Revises Guidance to

Reflect Slower than Anticipated Turnaround in Texas Sterling

Division

Sterling’s Four Other

Businesses Performing at or Above Expectations

Average Gross Margin

in Backlog Continues to Improve

Strengthened Balance

Sheet and Improved Liquidity

Sterling Construction Company, Inc. (NasdaqGS:STRL) (“Sterling”

or “the Company”) today announced financial results for the third

quarter ended September 30, 2016.

Third Quarter 2016 Financial Results

Compared to Third Quarter 2015:

- Revenues grew 16.8% to $205.6 million

compared to $176.0 million;

- Gross margin was 8.3% of revenues

compared to gross margin of 8.2%;

- Operating income was $3.7 million

compared to $2.4 million;

- Net income attributable to Sterling

common stockholders was $2.4 million compared to $0.3 million;

and,

- Net income per share attributable to

common stockholders was $0.10 compared to $0.01.

Third Quarter 2016 Backlog

Highlights:

- Total backlog at September 30, 2016 of

$820 million was up 7.8% from December 31, 2015 and was up 14.2%

from the third quarter of 2015;

- Total backlog at September 30, 2016

excluded $94 million of projects where the Company was the apparent

low bidder but the contract had not yet been signed; and,

- Gross margin of projects in backlog as

of September 30, 2016 averaged 8.0% as compared with 6.5% the end

of the third quarter of 2015, while expected gross margin of the

projects awarded in the first nine months of 2016 averaged more

than 8.5%.

Business Overview:

Third quarter 2016 revenues increased 16.8% compared to the

third quarter of 2015 driven by increased project activity with the

majority of this increase due to a substantial ramp up of two

projects in process by Sterling’s Utah Subsidiary construction

joint ventures.

Gross profit was $17.0 million in the third quarter of 2016

compared to $14.5 million in the prior year third quarter,

reflecting the strong revenue increase combined with a small

improvement in gross margin compared to the prior year quarter as

the proportion of zero or near zero margin projects has diminished

this year.

General and administrative expenses were $9.6 million in the

third quarter of 2016, or 4.7% of revenues compared to $11.1

million or 6.3% in the third quarter of 2015. The decrease in

G&A expense as a percentage of revenues reflects the higher

level of revenues in the third quarter of 2016, along with a

decrease in employee benefit costs and the non-recurring employee

severance costs paid in the third quarter of 2015.

Other operating expense, net totaled $3.8 million in the third

quarter of 2016 compared to $1.0 million in the third quarter of

the prior year. The increase in expense was primarily due to higher

noncontrolling interest expense, driven by the combined increase in

income generated by the Company’s two partially owned

subsidiaries.

Financial Position at September 30,

2016:

- Cash and cash equivalents was $43.0

million.

- Working capital totaled $40.6

million.

- Total debt was reduced to $11.6

million.

- Tangible net worth was $59.6

million.

CEO Remarks:

Paul J. Varello, Sterling’s CEO, commented, “We generated

revenues in the third quarter that were in-line with our

expectations heading into the period, and meaningfully stronger

than in the third quarter of 2015. Net income, however, was below

our expectations as our Texas subsidiary (TSC) continued to lag in

profitability. While TSC has been making headway in burning off its

low margin legacy backlog and beginning to execute more of its

higher margin contracts, both have occurred at a slower pace than

we’d previously forecast as a result of challenging weather

conditions in the first half of the year and slower ramp up of new

work driven by owner delays. Fortunately, this drag was partially

offset by strong performances by our other business units, which

enabled us to deliver year-over-year improvement on our bottom

line. We are also very pleased with our increasing average margin

in backlog, which reflects our selective and more disciplined

bidding process and improved project execution.”

Mr. Varello continued, “We also made meaningful progress in our

goal to diversify our project mix towards more profitable

opportunities. While road and highway building will always be an

important part of our business, we believe that we have the

combination of experience, capability and reputation to win new

awards at attractive margins in existing and adjacent markets. As

an example, we were pleased with the sizeable airport projects we

announced in Arizona and Utah earlier this month and expect to add

similar projects in the coming quarters. Overall, the bidding

landscape throughout our operating geographies continues to look

favorable and, given the federal and state funding outlook, we

expect the volume and pace of project lettings to continue its

current momentum for the balance of 2016 and into 2017. As a

result, we are optimistic that our strategy of selectively bidding

projects that give us the greatest opportunity to improve

profitability will remain successful in the coming year.”

“During the third quarter we deployed proceeds of our May 2016

equity offering to reduce our debt. We also strengthened our

balance sheet with cash provided by operating activities of

approximately $9 million. Given our improved cash balance and

liquidity, we intend to refinance our asset-based credit facility

with a lower cost, higher capacity, revolving credit line which

will further strengthen our financial position to support future

growth. We maintain our original target of the first half of 2017

to complete this refinancing.”

Mr. Varello concluded, “Turning to our outlook for the remainder

of 2016, the majority of our business units are performing at

expected levels, which makes us confident in our previously

announced guidance for full year 2016 revenues. This extrapolates

to fourth quarter revenue in the range of $150 million to $170

million. As mentioned previously, however, our Texas business has

not recovered as rapidly as we originally anticipated, and remains

below our targets from a profitability standpoint. As a result, we

are revising our outlook for the balance of 2016 and now expect our

net income for the fourth quarter, one of our seasonally slowest

quarters, to approximate breakeven. Our focus remains on gross

margin improvement and tight G&A cost controls to further

enable us to grow our bottom line. In summary, we are continuing to

make progress with Sterling’s turnaround, and expect to deliver

additional improvements for the balance of 2016 and into 2017.”

Conference Call:

Sterling’s management will hold a conference call to discuss

these results and recent corporate developments on Monday, October

31, 2016 at 4:30 p.m. ET/3:30 p.m. CT. Interested parties may

participate in the call by dialing (201) 493-6744 or (877) 445-9755

ten minutes before the conference call is scheduled to begin, and

asking for the Sterling Construction call.

To listen to a simultaneous webcast of the call, please go to

the Company’s website at www.strlco.com at least 15 minutes early

to download and install any necessary audio software. If you are

unable to listen live, the conference call webcast will be archived

on the Company’s website for 30 days.

Sterling is a leading heavy civil construction company that

specializes in the building and reconstruction of transportation

and water infrastructure projects in Texas, Utah, Nevada, Colorado,

Arizona, California, Hawaii, and other states in which there are

construction opportunities. Its transportation infrastructure

projects include highways, roads, bridges, airfields, ports and

light rail. Its water infrastructure projects include water,

wastewater and storm drainage systems.

This press release includes certain statements that fall within

the definition of “forward-looking statements” under the Private

Securities Litigation Reform Act of 1995. Any such statements are

subject to risks and uncertainties, including overall economic and

market conditions, federal, state and local government funding,

competitors’ and customers’ actions, and weather conditions, which

could cause actual results to differ materially from those

anticipated, including those risks identified in the Company’s

filings with the Securities and Exchange Commission. Accordingly,

such statements should be considered in light of these risks. Any

prediction by the Company is only a statement of management’s

belief at the time the prediction is made. There can be no

assurance that any prediction once made will continue thereafter to

reflect management’s belief, and the Company does not undertake to

update publicly its predictions or to make voluntary additional

disclosures of nonpublic information, whether as a result of new

information, future events or otherwise.

(See Accompanying Tables)

STERLING CONSTRUCTION COMPANY, INC.

& SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Amounts in thousands, except share and

per share data)

(Unaudited)

Three Months EndedSeptember

30,

Nine Months EndedSeptember

30,

2016 2015 2016

2015 Revenues $ 205,629 $ 176,000 $ 521,778 $ 471,107

Cost of revenues (188,597 ) (161,542 )

(484,827 ) (454,374 ) Gross profit 17,032 14,458 36,951

16,733 General and administrative expenses (9,575 ) (11,119 )

(29,221 ) (32,320 ) Other operating income (expense), net

(3,785 ) (958 ) (7,143 ) 1,128

Operating income (loss) 3,672 2,381 587 (14,459 ) Interest income

15 32 19 464 Interest expense (491 ) (1,087 ) (2,176 ) (2,103 )

Loss on extinguishment of debt -- -- --

(240 )

Income (loss) before income taxes and

earnings attributable to noncontrolling interests

3,196 1,326 (1,570 ) (16,338 ) Income tax (expense) benefit

(41 ) 39 (68 )

8 Net income (loss) 3,155 1,365 (1,638 ) (16,330 )

Noncontrolling owners’ interests in earnings of subsidiaries and

joint ventures (740 ) (1,109 ) (1,252 )

(2,948 ) Net income (loss) attributable to Sterling common

stockholders $ 2,415 $ 256

$

(2,890

)

$

(19,278

) Net income (loss) per share attributable to Sterling

common stockholders: Basic and diluted $ 0.10 $ 0.01 $ (0.12 ) $

(1.00 ) Weighted average number of common shares outstanding

used in computing per share amounts: Basic 25,002,964 19,627,674

23,914,688 19,269,123 Diluted 25,364,881 19,627,674 23,914,688

19,269,123

STERLING CONSTRUCTION COMPANY, INC.

& SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Amounts in thousands, except share and

per share data)

September 30,2016

December 31,2015

(Unaudited)

ASSETS Current assets: Cash and cash

equivalents $ 43,021 $ 4,426 Contracts receivable, including

retainage 105,415 82,112 Costs and estimated earnings in excess of

billings on uncompleted contracts 31,989 26,905 Inventories 4,000

2,535 Receivables from and equity in construction joint ventures

9,469 12,930 Other current assets 6,170 6,013 Total

current assets 200,064 134,921 Property and equipment, net 70,363

73,475 Goodwill 54,820 54,820 Other assets, net 2,968

2,949 Total assets $ 328,215 $ 266,165

LIABILITIES AND

EQUITY Current liabilities: Accounts payable $ 76,861 $ 58,959

Billings in excess of costs and estimated earnings on uncompleted

contracts 61,896 30,556 Current maturities of long-term debt 4,653

4,856 Income taxes payable 63 67 Accrued compensation 10,412 5,977

Other current liabilities 5,545 3,896 Total current

liabilities 159,430 104,311 Long-term liabilities:

Long-term debt, net of current maturities 6,952 15,324 Member’s

interest subject to mandatory redemption and undistributed earnings

46,466 50,438 Other long-term liabilities 911 338

Total long-term liabilities 54,329 66,100 Commitments

and contingencies (Note 5) Equity: Sterling stockholders’ equity:

Preferred stock, par value $0.01 per share; 1,000,000 shares

authorized, none issued -- -- Common stock, par value $0.01 per

share; 28,000,000 shares authorized, 25,002,964 and 19,753,170

shares issued 250 198 Additional paid in capital 208,435 188,147

Retained deficit (95,390 ) (92,500 ) Total Sterling

common stockholders’ equity 113,295 95,845 Noncontrolling interests

1,161 (91 ) Total equity 114,456 95,754

Total liabilities and equity $ 328,215 $ 266,165

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161031006040/en/

Sterling Construction Company, Inc.Jennifer Maxwell, Director of

Investor Relations281-951-3560orInvestor Relations

Counsel:The Equity Group Inc.Fred Buonocore 212-836-9607Kevin

Towle 212-836-9620

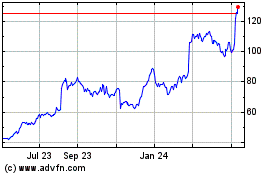

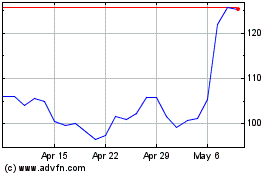

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Apr 2023 to Apr 2024