Domestic Net Revenue Per Hectoliter Grew 1.6

Percent in the Quarter; STR Volume Down 4.0%

Molson Coors Brewing Company (NYSE: TAP; TSX: TPX) today

reported that MillerCoors third quarter underlying net income, a

non-GAAP measure, increased 9.6 percent to $377.5 million versus

the same period in the prior year. This increase was driven

primarily by higher net pricing, positive sales mix and lower cost

of goods sold. MillerCoors sales-to-retail volume (STRs) decreased

4.0% in the third quarter and sales-to-wholesalers volume (STWs)

was down 0.6%.

“Now that we are officially part of the Molson Coors Brewing

Company, we are more focused than ever on getting to growth,” said

Gavin Hattersley, MillerCoors chief executive officer. “Joining

forces with Molson Coors adds to the momentum we gained this

quarter, as underlying net income grew and our premium light beers

continued to gain segment share. While STR volumes were down this

quarter, reflecting industry trends, we remain steadfast in our

drive to achieve flat volume in 2018 and growth in 2019.”

Third Quarter Highlights

Unless otherwise indicated, all amounts are in U.S. dollars and

calculated in accordance with generally accepted accounting

principles in the U.S. (U.S. GAAP). All market share references are

per A.C. Nielsen. Percentages are versus the prior year comparable

period and include MillerCoors operations in the U.S. and Puerto

Rico.

- U.S. GAAP net income was $369.2

million, up 16.7 percent.

- Underlying net income, a non-GAAP

measure, increased 9.6 percent to $377.5 million.

- Total net sales increased 0.4 percent

to $2.008 billion.

- Domestic net revenue per hectoliter,

excluding contract brewing and company-owned distributor sales,

increased 1.6 percent.

- Total cost of goods sold (COGS) per

hectoliter decreased 0.9 percent.

- Domestic sales-to-retail volume (STRs)

decreased 4.0 percent.

- Domestic sales-to-wholesalers volume

(STWs) decreased 0.6 percent.

Brand Highlights for the Third Quarter

Miller Lite gained share of the Premium Light segment for the

eighth consecutive quarter, but STRs were down mid-single digits.

The brand recently brought back the limited release Steinie bottle,

building on the success of the same seasonal release last year. The

Steinie, available through the holiday season, will be supported

through robust media support and a variety of on- and off-premise

tools. The brand also launched new ads comparing the beer to its

chief competitor, with all the commercials emphasizing that Miller

Lite has “more taste, less calories and half the carbs.”

Coors Light gained share of the Premium Light segment for the

sixth consecutive quarter, but STRs were down low-single digits.

The brand was recognized with a bronze medal at the Great American

Beer Festival last month. Coors Light recently announced a number

of retail promotions around college football, from celebrity

ambassadors to pregame concerts, now through the National

Championship in January.

Total MillerCoors Above Premium STRs finished down mid-single

digits, despite success from Henry’s Hard Soda, which continues as

the number-one Hard Soda franchise according to Nielsen. The Redd’s

family declined high-single digits, as low-single-digit growth of

the Wicked brands was more than offset by declines across the

balance of the Redd’s portfolio.

The MillerCoors Tenth & Blake portfolio finished the quarter

down high-single digits. The Blue Moon Brewing Company STRs

declined high-single digits, led by declines in Blue Moon

seasonals. The Jacob Leinenkugel Brewing Company STRs were down

mid-teens, partially caused by Summer Shandy demand outselling

production a month earlier than planned.

MillerCoors recently announced that, due to the current scale of

Blue Moon and Leinenkugel’s and the capacity needed to fuel their

growth, both brand families will be moved out of Tenth and Blake

and into the MillerCoors commercial organization.

The belief is that the shift of Blue Moon and Leinenkugel’s to

the MillerCoors organization will not only allow a deeper focus on

and commitment to these two strategic brand families, but it will

also enable Tenth and Blake to focus on the development and

integration of our new craft partners into the MillerCoors system.

With Tenth and Blake’s acquisitions of Saint Archer Brewery,

Terrapin Beer Company, Hop Valley Brewing and Revolver Brewing, our

portfolio of craft brands has grown within the past 11 months.

Nearly a year after partnering with Tenth and Blake, Saint Archer

Brewing in San Diego achieved its highest-ever STR volume in the

quarter. Saint Archer is currently working to expand its presence

at retail, having recently launched in Las Vegas and Arizona, and

is considering additional markets for expansion. Revolver, which

joined Tenth and Blake just months ago, took home a gold medal at

the Great American Beer Festival for its Anodyne Wheat Wine.

In the Premium Regular segment, Coors Banquet gained segment

share and grew STR volume low-single digits for the quarter and

remains on target for a 10th consecutive year of growth. According

to Nielsen, Coors Banquet remains the only national Premium Regular

brand that is growing, and was recognized for the third consecutive

year at the Great American Beer Festival by taking home a silver

medal. The growth from Banquet partially offset a low-double-digit

decline for Miller Genuine Draft, resulting in the Premium Regular

segment finishing down mid-single digits.

The MillerCoors Below Premium portfolio decreased mid-single

digits, driven by a low-single-digit decline of Miller High Life, a

mid-single-digit decline in Keystone and a high-single-digit

decline in Milwaukee’s Best. While Icehouse grew low-single digits

for the fourth consecutive quarter, the Steel Reserve franchise was

down low-single digits, with the Steel Alloy Series up low-single

digits. Milwaukee’s Best recently updated its packaging, which is

in market now, while Keystone Light will follow suit with refreshed

packaging of its own.

Financial Highlights for the Third Quarter

Domestic net revenue per hectoliter grew 1.6 percent for the

quarter as a result of favorable net pricing and positive sales

mix.

Total company net revenue per hectoliter, including contract

brewing and company-owned distributor sales, increased 1.5 percent.

Third-party contract brewing volumes were down 5.0 percent.

Total COGS per hectoliter decreased 0.9 percent, driven by

supply chain cost savings and lower commodity pricing, partially

offset by lower fixed-cost absorption due to lower volumes.

Marketing, general and administrative costs were unchanged for

the quarter.

MillerCoors achieved $19 million of cost savings in the quarter,

primarily related to brewery efficiencies and procurement

savings.

Depreciation and amortization expenses for MillerCoors were

$118.5 million. These results include $34.3 million of accelerated

depreciation expenses that are included in special items related to

the September closure of the Eden, North Carolina brewery.

Additions to tangible and intangible assets, which do not include

intangible asset additions related to the craft acquisitions,

totaled $84.1 million in the quarter.

MillerCoors recognized net special charges of $8.3 million,

primarily related to the closure of the Eden Brewery.

Overview of MillerCoors

Through its diverse collection of storied breweries, MillerCoors

brings American beer drinkers an unmatched selection of the highest

quality beers, flavored malt beverages and ciders, steeped in

centuries of brewing heritage. Miller Brewing Company and Coors

Brewing Company brew national favorites such as Miller Lite, Miller

High Life, Coors Light and Coors Banquet. MillerCoors also proudly

offers beers such as Leinenkugel’s Summer Shandy from

sixth-generation Jacob Leinenkugel Brewing Company, and Blue Moon

Belgian White from modern craft pioneer Blue Moon Brewing Company,

founded in 1995. Beyond beer, MillerCoors operates Crispin Cider

Company, an artisanal maker of pear and apple ciders using

fresh-pressed American juice, and offers pioneering brands such as

the Redd’s franchise, Smith & Forge Hard Cider and Henry’s Hard

Sodas. Tenth and Blake Beer Company, our craft and import division,

is the home to craft brewers Hop Valley Brewing, Revolver Brewing,

Saint Archer Brewing Company and the Terrapin Beer Company. Tenth

and Blake also imports world-renowned beers such as Italy’s Peroni

Nastro Azzurro, the Czech Republic’s Pilsner Urquell and the

Netherlands’ Grolsch. MillerCoors, the U.S. business unit of the

Molson Coors Brewing Company, has an uncompromising dedication to

quality, a keen focus on innovation and a deep commitment to

sustainability. Learn more at MillerCoors.com, at

facebook.com/MillerCoors or on Twitter at @MillerCoors.

Overview of Molson Coors

Molson Coors Brewing Company is a leading international brewer

delivering extraordinary brands that delight the world's beer

drinkers. It brews, markets and sells a portfolio of leading brands

such as Coors Light, Miller Lite, Molson Canadian, Carling,

Staropramen and Blue Moon across The Americas, Europe and Asia. It

operates in Canada through Molson Coors Canada; in the US through

MillerCoors; across Europe through Molson Coors Europe; and outside

these core markets through Molson Coors International. The company

was listed on the Dow Jones Sustainability World Index for the past

five years and named global Beverage Sector Leader in 2012 and

2013. For the past two years, the company was the only alcohol

producer recognized on the Index for world class sustainability

performance. For more information on Molson Coors Brewing Company

visit the company's website, http://molsoncoors.com or

http://ourbeerprint.com

Forward-Looking Statements

This press release includes estimates or projections that

constitute “forward-looking statements” within the meaning of the

U.S. federal securities laws. Generally, the words “believe,”

"expect,” "intend,” "anticipate,” “project,” “will,” and similar

expressions identify forward-looking statements, which generally

are not historic in nature. Although the Company believes that the

assumptions upon which its forward-looking statements are based are

reasonable, it can give no assurance that these assumptions will

prove to be correct. Important factors that could cause actual

results to differ materially from the Company’s historical

experience, and present projections and expectations are disclosed

in the Company’s filings with the Securities and Exchange

Commission (“SEC”). These factors include, among others, our

ability to successfully integrate the acquisition of MillerCoors;

our ability to achieve expected tax benefits, accretion, synergies

and other cost savings; impact of increased competition resulting

from further consolidation of brewers, competitive pricing and

product pressures; health of the beer industry and our brands in

our markets; economic conditions in our markets; additional

impairment charges; our ability to maintain

manufacturer/distribution agreements; changes in our supply chain

system; availability or increase in the cost of packaging

materials; success of our joint ventures; risks relating to

operations in developing and emerging markets; changes in legal and

regulatory requirements, including the regulation of distribution

systems; fluctuations in foreign currency exchange rates; increase

in the cost of commodities used in the business; the impact of

climate change and the availability and quality of water; loss or

closure of a major brewery or other key facility; our ability to

implement our strategic initiatives, including executing and

realizing cost savings; our ability to successfully integrate newly

acquired businesses; pension plan costs; failure to comply with

debt covenants or deterioration in our credit rating; our ability

to maintain good labor relations; our ability to maintain brand

image, reputation and product quality; lack of full-control over

the operations of MillerCoors and other risks discussed in our

filings with the SEC, including our most recent Annual Report on

Form 10-K. All forward-looking statements in this press release are

expressly qualified by such cautionary statements and by reference

to the underlying assumptions. You should not place undue reliance

on forward-looking statements, which speak only as of the date they

are made. We do not undertake to update forward-looking statements,

whether as a result of new information, future events or

otherwise.

Three Months Ended Nine

Months Ended (In millions of $US)

Sept 30,2016

Sept 30,2015

Sept 30,2016

Sept 30,2015

U.S.

GAAP: Net Income Attributable to MillerCoors

$ 369.2 $ 316.5 $ 1,134.0 $ 1,108.3 Plus: Special Items¹ 8.3 28.0

84.6 28.0

Tax effect of the adjustments to arrive at

underlying net income2

- (0.1) (0.2) (0.1)

Non-GAAP

Underlying Net Income

$ 377.5 $ 344.4

$

1,218.4

$ 1,136.2 Percent change versus prior year MillerCoors

non-GAAP underlying net income 9.6% 7.2%

1 Current and prior year Special items

primarily relate to net costs incurred due to the closure of the

Eden Brewery.

2 The tax effect of the adjustments to

arrive at underlying net income attributable to MillerCoors, a

non-GAAP measure is calculated based on the estimated tax rate

applicable to the item(s) being adjusted in the period in which

they arose.

MILLERCOORS LLC

RESULTS OF OPERATIONS (VOLUMES IN THOUSANDS, DOLLARS IN

MILLIONS $US) (UNAUDITED) U.S. GAAP

Three Months

Ended Nine Months Ended

Sept 30,2016

Sept 30,2015

Sept 30,2016

Sept 30,2015

Total STW volume in Hectoliters 18,265 18,470

53,721 54,573 Sales $ 2,292.5 $ 2,286.8 $

6,788.1 $ 6,826.9 Excise taxes (284.8) (286.8)

(837.6) (849.6) Net sales 2,007.7 2,000.0 5,950.5 5,977.3

Cost of goods sold (1,150.8) (1,173.9)

(3,358.3) (3,490.6)

Gross profit

856.9 826.1 2,592.2 2,486.7

Marketing, general and administrative

expenses

(475.2) (475.1) (1,362.0) (1,333.0) Special items, net (8.3)

(28.0) (84.6) (28.0) Operating income 373.4

323.0 1,145.6 1,125.7

Interest income (expense), net

(0.5) (0.3) (1.4) (1.0)

Other income (expense), net

1.1 0.2 3.7 4.6

Income before income taxes and

non-controlling interests

374.0 322.9 1,147.9 1,129.3 Income taxes (1.3) (1.1)

(3.3) (3.8) Net income 372.7 321.8 1,144.6 1,125.5

Net income attributable to non-controlling

interests

(3.5) (5.3) (10.6) (17.2)

Net income attributable to MillerCoors

LLC

$ 369.2 $ 316.5 $ 1,134.0 $ 1,108.3

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161101005212/en/

MillerCoorsDave Dunnewald, 303-927-2443Media Relations,

Molson CoorsorColin Wheeler, 303 927 2334Investor Relations, Molson

Coors

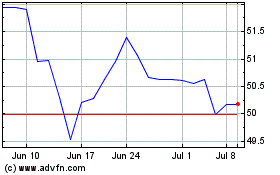

Molson Coors Beverage (NYSE:TAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

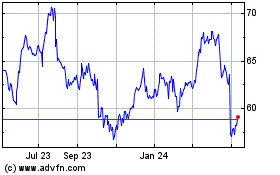

Molson Coors Beverage (NYSE:TAP)

Historical Stock Chart

From Apr 2023 to Apr 2024