Exxon Mobil Profit, Revenue Slide Again -- 2nd Update

October 28 2016 - 9:44AM

Dow Jones News

By Bradley Olson and Anne Steele

Exxon Mobil Corp., which is under state and federal

investigation for how it accounts for the value of its oil and gas

wells, said Friday that it may be forced to recognize that as much

as 4.6 billion barrels of its reserves are no longer profitable to

produce.

The disclosure came as the oil producer reported a 38% decline

in quarterly profit.

The vast majority of Exxon's holdings under scrutiny are in

Canada's oil sands, an area that has been devastated by low prices

and environmental concerns as countries around the world seek to

reduce high-emitting forms of energy. The company also said it

plans to examine its assets to determine whether their value should

be written down.

The U.S. Securities and Exchange Commission and New York

Attorney General Eric Schneiderman are investigating the company

over its accounting practices and how the value of its future oil

and gas wells could be impacted by government action from climate

change.

The Exxon release came as the company reported third-quarter

earnings of $2.7 billion, a 38% decline from the same period last

year, as revenue slid more than expected amid the prolonged swoon

in oil prices.

Shares lost 1.7% premarket to $85.65 as the oil giant reported

its eighth straight quarter of year-over-year profit declines and

its ninth straight quarter of falling revenue.

Chief Executive Rex Tillerson said the operating environment

"remains challenging."

For the September quarter, Exxon, the largest U.S. oil company,

reported earnings fell to $2.65 billion, or 63 cents a share, from

$4.24 billion, or $1.01 a share, a year earlier. Analysts polled by

Thomson Reuters were looking for 58 cents a share.

Revenue slipped 13% to $58.68 billion, below analysts' forecast

for $63.85 billion.

Profit in the exploration and production, or upstream, business

fell 16% to $620 million. Volumes declined 3% from a year ago, due

to unplanned downtime, primarily in Nigeria, and new projects

unable to fully offset declines at existing properties, the company

said. In the U.S., the upstream division widened its loss to $477

million from $442 million a year earlier.

Exxon also was hurt by declining profit in the downstream

division, which had previously been a boon amid lower prices for

oil and gas. In the latest quarter, refining and marketing, or

downstream, earnings were $1.2 billion, $804 million lower than in

the year-earlier period. Exxon said weaker margins, mostly in

refining, weighed on earnings by $1.6 billion while volume and mix

effects lifted earnings by $170 million.

Chemical earnings, meanwhile, were comparable with last year's

quarter, as higher maintenance costs, were offset by increased

specialty product sales.

Exxon slashed its capital and explorations spending 45% from a

year ago to $4.19 billion, bringing 2016's decline to 39%.

Write to Bradley Olson at Bradley.Olson@wsj.com and Anne Steele

at Anne.Steele@wsj.com

(END) Dow Jones Newswires

October 28, 2016 09:29 ET (13:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

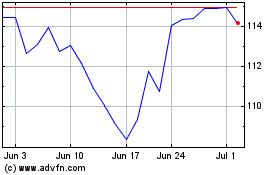

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

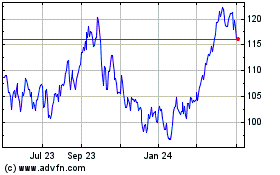

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024