New York Mortgage Trust, Inc. (Nasdaq:NYMT) (“NYMT,” the “Company,”

“we,” “our” or “us”) today reported results for the three and nine

months ended September 30, 2016.

Summary of Third Quarter 2016:

- Net income attributable to common stockholders of $20.0

million, or $0.18 per share.

- Net interest income of $15.5 million.

- Portfolio net interest margin of 282 basis points.

- Book value per common share of $6.34 at September 30,

2016, delivering an economic return of 3.1% for the quarter and

8.0% for the nine months ended September 30, 2016.

- Sold distressed residential mortgage loans with a carrying

value of approximately $30.4 million for aggregate proceeds of

approximately $37.1 million, which resulted in a net realized

gain, before income taxes, of approximately $6.7 million.

- Funded $32.4 million of preferred equity investments in

multi-family properties.

- Purchased approximately $75.7 million of Non-Agency RMBS backed

by re-performing and non-performing loans bringing our total

investment in Non-Agency RMBS to $175.9 million at

September 30, 2016.

- Declared third quarter dividend of $0.24 per common share that

was paid on October 28, 2016.

Subsequent Developments:

On October 26, 2016, the Company repaid $55.9 million of

outstanding notes from its November 2013 collateralized recourse

financing, which was collateralized by multi-family CMBS issued

from three separate Freddie Mac-sponsored multi-family K-Series

securitizations. In connection with the repayment of the

notes, approximately $181.9 million of multi-family CMBS collateral

value was transferred back to the Company.

Management Overview

Steven Mumma, NYMT’s Chairman and Chief

Executive Officer, commented: “The Company’s investment portfolio

generated solid returns and a stable book value during the quarter,

as evidenced by a total economic return of 3.1% and book value of

$6.34 per share. Overall, portfolio performance benefited

primarily from our multi-family and residential credit assets,

including sales of distressed residential mortgage loans producing

$6.7 million of net realized gains for the quarter.

We continued to transition our portfolio during

the quarter to one increasingly focused on multi-family and

residential credit assets, purchasing $75.7 million of Non-Agency

RMBS backed by distressed residential loans and originating $32.4

million in multi-family preferred equity investments, while further

reducing our capital allocation to Agency RMBS by 9% during the

quarter. Subsequent to the end of the quarter, we also repaid $55.9

million of outstanding notes issued by one of our multi-family CMBS

collateral recourse financings. As a result of the repayment of

this financing, we were able to unlock approximately $181.9 million

of multi-family CMBS that served as collateral. We expect to

securitize these assets again in the near future on terms that will

be more favorable than the terms of the prior financing, which was

originated in November 2013.

On a macro-level, interest rates continued their

volatile but range-bound movements, with the 10-year U.S. Treasury

note yield hitting a historic low in July at 1.36%, only to go back

up to 1.60% by quarter end. The markets in which we compete for

investments continue to be challenging, as asset pricing remains

high due in large part to greater competition for assets. Because

of this, we continue to be diligent in our search for investments

consistent with our goal to deliver attractive risk adjusted

spreads.”

Capital Allocation

The following tables set forth our allocated

capital by investment type at September 30, 2016 and the

related interest income, interest expense, weighted average yield,

average cost of funds and portfolio net interest margin for the

three months ended September 30, 2016 (dollar amounts in

thousands):

|

Capital Allocation at September 30, 2016: |

| |

Agency RMBS |

|

Agency IOs |

|

Multi-Family (1) |

|

Distressed Residential (2) |

|

Residential Securitized Loans |

|

Other (3) |

|

Total |

| Carrying Value |

$ |

479,359 |

|

|

$ |

86,343 |

|

|

$ |

561,207 |

|

|

$ |

679,873 |

|

|

$ |

99,426 |

|

|

$ |

27,415 |

|

|

$ |

1,933,623 |

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Callable |

(428,597 |

) |

|

(59,763 |

) |

|

(61,555 |

) |

|

(303,838 |

) |

|

— |

|

|

— |

|

|

(853,753 |

) |

| Non-Callable |

— |

|

|

— |

|

|

(83,956 |

) |

|

(148,409 |

) |

|

(96,062 |

) |

|

(45,000 |

) |

|

(373,427 |

) |

| Hedges (Net) (4) |

2,445 |

|

|

10,530 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

12,975 |

|

| Cash (5) |

4,794 |

|

|

45,190 |

|

|

2,252 |

|

|

— |

|

|

— |

|

|

58,842 |

|

|

111,078 |

|

| Goodwill |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

24,982 |

|

|

24,982 |

|

| Other |

1,481 |

|

|

5,545 |

|

|

(4,005 |

) |

|

31,033 |

|

|

828 |

|

|

(27,280 |

) |

|

7,602 |

|

| Net Capital

Allocated |

$ |

59,482 |

|

|

$ |

87,845 |

|

|

$ |

413,943 |

|

|

$ |

258,659 |

|

|

$ |

4,192 |

|

|

$ |

38,959 |

|

|

$ |

863,080 |

|

| % of Capital

Allocated |

6.9 |

% |

|

10.2 |

% |

|

47.9 |

% |

|

30.0 |

% |

|

0.5 |

% |

|

4.5 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Spread - Three Months Ended September 30,

2016: |

| Interest Income |

$ |

1,904 |

|

|

$ |

1,222 |

|

|

$ |

10,719 |

|

|

$ |

9,398 |

|

|

$ |

712 |

|

|

$ |

211 |

|

|

$ |

24,166 |

|

| Interest Expense |

(652 |

) |

|

(718 |

) |

|

(2,179 |

) |

|

(3,958 |

) |

|

(322 |

) |

|

(819 |

) |

|

(8,648 |

) |

| Net Interest

Income |

$ |

1,252 |

|

|

$ |

504 |

|

|

$ |

8,540 |

|

|

$ |

5,440 |

|

|

$ |

390 |

|

|

$ |

(608 |

) |

|

$ |

15,518 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Interest

Earning Assets (6) |

$ |

491,843 |

|

|

$ |

118,945 |

|

|

$ |

341,637 |

|

|

$ |

686,122 |

|

|

$ |

108,641 |

|

|

$ |

14,184 |

|

|

$ |

1,761,372 |

|

| Weighted Average Yield

on Interest Earning Assets (7) |

1.55 |

% |

|

4.11 |

% |

|

12.55 |

% |

|

5.48 |

% |

|

2.62 |

% |

|

5.95 |

% |

|

5.49 |

% |

| Less: Average Cost of

Funds (8) |

(0.58 |

)% |

|

(3.98 |

)% |

|

(6.55 |

)% |

|

(3.45 |

)% |

|

(1.24 |

)% |

|

— |

|

|

(2.67 |

)% |

| Portfolio Net Interest

Margin (9) |

0.97 |

% |

|

0.13 |

% |

|

6.00 |

% |

|

2.03 |

% |

|

1.38 |

% |

|

5.95 |

% |

|

2.82 |

% |

(1) The Company through its ownership of

certain securities has determined it is the primary beneficiary of

the Consolidated K-Series and has consolidated the Consolidated

K-Series into the Company’s consolidated financial

statements. Average Interest Earning Assets for the

quarter excludes all Consolidated K-Series assets other than those

securities actually owned by the Company. Interest income amounts

represent interest income earned by securities that are actually

owned by the Company. A reconciliation of net capital allocated to

and interest income from multi-family investments is included below

in “Additional Information.”(2) Includes $501.9 million of

distressed residential mortgage loans and $174.6 million of

Non-Agency RMBS backed by re-performing and non-performing

loans.(3) Other includes investments in unconsolidated

entities amounting to $9.6 million and mortgage loans held for sale

and mortgage loans held for investment totaling $16.5 million.

Mortgage loans held for sale and mortgage loans held for investment

are included in the Company’s accompanying condensed consolidated

balance sheet in receivables and other assets. Other non-callable

liabilities consist of $45.0 million in subordinated

debentures.(4) Includes derivative assets, derivative

liabilities, payable for securities purchased and restricted cash

posted as margin.(5) Includes $41.1 million held in overnight

deposits in our Agency IO portfolio to be used for trading

purposes. These deposits are included in the Company’s accompanying

condensed consolidated balance sheet in receivables and other

assets.(6) Our Average Interest Earning Assets is calculated

each quarter based on daily average amortized cost.(7) Our

Weighted Average Yield on Interest Earning Assets was calculated by

dividing our annualized interest income for the quarter by our

Average Interest Earning Assets for the quarter.(8) Our

Average Cost of Funds was calculated by dividing our annualized

interest expense for the quarter by our average interest bearing

liabilities, excluding subordinated debentures, for the quarter.

Our Average Cost of Funds includes interest expense on our interest

rate swaps.(9) Portfolio Net Interest Margin is the

difference between our Weighted Average Yield on Interest Earning

Assets and our Average Cost of Funds, excluding the weighted

average cost of subordinated debentures.

Prepayment History

The following table sets forth the actual

constant prepayment rates (“CPR”) for selected asset classes, by

quarter, for the quarterly periods indicated. The change in

prepayment rates from the first quarter of 2016 through the third

quarter of 2016 primarily negatively impacted the net interest

income from our Agency IOs.

|

Quarter Ended |

|

Agency ARMs |

|

Agency Fixed Rate |

|

Agency IOs |

|

Non-Agency RMBS |

|

Residential Securitizations |

|

Total Weighted Average |

| September 30, 2016 |

|

20.7 |

% |

|

10.0 |

% |

|

18.2 |

% |

|

21.0 |

% |

|

15.9 |

% |

|

16.1 |

% |

| June 30, 2016 |

|

17.6 |

% |

|

10.2 |

% |

|

15.6 |

% |

|

14.4 |

% |

|

17.8 |

% |

|

14.6 |

% |

| March 31, 2016 |

|

13.5 |

% |

|

7.9 |

% |

|

14.7 |

% |

|

12.9 |

% |

|

14.8 |

% |

|

12.7 |

% |

| December 31, 2015 |

|

16.9 |

% |

|

8.5 |

% |

|

14.6 |

% |

|

15.3 |

% |

|

31.2 |

% |

|

14.7 |

% |

| September 30, 2015 |

|

18.6 |

% |

|

10.5 |

% |

|

18.0 |

% |

|

12.5 |

% |

|

8.9 |

% |

|

15.1 |

% |

| June 30, 2015 |

|

9.2 |

% |

|

10.6 |

% |

|

16.3 |

% |

|

12.5 |

% |

|

11.1 |

% |

|

13.3 |

% |

| March 31, 2015 |

|

9.1 |

% |

|

6.5 |

% |

|

14.7 |

% |

|

15.5 |

% |

|

13.7 |

% |

|

11.5 |

% |

| December 31, 2014 |

|

12.3 |

% |

|

6.5 |

% |

|

14.6 |

% |

|

13.7 |

% |

|

5.4 |

% |

|

11.1 |

% |

| September 30, 2014 |

|

20.5 |

% |

|

9.2 |

% |

|

15.2 |

% |

|

18.7 |

% |

|

5.4 |

% |

|

13.1 |

% |

| June 30, 2014 |

|

9.9 |

% |

|

6.7 |

% |

|

12.7 |

% |

|

10.5 |

% |

|

7.0 |

% |

|

10.1 |

% |

Earnings Summary

For the quarter ended September 30, 2016,

we reported net income attributable to common stockholders of $20.0

million, an increase of $8.8 million from the second quarter of

2016.

We generated net interest income of $15.5

million and portfolio net interest margin of 282 basis points, a

decrease of $1.1 million and 39 basis points, respectively, from

the second quarter of 2016. The decrease was primarily driven

by:

- A decrease in net interest income of $1.4 million from our

Agency IO portfolio due to an increase in prepayment rates and

increase in financing costs.

- A decrease in net interest income of approximately $0.3 million

in our distressed residential portfolio due to an

increase in interest expense of $0.6 million resulting

from an increase in average liabilities during the period.

This was partially offset by an increase in interest income of $0.3

million due to investments made in Non-Agency RMBS backed by

re-performing and non-performing loans during the second

quarter.

- An increase in net interest income of $0.6 million from our

multi-family portfolio due to an increase in average interest

earning multi-family assets during the third quarter. The

increase in average interest earning multi-family assets can be

attributed to new multi-family preferred equity investments made

during the third quarter. In addition, yield on the interest

earning assets in our multi-family portfolio increased during the

period and average cost of funds decreased during the quarter.

For the quarter ended September 30, 2016,

we recognized other income of $16.6 million, primarily from the

following:

- Unrealized gains amounting to $0.7 million recognized on our

multi-family loans and debt held in securitization trusts.

- Realized gains of $2.3 million and unrealized gains of $1.6

million on our investment securities and related hedges, primarily

related to our Agency IO portfolio.

- Net realized gains of $6.4 million recognized on our distressed

residential mortgage loans primarily resulting from the sale of

pools of distressed residential mortgage loans.

- Other income of $5.6 million, which primarily included income

from our investments in unconsolidated entities during the

period.

The following table details the general,

administrative and other expenses incurred during the second and

third quarters of 2016:

| |

|

Three Months Ended |

|

General, Administrative and Other Expenses |

|

September 30, 2016 |

June 30, 2016 |

| Salaries, benefits and

directors’ compensation |

|

$ |

2,705 |

|

$ |

2,763 |

|

| Professional fees |

|

1,024 |

|

709 |

|

| Base management and

incentive fees |

|

1,453 |

|

2,979 |

|

| Expenses on distressed

residential mortgage loans |

|

2,398 |

|

2,740 |

|

| Other |

|

1,125 |

|

745 |

|

| Total |

|

$ |

8,705 |

|

$ |

9,936 |

|

Total general, administrative and other expenses

for the third quarter of 2016 were approximately $8.7 million, down

from $9.9 million for the second quarter of 2016. The $1.5 million

decrease in the Company's management and incentive fees is

primarily due to a change in methodology of calculation of

management fees on our distressed residential mortgage loan

portfolio from 1.5% of assets under management to 1.5% of invested

capital beginning in the third quarter of 2016 and the

internalization of RiverBanc into the Company in May 2016.

Analysis of Changes in Book Value

The following table analyzes the changes in book

value of our common stock for the quarter ended September 30,

2016 (amounts in thousands, except per share):

| |

Quarter Ended September 30, 2016 |

| |

Amount |

|

Shares |

|

Per Share(1) |

| Beginning

Balance |

$ |

698,967 |

|

|

109,569 |

|

|

$ |

6.38 |

|

| Common stock issuance,

net |

287 |

|

|

— |

|

|

|

| Balance after share

issuance activity |

699,254 |

|

|

109,569 |

|

|

6.38 |

|

| Dividends declared |

(26,297 |

) |

|

|

|

(0.24 |

) |

| Net change AOCI:

(2) |

|

|

|

|

|

| Hedges |

521 |

|

|

|

|

— |

|

| RMBS |

1,415 |

|

|

|

|

0.02 |

|

| CMBS |

54 |

|

|

|

|

— |

|

| Net income attributable to common

stockholders |

20,043 |

|

|

|

|

0.18 |

|

| Ending

Balance |

$ |

694,990 |

|

|

109,569 |

|

|

$ |

6.34 |

|

(1) Outstanding shares used to calculate book value per

share for the ending balance is based on outstanding shares as of

September 30, 2016 of 109,569,315.(2) Accumulated other

comprehensive income (“AOCI”).

Conference Call

On Wednesday, November 2, 2016 at 9:00 a.m.,

Eastern Time, New York Mortgage Trust's executive management is

scheduled to host a conference call and audio webcast to discuss

the Company’s financial results for the three and nine months ended

September 30, 2016. The conference call dial-in number is

(877) 312-8806. The replay will be available until Wednesday,

November 9, 2016 and can be accessed by dialing (855) 859-2056 and

entering passcode 4766254. A live audio webcast of the conference

call can be accessed via the Internet, on a listen-only basis, at

the Company's website at http://www.nymtrust.com. Please

allow extra time, prior to the call, to visit the site and download

the necessary software to listen to the Internet broadcast.

Third quarter 2016 financial and operating data

can be viewed in the Company’s Quarterly Report on Form 10-Q, which

is expected to be filed with the Securities and Exchange Commission

on or about November 3, 2016. A copy of the Form 10-Q will be

posted at the Company’s website as soon as reasonably practicable

following its filing with the Securities and Exchange

Commission.

About New York Mortgage Trust

New York Mortgage Trust, Inc. is a Maryland

corporation that has elected to be taxed as a real estate

investment trust for federal income tax purposes (“REIT”). NYMT is

an internally managed REIT which invests in mortgage-related and

financial assets and targets residential mortgage loans, including

second mortgages and loans sourced from distressed markets,

multi-family CMBS, direct financing to owners of multi-family

properties through mezzanine loans and preferred equity investments

and other commercial real estate-related investments and Non-Agency

RMBS backed by re-performing and non-performing loans. The

Midway Group, L.P. and Headlands Asset Management, LLC provide

investment management services to the Company with respect to

certain of its asset classes. Prior to the Company's acquisition of

RiverBanc on May 16, 2016, RiverBanc provided investment management

services to the Company with respect to its investments in

multi-family CMBS and certain commercial real estate-related

investments. For a list of defined terms used from time to

time in this press release, see “Defined Terms” below.

Defined Terms

The following defines certain of the commonly

used terms in this press release: “RMBS” refers to residential

mortgage-backed securities comprised of adjustable-rate, hybrid

adjustable-rate, fixed-rate, interest only and inverse interest

only, and principal only securities; “Agency RMBS” refers to RMBS

representing interests in or obligations backed by pools of

residential mortgage loans issued or guaranteed by a federally

chartered corporation ("GSE"), such as the Federal National

Mortgage Association (“Fannie Mae”) or the Federal Home Loan

Mortgage Corporation (“Freddie Mac”), or an agency of the U.S.

government, such as the Government National Mortgage Association

(“Ginnie Mae”); "Non-Agency RMBS" refers to RMBS backed by prime

jumbo mortgage loans including re-performing and non-performing

loans; “Agency ARMs” refers to Agency RMBS comprised of

adjustable-rate and hybrid adjustable-rate RMBS; "Agency fixed-rate

RMBS" refers to Agency RMBS comprised of fixed-rate RMBS; “IOs”

refers collectively to interest only and inverse interest only

mortgage-backed securities that represent the right to the interest

component of the cash flow from a pool of mortgage loans; “Agency

IOs” refers to an IO that represents the right to the interest

component of cash flow from a pool of residential mortgage loans

issued or guaranteed by a GSE, or an agency of the U.S. government;

“POs” refers to mortgage-backed securities that represent the right

to the principal component of the cash flow from a pool of mortgage

loans; “ARMs” refers to adjustable-rate residential mortgage loans;

“residential securitized loans” refers to prime credit quality

residential ARM loans held in securitization trusts; “distressed

residential mortgage loans” refers to pools of performing,

re-performing and to a lesser extent non-performing, fixed-rate and

adjustable-rate, fully amortizing, interest-only and balloon,

seasoned mortgage loans secured by first liens on one- to

four-family properties; “CMBS” refers to commercial mortgage-backed

securities comprised of commercial mortgage pass-through

securities, as well as IO or PO securities that represent the right

to a specific component of the cash flow from a pool of commercial

mortgage loans; “multi-family CMBS” refers to CMBS backed by

commercial mortgage loans on multi-family properties; “multi-family

securitized loans” refers to the commercial mortgage loans included

in the Consolidated K-Series; “CDO” refers to collateralized debt

obligation; “CLO” refers to collateralized loan obligation; and

"Consolidated K-Series” refers to five separate Freddie Mac-

sponsored multi-family loan K-Series securitizations.

Additional Information

We determined that the Consolidated K-Series

were variable interest entities and that we are the primary

beneficiary of the Consolidated K-Series. As a result, we are

required to consolidate the Consolidated K-Series’ underlying

multi-family loans including their liabilities, income and expenses

in our condensed consolidated financial statements. We have elected

the fair value option on the assets and liabilities held within the

Consolidated K-Series, which requires that changes in valuations in

the assets and liabilities of the Consolidated K-Series be

reflected in our condensed consolidated statements of

operations.

A reconciliation of our net capital allocated to

multi-family investments to our condensed consolidated financial

statements as of September 30, 2016 is set forth below (dollar

amounts in thousands):

| Multi-family loans held

in securitization trusts, at fair value |

$ |

7,221,402 |

|

| Multi-family CDOs, at

fair value |

(6,913,855 |

) |

| Net carrying value |

307,547 |

|

| Investment securities

available for sale, at fair value |

66,141 |

|

| Total CMBS, at fair

value |

373,688 |

|

| Mezzanine loan,

preferred equity investments and investments in unconsolidated

entities |

171,138 |

|

| Real estate under

development |

16,381 |

|

| Financing

arrangements |

(61,555 |

) |

| Securitized debt |

(83,956 |

) |

| Cash and other |

(1,753 |

) |

| Net Capital in

Multi-Family |

$ |

413,943 |

|

A reconciliation of our interest income in

multi-family investments to our condensed consolidated financial

statements for the three months ended September 30, 2016 is

set forth below (dollar amounts in thousands):

|

|

Three Months Ended September 30, 2016 |

| Interest income,

multi-family loans held in securitization trusts |

$ |

62,126 |

|

| Interest income,

investment securities, available for sale (1) |

1,281 |

|

| Interest income,

mezzanine loan and preferred equity investments (1) |

2,671 |

|

| Interest expense,

multi-family collateralized obligation |

55,359 |

|

| Interest income,

Multi-Family, net |

10,719 |

|

| Interest expense,

investment securities, available for sale |

609 |

|

| Interest expense,

securitized debt |

1,570 |

|

| Net interest income,

Multi-Family |

$ |

8,540 |

|

(1) Included in the Company’s accompanying

condensed consolidated statements of operations in interest income,

investment securities and other.

Cautionary Statement Regarding

Forward-Looking Statements

When used in this press release, in future

filings with the Securities and Exchange Commission (“SEC”) or in

other written or oral communications, statements which are not

historical in nature, including those containing words such as

“believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,”

“intend,” “should,” “would,” “could,” “goal,” “objective,” “will,”

“may” or similar expressions, are intended to identify

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and, as such, may

involve known and unknown risks, uncertainties and assumptions.

Forward-looking statements are based on the

Company’s beliefs, assumptions and expectations of its future

performance, taking into account all information currently

available to it. These beliefs, assumptions and expectations are

subject to risks and uncertainties and can change as a result of

many possible events or factors, not all of which are known to the

Company. If a change occurs, the Company’s business, financial

condition, liquidity and results of operations may vary materially

from those expressed in its forward-looking statements. The

following factors are examples of those that could cause actual

results to vary from the Company’s forward-looking statements:

changes in interest rates and the market value of the Company’s

securities; changes in credit spreads; the impact of the downgrade

of the long-term credit ratings of the U.S., Fannie Mae, Freddie

Mac, and Ginnie Mae; market volatility; changes in the prepayment

rates on the mortgage loans underlying the Company’s investment

securities; increased rates of default and/or decreased recovery

rates on the Company's assets; increased rates of default and/or

decreased recovery rates on the Company’s assets; the Company’s

ability to borrow to finance its assets and the terms thereof;

changes in governmental laws, regulations or policies affecting the

Company’s business; changes in the Company's relationships with its

external managers; the Company’s ability to maintain its

qualification as a REIT for federal tax purposes; the Company’s

ability to maintain its exemption from registration under the

Investment Company Act of 1940, as amended; and risks associated

with investing in real estate assets, including changes in business

conditions and the general economy. These and other risks,

uncertainties and factors, including the risk factors described in

the Company’s periodic reports filed with the SEC, could cause the

Company’s actual results to differ materially from those projected

in any forward-looking statements it makes. All forward-looking

statements speak only as of the date on which they are made. New

risks and uncertainties arise over time and it is not possible to

predict those events or how they may affect the Company. Except as

required by law, the Company is not obligated to, and does not

intend to, update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

FINANCIAL TABLES FOLLOW

NEW YORK MORTGAGE TRUST, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(Dollar amounts in thousands, except share

data)

| |

September 30, 2016 |

|

December 31, 2015 |

| |

(unaudited) |

|

|

|

ASSETS |

|

|

|

| Investment securities,

available for sale, at fair value (including $43,074 and $40,734

held in securitization trusts as of September 30, 2016 and December

31, 2015, respectively and pledged securities of $712,064 and

$639,683, as of September 30, 2016 and December 31, 2015,

respectively) |

$ |

807,702 |

|

|

$ |

765,454 |

|

| Residential mortgage

loans held in securitization trusts, net |

99,426 |

|

|

119,921 |

|

| Distressed residential

mortgage loans, net (including $204,275 and $114,214 held in

securitization trusts) |

501,881 |

|

|

558,989 |

|

| Multi-family loans held

in securitization trusts, at fair value |

7,221,402 |

|

|

7,105,336 |

|

| Derivative assets |

291,318 |

|

|

228,775 |

|

| Cash and cash

equivalents |

65,282 |

|

|

61,959 |

|

| Investment in

unconsolidated entities |

81,284 |

|

|

87,662 |

|

| Mezzanine loan and

preferred equity investments |

99,477 |

|

|

44,151 |

|

| Goodwill |

24,982 |

|

|

— |

|

| Receivables and other

assets |

168,572 |

|

|

83,995 |

|

| Total Assets

(1) |

$ |

9,361,326 |

|

|

$ |

9,056,242 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

Liabilities: |

|

|

|

| Financing arrangements,

portfolio investments |

$ |

671,774 |

|

|

$ |

577,413 |

|

| Financing arrangements,

residential mortgage loans |

181,979 |

|

|

212,155 |

|

| Residential

collateralized debt obligations |

96,062 |

|

|

116,710 |

|

| Multi-family

collateralized debt obligations, at fair value |

6,913,855 |

|

|

6,818,901 |

|

| Securitized debt |

232,365 |

|

|

116,541 |

|

| Derivative

liabilities |

1,788 |

|

|

1,500 |

|

| Payable for securities

purchased |

290,833 |

|

|

227,969 |

|

| Accrued expenses and

other liabilities |

64,590 |

|

|

59,527 |

|

| Subordinated

debentures |

45,000 |

|

|

45,000 |

|

| Total

liabilities (1) |

$ |

8,498,246 |

|

|

$ |

8,175,716 |

|

| Commitments and

Contingencies |

|

|

|

| Stockholders'

Equity: |

|

|

|

| Preferred stock, $0.01

par value, 7.75% Series B cumulative redeemable, $25 liquidation

preference per share, 6,000,000 shares authorized, 3,000,000 shares

issued and outstanding |

$ |

72,397 |

|

|

$ |

72,397 |

|

| Preferred stock, $0.01

par value, 7.875% Series C cumulative redeemable, $25 liquidation

preference per share, 4,140,000 shares authorized, 3,600,000 shares

issued and outstanding |

86,862 |

|

|

86,862 |

|

| Common stock, $0.01 par

value, 400,000,000 shares authorized, 109,569,315 and 109,401,721

shares issued and outstanding as of September 30, 2016 and December

31, 2015, respectively |

1,096 |

|

|

1,094 |

|

| Additional paid-in

capital |

735,507 |

|

|

734,610 |

|

| Accumulated other

comprehensive income (loss) |

9,584 |

|

|

(2,854 |

) |

| Accumulated

deficit |

(45,456 |

) |

|

(11,583 |

) |

| Company's stockholders'

equity |

$ |

859,990 |

|

|

$ |

880,526 |

|

| Non-controlling

interest |

$ |

3,090 |

|

|

$ |

— |

|

| Total equity |

$ |

863,080 |

|

|

$ |

880,526 |

|

| Total

Liabilities and Stockholders' Equity |

$ |

9,361,326 |

|

|

$ |

9,056,242 |

|

(1) Our condensed consolidated

balance sheets include assets and liabilities of consolidated

variable interest entities ("VIEs") as the Company is the primary

beneficiary of these VIEs. As of September 30, 2016 and

December 31, 2015, assets of consolidated VIEs totaled

$7,631,478 and $7,413,082, respectively, and the liabilities of

consolidated VIEs totaled $7,267,689 and $7,077,175,

respectively.

NEW YORK MORTGAGE TRUST, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Dollar amounts in thousands, except per

share data)(unaudited)

| |

For the Three Months Ended September

30, |

|

For the Nine Months Ended September

30, |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

| INTEREST INCOME: |

|

|

|

|

|

|

|

| Investment securities and

other |

$ |

8,587 |

|

|

$ |

6,792 |

|

|

$ |

25,612 |

|

|

$ |

28,332 |

|

| Multi-family loans held in

securitization trusts |

62,126 |

|

|

63,431 |

|

|

187,427 |

|

|

192,715 |

|

| Residential mortgage loans held in

securitization trusts |

947 |

|

|

875 |

|

|

2,705 |

|

|

2,950 |

|

| Distressed residential mortgage

loans |

7,865 |

|

|

11,489 |

|

|

25,173 |

|

|

31,975 |

|

| Total interest income |

|

79,525 |

|

|

|

82,587 |

|

|

|

240,917 |

|

|

|

255,972 |

|

| |

|

|

|

|

|

|

|

| INTEREST EXPENSE: |

|

|

|

|

|

|

|

| Investment securities and

other |

|

4,598 |

|

|

|

3,432 |

|

|

|

12,409 |

|

|

|

10,337 |

|

| Multi-family collateralized debt

obligations |

55,359 |

|

|

57,388 |

|

|

167,783 |

|

|

174,475 |

|

| Residential collateralized debt

obligations |

322 |

|

|

219 |

|

|

937 |

|

|

679 |

|

| Securitized debt |

3,209 |

|

|

2,782 |

|

|

8,436 |

|

|

8,883 |

|

| Subordinated debentures |

519 |

|

|

474 |

|

|

1,528 |

|

|

1,402 |

|

| Total interest expense |

64,007 |

|

|

64,295 |

|

|

191,093 |

|

|

195,776 |

|

| |

|

|

|

|

|

|

|

| NET INTEREST

INCOME |

15,518 |

|

|

18,292 |

|

|

49,824 |

|

|

60,196 |

|

| |

|

|

|

|

|

|

|

| OTHER INCOME

(LOSS): |

|

|

|

|

|

|

|

| (Provision) recovery for loan

losses |

(26 |

) |

|

(1,117 |

) |

|

661 |

|

|

(1,664 |

) |

| Realized gain (loss) on investment

securities and related hedges, net |

2,306 |

|

|

(2,895 |

) |

|

5,333 |

|

|

(3,062 |

) |

| Gain on de-consolidation of

multi-family loans held in securitization trust and multi-family

collateralized debt obligations |

— |

|

|

— |

|

|

— |

|

|

1,483 |

|

| Realized gain on distressed

residential mortgage loans |

6,416 |

|

|

27,224 |

|

|

11,990 |

|

|

31,514 |

|

| Unrealized gain (loss) on

investment securities and related hedges, net |

1,563 |

|

|

(2,631 |

) |

|

(1,594 |

) |

|

(3,643 |

) |

| Unrealized gain on multi-family

loans and debt held in securitization trusts, net |

738 |

|

|

(2,170 |

) |

|

2,340 |

|

|

16,876 |

|

| Other income |

5,635 |

|

|

1,807 |

|

|

16,833 |

|

|

6,393 |

|

| Total other income |

16,632 |

|

|

20,218 |

|

|

35,563 |

|

|

47,897 |

|

| |

|

|

|

|

|

|

|

| Base management and incentive

fees |

1,453 |

|

|

3,676 |

|

|

7,958 |

|

|

14,687 |

|

| Expenses related to distressed

residential mortgage loans |

2,398 |

|

|

3,261 |

|

|

8,332 |

|

|

7,827 |

|

| Other general and administrative

expenses |

4,854 |

|

|

2,893 |

|

|

11,711 |

|

|

7,302 |

|

| Total general, administrative and

other expenses |

8,705 |

|

|

9,830 |

|

|

28,001 |

|

|

29,816 |

|

| |

|

|

|

|

|

|

|

| INCOME FROM OPERATIONS

BEFORE INCOME TAXES |

23,445 |

|

|

28,680 |

|

|

57,386 |

|

|

78,277 |

|

| Income tax expense |

163 |

|

|

3,048 |

|

|

2,720 |

|

|

4,471 |

|

| NET INCOME |

|

23,282 |

|

|

|

25,632 |

|

|

|

54,666 |

|

|

|

73,806 |

|

| Net income attributable

to non-controlling interest |

(14 |

) |

|

— |

|

|

(12 |

) |

|

— |

|

| NET INCOME ATTRIBUTABLE

TO COMPANY |

|

23,268 |

|

|

|

25,632 |

|

|

|

54,654 |

|

|

|

73,806 |

|

| Preferred stock

dividends |

(3,225 |

) |

|

(3,225 |

) |

|

(9,675 |

) |

|

(7,765 |

) |

| NET INCOME ATTRIBUTABLE

TO COMPANY'S COMMON STOCKHOLDERS |

$ |

20,043 |

|

|

$ |

22,407 |

|

|

$ |

44,979 |

|

|

$ |

66,041 |

|

| |

|

|

|

|

|

|

|

| Basic income per common

share |

$ |

0.18 |

|

|

$ |

0.20 |

|

|

$ |

0.41 |

|

|

$ |

0.61 |

|

| Diluted income per

common share |

$ |

0.18 |

|

|

$ |

0.20 |

|

|

$ |

0.41 |

|

|

$ |

0.61 |

|

| Weighted average shares

outstanding-basic |

109,569 |

|

|

109,402 |

|

|

109,487 |

|

|

108,061 |

|

| Weighted average shares

outstanding-diluted |

109,569 |

|

|

109,402 |

|

|

109,487 |

|

|

108,061 |

|

NEW YORK MORTGAGE TRUST, INC. AND

SUBSIDIARIESSUMMARY OF QUARTERLY

EARNINGS(Dollar amounts in thousands, except per

share data)(unaudited)

| |

For the Three Months Ended |

| |

September 30, 2016 |

June 30, 2016 |

|

March 31, 2016 |

|

December 31, 2015 |

|

September 30, 2015 |

| Net interest

income |

$ |

15,518 |

|

$ |

16,664 |

|

|

$ |

17,642 |

|

|

$ |

15,991 |

|

|

$ |

18,292 |

|

| Total other income

(loss) |

16,632 |

|

10,071 |

|

|

8,860 |

|

|

(2,055 |

) |

|

20,218 |

|

| Total general,

administrative and other expenses |

8,705 |

|

9,936 |

|

|

9,360 |

|

|

9,665 |

|

|

9,830 |

|

| Income from operations

before income taxes |

23,445 |

|

16,799 |

|

|

17,142 |

|

|

4,271 |

|

|

28,680 |

|

| Income tax expense |

163 |

|

2,366 |

|

|

191 |

|

|

64 |

|

|

3,048 |

|

| Net income |

23,282 |

|

14,433 |

|

|

16,951 |

|

|

4,207 |

|

|

25,632 |

|

| Net (income) loss

attributable to non-controlling interest |

(14 |

) |

2 |

|

|

— |

|

|

— |

|

|

— |

|

| Net income attributable

to Company |

23,268 |

|

14,435 |

|

|

16,951 |

|

|

4,207 |

|

|

25,632 |

|

| Preferred stock

dividends |

(3,225 |

) |

(3,225 |

) |

|

(3,225 |

) |

|

(3,225 |

) |

|

(3,225 |

) |

| Net income attributable

to Company's common stockholders |

20,043 |

|

11,210 |

|

|

13,726 |

|

|

982 |

|

|

22,407 |

|

| Basic income per common

share |

$ |

0.18 |

|

$ |

0.10 |

|

|

$ |

0.13 |

|

|

$ |

0.01 |

|

|

$ |

0.20 |

|

| Diluted income per

common share |

$ |

0.18 |

|

$ |

0.10 |

|

|

$ |

0.13 |

|

|

$ |

0.01 |

|

|

$ |

0.20 |

|

| Weighted average shares

outstanding - basic |

109,569 |

|

109,489 |

|

|

109,402 |

|

|

109,402 |

|

|

109,402 |

|

| Weighted average shares

outstanding - diluted |

109,569 |

|

109,489 |

|

|

109,402 |

|

|

109,402 |

|

|

109,402 |

|

| |

|

|

|

|

|

|

|

|

| Book value per common

share |

$ |

6.34 |

|

$ |

6.38 |

|

|

$ |

6.49 |

|

|

$ |

6.54 |

|

|

$ |

6.82 |

|

| Dividends declared per

common share |

$ |

0.24 |

|

$ |

0.24 |

|

|

$ |

0.24 |

|

|

$ |

0.24 |

|

|

$ |

0.24 |

|

| Dividends declared per

preferred share on Series B Preferred Stock |

$ |

0.484375 |

|

$ |

0.484375 |

|

|

$ |

0.484375 |

|

|

$ |

0.484375 |

|

|

$ |

0.484375 |

|

| Dividends declared per

preferred share on Series C Preferred Stock |

$ |

0.4921875 |

|

$ |

0.4921875 |

|

|

$ |

0.4921875 |

|

|

$ |

0.4921875 |

|

|

$ |

0.4921875 |

|

Capital Allocation Summary

The following tables set forth our allocated

capital by investment type and the related weighted average yield

on interest earning assets, average cost of funds and portfolio net

interest margin for the periods indicated (dollar amounts in

thousands):

| |

Agency RMBS |

|

Agency IOs |

|

Multi-Family |

|

Distressed Residential |

|

Residential Securitized

Loans |

|

Other |

|

Total |

| At September

30, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carrying value |

$ |

479,359 |

|

|

$ |

86,343 |

|

|

$ |

561,207 |

|

|

$ |

679,873 |

|

|

$ |

99,426 |

|

|

$ |

27,415 |

|

|

$ |

1,933,623 |

|

| Net capital allocated |

$ |

59,482 |

|

|

$ |

87,845 |

|

|

$ |

413,943 |

|

|

$ |

258,659 |

|

|

$ |

4,192 |

|

|

$ |

38,959 |

|

|

$ |

863,080 |

|

| Three Months

Ended September 30, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average interest earning

assets |

$ |

491,843 |

|

|

$ |

118,945 |

|

|

$ |

341,637 |

|

|

$ |

686,122 |

|

|

$ |

108,641 |

|

|

$ |

14,184 |

|

|

$ |

1,761,372 |

|

| Weighted average yield on interest

earning assets |

1.55 |

% |

|

4.11 |

% |

|

12.55 |

% |

|

5.48 |

% |

|

2.62 |

% |

|

5.95 |

% |

|

5.49 |

% |

| Less: Average cost of funds |

(0.58 |

)% |

|

(3.98 |

)% |

|

(6.55 |

)% |

|

(3.45 |

)% |

|

(1.24 |

)% |

|

— |

|

|

(2.67 |

)% |

| Portfolio net interest margin |

0.97 |

% |

|

0.13 |

% |

|

6.00 |

% |

|

2.03 |

% |

|

1.38 |

% |

|

5.95 |

% |

|

2.82 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| At June 30,

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carrying value |

$ |

507,294 |

|

|

$ |

114,007 |

|

|

$ |

519,341 |

|

|

$ |

655,968 |

|

|

$ |

106,173 |

|

|

$ |

24,015 |

|

|

$ |

1,926,798 |

|

| Net capital allocated |

$ |

69,961 |

|

|

$ |

92,471 |

|

|

$ |

431,084 |

|

|

$ |

256,619 |

|

|

$ |

4,320 |

|

|

$ |

12,588 |

|

|

$ |

867,043 |

|

| Three Months

Ended June 30, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average interest earning

assets |

$ |

522,651 |

|

|

$ |

132,453 |

|

|

$ |

315,531 |

|

|

$ |

595,455 |

|

|

$ |

116,258 |

|

|

$ |

9,196 |

|

|

$ |

1,691,544 |

|

| Weighted average yield on interest

earning assets |

1.62 |

% |

|

8.18 |

% |

|

12.35 |

% |

|

6.11 |

% |

|

2.58 |

% |

|

5.39 |

% |

|

5.80 |

% |

| Less: Average cost of funds |

(0.71 |

)% |

|

(2.51 |

)% |

|

(6.73 |

)% |

|

(3.90 |

)% |

|

(1.13 |

)% |

|

— |

|

|

(2.59 |

)% |

| Portfolio net interest margin |

0.91 |

% |

|

5.67 |

% |

|

5.62 |

% |

|

2.21 |

% |

|

1.45 |

% |

|

5.39 |

% |

|

3.21 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| At March 31,

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carrying value |

$ |

531,572 |

|

|

$ |

188,251 |

|

|

$ |

473,745 |

|

|

$ |

555,233 |

|

|

$ |

113,186 |

|

|

$ |

18,899 |

|

|

$ |

1,880,886 |

|

| Net capital allocated |

$ |

78,387 |

|

|

$ |

101,895 |

|

|

$ |

383,733 |

|

|

$ |

350,150 |

|

|

$ |

4,295 |

|

|

$ |

(43,452 |

) |

|

$ |

875,008 |

|

| Three Months

Ended March 31, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average interest earning

assets |

$ |

573,605 |

|

|

$ |

137,546 |

|

|

$ |

286,051 |

|

|

$ |

563,001 |

|

|

$ |

121,152 |

|

|

$ |

5,420 |

|

|

$ |

1,686,775 |

|

| Weighted average yield on interest

earning assets |

1.71 |

% |

|

10.58 |

% |

|

12.09 |

% |

|

6.30 |

% |

|

2.46 |

% |

|

5.83 |

% |

|

5.79 |

% |

| Less: Average cost of funds |

(0.95 |

)% |

|

(2.48 |

)% |

|

(7.29 |

)% |

|

(4.18 |

)% |

|

(1.05 |

)% |

|

— |

|

|

(2.46 |

)% |

| Portfolio net interest margin |

0.76 |

% |

|

8.10 |

% |

|

4.80 |

% |

|

2.12 |

% |

|

1.41 |

% |

|

5.83 |

% |

|

3.33 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| At December 31,

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carrying value |

$ |

547,745 |

|

|

$ |

175,408 |

|

|

$ |

450,228 |

|

|

$ |

562,303 |

|

|

$ |

119,921 |

|

|

$ |

15,184 |

|

|

$ |

1,870,789 |

|

| Net capital allocated |

$ |

76,277 |

|

|

$ |

108,333 |

|

|

$ |

364,697 |

|

|

$ |

328,037 |

|

|

$ |

4,398 |

|

|

$ |

(1,216 |

) |

|

$ |

880,526 |

|

| Three Months

Ended December 31, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average interest earning

assets |

$ |

593,905 |

|

|

$ |

135,430 |

|

|

$ |

281,334 |

|

|

$ |

545,504 |

|

|

$ |

133,721 |

|

|

$ |

2,788 |

|

|

$ |

1,692,682 |

|

| Weighted average yield on interest

earning assets |

1.67 |

% |

|

9.40 |

% |

|

12.19 |

% |

|

5.41 |

% |

|

2.17 |

% |

|

4.02 |

% |

|

5.29 |

% |

| Less: Average cost of funds |

(0.90 |

)% |

|

(1.30 |

)% |

|

(7.12 |

)% |

|

(4.22 |

)% |

|

(0.80 |

)% |

|

— |

|

|

(2.25 |

)% |

| Portfolio net interest margin |

0.77 |

% |

|

8.10 |

% |

|

5.07 |

% |

|

1.19 |

% |

|

1.37 |

% |

|

4.02 |

% |

|

3.04 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| At September

30, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carrying value |

$ |

596,238 |

|

|

$ |

135,373 |

|

|

$ |

446,659 |

|

|

$ |

512,760 |

|

|

$ |

132,882 |

|

|

$ |

5,842 |

|

|

$ |

1,829,754 |

|

| Net capital allocated |

$ |

106,668 |

|

|

$ |

107,812 |

|

|

$ |

362,959 |

|

|

$ |

296,406 |

|

|

$ |

4,800 |

|

|

$ |

32,003 |

|

|

$ |

910,648 |

|

| Three Months

Ended September 30, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average interest earning

assets |

$ |

610,301 |

|

|

$ |

134,765 |

|

|

$ |

264,935 |

|

|

$ |

591,792 |

|

|

$ |

141,400 |

|

|

$ |

2,488 |

|

|

$ |

1,745,681 |

|

| Weighted average yield on interest

earning assets |

1.58 |

% |

|

6.89 |

% |

|

12.18 |

% |

|

7.80 |

% |

|

2.33 |

% |

|

4.82 |

% |

|

5.77 |

% |

| Less: Average cost of funds |

(0.88 |

)% |

|

(1.29 |

)% |

|

(7.06 |

)% |

|

(3.94 |

)% |

|

(0.64 |

)% |

|

— |

|

|

(2.23 |

)% |

| Portfolio net interest margin |

0.70 |

% |

|

5.60 |

% |

|

5.12 |

% |

|

3.86 |

% |

|

1.69 |

% |

|

4.82 |

% |

|

3.54 |

% |

AT THE COMPANY

Kristine R. Nario

Chief Financial Officer

Phone: (646) 216-2363

Email: knario@nymtrust.com

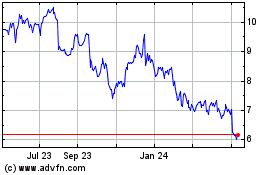

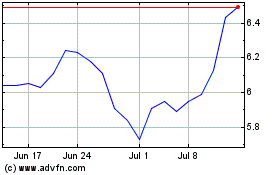

New York Mortgage (NASDAQ:NYMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

New York Mortgage (NASDAQ:NYMT)

Historical Stock Chart

From Apr 2023 to Apr 2024