Middlesex Water Company Announces Third Quarter 2016 Financial Results

November 01 2016 - 12:30PM

Third Quarter Highlights

Middlesex Water Company (NASDAQ:MSEX) ("Middlesex" or the

"Company") today reported third quarter consolidated operating

revenues of $37.8 million as compared to $34.7 million for the same

period in 2015. Net income for the quarter was $8.8 million,

compared to $6.7 million reported in the same quarter of

2015. Basic and diluted earnings per share for the quarter

were $0.54, compared to $0.41 for the same period in 2015.

Middlesex Chairman, President and Chief Executive Officer Dennis

W. Doll said, “Our positive third quarter results were largely

influenced by favorable weather conditions, higher demand for water

and the effect of rate relief granted to Middlesex by regulators in

August 2015. In addition to delivering results of $0.54 per

share for the quarter, we were pleased to announce a 6.29% increase

in the common dividend in October, which represents the 44th year

of consecutive dividend increases in our company’s history and

demonstrates our continuing focus on improving shareholder

value.”

Third Quarter Operating Results

Consolidated operating revenues for the third quarter increased

$3.1 million from the same period in 2015. Revenues in the

Company’s Middlesex system in New Jersey increased $2.3 million,

primarily due to New Jersey Board of Public Utilities (“NJBPU”)

approved rate increase implemented in August 2015, favorable

weather and higher wholesale contract customer demand.

Revenues in our Delaware system, Tidewater Utilities, Inc.,

(Tidewater) increased $0.5 million, primarily due to additional

customers and weather-related demand. Revenues from contract

operations increased $0.2 million, primarily related to scheduled

fixed fee increases under our operating contract with the City of

Perth Amboy, New Jersey as well as supplemental services earned

under our contract to operate the Borough of Avalon, New Jersey’s

water utility, sewer utility and storm water system.

Operation and maintenance expenses for the third quarter

decreased $0.2 million from the same period in 2015. This

decrease is primarily attributable to lower retirement plan costs

resulting from a higher actuarially-determined discount rate than

in the prior year. Labor costs increased $0.3 million due to higher

average labor rates and increased headcount, partially offset by

higher capitalized labor in the Middlesex system.

Nine Month Operating Results

For the nine months ended September 30, 2016, revenues increased

$6.0 million from the same period in 2015. Revenues in our

Middlesex system increased $5.5 million, due to favorable weather

conditions, a NJBPU-approved rate increase implemented in August

2015 and higher wholesale contract customer demand. Revenues

in our Tidewater system increased $0.1 million, primarily due to

additional customers offset by lower customer demand from

unfavorable weather conditions in late spring and early

summer.

Operation and maintenance expenses for the nine months ended

September 30, 2016 decreased $0.9 million from the same period in

2015, primarily due to lower employee benefit expenses, fewer water

main breaks and lower variable production costs due to improved

non-revenue water management and higher raw water quality in our

Middlesex system.

Net income increased $4.1 million from the same period in

2015. Basic and diluted earnings per share were $1.19,

compared to $0.95 for the same period in 2015.

Annual Dividend Increased for 44th Consecutive

Year

As previously reported, the Company's Board of Directors

declared a dividend of $0.21125 per share on its common stock, a

6.29 percent increase. Middlesex Water Company has paid cash

dividends in varying amounts continually since 1912. This

increase raises the annual dividend to $0.845 from $0.795 per share

of common stock. The dividend is payable December 1, 2016 to

shareholders of record as of November 10, 2016.

About Middlesex Water Company

Middlesex Water Company, organized in 1897, provides regulated

and unregulated water and wastewater utility services primarily in

New Jersey and Delaware through various subsidiary companies.

Information about the Company’s Direct Share Purchase and Sale and

Dividend Reinvestment Plan can be found at

investors.middlesexwater.com

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

including, among others, our long-term strategy and expectations,

the status of our acquisition program, the impact of our

acquisitions, the impact of current and projected rate requests and

the impact of our capital program on our environmental compliance.

There are important factors that could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements including: general economic business

conditions, unfavorable weather conditions, the success of certain

cost containment initiatives, changes in regulations or regulatory

treatment, availability and the cost of capital, the success of

growth initiatives and other factors discussed in our filings with

the Securities and Exchange Commission.

| |

|

|

|

|

|

|

|

|

|

|

| |

MIDDLESEX WATER

COMPANY |

|

| |

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME |

|

| |

(Unaudited) |

|

| |

(In thousands except per share

amounts) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|

| |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

2016 |

|

|

|

2015 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Operating Revenues |

$ |

37,794 |

|

|

$ |

34,654 |

|

$ |

101,098 |

|

|

$ |

95,100 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Operating Expenses: |

|

|

|

|

|

|

|

| |

|

Operations and Maintenance |

|

16,599 |

|

|

|

16,772 |

|

|

48,215 |

|

|

|

49,089 |

|

|

| |

|

Depreciation |

|

3,243 |

|

|

|

3,032 |

|

|

9,561 |

|

|

|

8,962 |

|

|

| |

|

Other Taxes |

|

3,796 |

|

|

|

3,390 |

|

|

10,537 |

|

|

|

9,671 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total Operating Expenses |

|

23,638 |

|

|

|

23,194 |

|

|

68,313 |

|

|

|

67,722 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Operating Income |

|

14,156 |

|

|

|

11,460 |

|

|

32,785 |

|

|

|

27,378 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Other Income (Expense): |

|

|

|

|

|

|

|

| |

|

Allowance for Funds Used During Construction |

|

207 |

|

|

|

113 |

|

|

387 |

|

|

|

297 |

|

|

| |

|

Other Income (Expense), net |

|

400 |

|

|

|

108 |

|

|

449 |

|

|

|

108 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Total Other Income, net |

|

607 |

|

|

|

221 |

|

|

836 |

|

|

|

405 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Interest Charges |

|

1,427 |

|

|

|

1,505 |

|

|

3,841 |

|

|

|

4,058 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Income before Income Taxes |

|

13,336 |

|

|

|

10,176 |

|

|

29,780 |

|

|

|

23,725 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Income Taxes |

|

4,523 |

|

|

|

3,433 |

|

|

10,258 |

|

|

|

8,258 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Net Income |

|

8,813 |

|

|

|

6,743 |

|

|

19,522 |

|

|

|

15,467 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Preferred Stock Dividend Requirements |

|

36 |

|

|

|

36 |

|

|

108 |

|

|

|

108 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Earnings Applicable to Common Stock |

$ |

8,777 |

|

|

$ |

6,707 |

|

$ |

19,414 |

|

|

$ |

15,359 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Earnings per share of Common Stock: |

|

|

|

|

|

|

|

| |

|

Basic |

$ |

0.54 |

|

|

$ |

0.41 |

|

$ |

1.19 |

|

|

$ |

0.95 |

|

|

| |

|

Diluted |

$ |

0.54 |

|

|

$ |

0.41 |

|

$ |

1.19 |

|

|

$ |

0.95 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Average Number of |

|

|

|

|

|

|

|

| |

|

Common Shares Outstanding : |

|

|

|

|

|

|

|

| |

|

Basic |

|

16,284 |

|

|

|

16,202 |

|

|

16,262 |

|

|

|

16,161 |

|

|

| |

|

Diluted |

|

16,440 |

|

|

|

16,358 |

|

|

16,418 |

|

|

|

16,317 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Cash Dividends Paid per Common Share |

$ |

0.1988 |

|

|

$ |

0.1925 |

|

$ |

0.5963 |

|

|

$ |

0.5775 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Contact:

Bernadette Sohler, Vice President – Corporate Affairs

Middlesex Water Company

1500 Ronson Road

Iselin, New Jersey 08830

(732) 638-7549

www.middlesexwater.com

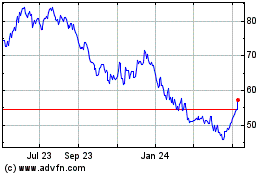

Middlesex Water (NASDAQ:MSEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

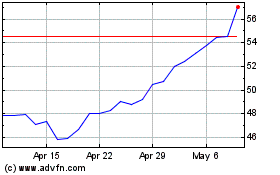

Middlesex Water (NASDAQ:MSEX)

Historical Stock Chart

From Apr 2023 to Apr 2024