AT&T-style zero-rating in the merger review.

"Zero-rating would no doubt have the effect of stamping out

small upstarts, or forcing them to accept unfavorable terms in

exchange for preferential distribution," he said.

The stakes are also high for bigger companies. Public-interest

advocates worry AT&T could start exempting Time Warner's HBO

Now streaming service from data caps, which would give HBO a leg up

over rival Netflix and its ilk.

Netflix is keeping all its options on the table, said a person

familiar with the company's thinking, including whether to oppose

the deal or merely seek conditions. The company's opposition to the

proposed Comcast-Time Warner Cable merger helped swing public

perception against that deal.

At the WSJDLive Conference in October, Netflix Chief Executive

Reed Hastings said it was important that "HBO's bits and Netflix's

bits are treated the same."

Regulators have made protecting internet TV a primary goal in

reviewing recent mergers. Earlier this year, they barred Charter

Communications from imposing home broadband caps or usage-based

pricing for seven years as a condition of their approval for its

Time Warner Cable purchase.

Still, the FCC has been hesitant to come down heavily against

zero-rating, people familiar with the agency's thinking said, based

on the idea that unlimited streaming could be seen as a benefit to

consumers, even if big companies had an advantage.

Late last year, the agency began closely studying zero-rating,

collecting information from companies including AT&T, which has

taken the view that any regulatory action on the subject should

apply to the rest of the industry.

Republican FCC Commissioner Michael O'Rielly agrees and has said

the agency's vague stance stifles innovation.

"These services live under a perpetual cloud of doubt," Mr.

O'Rielly said in a speech in September.

(END) Dow Jones Newswires

November 01, 2016 18:45 ET (22:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

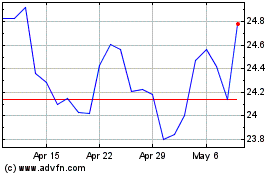

News (NASDAQ:NWSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

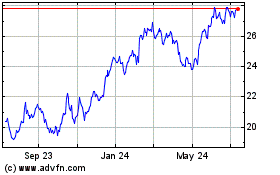

News (NASDAQ:NWSA)

Historical Stock Chart

From Apr 2023 to Apr 2024